Original Author: BUBBLE

The recent Libra incident has completely exposed the dark side of Crypto, fulfilling Plato's allegory of the cave once again. On the most transparent blockchain, we can only catch a glimpse of the shadows cast by the torches outside the cave. This time, the Libra incident has unprecedentedly shown those inside the cave the scenes outside, involving the central power of the state, market makers, core DeFi projects on Solana, and several key influencers in the industry.

After the incident, many issues remain for the entire industry to address. Among them, the core Dex of Solana, Jupiter and Meteora, were caught in the eye of the storm. A statement released by BenChow, co-founder of both projects, has prompted a reevaluation of a long-standing debate in the blockchain space: the discussion between "permissioned" and "permissionless" blockchain projects, representing two factions within the blockchain. To this end, Rhythm BlockBeats invited MinDao, founder of dForce, to discuss the reflections behind this incident.

The Boundaries of "Permission"

As Jupiter and Meteora found themselves in turmoil, social media was flooded with discussions about whether they were involved in the incident. MinDao, founder of dForce, stated, "The focus of the incident is not on the attack, but on knowing the authenticity of such events in advance through insider information and then attacking. I don't understand why Libra had to set up such a complex arrangement through Meteora instead of easily issuing tokens using UniSwap."

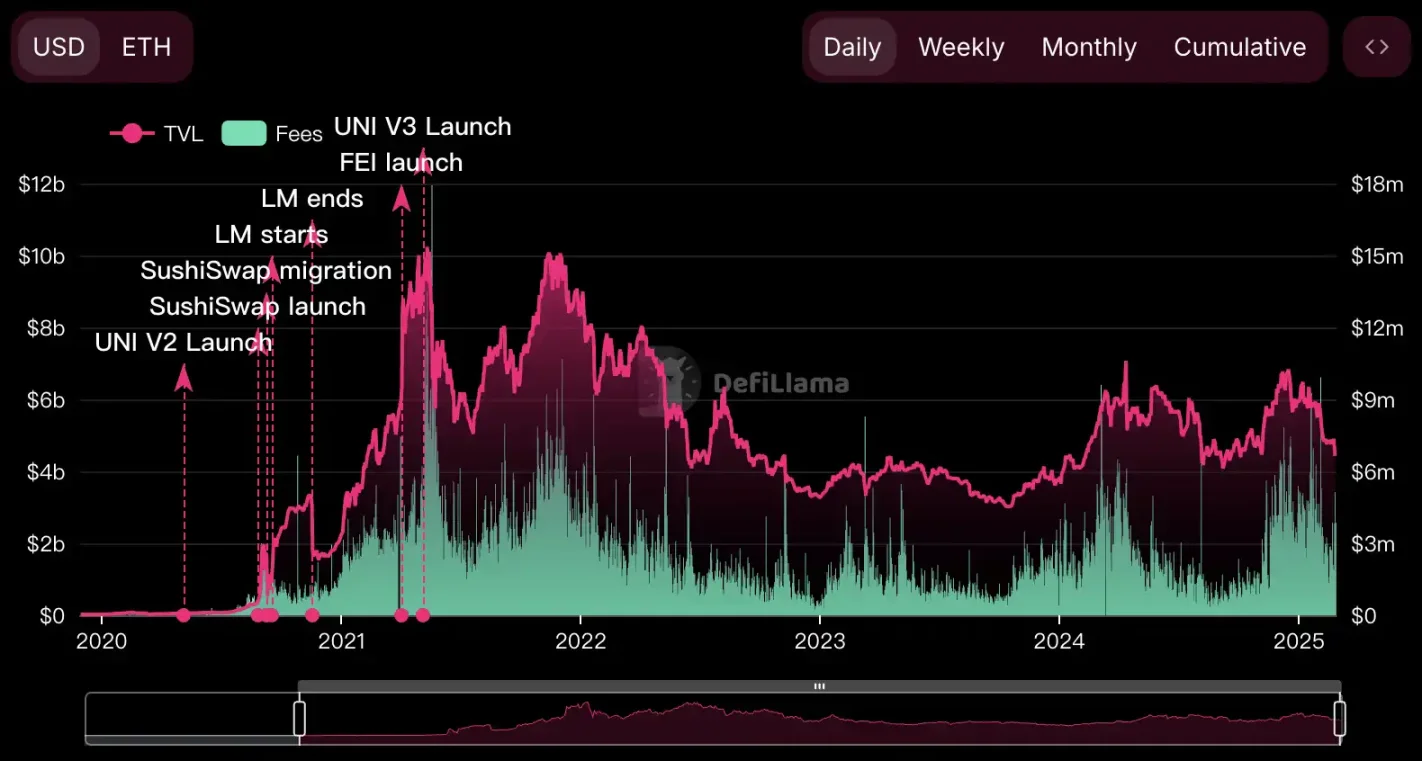

When Ben pointed out that Meteora's DLMM liquidity pool requires manual customization, the market naturally compared it to Uniswap V3's single-sided pool mechanism. Back in 2018, Vitalik initiated a landmark vote—over 80% of users supported "Uniswap should freely list tokens," which propelled the blockchain from ICO to the permissionless era of DeFi. Uniswap, with this mechanism, dominated over 80% of the DeFi market share at its peak, and its underlying logic of "permissionless" still profoundly influences the DeFi standards in the industry today.

