Author: Scof, ChainCatcher

Editor: TB, ChainCatcher

What is SIMD-0228?

SIMD-0228 was primarily proposed by Vishal Kankani, an investor at Multicoin Capital, aiming to adjust the inflation mechanism of the Solana network to make it smarter, allowing for automatic adjustments of SOL issuance based on market dynamics and staking conditions.

The current SOL issuance mechanism follows a fixed schedule that does not change with network activity, which is considered "blind issuance." This proposal introduces a "smart inflation" mechanism that enables SOL issuance to dynamically adapt to market demand, enhancing network security and reducing unnecessary inflationary pressure.

Why adjust the SOL issuance mechanism?

With the development of the Solana ecosystem, the earnings of stakers no longer solely depend on SOL issuance but increasingly come from MEV (Maximum Extractable Value). Data shows that in the fourth quarter of 2024, MEV revenue in the Solana network reached approximately 2.1M SOL (around $430 million), growing several times compared to the previous quarter. This means that even with reduced SOL issuance, the network can still attract enough stakers to ensure security. Therefore, the proposers believe that optimizing the inflation strategy and avoiding blind issuance of excess SOL can lead to healthier network development.

What problems does SIMD-0228 solve?

- Reduce centralization risk: High inflation can lead to SOL being concentrated in the hands of large stakers, while lowering inflation helps more users hold SOL, maintaining decentralization.

- Promote DeFi development: Reducing inflation helps increase the usage of SOL in DeFi applications rather than being heavily used for staking rewards.

- Lower selling pressure and stabilize prices: High inflation means more SOL needs to be sold to pay taxes, while reducing inflation can decrease selling pressure in the market, helping stabilize SOL prices.

- Improve market perception: Although technically SOL's inflation is not a direct cost, the market often views it as a long-term price pressure. Optimizing the inflation mechanism can improve SOL's positioning and perception in the market.

How does the "smart inflation" mechanism work?

The proposed "smart inflation" mechanism has two core objectives:

- Dynamic incentives for staking—when the staking rate decreases, the system will automatically increase the issuance to encourage more participation in staking, thereby maintaining network security.

- Minimum Necessary Inflation (MNA)—to minimize unnecessary SOL issuance, only issuing the minimum amount of SOL required to maintain network security, avoiding excessive SOL in the market that could lead to selling pressure.

