Dreams are good, but perhaps we need to wait a bit longer.

Written by: Deep Tide TechFlow

The market is a huge Christmas tree.

Yesterday, the market was still basking in the positive news brought by Trump’s support for cryptocurrency, but it didn’t last a day. Bitcoin fell back to its original point, erasing all the gains from Trump’s announcement, creating a painful situation for the market.

However, the market, having grasped a lifeline, did not easily give up on the possibility of digging out more positive news from Trump.

On the morning of March 4, Alpine Fox LP founder Mike Alfred tweeted that the Trump administration might announce a zero capital gains tax policy on cryptocurrency sales at the crypto summit on Friday.

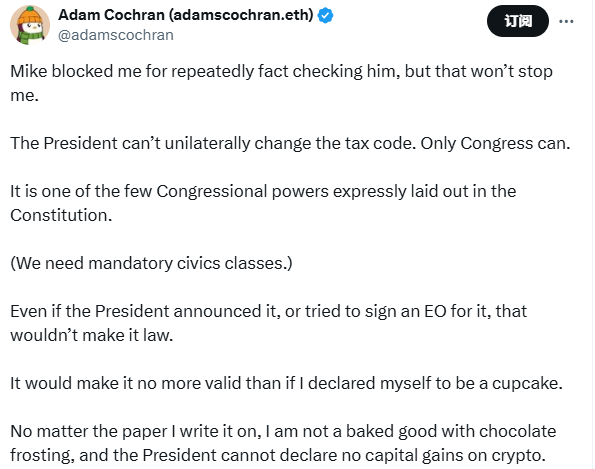

Regarding Mike Alfred's claim that "Trump is preparing to announce zero tax on cryptocurrency," Cinneamhain Ventures partner Adam Cochran directly criticized: "Mike blocked me because I repeatedly verified his facts, but that won't stop me. The president cannot unilaterally change tax laws. Only Congress can. This is one of the few powers explicitly granted to Congress by the Constitution. Even if the president announces this decision or attempts to sign an executive order for it, it won't make it law. This is no more effective than me claiming to be a cupcake."

Abolishing the capital gains tax on cryptocurrency is a significant matter for the crypto market itself, for market participants, and for the U.S. government.

As for the authenticity of such a major issue, social media is naturally rife with debate.

Setting aside the market noise, let’s first look at what impact a tax exemption on crypto would have on the market. If it doesn’t happen, what factors would restrict it?

How is cryptocurrency tax currently collected?

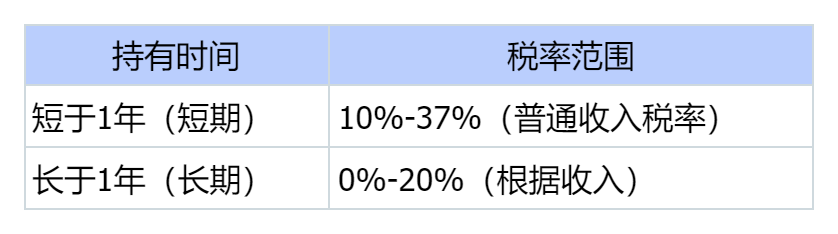

First, let’s discuss the current situation. According to the Coinbase tax guide, in the U.S., cryptocurrency is not considered "currency"; the IRS defines cryptocurrency as "property." If you buy Bitcoin and sell it at a higher price, the profit is subject to capital gains tax. The tax rate also depends on how long you hold the asset:

This means if a U.S. citizen buys $10,000 worth of Bitcoin, and three months later it rises to $20,000, selling it would yield a $10,000 profit, which would be taxed at the ordinary income tax rate (10%-37%), potentially costing them several thousand dollars. If they sell after holding it for a year, the tax rate is lower, possibly just a couple of thousand, or even tax-exempt if their income is low. But in any case, taxes are unavoidable.

Of course, it’s not just trading; the ordinary income tax on cryptocurrency applies to various activities involving cryptocurrency, such as mining, staking, salary payments, and airdrops. Individuals must report based on the fair market value at the time received and pay taxes at the ordinary income tax rate (10%-37%).

What if there really were zero capital gains tax?

Assuming Trump actually cancels the capital gains tax on crypto assets, what would be the impact? Setting aside high-level analysis, let’s talk about how the market and ordinary people would be affected.

For the market, removing tax restrictions would naturally encourage more American hot money to invest, while short-term trading activities would increase due to the absence of tax limitations, leading to greater short-term market volatility. More crypto project teams would also be attracted by the zero tax policy, with major projects relocating to the U.S., making it the "crypto asset capital" promised by Trump.

