Tokenization of real-world assets allows external investors to recognize the value of Web3 more effectively.

Author: @Moose777_ @Nihaovand

Introduction

This article will analyze the RWA track and the sub-players in the track, Ondo Finance, from the following three aspects in order:

Starting from the macro status of Web3, we will extract recent market data and compare it with data from the two major global securities markets, the A-shares and the US stock market, to observe the current issues and status of the Web3 track;

Analyzing the impact of the RWA track on the industry ecosystem;

Using Ondo Finance as a case study, we will analyze the product's yield solutions;

I. Analysis of the Current Status of Web3

(1) Current Development Status of Web3

According to market data, the average market capitalization of the cryptocurrency market in 2024 is approximately $2.6 trillion, a 62.5% increase compared to the last bull market (average market capitalization of $1.6 trillion in 2021);

Many leading financial and fund companies have included cryptocurrency assets in their asset allocation, while numerous sovereign nations accept cryptocurrency assets as strategic reserves; representative cases include: MicroStrategy, Grayscale, Tesla…

However, cryptocurrencies also face many challenges, such as insufficient liquidity, vague value assessment, security issues, and centralized scrutiny.

(2) Data Analysis and Comparison

- Concentration & Market Capitalization

As of February 23, 2025, the cryptocurrency market capitalization is $331.9774 billion. During the same period, according to the closing data on February 20, 2025, the total market capitalization of China's A-shares is approximately $1,378.4617 billion, and the total market capitalization of the US stock market is approximately $8,210.2492 billion. Detailed data is shown in the table below:

Data Source: CoinGecko, Wind

The data shows that whether or not the two largest cryptocurrencies, BTC and ETH, are excluded, the concentration of the cryptocurrency market is far higher than that of the A-shares and US stock markets.

This indicates that the crypto market is in a highly monopolized ecosystem, with BTC and ETH accounting for 70% of the market capitalization, forming a dual oligopoly.

This reflects the market's lack of confidence in holding other cryptocurrencies, which can be simply stated as a loss of "value recognition" for altcoins, resulting in funds being concentrated in mainstream coins. The consequence is a severe lack of liquidity for long-tail projects, as evidenced by the price trends of projects since their Token Generation Events (TGE).

- Trading Volume & Market Capitalization

As of February 23, 2025, the trading volume of the cryptocurrency market is $84.740 billion. During the same period, according to the closing data on February 20, 2025, the total trading volume of China's A-shares is approximately $255.923 billion, and the total trading volume of the US stock market is approximately $536.172 billion. Detailed data is shown in the table below:

Unit: $100 million

Data Source: CoinGecko, Wind

The data shows that the ratio of trading volume to market capitalization in the cryptocurrency market (2.55%) is better than that of A-shares (1.86%) and US stocks (0.65%), but market liquidity still appears insufficient. The reason is that aside from cryptocurrencies with good liquidity, the remaining cryptocurrencies suffer from severe liquidity shortages; in simple terms, most traders are concentrated on trading the leading mainstream coins, while the number of traders for altcoins is relatively small.

Unit: $100 million

Data Source: CoinGecko, Wind

The top 40 cryptocurrencies by trading volume contribute 99.67% of the trading volume, while the remaining cryptocurrencies contribute only 0.33% of the trading volume, with their market trading volume to market capitalization ratio (a/b) being only 0.09%. However, the market capitalization of the remaining cryptocurrencies is approximately 90% of ETH's market capitalization, which is a substantial currency collective from a market capitalization perspective.

For further reference, the average daily real estate transaction amount in Beijing in 2023 accounts for about 0.042% of the total unsold real estate (new + second-hand) amount in Beijing in 2023. Based on the above comparison, the liquidity of non-leading cryptocurrencies is indeed concerning, which aligns well with the concentration data.

- Price Volatility

The table below shows that the volatility of cryptocurrencies is indeed higher than that of traditional currencies or general equivalents like gold, but due to the strengthening of consensus and industry development, the digital gold and currency attributes of Bitcoin and Ethereum are becoming more prominent, with value fluctuations tending to stabilize. In contrast, other currencies (taking SOL as an example) exhibit significant volatility, resembling a form of crypto security rather than a cryptocurrency.

I believe that if we extract the data of other cryptocurrencies with low market capitalization and poor liquidity discussed earlier, their volatility would be even more pronounced. The severe price fluctuations elevate the risks associated with providing liquidity, which, in a scenario of mismatched returns, reduces the willingness of market makers and liquidity providers to offer liquidity, creating a negative cycle. Even though many cryptocurrencies can list on exchange platforms, many peak upon listing, leading investment institutions and retail investors to withdraw until liquidity is exhausted.

Data Source: CoinGecko, Wind; the US dollar index is anchored at 100 based on the 1973 dollar value.

Statistical Range: January 1, 2021 - February 23, 2025, excluding dates without COMEX gold trading data; the trading interval for non-cryptocurrency products is based on natural days, while cryptocurrency trading closing prices are calculated based on Beijing time at 0:00.

Indicator Calculation: The average absolute volatility calculation formula is abs (closing price today / closing price yesterday - 1) averaged over the statistical range; the maximum volatility calculation formula is (maximum value / minimum value - 1) over the statistical period.

(3) Analysis of Existing Problems

- Liquidity Dilemma

I believe the liquidity dilemma exists in two aspects:

One is due to the concentration of consensus on leading cryptocurrencies, and the investment strategies of currency holders and consensus mechanisms like POS. Cryptocurrencies like BTC and ETH are held for long periods or staked/lost on their respective chains, resulting in liquidity not being released.

