Great business models can often be explained in a single sentence. For example:

Apple: A high-end smartphone brand with integrated hardware and software

Tesla: New energy electric vehicles accelerating the world's transition to sustainable energy

Binance: An efficient cryptocurrency trading ecosystem (the new era's big casino)

@Stake_Stone is also on the path to shaping its great business model, with the grand vision of becoming the "full-chain liquidity distribution layer" of Web3. Taking the opportunity of StakeStone's official snapshot announcement, I would like to share my observations.

1/ Vision - Full-Chain Liquidity Distribution Layer

Why have previous full-chain protocols failed (or at least not achieved the expected results)? To put it metaphorically, what these protocols are trying to do is akin to creating a set of laws that can be universally accepted among the warring states during the Spring and Autumn period, aiming to reduce conflicts and achieve peace. The vision is good, but the implementation is as difficult as climbing to the sky. Building a full-chain foundation in Web3, where liquidity is severely fragmented and warlords are entrenched (various L1s and L2s), is no easy task.

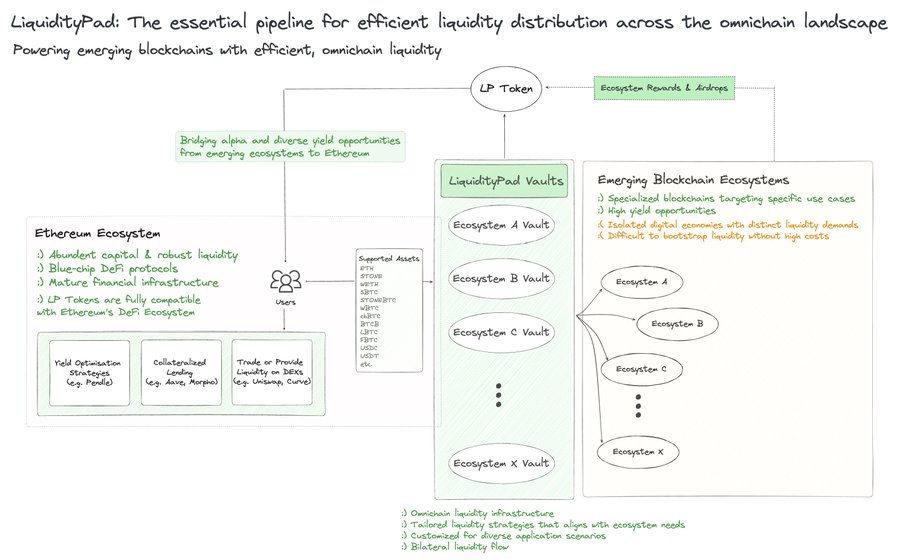

What sets StakeStone apart from previous full-chain protocols is that it has identified a pain point or a touchpoint with practical application scenarios: project teams need more high-quality and long-term stable liquidity, while on-chain and off-chain funds are also seeking reliable yield opportunities. What StakeStone needs to do is build a bridge between quality projects and liquidity, reducing friction and shortening the path. So far, StakeStone has delivered a satisfactory answer as a "pipeline":

Providing over 90% of the $1.3 billion TVL to Manta

Providing over 80% of the $800 million active TVL to Scroll

StakeStone Berachain Vault achieving over $430 million TVL and over 120,000 users

StakeStone LiquidityPad's first project, Story, raised $7 million in just 9 minutes

Capital never sleeps. The essence of capital in a capitalist economic system is a self-driven force that constantly seeks to maximize returns while maintaining continuous activity. As a full-chain liquidity distribution layer, StakeStone has the potential to become one of the largest capital flow pipelines in the Web3 era, with a business that is undeniably real and a prospect that is undeniably vast.

2/ Governance and Token Economics

$STO Token Empowerment:

Governance: Use $STO to vote on key matters, such as the direction of liquidity incentives

Rewards: Liquidity providers can receive additional rewards paid in $STO

Upgrade to veSTO: Lock your $STO to obtain veSTO, unlocking more revenue sharing and greater governance influence

StakeStone can be likened to Curve; both are liquidity/capital distribution centers and utilize the veToken mechanism. Therefore, the protocol flywheel is also consistent: veToken → more liquidity and a more robust protocol → more rewards and sharing → more people buying and locking tokens → more liquidity and a more robust protocol.

There’s no need to worry about the governance aspect; StakeStone is led by Polychain, with investments from both Binance and OKX, along with strong business performance, making it a sought-after listing for exchanges. However, from a personal perspective, I hope StakeStone does not launch on too many large exchanges right away, as it could overshoot market expectations for the project, leading to a high opening. Steady and solid progress is the key.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。