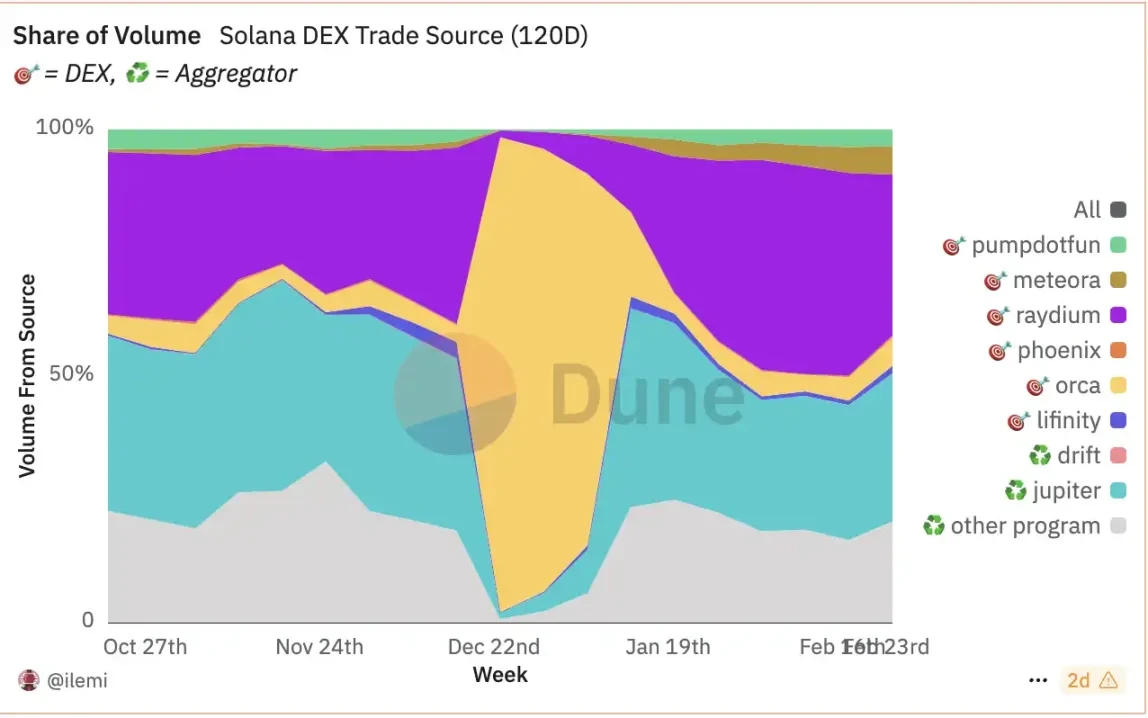

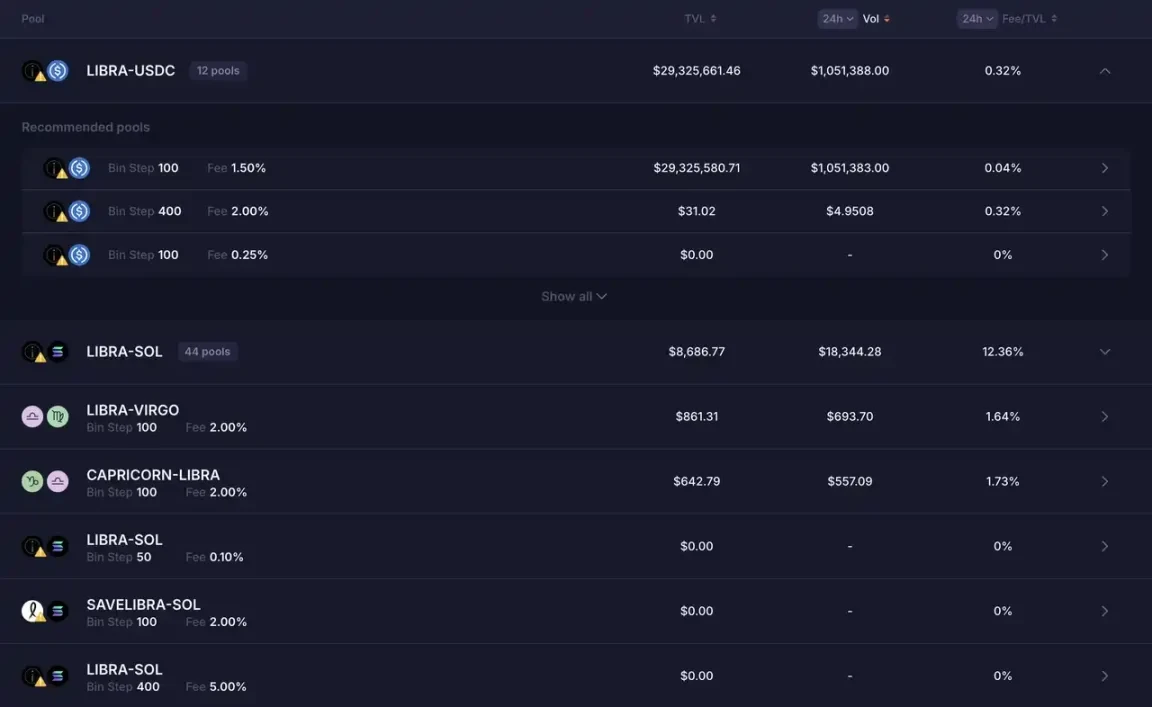

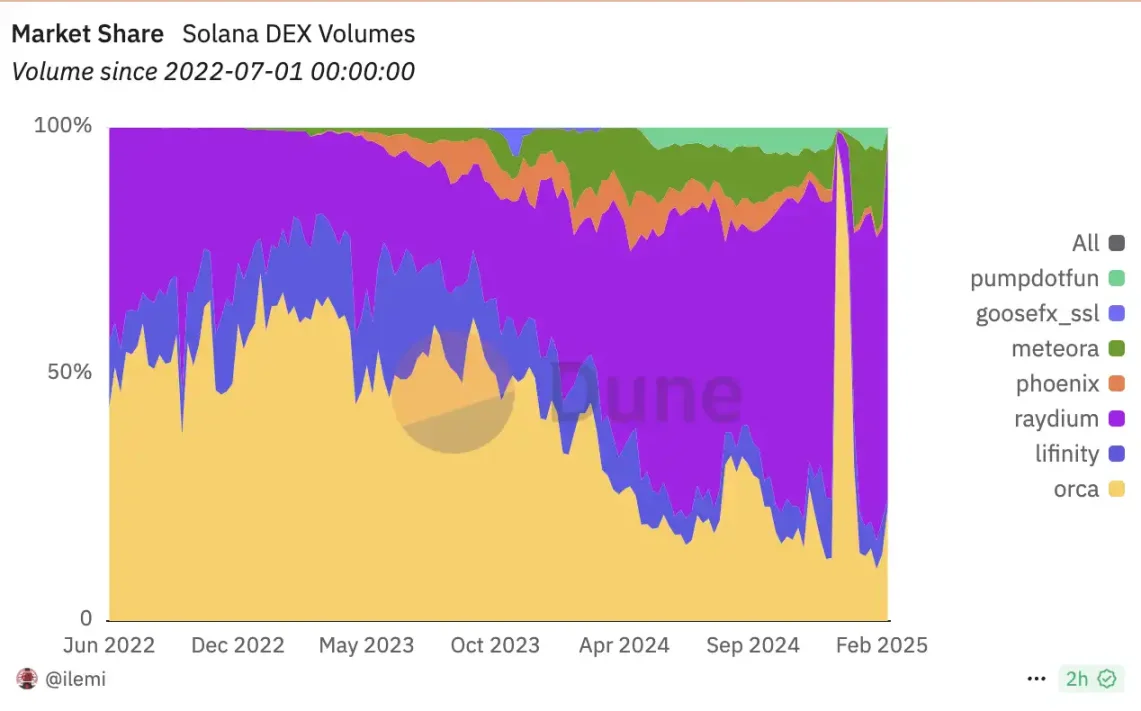

At the same time that Uniswap dominated the market, Meteora quickly developed into a leader among Solana DEXs after its launch in the Solana ecosystem. This was during the DeFi Summer when many stars gathered. However, Meteora effectively solved the slippage problem with its innovative routing algorithm, thus gaining a portion of the DeFi market share. After the team branched out to create the aggregator Jupiter, the Jupiter ecosystem soared in market share, once occupying