Regarding this aspect, various applications and projects in the DeFi field have already provided rich solutions, whether it is Solv through re-staking, the mechanisms of LSD and LST issuing staking tokens for secondary staking, or Babylon releasing liquidity through remote staking of BTC, all of which provide numerous solutions for releasing liquidity of leading currencies.

On the other hand, according to the previous data analysis, the liquidity dilemma is reflected in the severe lack of liquidity for non-leading cryptocurrencies (altcoins).

I believe the main reasons for this are:

(1) The actual application scenarios and users' judgments on the project's fundamentals drive liquidity. If the actual application scenarios are vague and lack fundamental support, then weak currency consensus naturally leads to a lack of liquidity;

(2) The liquidity of the blockchain market is often driven by "hot narratives," which are usually short-term. Once the narrative loses its appeal, market funds quickly withdraw/shift, leading to liquidity exhaustion and tokens losing traders, while liquidity providers and project parties find it challenging to time their actions, bearing high risks while providing liquidity for the currency.

- Vague Value

The value of cryptocurrencies comes from consensus, and the manifestation of consensus is a collection of mainstream and non-mainstream values and recognized entities among different groups; just like BTC has shaped a decentralized currency system recognized as the trend of the next stage of society, which is the future.

Many cryptocurrency enthusiasts unanimously believe that the future society will be decentralized.

Every cryptocurrency must find its value, whether it is cultural & emotional (meme), or DeFi (bringing more returns to cryptocurrency holders and stakers), or reducing original transaction costs through scaling, but the premise for achieving consensus is clear value.

Undeniably, those advanced terms and application scenarios are very captivating, but the cryptocurrency market is still in a rapid growth phase, accommodating external members, and a business logic that many new investors with less knowledge can recognize will help Web3 gain more attention and builders.

- How to Spread Belief

Events like the Russia-Ukraine war have exposed the unreliability of centralized financial systems, while the decentralized nature of the cryptocurrency system provides a potential solution to this issue. How to accelerate the acceptance process, gain majority trust, and spread belief is an important topic.

Tokenization of real-world assets can serve as a case worth studying in this context, as it allows external investors to recognize the value of Web3 more effectively.

II. Analysis of the RWA Track

(1) Definition

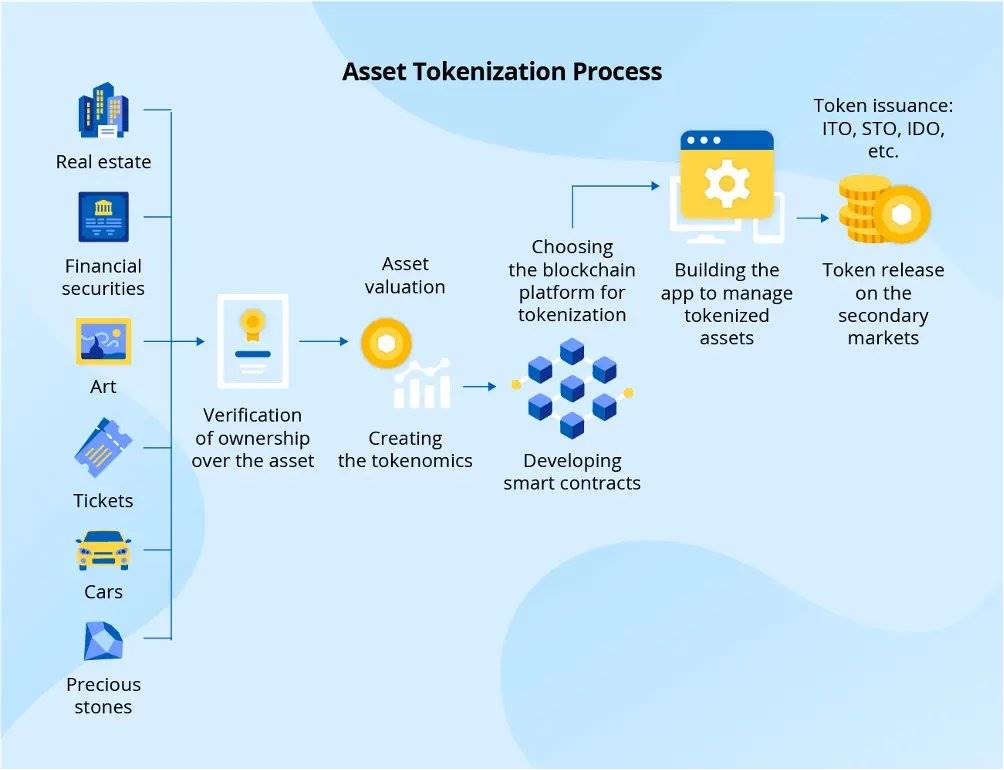

To bring real-world assets into DeFi, it is necessary to "tokenize" the value of the assets—referring to the process of converting something with monetary value into a digital token so that its value can be represented and traded on the blockchain.

