4 Alpha Insights

I. Current Market Trading Logic: Recession Expectations Dominate, Stagflation Risks Emerge

Interest Rate Market Signals: The 2-year U.S. Treasury yield has rapidly declined, with the SOFR spread widening, and the 10-year yield falling below the SOFR rate, reflecting that the market is pricing in an economic slowdown ahead → the Federal Reserve is forced to cut rates, while the long-end yield inversion (10-year SOFR) reinforces recession warnings.

Liquidity Contradiction: Although the consumption of the TGA account has marginally improved dollar liquidity, market risk aversion has led to capital withdrawal from high-risk assets (U.S. stocks, crypto) into the Treasury market, creating a paradox of "liquidity easing but risk appetite contracting."

II. Roots of Turbulence in Risk Assets: Weak Economic Data + Policy Uncertainty

Economic Fractures: A sharp drop in consumer confidence index, a cooling job market, combined with Trump’s tariff threats, have intensified market fears of a "hard landing."

AI Narrative Shaken: Controversies over "Scaling Law failure" following Nvidia's earnings report and technological iterations from OpenAI have raised doubts about the feasibility of AI commercialization, leading to sell-offs in tech stocks (especially in the computing sector).

Chain Reaction in the Crypto Market: The CME futures backwardation structure has weakened arbitrage attractiveness, compounded by ETF capital outflows, resulting in Bitcoin and U.S. stocks declining in sync, with the greed-fear index entering extreme fear territory.

III. Key Battleground Next Week: Non-Farm Data to Set the Tone for "Recession Trade" Intensity

Data Focus: If February non-farm employment continues to exceed expectations, or if ISM manufacturing PMI continues to decline, it will strengthen recession pricing, pushing U.S. Treasury yields further down and putting pressure on risk assets; conversely, better-than-expected data may briefly restore "soft landing" expectations.

Policy Risks: Details on Trump’s tariffs and statements from Federal Reserve officials (especially regarding rate cut paths) may trigger significant market volatility.

Strategy Recommendations: Focus on defense, waiting for opportunities to counterattack. The short-term selling pressure in the crypto industry stems from leveraged capital withdrawal, but regulatory easing and technological innovation still support long-term growth potential.

Stagflation or Recession, What is the Market Trading?