over 70% of Solana's liquidity entry, becoming the most dominant entry infrastructure during Solana's DeFi technological explosion.

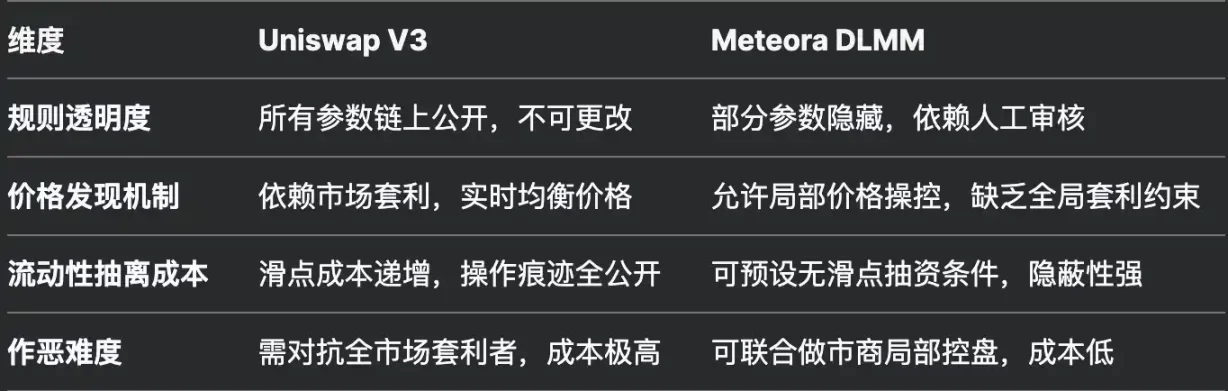

Both have single-sided liquidity pools; one is the absolute monopolist of the DeFi golden age, Uniswap, while the other is the grassroots upstart, Jupiter. Why, even after Uniswap has existed for 5 years, gone through multiple bull and bear markets, and countless Rug tokens launched on it, has it not faced as much public scrutiny as Jupiter did this time? The reason lies in a struggle between open source and closed source.