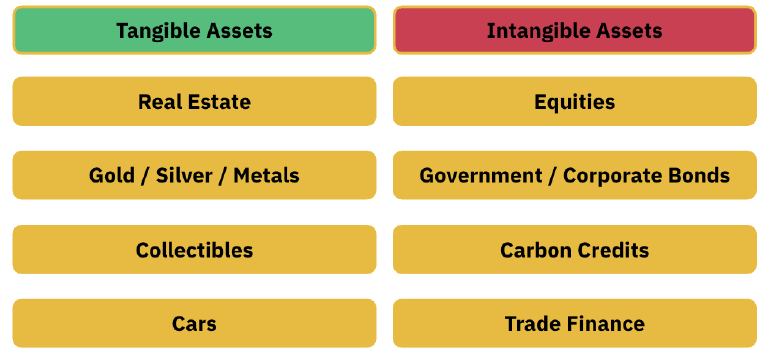

Tokenized real-world assets (RWAs) are digital tokens recorded on the blockchain that represent ownership or legal rights to tangible or intangible assets. Any real-world asset with a clear monetary value can be represented by RWA, which can represent tangible assets, including real estate (residential, commercial properties, and real estate investment trusts REITs), commodities (gold, silver, oil, and agricultural products); it can also represent intangible assets, such as artworks and collectibles (high-value artworks, rare stamps, and vintage wines), intellectual property (patents, trademarks, and copyrights), carbon emission credits, and financial instruments (bonds, mortgages, and insurance policies).

Source: Binance Research

(2) Tokenization Process and Methods

Tokenization Process:

The four methods of tokenization are as follows:

Direct Title: In this method, the digital token itself serves as the official ownership record, eliminating the need for custodians. This method is only applicable to digitally native assets. The system uses a single ledger (which may be a distributed ledger) to record token ownership. For example, instead of issuing tokens supported by a share registration system, it is better to directly tokenize the registration system, making the token a true ownership record. This streamlined approach eliminates the need for custodians or duplicate registrations. While this method can utilize distributed ledgers, the registration system itself does not necessarily need to be distributed. However, the legal framework for most asset classes under this tokenization method is still limited, and the regulatory structure is not mature.

1:1 Asset-Backed Tokens: In this method, custodians hold the assets and issue tokens that represent direct rights to the underlying assets. Each token can be exchanged for the actual asset or its cash equivalent. For example, a financial institution can issue bond tokens based on bonds held in a trust account, or a commercial bank can issue stablecoin tokens backed one-to-one by commercial bank money in a dedicated account.

Collateralized Tokens: This method issues asset tokens by using assets that differ from the expected assets or related rights as collateral. Typically, to address the volatility of the collateral asset's value relative to the expected asset value of the token, the tokens are over-collateralized. For example, the stablecoin Tether is supported not only by cash but also by a range of other assets (such as fixed-income securities). Similarly, a government bond token can be created that is backed by commercial bank bonds, or a stock token supported by an over-collateralized related stock portfolio.

Under-Collateralized Tokens: Tokens issued under this method aim to track the value of an asset but are not fully collateralized. Similar to a fractional reserve banking system, maintaining the token's value requires active management of a portion of reserve assets and open market operations. This is a higher-risk form of asset tokenization, with historical cases of failure. For example, the collapsed Terra/Luna stablecoin was not supported by independent assets but relied on algorithmic stability through supply control algorithms. Other lower-risk partially collateralized tokens have also been issued.

(3) Development History and Current Status

- Development History

Historically, physical certificates were used to prove asset ownership. While useful, these certificates are vulnerable to theft, loss, forgery, and money laundering. In the 1980s, digital holding tools emerged as a potential solution. For example: RSA digital signatures, blind signatures, electronic cash, digital certificates, and public key infrastructure (PKI).

However, limited by the computing power and cryptographic technology of the time, these tools failed to materialize. Instead, the financial industry turned to centralized electronic registration systems to record digital assets. Although these paperless assets brought some efficiency improvements, their centralized nature required the involvement of multiple intermediaries, introducing new costs and inefficiencies.

One of the earliest forms of RWA was stablecoins. Stablecoins, as tokenized versions of fiat currency, provide a stable unit of transaction. Since 2014, companies like Tether and Circle have issued tokenized stable assets backed by real-world collateral such as bank deposits, short-term notes, and even physical gold.

In 2019, in addition to creating tokenized versions of fiat currency, companies like Paxos also launched tokenized versions of gold, pegged to the price of a specific amount. Tokenized gold is backed by physical gold stored in bank vaults and verified through monthly attestation reports.

In 2021 and 2022, the private credit market saw the emergence of unsecured lending platforms like Maple, Goldfinch, and Clearpool, allowing established institutions to borrow funds based on their creditworthiness. However, these protocols were affected by the collapses of Luna, 3AC, and FTX, leading to significant defaults.

As DeFi yields plummeted in 2023, tokenized government bonds experienced explosive growth as users flocked to access the rising rates of US Treasury bills. The total locked value of tokenized government bonds surged 782% from $104 million in January 2023 to $917 million by the end of the year, with providers like Ondo Finance, Franklin Templeton, and OpenEden receiving substantial inflows.

- Current Development Status

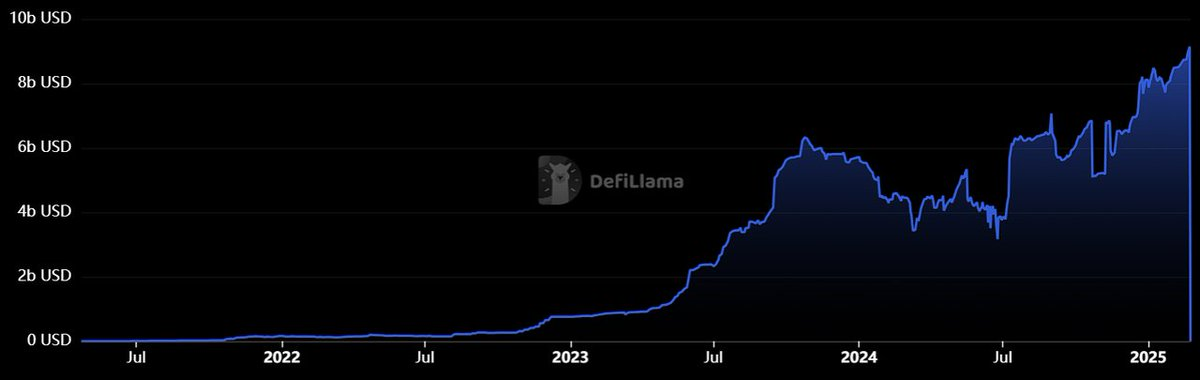

According to data from Defillama, the RWA track currently has a Total Value Locked (TVL) of approximately $9 billion, a 34% increase from the beginning of 2024 ($6.7 billion).