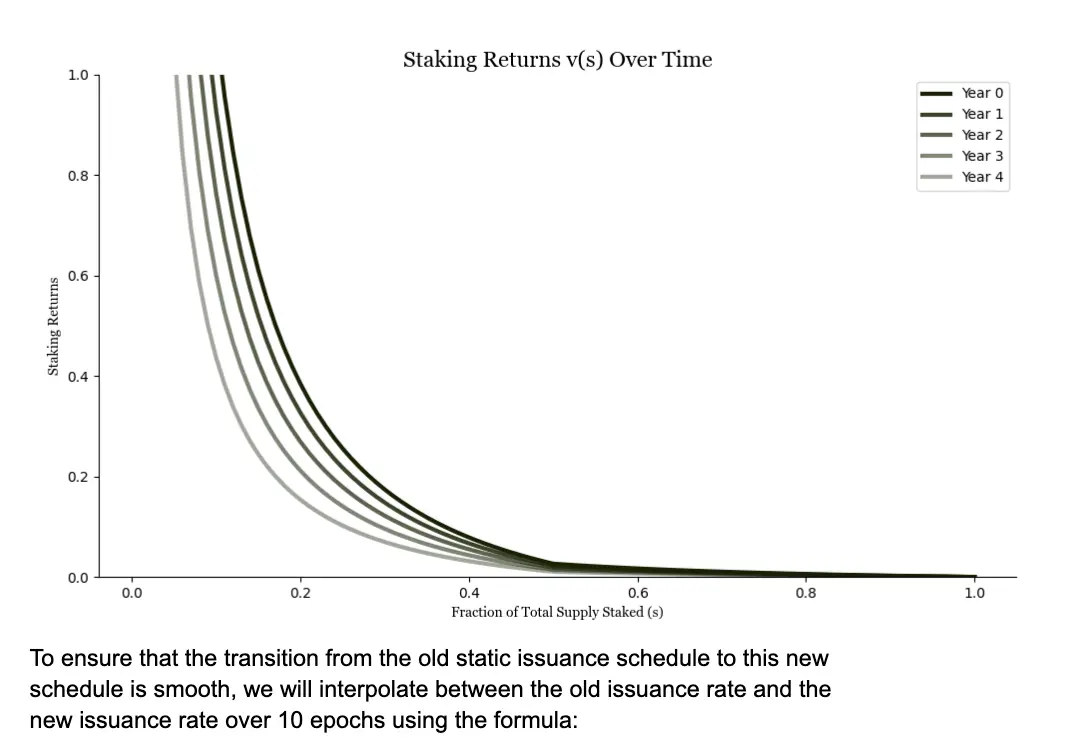

The core of this proposal is a new SOL issuance calculation formula that automatically adjusts the issuance based on the staking rate (s). If the staking rate is high (e.g., above 50%), the inflation rate decreases; if the staking rate is low (e.g., below 33%), the inflation rate increases to ensure sufficient security. The new issuance mechanism will transition gradually over 50 epochs (approximately 25 days) to ensure smooth implementation.

What impact does this have on various stakeholders in the ecosystem?

This proposal reform essentially represents a power rebalancing between large token holders, validators, and ecosystem builders. If the proposal passes, staking yields will drop from 7.03% to 1.41%, and validators will shift from relying on inflationary rewards to focusing on MEV and transaction fees—this presents both opportunities and challenges.

For investors holding large amounts of SOL, the reduction in inflation rate helps minimize token dilution and maintain the value of their holdings. However, the drop in staking yield from the current 7.03% to 1.41% means that large holders will need to reassess their investment strategies, potentially weighing between staking and other revenue channels.

The income structure for validators will undergo significant changes. As staking yields decline, validators will have to rely more on income sources such as maximum extractable value (MEV) and transaction fees. This may encourage validators to actively participate in network activities to compensate for the reduced staking rewards. However, for smaller or resource-limited validators, declining income may increase operational pressure, potentially leading to exits from the network, affecting the level of decentralization.

For ecosystem builders, a lower inflation rate may encourage more SOL to enter the DeFi ecosystem, increasing liquidity and user participation. This provides more opportunities for ecosystem builders to develop and promote new DeFi products and services, fostering the ecosystem's prosperity. However, this also depends on the market's acceptance of the new mechanism and changes in user behavior.

Community Perspective: Debating the Inflation Spiral, Can Solana Escape?

Although formal voting has not yet begun, this proposal blueprint has sparked intense discussions in the community regarding the "inflation spiral" and the battle of interests.