Open Source or Closed Source? Ethereum or Solana?

The liquidity rules of Uniswap V3 are enforced by mathematical formulas, with all parameters—"fees, price ranges"—publicly transparent and unalterable after the fact. Therefore, even with single-sided liquidity, on-chain arbitrageurs can monitor and arbitrage in real-time through on-chain data, balancing the market. This is a method with extremely high sunk costs for projects expecting to control the market through specific price ranges. In contrast, for DLMM, project teams need the help of the Meteora team to create customized liquidity pools, a process that involves considerable subjective judgment—"only Meteora can assess the reliability of the project team"—and information asymmetry. For example, the Libra team might require unconventional slippage parameters or hidden liquidity lock-up periods under the guise of "optimizing user experience," and these details often make it difficult for on-chain arbitrageurs to execute strategies and balance market prices in a short time.

The closed-source protocol, combined with special liquidity pool settings, also allows tokens like $Libra to exit liquidity conveniently and with low risk when using Meteora DLMM. This indirectly enables the teams behind malicious tokens to harvest selectively. According to Nansen's post-incident analysis report, among 15,000 wallets with PNL exceeding $1,000, a staggering 86.07% incurred losses totaling $250 million, while the remaining 2,100 wallets made a profit of $180 million. The main market maker of this incident, KelsierVentures founder Hayden, openly stated that he profited $100 million from the trades, in addition to over $10 million in transaction fees.

In fact, even if a product cannot be open-sourced due to ecological constraints or requires customization, there are various ways to prevent the market makers behind it from engaging in malicious activities. For instance, Olympus Pro's Bond mechanism "requires market makers to stake tokens to prevent wrongdoing," and Trader Joe's liquidity book with a time-weighted exit model "unlocks based on trading volume and survival time" can simultaneously meet the needs for large token launches and protect users.

The rapid rise of DLMM TVL after the Trump incident, data from DeFiLlama

"Permissionless DeFi or a compliant CEX, there is no middle ground," MinDao pointed out the core issue and added, "Where are the boundaries? What kind of product qualifies as DeFi? I think we need a clearer framework on this point. I believe everyone in the crypto space is looking for various compromises, striving towards a balance between compliance and decentralization."

Indeed, as long as humans are involved in the process, it cannot be called DeFi "decentralized" finance, and this product will inevitably face regulatory compliance issues. In this regard, even Uniswap Labs, which has completely separated its protocol and company entity, cannot escape. The U.S. SEC attempted to charge Uniswap Labs with operating unregistered brokers, exchanges, and clearinghouses, and issuing unregistered securities. From warnings, sending Wells Notices, investigations to formal charges, Uniswap underwent a three-year self-defense against the SEC, forcing the team to waste a significant amount of time and millions of dollars. Until now, on February 26, 2025, the U.S. SEC finally abandoned its investigation into Uniswap Labs. We are currently caught between the policy's abandonment of enforcing traditional financial rules on DeFi and the impending DeFi regulations.

The Double-Edged Sword of Traffic

The aforementioned risks of manual "permission" are just one reason for the community's opposition. Meteora itself does not hold a significant market share and cannot shake the entire industry. What is truly concerning is the vertical dominance of the Jupiter ecosystem.

According to Dune data, Meteora's market share is only 5%.

Starting in 2024, Jupiter began frequently acquiring various ecological projects, from user entry Ultimate Wallet to data analysis tool Coinhall, blockchain explorer SolanaFM, from backend liquidity pool Meteora to frontend Moonshot. By integrating wallets, data, trading, and other core infrastructures, Jupiter is building a self-contained DeFi service collection. Users can complete the entire process from deposit, trading to yield optimization within this ecosystem, and the recently launched Jupnet indicates its intentions extend beyond Solana, venturing into the entire DeFi ecosystem.

Such powerful influence and products are like a double-edged sword. When nothing happens, this is undoubtedly the best path for new users to enter the blockchain, as evidenced by the hundreds of thousands of non-crypto users added during the Trump coin period through Moonshot. However, when it gets embroiled in an "insider trading" incident, the market naturally becomes anxious about how such complex DeFi functions and processes should be regulated, especially since it is tied to Solana, which currently holds the largest liquidity in Crypto.

As the saying goes, "everyone in the crypto space is looking for various compromises." Open-source Uniswap has set the shackles of BSL "Business Source License" on V3 and V4 for its own business logic or delisted certain tokens on the frontend for regulatory legitimacy. How will the closed-source Jupiter compromise its commercial landscape, user trust, and compliance balance?

Cultural Gene

When we extend the discussion of Uniswap and Jupiter, we consider whether the products of ETH and Solana are influenced by the underlying cultures of these two chains. MinDao believes that "Solana is closed-source and pragmatic, pursuing efficiency and value chain integration, which is conducive to rapid expansion; while Ethereum is open-source and free, with a diverse ecosystem but more considerations needed for its development direction. The underlying culture of the chain profoundly influences the product path."