- Major Participants

As shown in the table below:

According to market data, as of February 24, 2025, the total locked volume of the top 10 RWA track projects is shown in the table below:

(4) Advantages of the Track

- Significance to Web3

(1) Value Support

In the overall macro context, DeFi assets lack yield; at the same time, the yield of DeFi assets is highly volatile, making it difficult to provide certainty. In contrast, traditional financial products are richer and more diverse, with more complete hedging methods, capable of providing more robust returns. Moreover, the valuation system is mature, and bringing real assets on-chain will play a crucial role in supporting the value of the Web3 industry.

Cryptocurrency assets with solid value support will also see stronger market willingness to provide liquidity, and investors' holding willingness will increase, which can help reduce the liquidity issues of non-leading cryptocurrencies and the overall high concentration to some extent.

(2) Resistance to Cyclical Fluctuations

Assets on the blockchain exhibit high correlation, and market fluctuations can easily trigger inter-asset linkages, leading to runs on lending protocols or large-scale liquidations, further exacerbating market volatility. Introducing real-world assets, especially more stable assets like real estate and bonds that are less correlated with the native cryptocurrency market, can achieve a certain degree of hedging, enriching the asset types and investment strategies of the DeFi system, which is beneficial for the overall health of the Web3.0 economic ecosystem.

(3) Diversification of On-Chain Asset Management Products

On-chain asset management seeks stable returns and good liquidity, with financial products like US Treasury bonds being widely recognized investment targets.

(4) Building a Bridge for Transformation and Trust

Bringing real-world assets on-chain serves as a bridge for the transformation from traditional finance to decentralized finance and also builds a bridge of trust.

- Significance to Traditional Financial Tracks

(1) Increased Investment Flexibility

Tokenization achieves partial ownership by dividing high-value assets (such as real estate and artworks) into tradable tokens, allowing small investors to participate in markets that were previously inaccessible due to high costs, thereby democratizing investment opportunities.

(2) Improved Liquidity and Price Discovery

Tokenization can reduce friction in the processes of asset sales, transfers, and record-keeping, enabling assets that were previously illiquid to be traded seamlessly at near-zero cost.

In traditional financial markets, asset transfers often involve multiple intermediaries, complicating and prolonging the transaction process. For example, in the case of rare gems or private equity, investors historically faced significant challenges in trading positions in these asset classes, often requiring substantial time and effort to find buyers or sellers.

Tokenization leverages the decentralized nature of blockchain to simplify this process, allowing buyers and sellers to transact directly, thereby reducing transaction costs. With blockchain technology, investors no longer need to wait months or even years to find suitable buyers; instead, they can quickly transfer assets to other investors when needed, providing secondary market liquidity in a secure and compliant manner.

Additionally, buyers and sellers can transact more conveniently and price assets based on the latest relevant information. This transparency and real-time nature enable market participants to more accurately assess asset values, leading to more informed investment decisions.

(3) Enhanced Transparency of Financial Products and Reduced Systemic Risk

The 2008 financial crisis is a classic example of a global financial disaster triggered by financial derivatives. In this crisis, financial institutions packaged subprime mortgages into securities (such as mortgage-backed securities (MBS) and collateralized debt obligations (CDOs)) and sold them to investors, creating complex financial products that made it impossible for people to trace the underlying real assets.

Under a blockchain system, investors can easily and transparently trace the underlying assets of financial products, thereby reducing the likelihood of systemic risk at its source.

(5) Potential Risks

- Risk of Ownership Disconnection Between the Real and Virtual Worlds

Although real-world assets can be traded on-chain through tokenization and partially traded through tokenization, the physical characteristics of some real-world assets prevent actual transfer of the assets, thus still subject to limitations such as sovereignty on a physical level.

- Consistency Risk Between the Real World and the Crypto Market

The trust and consistency issues between assets and on-chain data are core challenges of RWA on-chain. The key to RWA on-chain is ensuring the consistency between real-world assets and on-chain data. For example, after tokenizing real estate, the ownership, value, and other information recorded on-chain must completely match the legal documents and asset status in reality.

However, this involves two key issues: first, the authenticity of on-chain data, i.e., how to ensure the source of on-chain data is trustworthy; second, data synchronization and updating, i.e., how to ensure that on-chain information can reflect changes in the status of real assets in real-time. Solving these issues often requires the introduction of trusted third parties or authoritative institutions (such as governments or certification bodies), but this conflicts with the decentralized nature of blockchain, making trust issues a core challenge that is difficult to avoid in RWA on-chain.

- Balancing Decentralization and Compliance

In terms of legal recognition, tokenized assets must have the same legal effect as assets in the real world. This means that the ownership, responsibilities, and protections of tokenized assets should align with traditional legal frameworks. However, without appropriate regulatory coordination, the ownership of tokenized assets may face risks of difficult court enforcement or non-recognition in certain jurisdictions.

