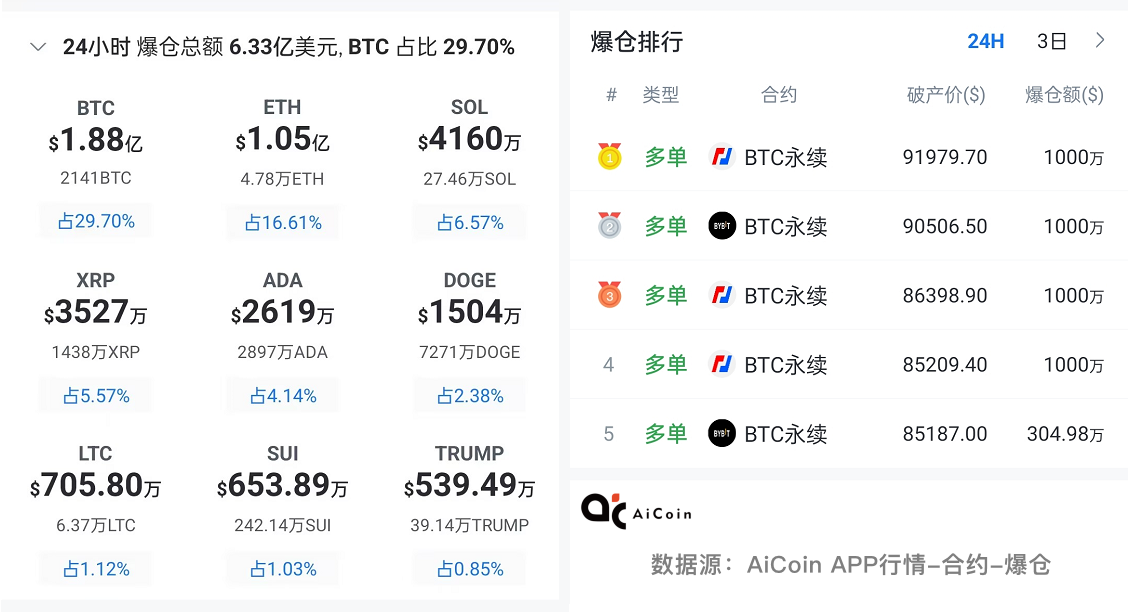

Last night, after the U.S. stock market opened, Bitcoin plummeted, briefly falling below $83,000, with a volatility exceeding 13%. Major cryptocurrencies like ETH, XRP, and SOL also fell in tandem, with declines surpassing 14%. AICoin data shows that over $630 million in positions in the futures market were liquidated, with multiple ten-million-dollar long positions being wiped out.

Policy Drivers Can't Hide Macro Pressures, Bitcoin Once Again Correlates with U.S. Stocks

The recent rise and fall of Bitcoin, aside from policy factors, was also influenced by deeper market environment issues.

1. U.S. Stocks Drag Down Crypto Market

The U.S. has officially imposed a 25% tariff on Canada and Mexico, raising concerns in global markets and causing significant fluctuations in U.S. stocks. The Nasdaq index saw a volatility of over 770 points, the Dow Jones fluctuated by 2.5%, and the S&P 500 index briefly dropped over 2.8%. Due to the high correlation between Bitcoin and U.S. stocks (especially tech stocks), the sharp fluctuations in U.S. stocks directly impacted the crypto market's performance.

2. Policy Commitments Hard to Fulfill, Market Quickly Digests Good News

Trump proposed including BTC, ETH, SOL, XRP, ADA, etc., in "strategic reserves," but this proposal has yet to receive legal support and is unlikely to be implemented in the short term. The market's reaction to this news was akin to a "promise-based good news," with prices rising momentarily before investors quickly calmed down, leading to a return of funds and making it difficult for the upward trend to continue.

3. ETF Funds Continue to Flow Out, Selling Pressure Intensifies

The spot Bitcoin ETF has seen net outflows for two consecutive weeks, with a total outflow amounting to $3.2 billion, including a single-day outflow of $1.139 billion, creating additional selling pressure. Furthermore, some analysts suggest that institutional investors appear to be increasing their Bitcoin holdings on the surface, but may be secretly hedging risks through options and other tools, creating a "double kill" situation for both bulls and bears.