In his article "Layer 2s as cultural extensions of Ethereum," Vitalik mentions that Ethereum's underlying subcultures broadly fall into three camps: cypherpunks, Regens, and Degens. Looking at it now, Ethereum's "crypto-punk culture" is more vibrant, while Degens culture has flourished on Solana. Ethereum leans more towards the left, with its cultural genes rooted in the spirit of open source and decentralized idealism, which is essentially a continuation of the BTC spirit, and its ecological evolution follows the logic of "commons collaboration."

Core protocols on Ethereum like Uniswap and Aave are completely open-source, allowing any developer to fork and iterate—such as Sushiswap forking Uniswap—creating a free market-style competition. This has led to a greater variety of vertical products on Ethereum, where each product shines in its own domain, and the moat of the product is the "brand" itself. The speed of iteration and the solidity of the community significantly influence the project's dominance, and its development path is more horizontal.

Protocols on EVM are mostly multi-chain

In contrast, Solana embraces efficiency, with its culture based on competitive sportsmanship and relentless execution, closer to the "winner takes all" mentality of Web2. This has allowed "Degen culture" to take root extensively in this soil. The Solana Foundation is very adept at actively integrating resources, such as capital and government relations, which has enabled their rapid development. This is also reflected in various products below; most mainstream projects on Solana either struggle with compatibility with other chains due to underlying technology or choose to remain closed-source to prevent competitors on the same chain from copying them. They are also skilled at utilizing various resources to develop, prioritizing the creation of value chain monopolies with maximum efficiency and controlling the entire profit chain, similar to Tencent's "super app" strategy. For example, Jupiter achieves "trading - issuance - liquidity" by acquiring Meteora (DEX) and Moonshot (fiat entry), or recently, Pumpfun announced it would abandon Raydium and directly develop AMM pool product business on Pumpfun.

Protocols on Solana are mostly single-chain

The Future of Blockchain: Ethereum to the Left, Solana to the Right

"Liberal" Ethereum

The underlying cultures of both sides have nurtured the paths they are currently on. First, environmentalist Vitalik proposed transitioning Ethereum from PoW (Proof of Work) to PoS (Proof of Stake) due to the excessive "energy consumption" of PoW. In September 2022, Ethereum completed The Merge, officially switching from PoW to PoS, reducing energy consumption from approximately 78 TWh per year (equivalent to the total electricity consumption of Chile) to about 0.01 TWh. The staking mechanism introduced by PoS ("32 ETH threshold") and the deflationary model ("EIP-1559 burning mechanism") changed Ethereum's token economic model. After the merge, the circulating supply of ETH decreased by 3 million, and the annual inflation rate dropped from 3.5% to -0.2%. The number of validator nodes expanded from thousands of miners in the PoW era to over 1 million stakers.

However, this initial choice led to a phenomenon where the PoS staking threshold of "32 ETH" limited the participation of most ordinary users. The top three staking service providers—Lido, Coinbase, and Kraken—control over 35% of the staking volume, leading to market criticisms of "the rich getting richer." Even Ethereum core developer Dankrad Feist acknowledged that "if Lido's share exceeds 33%, it could trigger social consensus intervention." Coupled with extremely high Gas fees, this has resulted in "whales" becoming the primary users of Ethereum, which is why Ethereum has become known as the "noble chain."