I. Macro Review of the Week

1. Changes in Liquidity and Interest Rates

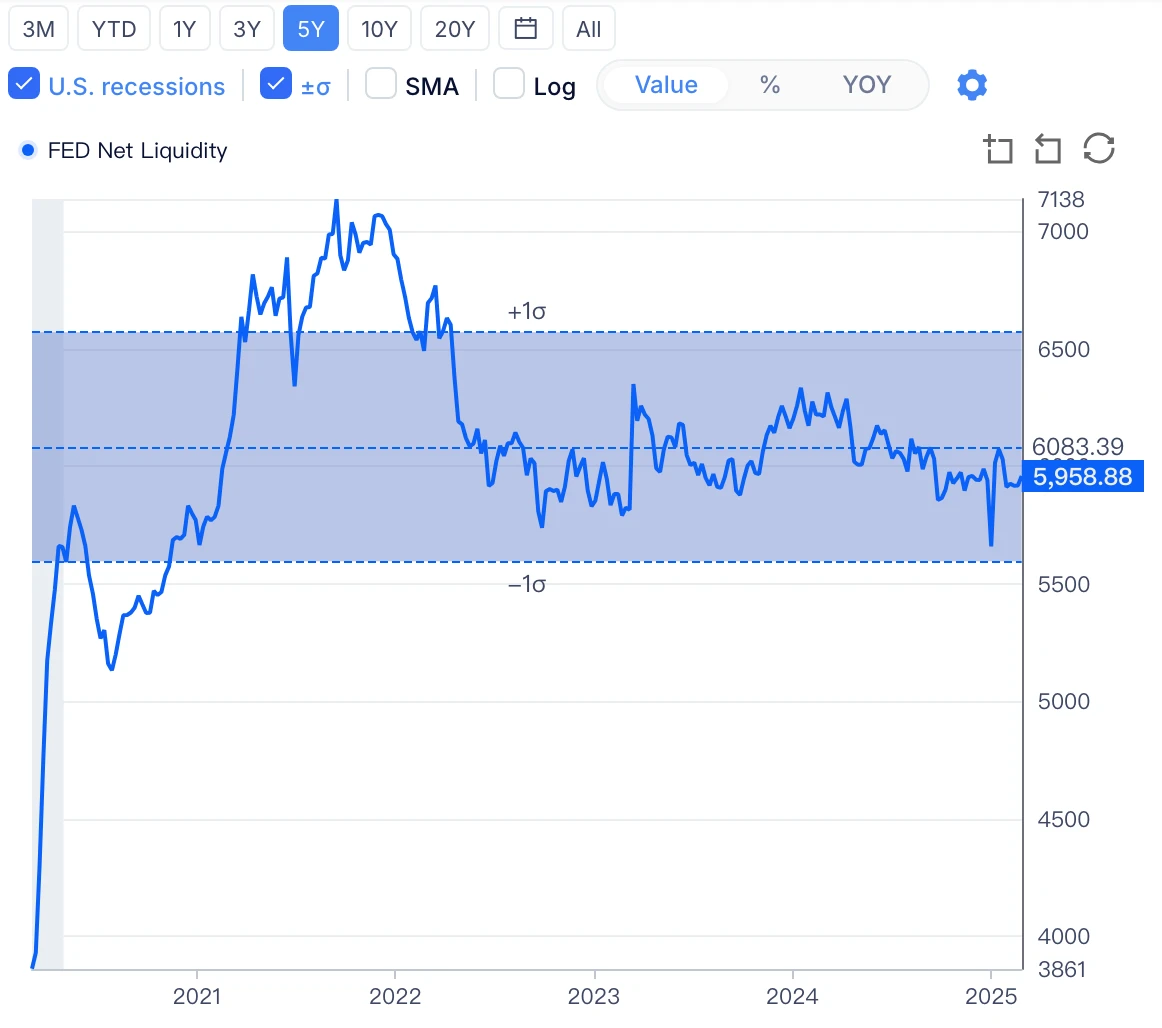

Marginal improvement in liquidity, primarily due to the consumption of the Treasury's TGA account. As discussions on the U.S. debt ceiling remain unresolved, this week saw a slight improvement in dollar-based liquidity, increasing by $39 billion compared to last week, but still in a tightening state compared to the same period last year. Further analysis shows that the consumption of the Treasury's TGA account has accelerated, dropping from $800 billion in mid-February to the current $530 billion+.

