🧐Reconstructing the Web3 Asset Protection System丨 #Binance 11th HODLer Project @GoPlusSecurity Full Analysis

If you ask me what is the most important aspect of WEB3, my answer is:

It is definitely not making money, nor the development of innovative concepts; the most important theme will always be: security!

Especially in the past month or two, from smart contract vulnerabilities to malicious token behaviors, security issues have been frequent, directly threatening user assets and ecological trust, causing the crypto community to refocus on the security track.

Therefore, this time Binance HODLer has partnered with GoPlus, which is a good move to seize the opportunity, maximizing attention and market demand.

$GPS has been closely monitored and has been released many times, for three reasons:

First, it has a solid product landing, and it is a necessity for WEB3.

Second, it can quickly rebound during extreme market conditions.

Third, CZ has interacted multiple times, generating high attention.

This article will deeply analyze from the following dimensions——

GoPlus——The "Modular Guardian" in the Web3 Security Field

The Three Major Technical Moats of GoPlus

GPS Token Economics

Binance Listing Price Projection

1⃣GoPlus——The "Modular Guardian" in the Web3 Security Field

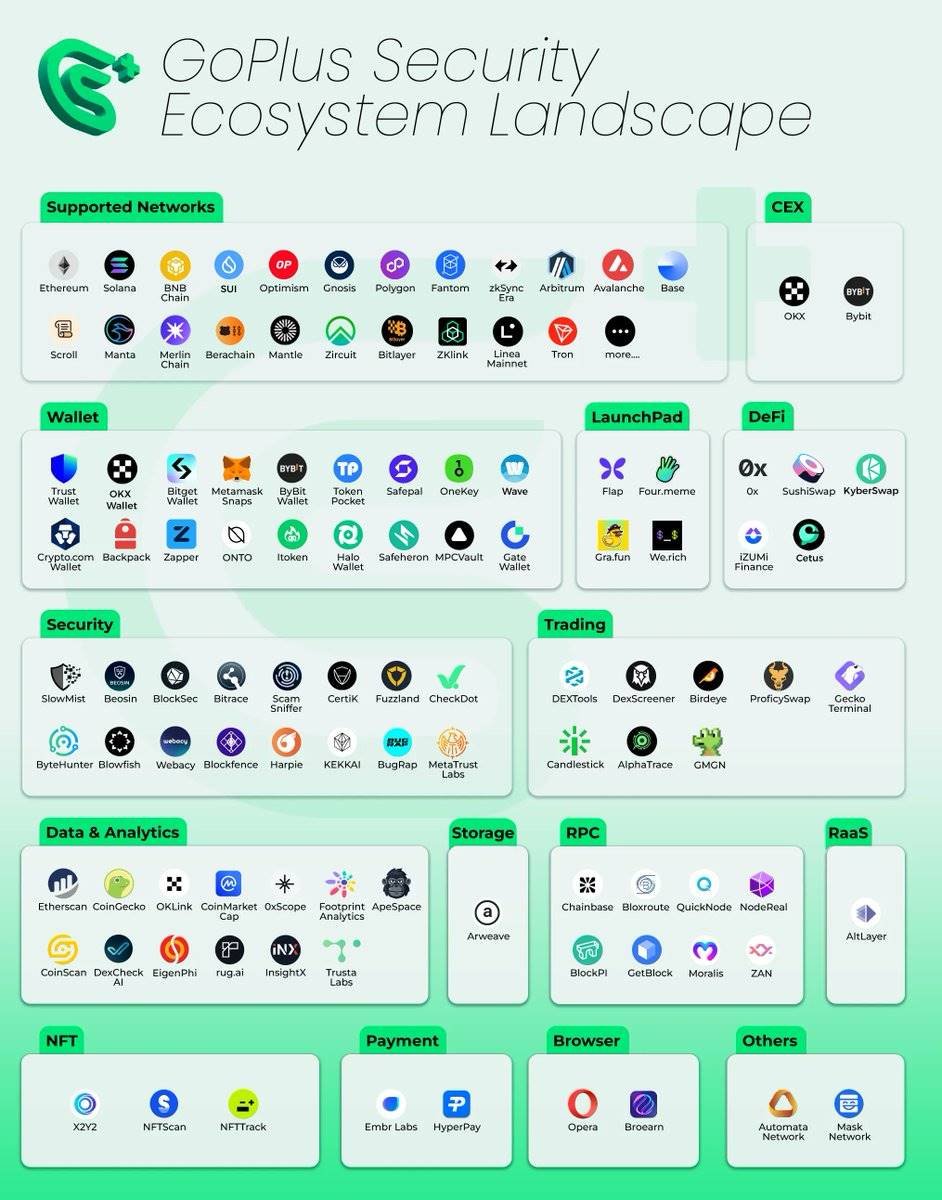

As the first security track project on Binance HODLer, GoPlus has become a phenomenal protocol in the Web3 security field with its innovative "Modular User Security Layer" architecture and an average of over 21 million security API calls per day across the network.