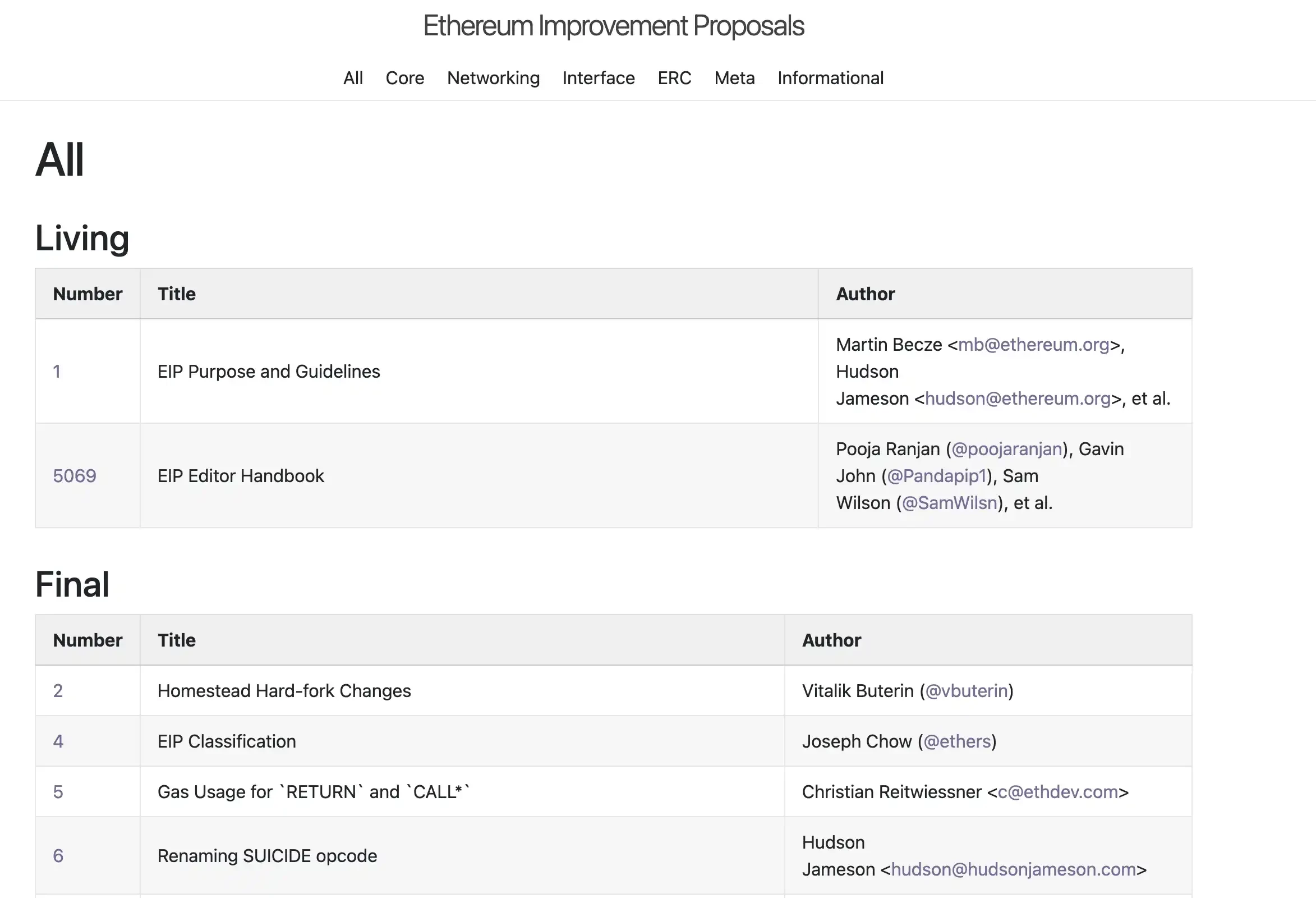

The voting process for EIPs (Ethereum Improvement Proposals) is lengthy, and community consensus is difficult to reach quickly unless core members push hard. Reports indicate that 68% of Ethereum improvement proposals are implemented by just 10 individuals related to the Ethereum Foundation. Ecological decision-making can also fall into multi-party games, leading to inefficiencies in key upgrades. For example, innovations like "account abstraction" have yet to be fully promoted, and the aforementioned PoS transition has taken six years to advance, while the accompanying "EIP-1559" burning mechanism took two years of discussion to be implemented. YBB Capital researcher Zeke believes that the EIP process has lost its original democratic intent, stating, "Governance tokens are meaningless before solving the witch problem. Democratic voting can never be reflected in governance proposals. In the current Ethereum, large institutions like a16z can veto a large community's approval vote with just a few wallets, rendering voting meaningless."