Chart 1: Changes in Dollar-Based Liquidity Source: Gurufocus

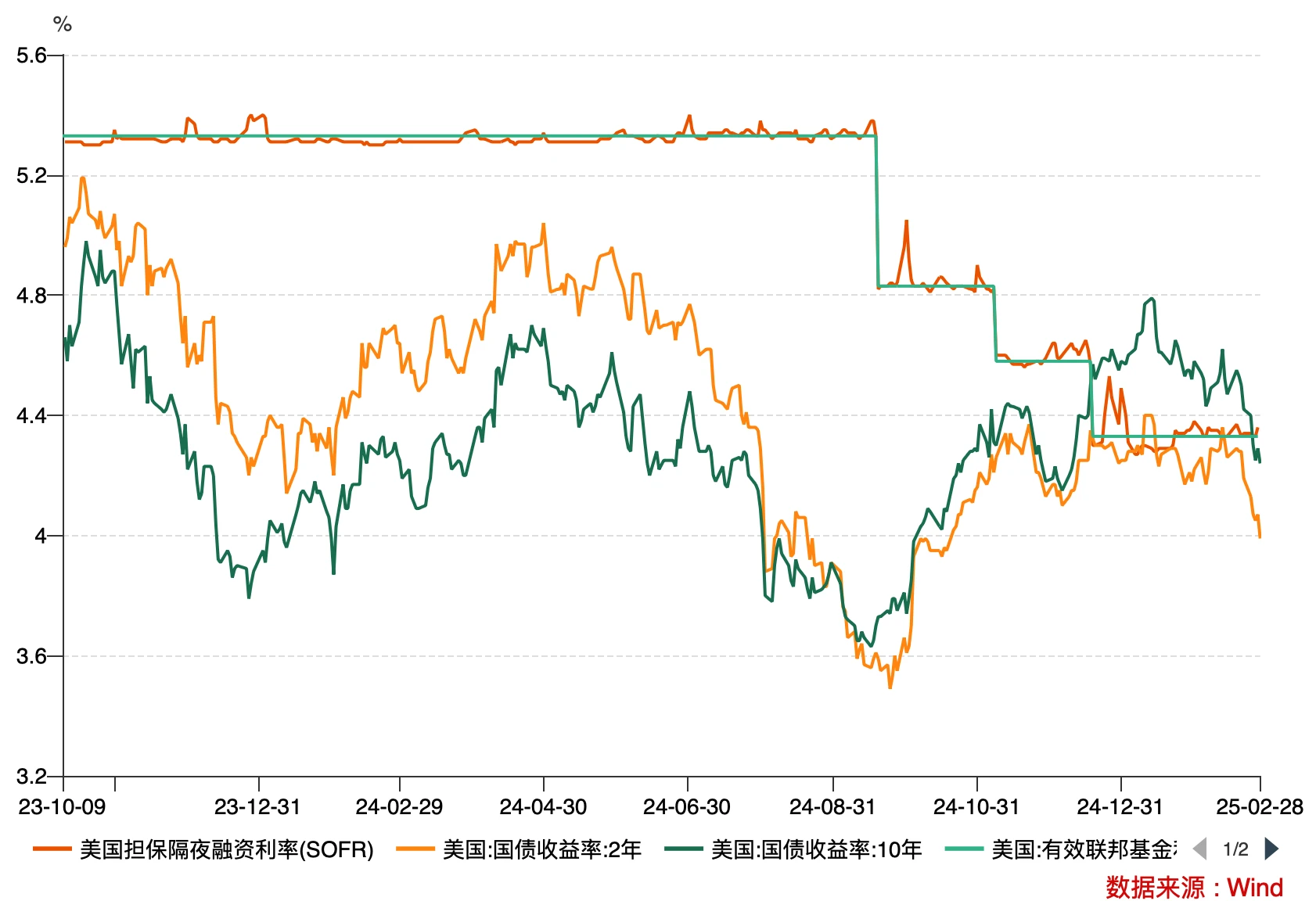

The interest rate market begins to price in rate cuts, with long-term Treasury yields reflecting economic slowdown. Data shows that in recent times, the 2-year Treasury yield, which measures implied interest rate paths, and the SOFR, which measures short-term financing rates, have not shown significant large fluctuations. However, since this week, due to economic data and Trump’s tariff impacts, the 2-year Treasury yield has rapidly declined, widening the spread with short-term financing rates; meanwhile, the 10-year Treasury yield has started to fall significantly below the SOFR rate.

Chart 2: Changes in Short-Term Financing Rates and Treasury Yields Source: Wind

The above trends are the result of global investors' trading, reflecting several facts:

In the context of deteriorating economic data, the Treasury market's expectations for the Federal Reserve's rate cuts this year have risen sharply. Historically, when short-term financing costs are significantly higher than long-term rates, it generally indicates the end of the Federal Reserve's tightening policy.

Short-term financing rates have not priced in rate cuts, indicating that the Federal Reserve is still managing liquidity through open market operations, ensuring that short-term financing costs remain somewhat tight to prevent the market from excessively front-running rate cuts, which could affect inflation control.