However, the conditions for regulatory and judicial oversight mentioned above contradict the decentralized vision of blockchain itself, making it a challenge to find a balance for the RWA track between compliance and decentralization.

III. Analysis of Ondo Finance as a Use Case

(1) Basic Information

(2) Product Information

- Own Products

(1) USDY (US Dollar Yield)

USDY is a tokenized note backed by short-term U.S. Treasury bonds and bank demand deposits. USDY is aimed at ordinary investors, with a minimum purchase amount of $500, and can be minted and transferred on-chain 40-50 days after purchase.

Compared to stablecoins like USDT and USDC commonly used in the crypto world, USDY is more like an interest-bearing stablecoin and can be categorized under the yield-bearing stablecoin segment. However, unlike other yield-bearing stablecoins, it is supported by traditional banks, and according to its official website, USDY complies with U.S. regulatory requirements.

Since USDY can be minted for circulation on-chain after a certain period, functioning as a stablecoin, the structural design and risk control of USDY become particularly important. Below are the key points of USDY's design and regulatory approach.

Structural Design: USDY is issued by Ondo USDY LLC and acts as a Special Purpose Vehicle (SPV). Assets are managed separately from Ondo Finance and maintain independent ledgers and accounts. This structure ensures the separation of USDY collateral assets from potential financial risks of Ondo Finance.

Over-Collateralization: USDY employs over-collateralization as a risk mitigation measure. A minimum of 3% of the first loss position is used to mitigate short-term fluctuations in U.S. Treasury bond prices. Currently, USDY is over-collateralized by a 4.64% first loss position.

First Priority: USDY investors have "first priority" on the underlying bank deposits and Treasury bonds. Ankura Trust acts as the collateral agent, overseeing the security interests of USDY holders. Control agreements have been established with the banks and custodians holding the assets, granting Ankura Trust the authority to control the assets and repay token holders' legal rights and obligations in specific default situations or upon acceleration of loans through USDY holder votes.

Daily Transparency Reports: Ankura Trust serves as the verification agency, providing daily transparency reports on reserve status. These reports detail asset holdings, ensuring transparency and accountability. The reports are independently verified, providing additional reliability assurance.

Asset Allocation: USDY adopts a prudent investment strategy to maintain the safety and liquidity of funds. The asset allocation target is 65% bank deposits and 35% short-term U.S. Treasury bonds. This conservative investment approach focuses solely on these safe and highly liquid instruments, minimizing risk exposure.

Asset Custody: The U.S. Treasury bonds supporting USDY are held in "cash custody" accounts at Morgan Stanley and StoneX, ensuring asset safety. These assets will not be re-pledged. Ankura Trust verifies the existence of these deposits daily.

Through the above methods, the USDY product isolates assets and crypto projects, reducing the project's RUG risk; collateral is over-collateralized to buffer against Treasury bond interest rate declines; Ankura Trust acts as the regulatory body, ensuring the safety of investors' funds and returns; and collateral is stored in traditional banks' cash custody accounts, ensuring that funds are not reused.

The investment threshold for USDY is relatively low compared to other RWA products, and in addition to purchasing on-chain with USDC, participation can also be done via wire transfer.

(2) OUSG (U.S. Treasury Bonds)

The underlying assets of OUSG primarily come from BlackRock's short-term Treasury bond ETF: iShares Short Treasury Bond ETF (NASDAQ: SHV), with a small portion in USDC and USD for liquidity.

Notably, Ondo I LP, as the fund manager, manages the SHV ETF shares purchased by investors in OUSG. Ondo I LP, as the SPV for OUSG, is a U.S. entity, which benefits investors by providing risk isolation and helping users redeem shares in case of emergencies (such as project bankruptcy).

(3) OMMF (U.S. Government Money Market Fund)

OMMF is an RWA token based on U.S. government money market funds (MMF), and this product has not yet been officially released.