Especially during the CEX private key leak incident in February 2025, GoPlus intercepted over $1 million in risky asset transfers in real-time, validating its technical effectiveness.

GoPlus reconstructs the security protection logic through a modular layered architecture, covering the entire user interaction lifecycle——

- Fundamental Layers

Security Data Layer: Aggregates 20 types of security data such as on-chain risk tokens, phishing contracts, and malicious addresses, having identified over 560,000 risk tokens affecting 13.6 million addresses.

Security Computing Layer: Based on EigenLayer AVS's distributed node network, it achieves real-time calculations such as transaction simulations and risk scoring, enhancing single-point failure resistance by 300%.

- SecWare Ecosystem

Developers can deploy over 100 security modules (SecWare) such as anti-MEV and anti-phishing without permission, while users can customize protection strategies through the SecWareX platform, currently accumulating 1.8 million independent users.

- User Security Module

Integrated into wallets, dApps, and other entry points, it intercepts risky operations before transaction signing. For example, during the private key leak incident in February 2025, it prevented 80% of abnormal asset transfers through real-time authorization detection.

GoPlus's goal is clear: to provide comprehensive protection for every transaction and every asset of users.

Compared to other security products on the market, GoPlus is not just a tool; it is more like a dedicated on-chain security assistant.

I have previously written several research reports, which you can read in depth if interested:

https://x.com/btw0205/status/1866829953536516397?s=46&t=1fmViEEp4ahAv6QgAcIA2g

https://x.com/BTW0205/status/1871005033485197667

2⃣The Three Major Technical Moats of GoPlus

1) Scalability Advantage of Modular Security Layers

Unlike traditional security tools (such as CertiK) with a single audit model, GoPlus supports dynamic loading of security modules. For example, in response to the recent surge in L2 chain meme coin scams, developers can quickly launch customized SecWare such as "honeypot contract detection" and "token permission analysis," with a response speed four times faster than traditional solutions.

2) Full Lifecycle Risk Interception

From pre-interaction risk warnings (such as phishing site identification), real-time interception during interactions (such as malicious contract calls), to post-interaction asset tracking, GoPlus's USM module can cover 12 types of risk scenarios. Its multi-chain wallet scanner supports 15 mainstream chains including Ethereum, Base, and Arbitrum, with a detection accuracy of 99.3%.

3) Security Ecosystem Driven by Economic Models

Through GPS token incentives, GoPlus has built a multi-party participation flywheel——

Developers: Stake GPS to release SecWare services and earn 70% of service fee sharing;

Node operators: Provide security computing resources and receive staking rewards combined with EigenLayer re-staking earnings;

Users: Use GPS to pay for security service fees and enjoy "insurance-style" protection for on-chain interactions.

3⃣GoPlus's Economic Token Model

$GPS is the native utility and governance token of GoPlus, which can be used for the following functions:

① Payment of security service fees: dApps and wallets integrating GoPlus API need to consume GPS;

② Staking and governance: Holders can participate in SecWare service audits, risk parameter adjustments, and other governance;

③ Ecological incentives: 30% of service fees are used for buyback and burn, forming a deflationary model.

Token Name: GoPlus Security (GPS)

Initial Circulation: 1,813,400,000 GPS (18.1% of the maximum token supply)

Maximum Token Supply: 10,000,000,000 GPS

Total Amount of HODLer Airdrop Tokens: 300,000,000 GPS (9% of the total token amount)

4⃣Binance Listing Price Projection

Since $GPS was launched, it has remained relatively stable, currently priced at 0.15u, with an FDV of around 1.5 billion.

Recent frequent security incidents may simultaneously drive up the demand for GPS.

Therefore, if we refer to GoPlus's post-investment valuation of $150 million last year and the average premium of the security track as a price anchor, with support from both Binance and OKX exchanges, the FDV could reach $3 billion, corresponding to a GPS price of 0.3u, with further growth potential.

However, recent market sentiment has been relatively average, and expectations may need to be adjusted downwards, with a reasonable opening range likely between 0.15-0.25.

It is recommended to focus on the following indicators in the future——

Growth rate of SecWare ecosystem developers;

API integration progress of mainstream wallets/exchanges;

GPS staking rate and deflation rate.

Opening Time: March 4, 2025, 21:00

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。