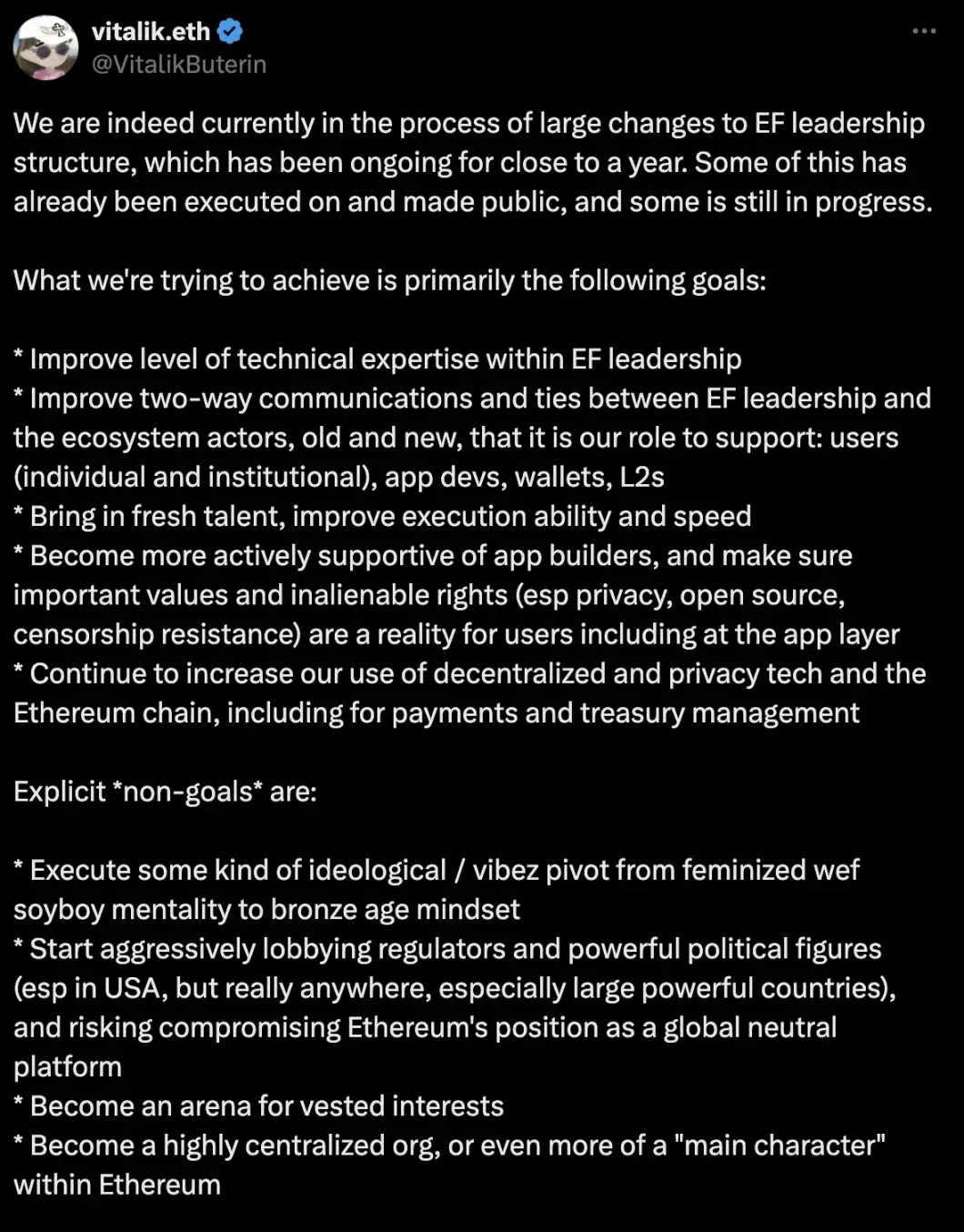

On the same day that Trump announced strong support for "American" blockchain, Vitalik tweeted that "the Ethereum Foundation will avoid executing any ideology, actively lobbying regulators and powerful political figures—especially in the U.S. and any major power—at the risk of damaging Ethereum's status as a global neutral platform, becoming a battleground for vested interests, and turning into a highly centralized organization." Vitalik still hopes to maintain Ethereum as a digital Babel that resists authoritarianism, where only global validators guard a globally open network through mathematics.

"Pragmatic" Solana

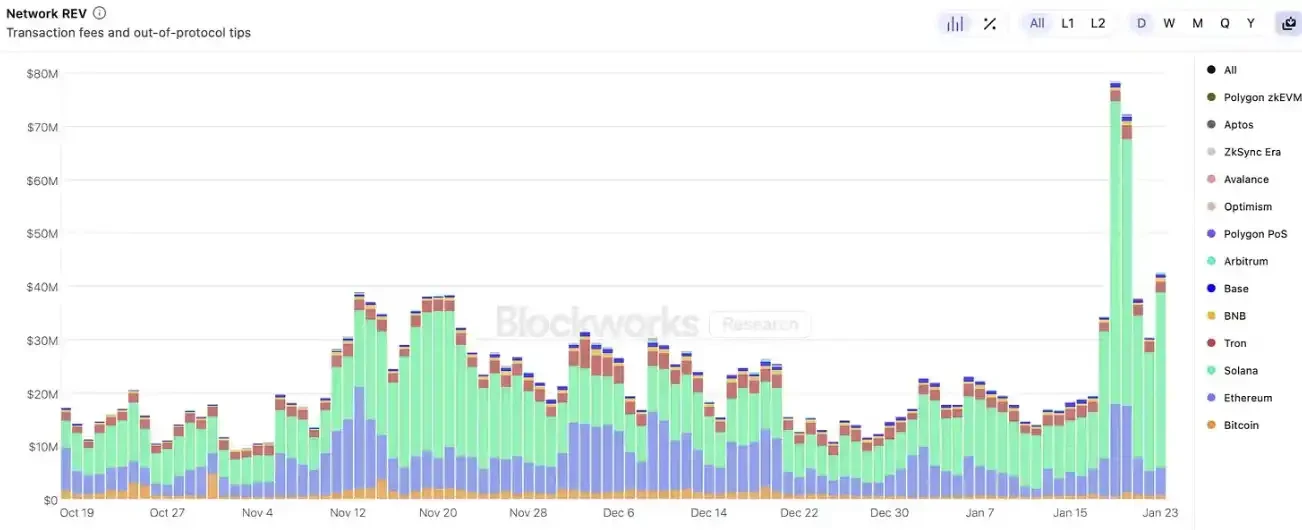

Image Source: Blockworks

In contrast, Solana, moving to the right, is gradually realizing its vision of Mass Adoption through ultra-fast transaction efficiency and throughput, forming an overwhelming advantage within a single blockchain. From transaction volume, activity, to liquidity, Solana has become the undisputed leader. The launch of Trump coin can be seen as the best stress test for Solana's performance. A real value of $560 million was generated in a single day, half of which came from individuals who had never participated in blockchain before. Brendan Farmer, co-founder of Polygon, expressed concerns about Solana's structural issues, noting that most of Solana's economic value generation comes from pumpfun and trading bots—essentially the derivative industry of meme coins—which do not create any economic value. The consequence is that they will extract liquidity from the ecosystem. Every dollar paid in REV means a reduction in future meme coin trading funds, creating a vicious cycle.