The downward slope of Treasury yields is steep, indicating strong market risk aversion. As shown in the chart, this week the downward slope of the 10-year Treasury yield is noticeably steeper, indicating a rapid influx of funds into the Treasury market, reflecting heightened risk aversion.

Overall, although the Federal Reserve ensures the tightness of financing costs at the short end of the yield curve through liquidity management, the trading results in the Treasury market indicate that due to the influences of economic data, Trump’s tariffs, inflation, and other factors, the market is pricing in "due to economic slowdown, the Federal Reserve is forced to cut rates."

2. Review of Risk Markets

In the U.S. stock market, this week saw significant volatility. Following the poor data from last week, the market sell-off continued, with the VIX index maintaining volatility above 19. The market's pricing of uncertainty has become increasingly pessimistic, shifting attention from inflation to economic data, particularly the consumer confidence index released on Tuesday, which saw its largest drop in three years, reigniting recession fears and intensifying sell-offs and short-selling activities until Friday's PCE data eased market concerns, leading to a rebound in U.S. stocks.

Chart 3: Consumer Confidence Index from the Conference Board Source: NBER

From the perspective of U.S. stock market volatility, aside from the deteriorating signals from economic data, the most significant data from last week was Nvidia's earnings report. Despite strong performance, the issue of "Scaling Law" failure has been magnified by the market, putting the AI narrative under immense scrutiny, especially after OpenAI launched ChatGPT 4.5, making these concerns seem increasingly real. In the context of the AI narrative being questioned and economic data indicating a slowdown, U.S. stocks are facing a comprehensive adjustment of expectations and market pricing.

In the crypto market, this week has been clouded with uncertainty. Following the Bybit incident last week, due to the deteriorating risk appetite in the entire U.S. stock market, capital has flowed into the Treasury market for safety, leading to significant pullbacks across the crypto industry, with the greed-fear index dropping below 15, entering extreme fear territory.

As analyzed earlier, although the marginal liquidity of the dollar has eased somewhat, when the market is pricing in rate cuts due to economic slowdown or even recession fears, it does not provide significant support for high-risk assets. Capital is more inclined to withdraw from high-risk assets and shift towards the Treasury market with positive carry yields.

At the same time, further observation of BTC shows that the price gap between the CME futures market and the spot market has rapidly narrowed, even entering a backwardation structure. This change in structure has diminished the attractiveness for hedge funds that rely on basis arbitrage through spot ETFs and CME futures, especially in comparison to Treasury yields above 4%. This also partly explains why Bitcoin ETF funds faced significant outflows this week.

The entire transmission logic is: market fears economic recession - risk appetite declines - capital withdraws from high-risk markets - hedge funds begin to exit Bitcoin basis trading - ETF funds flow out - exacerbating concerns in the crypto market - accelerating sell-offs. With the easing of concerns following Friday's PCE data, the market rebounded due to a recovery in risk appetite.

II. Outlook for Next Week

As analyzed earlier, the market is at a turning point of intense adjustment of expectations, with complex factors increasing the difficulty for subjective trading investors, necessitating close tracking of the latest data and timely adjustment of expectations.

Key macro data for next week is as follows:

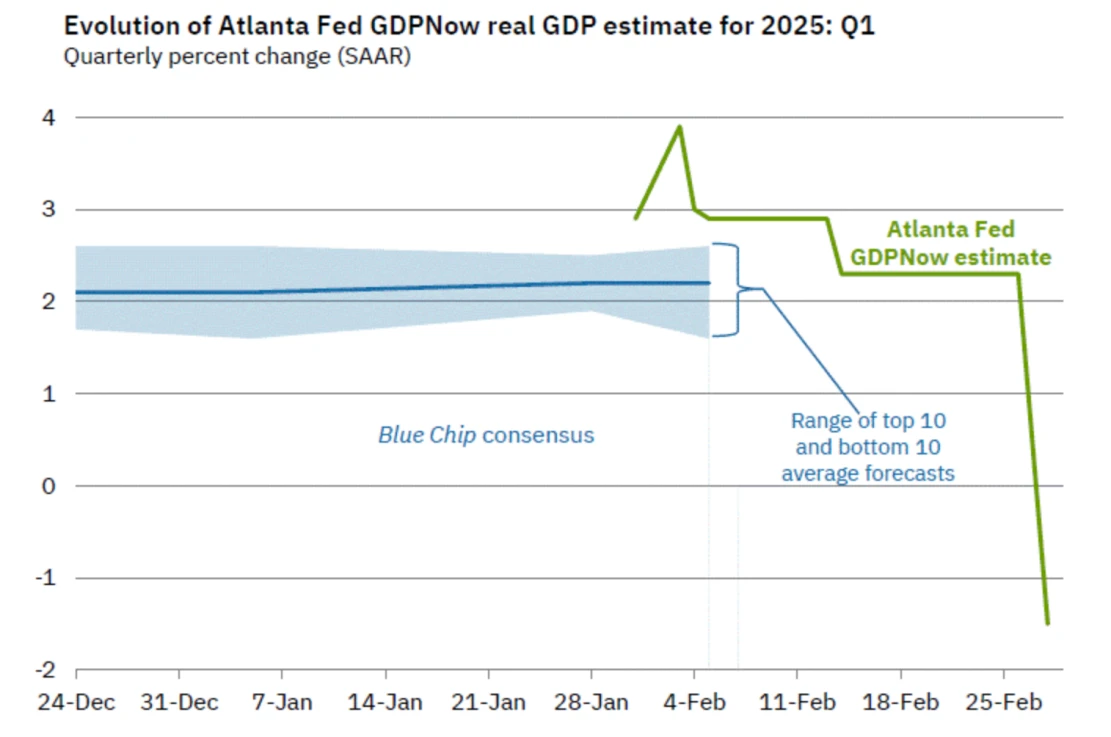

Due to the Atlanta Fed's release of the latest GDP NOW forecast data last Friday, the data unusually predicts a -1.5% GDP (seasonally adjusted) for the first quarter of 2025.

Although the deterioration of this forecast data is partly due to seasonal factors affecting U.S. consumer spending, it indeed reflects the increasing danger of economic slowdown under the threat of Trump’s tariff policies. The current market is at a critical period of dual expectation adjustments of "strengthened recession expectations" and "impact of Trump’s policies," and asset prices may still maintain high volatility. Especially with next week's non-farm data about to be released, it will determine whether the market further strengthens the "recession trade" during this critical period of contention.

Based on the above factors, we recommend:

From a risk-averse standpoint, we advise investors not to chase high prices when market expectations are unclear; however, if risk appetite stabilizes and rebounds, there may be short-term corrective rallies, but volatility risks should still be monitored.

Given the high uncertainty in the current market, for defensive needs, we recommend diversifying allocations as much as possible, increasing defensive assets/quantitative arbitrage products to ensure a balance of risk and return.

Closely monitor economic data, macro interest rates, liquidity, and policy-induced market expectation adjustments.

Despite last week's decline severely impacting market sentiment, investors should note that the easing of U.S. policies and regulations has not stopped, providing long-term growth momentum and broad growth space for the crypto industry. The short-term market decline is a risk-averse action taken when the main trading line is unclear, especially for leveraged/short-term funds primarily from hedge funds; capital withdrawal and position closing do not imply a bearish outlook on Bitcoin, but merely trigger their risk management measures due to market signals.

In the long run, we firmly believe that Bitcoin and the crypto industry still have ample upside potential, and we maintain strong confidence in this.

Disclaimer

The content of this article is for informational sharing only and does not promote or endorse any business or investment activities, nor is it financial advice. Readers are strictly advised to comply with the laws and regulations of their respective regions and not to engage in any illegal financial activities.

No trading access, guidance, or issuance channels related to any virtual currency or digital collectibles are provided. The above content is original to 4 Alpha, and any content without permission is prohibited from being reproduced or copied; violators will be held legally accountable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。