4. Major Players Dumping, Market Panic Intensifies

After the U.S. stock market opened, the three major platforms—Binance, Coinbase, and OKX—saw major players engage in a "selling storm," dumping $205 million, $72.93 million, and $70.78 million respectively, with average prices concentrated in the $85,000 to $88,000 range.

The actions of the major players released two key signals:

First, they leveraged the volatility of U.S. stocks to create panic, amplifying selling pressure and triggering follow-on selling;

Second, they sold off in a tiered manner across platforms, with Binance selling at high prices to lock in profits, while Coinbase accelerated the breakdown with low-price dumping, exacerbating market panic.

Is "Strategic Crypto Reserves" a Real Benefit or a Negotiation Chip?

In this statement, Trump listed several crypto assets: BTC, ETH, SOL, XRP, ADA, attempting to shape them into national strategic assets. However, from the market reality, aside from BTC, other cryptocurrencies do not yet have the foundation to become national reserve assets.

Reason 1: BTC Has Not Officially Become a Reserve Asset, How Can SOL, XRP, ADA Be Selected?

Bitcoin is the highest market cap and most liquid crypto asset, but the U.S. government has not officially recognized BTC as a national reserve asset. In contrast, SOL, XRP, and ADA are smaller in scale, have higher compliance risks, and lack the realistic foundation to become "national strategic assets."

Reason 2: ETFs Have Not Been Fully Approved, How Can We Talk About National Reserves?

Currently, the U.S. Securities and Exchange Commission (SEC) has approved spot ETFs for BTC and ETH, but applications for ETFs for mainstream coins like SOL and XRP have not yet been approved, indicating that regulators remain cautious about the crypto market. In this context, discussing the inclusion of various cryptocurrencies in national strategic reserves seems more like a political statement rather than a feasible plan.

Reason 3: While These Projects Have U.S. Companies Behind Them, They Are Not "U.S. Stock Level" Assets

The teams behind SOL, XRP, and ADA are mostly U.S. companies, but they cannot avoid systemic financial risks in the U.S., unlike U.S. tech companies that receive clear policy protection.

Trump's true intention may not be to genuinely push for crypto assets to become strategic reserves, but rather to:

✔ Create Negotiation Chips: By proposing a more aggressive plan (such as including SOL, XRP, ADA in national reserves), he can make the BTC proposal seem more feasible in subsequent negotiations, thereby increasing its chances of approval.

✔ Attract Foreign Capital into the U.S. Market: SOL, XRP, and ADA have more international characteristics compared to U.S. stocks, and through this strategy, the U.S. may attract more foreign investors into the crypto market, thereby increasing tax revenue.

Overall, Trump's "Strategic Reserves" appears to be a carefully designed arbitrage game; he is not concerned about the decentralized vision of cryptocurrencies but hopes to attract capital inflows through policy and market manipulation, ultimately achieving capital harvesting.

Trump's Grand Crypto Strategy

Let's face it: U.S. politicians and Wall Street capital are using blockchain to reshape the rules of power.

Originally, the vision of cryptocurrencies was to break free from the control of states and capital; now, blockchain has not eliminated power but has instead become an amplifier of power. Decentralization has not brought more freedom; rather, it has allowed those in power to manipulate in more covert ways. Previously, they needed traditional financial tools like banks, exchanges, and funds to influence the market; now, they only need a tweet, a piece of news, or a public opinion battle to direct billions of dollars in the desired direction.

You think you are pursuing wealth freedom, but in their eyes, you are merely a provider of liquidity.

Special Reminder: BTC is under significant short-term pressure, having failed to break through the EMA24 moving average in the 15-minute cycle. It is recommended to assess the stop-loss situation based on the strength of buying power, with key support at $83,000.

- Support: $82,000, $80,000

- Resistance: $84,000, $86,250

The above content is for sharing purposes only and is for reference only, not constituting any investment advice. If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

Please recognize AiCoin's official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。