Alright, today's first big news, although a bit late, has been digested. On the third day after being kicked out of the White House and expressing his feelings, Zelensky tweeted again, generally expressing gratitude for American assistance and hoping that under Trump's leadership, Ukraine can quickly end the war with Russia.

Is this a good thing? I think so. The pinned tweet mentioned that currently, America's biggest trouble is the persistently high inflation, which has led the Federal Reserve to be unwilling to cut interest rates. Secondly, high interest rates can easily trigger an economic recession.

Yesterday, GDPNow provided information that has revised the GDP forecast for the first quarter in the U.S. to a negative 2.8%, and Trump's tariff policy continues to exacerbate inflation. The increase in tariffs on Canada, Mexico, and China has already begun to be implemented. Therefore, the market's expectations are not good.

This is also the main reason for the market decline that started yesterday, due to the Russia-Ukraine war and tariffs. I wrote clearly in yesterday's analysis that the only thing that can counter Trump's tariffs is the end of the Russia-Ukraine war. On one hand, it would reduce inflation in food and raw materials, and on the other hand, the rare earth minerals mined from Ukraine could compensate for the losses from the trade war with China.

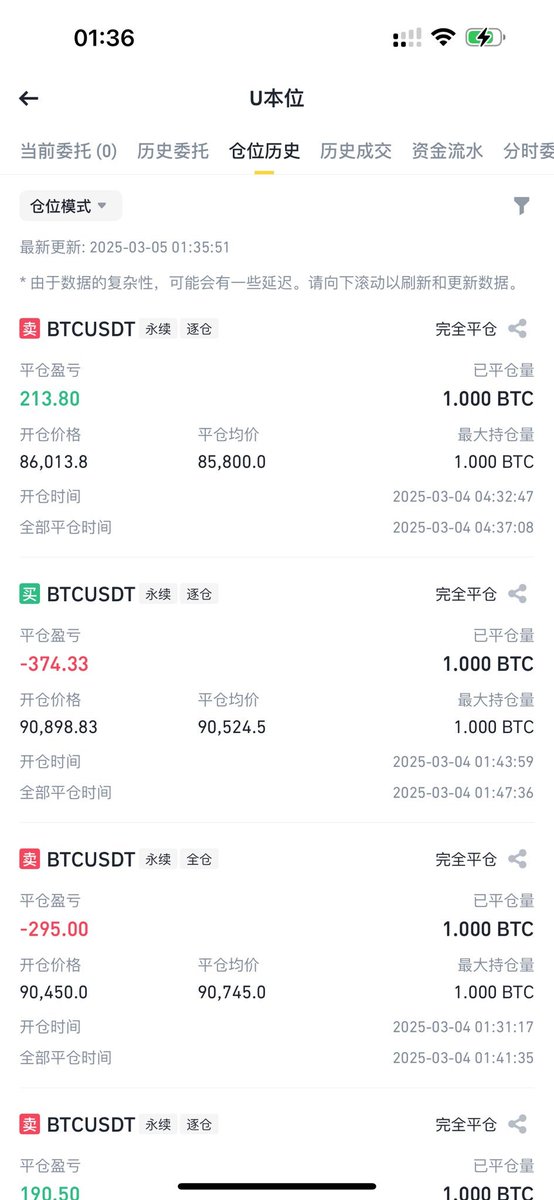

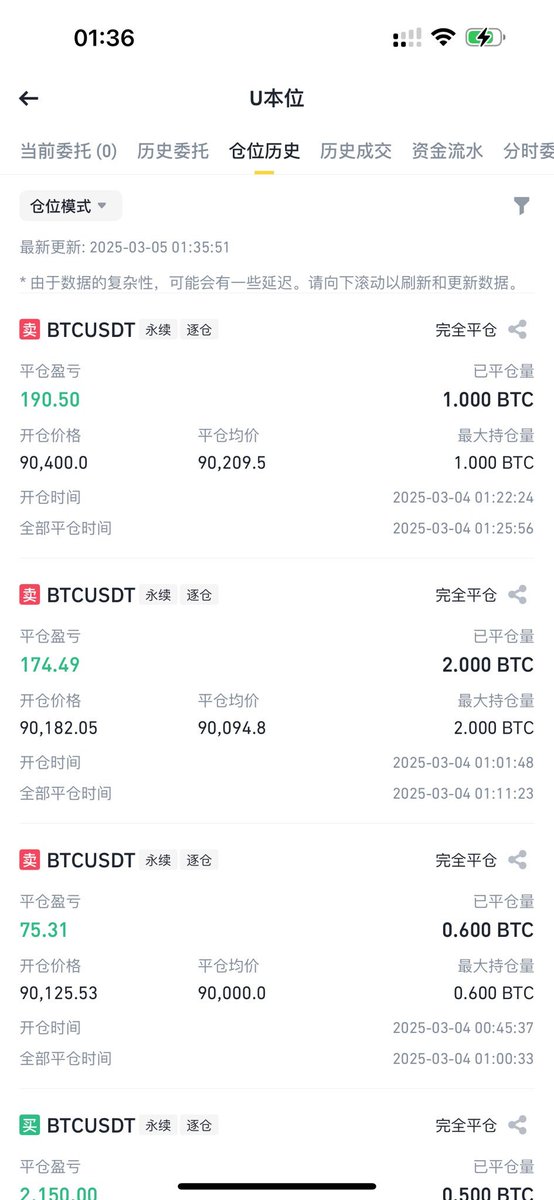

So I did a few things. First, I opened a long position in Bitcoin at $84,000. I actually really like to open an ant position contract when the market is uncertain to gauge my thoughts. The last ant position I opened at $85,800 was closed when it retraced to $90,000. Then last night, I opened several test positions, but found they did not align with my expectations, so I gave up.

In fact, I am someone who particularly dislikes talking about contracts. I have lost quite a bit of money on contracts, so unless I have a market prediction, I won't open contracts. Moreover, I only open ant positions, which means if I lose, I lose. But basically, if I feel I can't control the direction, I will cut losses in time, so the stop-loss orders I saw last night were also in line with this.

Returning to the market, I see signals of the end of the Russia-Ukraine war, which aligns with the hedging against tariffs I mentioned earlier. Therefore, I think there is an opportunity in this direction. Since I already bought at $88,000 in spot, I didn't plan to buy more spot, but I opened a contract to test the direction and also as a small compensation.

So my view remains that I am optimistic about Q1. Although it is quite unpleasant right now, yes, it is very unpleasant, the end of the Russia-Ukraine war is a positive trend. The market's expectation that the Federal Reserve can cut interest rates three times in 2025 is not a bad thing, of course, provided that there is no economic recession.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。