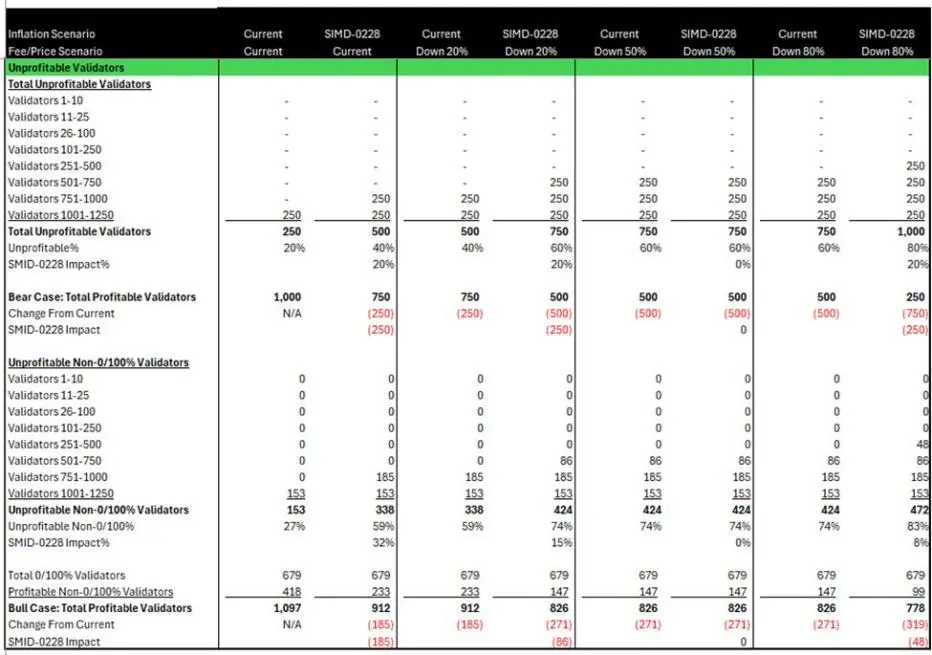

David Grider, a former researcher at Grayscale, established a model to analyze the current and proposed SIMD-0228 inflation rates, as well as various scenarios of Solana fees/prices declining, estimating the number of validators that could remain profitable. The results indicate that after the proposal passes, Solana could potentially lose an additional 50 to 250 validators under different revision scenarios.

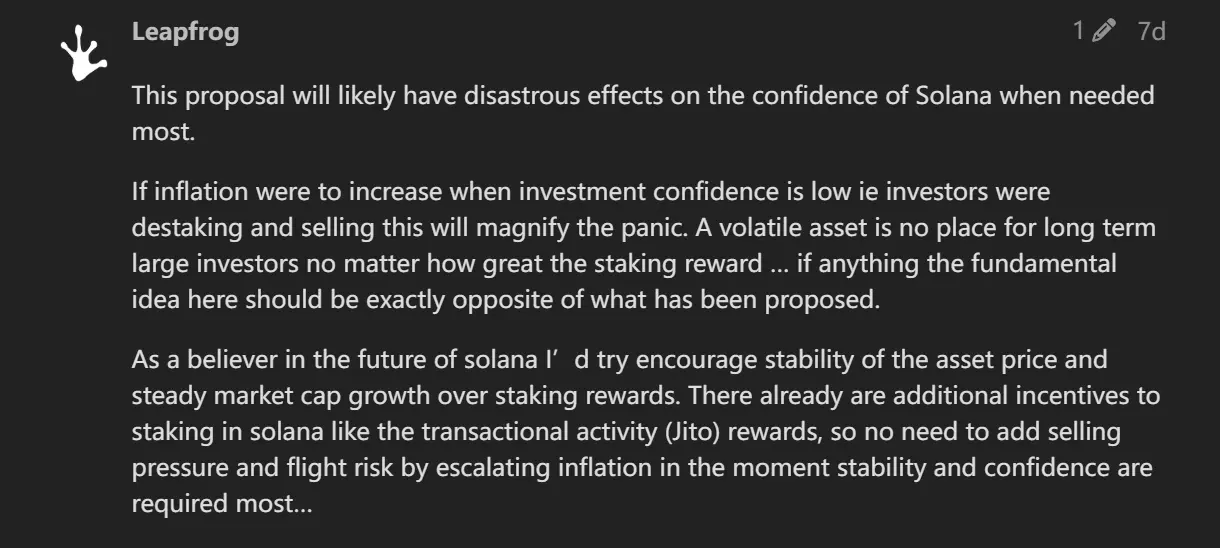

Community member Leapfrog bluntly stated in the Solana developer forum that this proposal "would have catastrophic effects on Solana." He believes that if inflation rises during periods of low investor confidence, it could lead to investors withdrawing and selling, exacerbating panic and creating a death spiral. Regardless of how high staking returns are, volatile assets are not suitable for long-term large investors.

The managing partner of Multicoin Capital stated that the current inflation rate being too high is a consensus, and action should be taken promptly. He is not concerned about consensus security but acknowledges that the profitability of validators may be affected, expecting that some validators may exit the network. He emphasized that excessive caution could lead to "analysis paralysis," hindering Solana's development, and thus a rapid advancement should be maintained to avoid falling into a similar predicament as Ethereum.

However, market analysis suggests that as a major holder of SOL, Multicoin Capital's push for the SIMD-0228 proposal aims to alleviate selling pressure on SOL through reduced inflation, enhancing its value storage function.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。