However, giving benefits to the market essentially means the government would be sacrificing revenue, losing the tens of billions of dollars it collects annually from crypto taxes, which would require a reevaluation of the government’s public budget. Spending on infrastructure, healthcare, and other areas might need to be squeezed from elsewhere. For ordinary American taxpayers who do not engage with cryptocurrency, learning that wealthy traders are tax-exempt while they still have to pay income tax could lead to feelings of psychological imbalance.

In summary, if the current U.S. capital gains tax on crypto has no impact on you, the (potential) tax exemption policy's effect on your personal crypto asset returns would need to be analyzed on a case-by-case basis; it would be inappropriate to simply label it as a positive or negative.

Rumors abound, but will it ultimately happen?

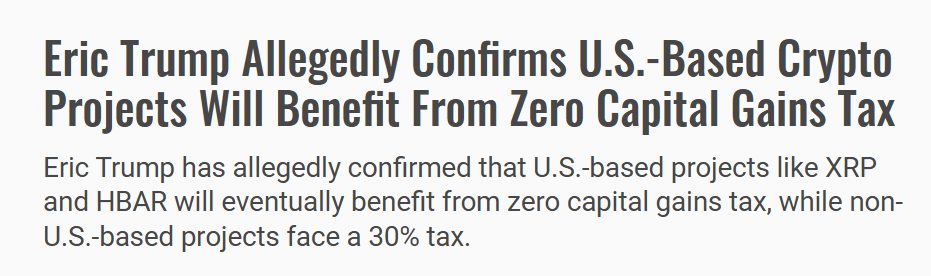

There have been ongoing reports regarding changes to cryptocurrency taxes. In January, The Street reported that Eric Trump, who is keen on participating in crypto activities, confirmed that top U.S. crypto projects like XRP and HBAR would enjoy the benefits of zero capital gains tax, while non-U.S. projects would face over 30% capital gains tax.

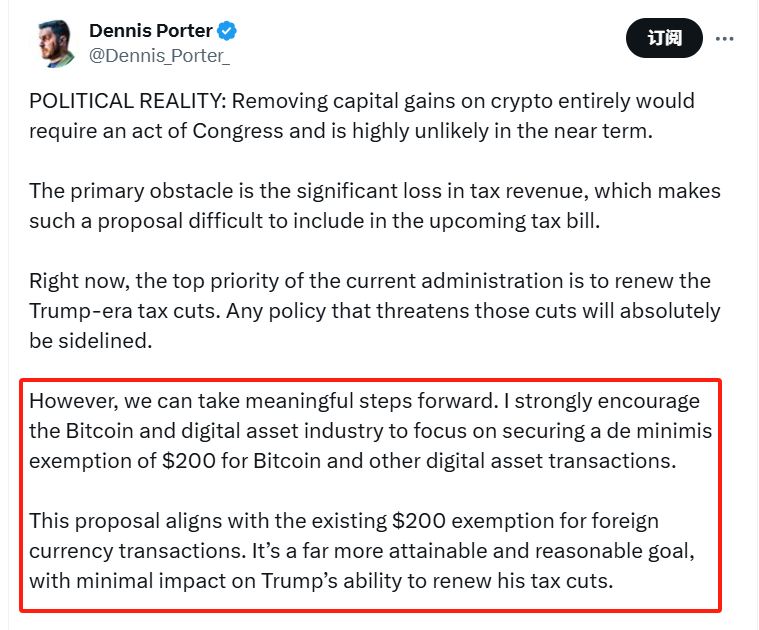

Satoshi Action Fund co-founder Dennis Porter stated that completely abolishing the crypto tax is unrealistic in the short term, but changes like a "minimum exemption amount" could be pursued.

So, even if the slogans are loud, tax law is not solely determined by Trump.

The U.S. Constitution stipulates that changes to tax policy must be approved by Congress. Even if the Republican Party supports it, the Democratic Party may not agree.

Moreover, the U.S. local tax law system is complex, with varying policies across states, making it a lengthy process to unify opinions.

Conclusion: Dreams are good, but perhaps we need to wait a bit longer

Looking solely at the cancellation of the capital gains tax on crypto, it is an incredibly desirable wish for the vast majority of market participants. If realized, it could certainly help revive the struggling market for another round. But returning to reality, the market changes and a series of social issues brought about by a zero tax rate are hurdles that policymakers cannot avoid, so this wish may only be something to hope for in the short term.

In my view, this seems more like one of the many grand promises made to the crypto market; it looks appealing, but whether it can be successfully realized depends on Congress's mood. For retail investors like us, dreams can be dreamed, but we must also keep our wallets tight and not gamble our future based on mere rumors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。