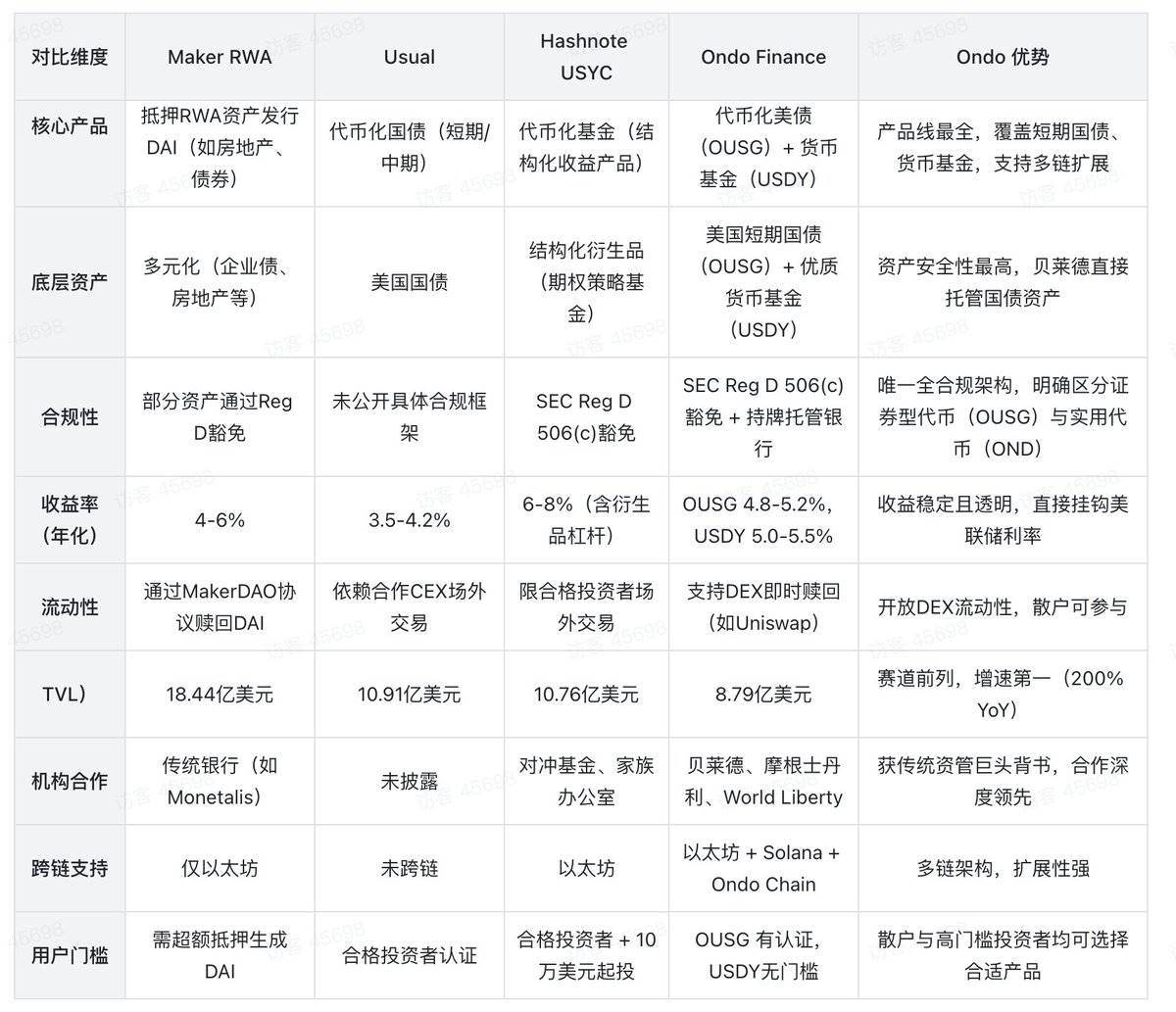

- Competitive Analysis

(3) Token Economics

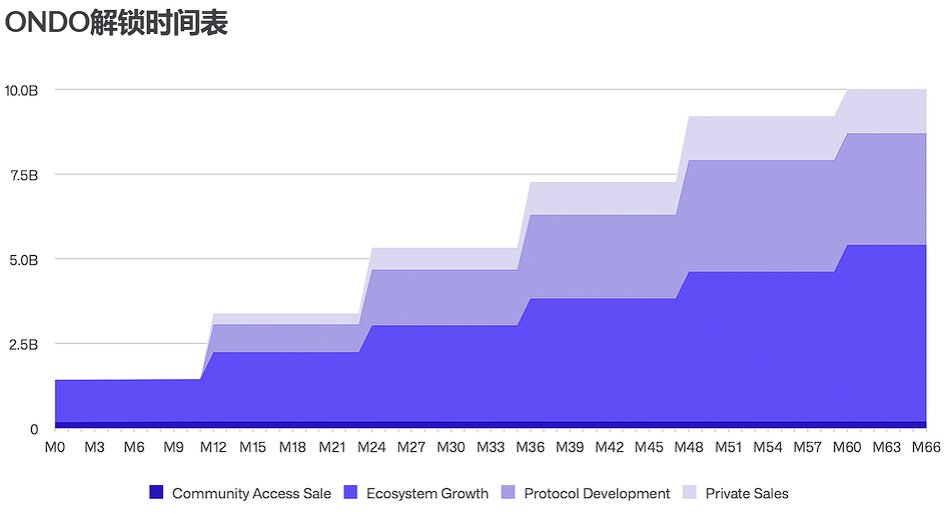

The ONDO token was launched on Ethereum in January 2024 and serves as the driving token for the Ondo Finance ecosystem, with a maximum supply of 10 billion tokens, distributed as follows:

Community Access Sale: 198,884,411 tokens (approximately 2%) are distributed to early supporters through CoinList, with about 90% unlocked at launch.

Ecosystem Growth: 5,210,869,545 tokens (approximately 52.1%) are allocated for airdrops, contributor incentives, and expansion. 24% are unlocked at launch, with the remainder vesting over five years.

Protocol Development: 3,300,000,000 tokens (approximately 33%) are allocated for infrastructure and product development, locked for at least 12 months, and gradually unlocked over five years.

Private Sale: 1,290,246,044 tokens (approximately 12.9%) are issued to seed and Series A investors, with a lock-up period of at least 12 months and gradual issuance over five years.

(4) Industry and Track Fit

- Alignment with Industry Focus

The core narratives of the 2024-2025 bull market include RWA, institutional entry, and demand for stable yields, which align closely with Ondo's strategy.

- Building Bridges Between TradFi and DeFi

As a bridge for traditional financial institutions in the Web3 landscape, Ondo equips traditional finance with blockchain technology, allowing traditional financial assets to reshape liquidity on-chain while providing solid value support for the cryptocurrency industry, meeting the dual needs of TradFi and DeFi.

- Product Alignment with Industry Needs

In the liquidity-scarce cryptocurrency market, Ondo chooses highly recognized U.S. Treasury bonds and related assets as the first step for RWA, providing liquidity while introducing RWA. Additionally, the cryptocurrency market is known for high yields and volatility, which deters many low-risk-tolerant investors. Ondo's stable RWA products undoubtedly increase the appeal for risk-averse investors to enter the cryptocurrency market.

