The final validation depends on the establishment of positive feedback between the TAO price and the practical value of the subnet. Failure may lead to a continuous shift towards lightweight solutions in the Web3 AI track.

Written by: Kevin, the Researcher at BlockBooster

TL;DR

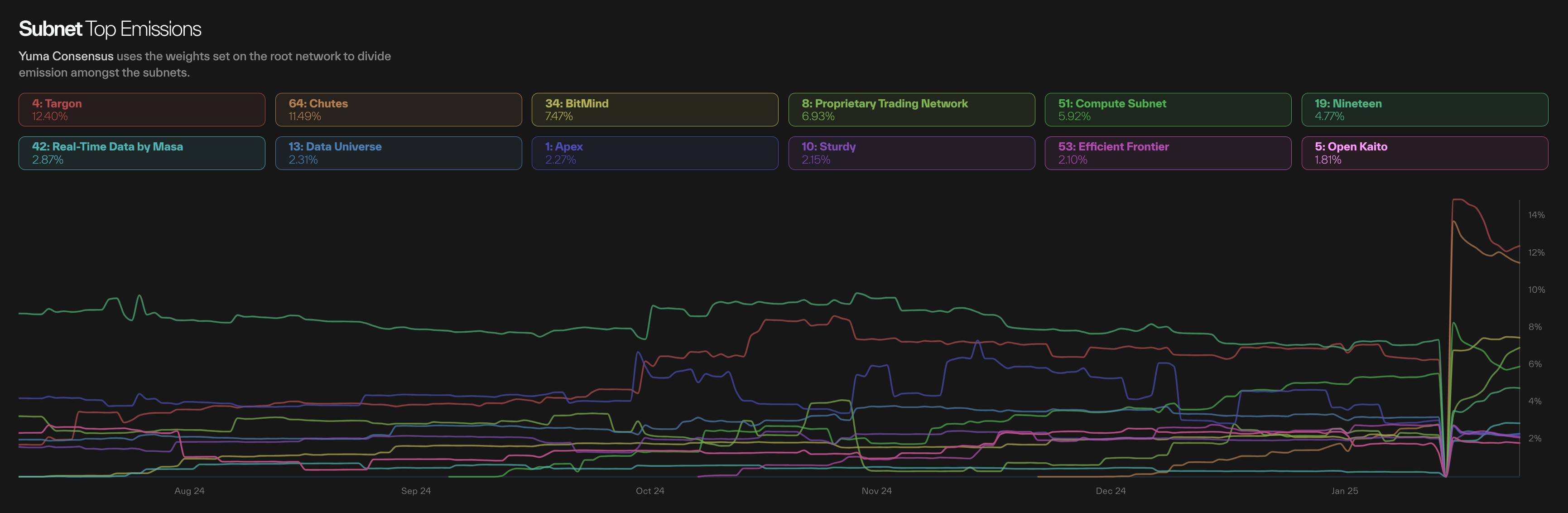

Bittensor has shifted subnet reward distribution from a fixed ratio to one determined by staking weight through dTAO, with 50% injected into the liquidity pool, aiming to promote the development of quality subnets through decentralized evaluation.

Early high volatility, APY traps, and adverse selection coexist, necessitating a balance among the three contradictions: miner quality screening, user cognitive thresholds, and market enthusiasm mismatch.

Among the current TOP10 subnets, only one requires miners to submit open-source models, while the others generally suffer from issues such as anonymous teams and lack of product anchoring, exposing the bottlenecks in Web3 AI infrastructure.

The final validation depends on the establishment of positive feedback between the TAO price and the practical value of the subnet. Failure may lead to a continuous shift towards lightweight solutions in the Web3 AI track.

Background Review

The introduction of dTAO reshapes the daily release rules of Bittensor:

Previous rules: Subnet rewards were distributed at a fixed ratio—41% to validators, 41% to miners, and 18% to subnet owners. The amount of TAO released by the subnet was determined by validator votes.