- Compliance and Trust Needs

After experiencing a period of wild growth, the industry is bound to trend toward standardization. Ondo has made its own attempts at RWA solutions that combine the openness of public chains with institutional-level security, and its compliance efforts also signify efforts to diffuse trust, aligning with future industry demands.

(5) Innovation — Balancing Compliance and Decentralization

- Native Support for RWA Assets

The core highlight of Ondo Chain is its native support for RWA assets, particularly the tokens issued by Ondo GM. Ondo Chain plans to support the staking of Ondo GM tokens and other high-quality liquid assets, providing security for the network while creating yield opportunities for idle assets.

- Introducing TradFi Institutional Collaboration

By collaborating with leading industry players such as Morgan Stanley, BlackRock, and Coinbase (which is also an investor in Ondo), Ondo tokenizes assets like U.S. Treasury bonds and money market funds, strictly adhering to U.S. laws and regulations, making it easier to gain investor trust.

Additionally, Ondo achieves seamless integration with private networks and traditional financial environments by allowing a select group of financial institutions to operate some verification nodes. This design can reduce transaction delays, prevent front-running, and provide institutions with access to their unique assets and liquidity, further enhancing Ondo Chain's appeal and practicality in institutional applications.

- Accurate On-Chain Data to Prevent Fraud

Built-in oracles ensure real-time synchronization of asset prices, interest rates, and other data, maintained by permissioned verification nodes to ensure data authenticity. This transparency reduces the possibility of market manipulation.

- Cross-Chain Interoperability

Ondo Chain achieves full-chain messaging and cross-chain asset transfers through the native integration of Ondo Bridge. Its Decentralized Verification Network (DVN) provides primary security for the system and can further enhance protection during high transaction amounts. More importantly, Ondo Chain supports seamless sharing of data such as KYC status, sanction lists, and collateral amounts, simplifying the process for developers to create full-chain applications.

- Compliance Pioneer

(1) Securities Law Compliance: Reg D Exemption and Accredited Investor Restrictions

Reg D 506(c) Clause: Ondo's tokenized U.S. Treasury products (such as OUSG, USDY) are issued under the Reg D 506(c) clause of the U.S. Securities Act, which allows private securities offerings to accredited investors without SEC registration, but must meet:

Investors must verify assets (individual net worth > $1 million or annual income > $200,000).

Issuers must take reasonable steps to verify investor qualifications (such as bank statements, tax documents).

Tokens are prohibited from public resale within one year of issuance.

Compliance Significance: Avoid being deemed an illegal public offering of securities, reducing SEC enforcement risks.

(2) Key Qualifications

(3) Compliance Comparison with Peers

(6) Limitations

- Over-Reliance on Institutions, Lack of Community Drive

Ondo Finance's structure largely relies on the participation of traditional financial institutions, with the credibility and liquidity of tokenized assets primarily supported by these institutions. While this ensures asset quality and compliance, it also presents a core issue: its ecosystem is mainly oriented toward institutions, with limited participation from retail users. Compared to fully decentralized RWA projects, Ondo resembles an extension of the traditional financial world, where the circulation and trading of tokenized assets mainly occur between institutions, reducing the influence of individual investors and decentralized communities.

- Centralized Power Distribution Under Institutional Control

Despite Ondo Chain retaining a certain level of openness, its validators are permissioned, meaning that core power is concentrated in the hands of a few institutions. This sharply contrasts with fully decentralized RWA projects, where any participant can become a key node in the network. Ondo's design somewhat reflects the power structure of traditional finance, where most control remains with a few large financial institutions. This centralized control may lead to conflicts in future governance and resource allocation, especially when the interests of token holders conflict with those of institutional players.

- Compliance and Traditional Institutions May Limit Innovation Speed

Since Ondo Finance's core pillar is compliance and institutional participation, this may limit its speed of innovation. Compared to fully decentralized projects, Ondo may face complex compliance processes and institutional approvals when launching new financial products or technologies. This could slow its response in the rapidly evolving crypto industry, especially when competing with more agile DeFi projects, where compliance and institution-oriented structures may become a burden.

(7) Future Development

- Products

I believe that in the future, Ondo Finance will continue to strengthen its cooperation with institutions, starting with the tokenization of high-yield, stable U.S. Treasury bonds, gradually leveraging the product endorsements of its financial giant partners to bring other financial assets from traditional finance onto the chain, thereby increasing its market depth.

At the same time, Ondo can use its current layout of U.S. Treasury RWA as a defensive base; it can explore real estate RWA to capture regional arbitrage (e.g., Southeast Asia vs. North America rental yield differences), and carbon credit RWA as a hedging tool against black swan events (with a correlation of 0.72 with energy futures), among other RWA products, diversifying its RWA product types to meet investors' diverse investment needs.

Data Source: MSCI RWA Index (2025Q2), backtesting period 2023-2025

- Substantial Commitment to Decentralization

How to maintain a balance between compliance and decentralization remains an open question for Ondo. In the context of permissioned verification nodes, is the decentralized model merely superficial? Can Ondo still fulfill its original vision of being part of the blockchain, ensuring immutability and non-interference?

(8) Investment Recommendations

- Short-Term Recommendations — Investment

(1) Cyclicality

From the perspective of blockchain cycle fluctuations, if we enter a bear market in the future, Ondo and mainstream stablecoin protocols like EVA may become market favorites, and its U.S. Treasury products are suitable for low-risk-tolerant investors.

(2) The Cooperation Between TradFi and DeFi is Still in the Honeymoon Phase

Currently, I believe that TradFi and DeFi are still in a honeymoon phase of cooperation, with RWA being a win-win collaboration for both sides. Both parties will accelerate the incubation of more valuable RWA products during this honeymoon period, and Ondo's business will also enter a rapid development cycle, making it a good time to invest.

(3) Abundant Driving Factors (see Appendix 1)

According to the driving factor model (4+3 factors), Ondo has strong driving forces in Benchmark, Status, Vision, Useful, and Revenue Generation. However, its weak token economic model, single revenue stream, and competitive pressure are major risks. If Ondo Chain can successfully bridge traditional finance and on-chain liquidity, its valuation is expected to exceed $10 billion.

(4) Undervalued Valuation (detailed process in Appendix 2)

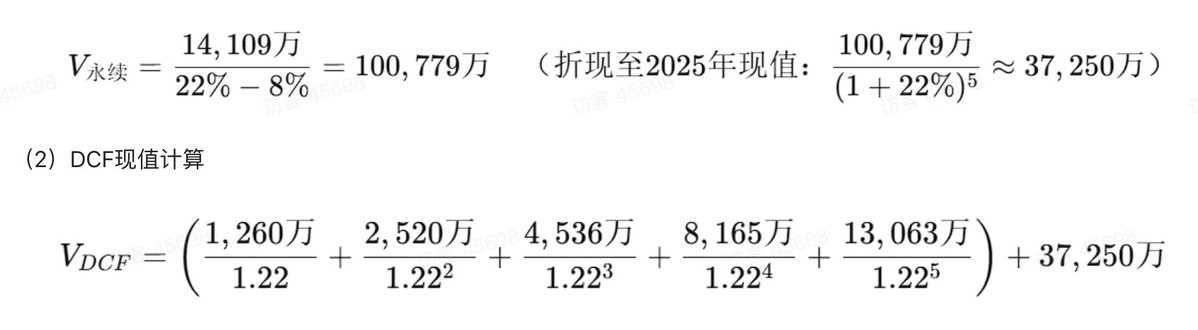

Based on the absolute valuation method, under assumptions of WACC 22%, profit margin 30%, and perpetual growth of 8%, if the number of tokens remains unchanged, the valuation for each ONDO token is $1.81. As of February 24, the data shows Ondo's price at $1.23, indicating some room for growth.

Appendix

1. Valuation Driving Force Analysis (4+3)

Ondo Finance occupies a leading position in the RWA track due to its compliance first-mover advantage and product innovation, but its weak token economic model, single revenue stream, and competitive pressure are major risks.

Short-term speculative opportunities and long-term value need to be assessed in conjunction with Federal Reserve policies and ecosystem expansion progress. If Ondo Chain can successfully bridge traditional finance and on-chain liquidity, its valuation is expected to exceed $10 billion.

2. Ondo Finance (ONDO) Valuation Analysis as of February 24, 2025 (based on a hybrid model)

(A) TVL Growth Assumptions and Cash Flow Forecast

- TVL Growth Path

- Free Cash Flow (FCF) Calculation

Protocol Fee Rate: 1.00% (TVL × Fee Rate) (of which: 0.35% asset management fee, 0.5% staking fee, 0.15% transaction fee)

Cost Ratio: 30% (Gas fees 15% + Audit 5% + Operations 10%)

Annualized FCF = TVL × 1.00% × 70%

(B) Hybrid Valuation Model Calculation

- Traditional DCF Component

(1) Discount Rate and Perpetual Value

Discount Rate: 22% (WACC 12% + Web3 Risk Premium 10%)

Perpetual Value (Gordon Model):

DCF Value per Token: 52,180 million / 1.445 billion ≈ $0.36

- Web3 Specific Factor Modeling

(1) Token Economic Multiplier

Staking Yield: Staking Ratio 30%, Staking Amount = 1.445 billion × 30% = 433.5 million tokens, Annualized Yield Rate 8% Staking Yield Present Value = 4.335 × 8% × 1.23 (current price) / 22% (WACC) / 1.445 = $0.13 per token

Governance Premium: Governance Participation Rate 15%, Premium +9% → $0.11 per token

(2) Network Effect Value

Network Effect Value = β1⋅TVL^k = 0.15 * 186.62^1.1 / 1.445 / 2.7 = $1.21 per token

β₁=0.15 (benchmarking leading projects: reference to the ratio of TVL to market cap of DeFi protocols like Compound and Aave. Example: When Compound's TVL is $10 billion, its market cap is about $2.5 billion → β1=25/100^1.2≈0.15)

TVL Index (k=1.1)

Theoretical Basis: Revised Metcalfe's Law.

Original Formula: Network Value ∝ n² (n is the number of users)

Real Adjustment: Due to differences in asset liquidity, the network effect of TVL is weaker than direct user interaction, reduced to 1.1.

Empirical Support: Research shows that the value of DeFi protocols is correlated with the 1.1-1.3 power of TVL (IEEE Blockchain Transactions, 2023). Ondo chooses k=1.1 to balance conservatism and growth expectations.

(C) Comprehensive Valuation Result

Vtotal = 0.36 (DCF) + 0.13 (Staking) + 0.11 (Governance) + 1.21 (Network) = $1.81 per token

(D) Conclusion and Operational Recommendations

Reasonable Valuation Range: $1.81 - $2.40

Current price is significantly undervalued, with core driving factors being the TVL growth engine.

Protocol fee rate optimization, 1% fee balances revenue and competitiveness.

Cross-chain ecosystem explosion, multi-chain asset injection after Ondo Chain launch.

However, based on the current market situation, the price fluctuations of this asset may not be the optimal choice in the market, and it is analyzed merely as a research case in this report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。