Rules after dTAO: Now, 50% of the newly issued dTAO tokens will be added to the liquidity pool, while the remaining 50% will be distributed among subnet participants based on their decisions, among validators, miners, and subnet owners. The amount of TAO released by the subnet is determined by the subnet's staking weight.

Design Goals of dTAO:

The main goal of dTAO is to promote the development of subnets with real income potential, stimulate the birth of real-use case applications, and ensure these applications are correctly evaluated.

Decentralized subnet evaluation: No longer relying on a few validators, the dynamic pricing of the dTAO pool will determine the distribution of TAO issuance. TAO holders can support the subnets they believe in by staking TAO.

Increase subnet capacity: Removing upper limits on subnets promotes competition and innovation within the ecosystem.

Encourage early participation: It can incentivize users to pay attention to new subnets, motivating the entire ecosystem to evaluate new subnets. Validators who migrate to new subnets earlier may receive higher rewards. Early migration to new subnets means purchasing dTAO at a lower price, increasing the likelihood of obtaining more TAO in the future.

Encourage miners and validators to focus on high-quality subnets: Further stimulate miners and validators to seek high-quality new subnets. Miners' models are kept off-chain, and validators' evaluations are also off-chain. The Bittensor network rewards miners based solely on validators' evaluations. Therefore, for different types or all types of AI applications, as long as they conform to the miner-validator architecture, Bittensor can evaluate them correctly. Bittensor has a high level of inclusivity for AI applications, allowing participants at every stage to receive incentives, thereby feeding back into the value of Bittensor.

Three Scenario Analyses Affecting dTAO Price Trends

Basic Mechanism Review

The daily fixed release of TAO and an equivalent amount of dTAO injected into the liquidity pool constitute the new liquidity pool parameters (k value). Of this, 50% of dTAO enters the liquidity pool, and the remaining 50% is distributed to subnet owners, validators, and miners based on weight. The higher the weight of the subnet, the larger the proportion of TAO allocation it receives.

Scenario One: Positive Cycle of Staking Growth

When the TAO delegated to validators continues to increase, the subnet weight rises accordingly, and the miner reward distribution ratio expands simultaneously. The motivations for validators to purchase subnet tokens in large quantities can be divided into two categories:

1. Short-term arbitrage behavior

Subnet owners acting as validators push up the token price by staking TAO (continuing the old release model). However, the dTAO mechanism weakens the certainty of this strategy:

When the proportion of irrational staking users exceeds that of quality-focused users, short-term arbitrage can be sustained.

Conversely, this will lead to the rapid devaluation of early accumulated tokens, compounded by the uniform release mechanism limiting chip acquisition, which may lead to elimination by quality subnets in the long term.

2. Value capture logic

Subnets with real application scenarios attract users through genuine revenue, allowing stakers to gain leveraged dTAO returns while also receiving additional staking rewards, forming a sustainable growth loop.

Scenario Two: Dilemma of Relative Growth Stagnation

When the subnet staking amount continues to grow but lags behind leading projects, the market value may steadily rise but fail to maximize returns. At this point, it is essential to examine:

Miner quality determines the upper limit: TAO serves as an open-source model incentive platform (not a training platform), and its value derives from the output and application of quality models. The strategic direction chosen by subnet owners and the quality of models submitted by miners together constitute the development ceiling.

Team capability mapping: Top miners often come from subnet development teams, and the quality of miners essentially reflects the technical strength of the team.

Scenario Three: Death Spiral of Staking Loss

When the subnet staking amount declines, it can easily trigger a vicious cycle (reduced staking → decreased revenue → further loss). Specific triggers include:

Competitive elimination: Subnets may have practical value but lag in product quality, leading to a decline in weight and eventual exit. This is an ideal state for healthy ecological development, but there are currently no signs of TAO manifesting as a "Web3 application incubation shovel."

Expectation collapse effect: A pessimistic market outlook on the subnet's prospects leads to speculative staking withdrawals. When the daily release amount begins to decline, non-core miners accelerate their exit, ultimately forming an irreversible decline trend.

Potential Risks and Investment Strategies

High volatility window: The total amount of dTAO released in the early stages is large, but the daily average release is constant, leading to potential severe price fluctuations in the first few weeks. At this time, staking in the root network becomes a risk mitigation strategy, allowing for stable acquisition of basic returns.

APY trap: The short-term temptation of high APY may obscure the long-term risks of insufficient liquidity and lack of competitiveness among subnets.

Weight game mechanism: Validator weight is jointly determined by the value of subnet dTAO + root network TAO staking (composite weight model). In the first 100 days after the subnet goes live, root network staking still has a certainty advantage in returns.

- Meme-like trading characteristics: At the current stage, the staking behavior of subnets shares similar risk attributes with Memecoin speculation.

Value Investment and Market Mismatch

Ecological construction paradox: The dTAO mechanism aims to cultivate practical subnets, but the characteristics of value investment lead to:

High market education costs: Continuous assessment of miner quality / application scenarios / team backgrounds / profit models creates cognitive thresholds for non-AI professional investors.

Lag in enthusiasm conversion: In stark contrast to Agent tokens, subnet tokens have yet to form a market consensus of equivalent scale.

Systemic Risks of Irrational Staking

Replaying historical dilemmas: If users continue to blindly follow release volume indicators, it will lead to:

Validator power rent-seeking: Repeating the voting flaws of subnets under the old mechanism.

Mechanism upgrade failure:** Violating the quality screening function intended by the dTAO design.

Cognitive threshold requirements: Investors need to possess the ability to assess subnet quality, and there is a gap between current market maturity and mechanism requirements.

Game Theory Dilemma of Investment Timing

- Optimal intervention window: The investment window should be pushed back to several months after the subnet goes live (when team capabilities / network potential become visible), but it faces:

The risk of declining market attention.

Liquidity shrinkage caused by early speculators exiting.

- Success indicators of dual validation:

The TAO price and subnet practical value form positive feedback.

Validators choose to hold TAO for sustained returns rather than sell.

Risks of Miner Quality Control Loss

Adverse selection dilemma:

Lack of quality screening mechanism: Current models struggle to effectively distinguish the quality of miner contributions.

Imbalance in the incentive environment: Low-quality miner arbitrage behavior squeezes the survival space of quality developers.

Bottlenecks in ecological construction: The open-source model incubation environment is not yet mature, potentially falling into the "bad money drives out good" dilemma.

Three Contradictions in Investing in dTAO Subnets:

Core Contradictions:

Can the subnet attract quality miner resources?

Does the user evaluation system possess effectiveness?

Secondary Contradictions:

- Does the subnet have real commercial application scenarios?

Potential Risk Points:

Transparency of development team information.

Reasonableness of profit model design.

Market execution capability.

Possibility of external capital involvement.

Design of token issuance mechanism.

Observations and Expectations

While open-source models are the mainstream direction of technological evolution, they may struggle to break through development bottlenecks in the decentralized field.

Currently, as an industry leader, Bittensor's dTAO subnet ecosystem still has significant quality defects. Analyzing the top ten subnets by TAO reward release volume reveals that only one of the TOP10 subnets requires miners to submit open-source models, while the miner groups in the other subnets have weak correlations with model development.

Training open-source models has a very high technical threshold, posing a significant challenge for Web3 developers. Most subnets actively lower technical entry barriers to maintain the miner base, avoiding model open-source requirements to ensure the supply of token incentive pools.

Even for subnets with non-mandatory open-source models, their ecological quality remains concerning.

Common Issues Among the TOP10 Subnets:

Lack of verifiable landing products

Excessive proportion of anonymous development teams.

Lack of effective anchoring between dTAO tokens and product value.

Profit models lack market persuasiveness.

The underlying design concept of dTAO is forward-looking, but the current Web3 infrastructure is still insufficient to support its ideal ecological construction. This misalignment between ideals and reality may lead to two consequences:

The valuation system of dTAO subnets needs downward adjustment.

If the Bittensor open-source model platform fails to validate, the Web3 AI track may shift towards lightweight directions such as Agent applications and middleware development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。