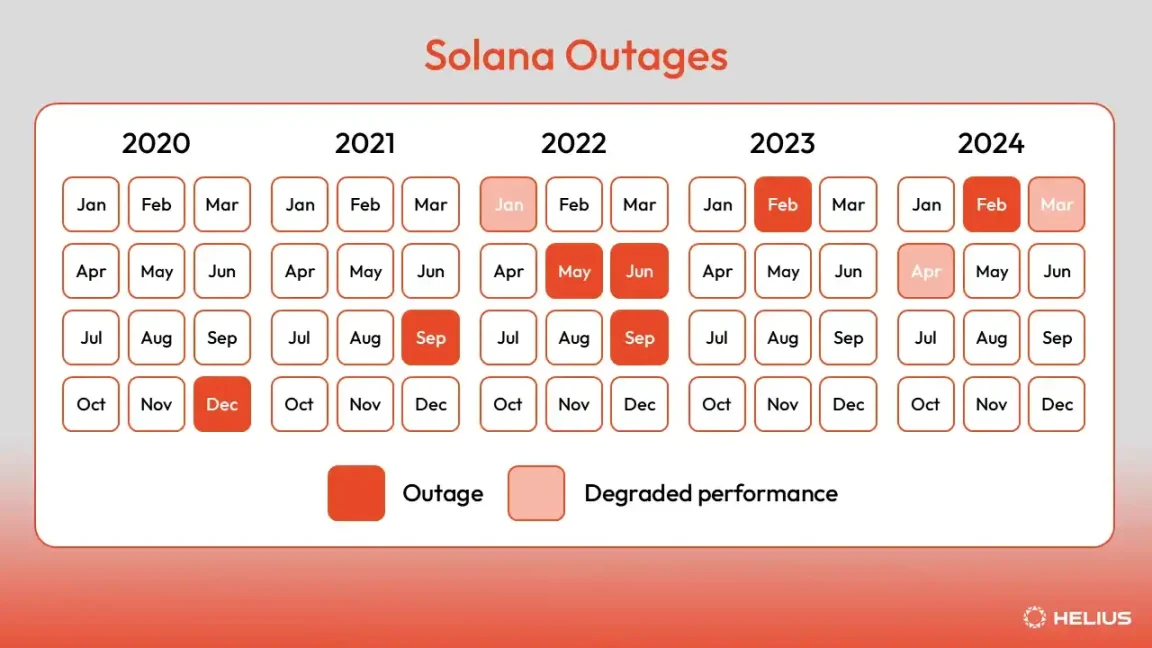

Over the past five years, Solana has experienced seven independent outage events, five of which were caused by client errors, and two due to the network's inability to handle a large number of spam transactions. However, some community leaders, including Helius founder Mert Mumtaz, predict that outages will continue to occur. The issues of Solana's excessive centralization were widely discussed around 2022, but as the market shifted from geek culture to application-driven ideology, the transaction throughput of Solana comparable to Web2 networks has led to a decline in concern over this issue.

Source: Helius report on Solana's outage history

Unlike Vitalik, Lily Liu, head of the Solana Foundation, mentioned in an interview that "we believe the new government will recognize the strategic support of blockchain for the U.S., so we are very eager and have plans to cooperate with the U.S. government in the future." The facts show that the Solana Foundation's excellent resource integration capabilities have tilted opportunities in this round of market trends from government support to the U.S. president issuing memecoins towards Solana. However, MinDao believes that "if Solana leans too much politically, its excessive political attributes may subject it to potential political influences in the future global ecological process. For example, if a Chinese company wants to issue Layer 2, it is unlikely that they would want to do so on a chain representing the U.S."

The Crossroads: Moving Forward

We are wandering at the crossroads, where Ethereum's governance deadlock and Solana's capital frenzy seem to encounter a dead end. However, this seemingly "betrayal" of the original intention in the evolutionary movement may be forging a financial system holy grail that can simultaneously accommodate Hayek and Keynes.

Ethereum, moving to the left, has become an aristocratic chain after its PoS transition, which reduces resource consumption and the possibility of centralized regulation. The original intention of accepting democratic voting in the EIP process has made it difficult for Ethereum to progress. Meanwhile, its firm stance against political ties has caused it to lose to Solana in this round of large-scale applications. Ethereum, which has always been a hub for ecological development, saw its growth in ecological developers surpassed by Solana in 2024.

On the right, Solana has become the undisputed "king of liquidity" amid the meme craze, thanks to its efficient performance and wealth effect. However, the monthly production of hundreds of thousands of meme tokens has transformed Solana, originally envisioned as a decentralized "Nasdaq," into a perfect decentralized "casino," which simultaneously devours the potential value Solana could create in the future. Its excessive involvement in geopolitical matters also limits its application on a global scale.

It seems that both paths encounter difficulties.

However, MinDao expresses optimism about the left and right tendencies of "Ethereum" and "Solana." He believes that "the competition between them is not a zero-sum game. The ultimate possibility of blockchain is neither Ethereum's ideal state nor Solana's efficiency empire, but a new species born from their confrontation and fusion. This will certainly include the utilitarianism of human nature while using scale effects to drive improvements in 'decentralization.' This revolution is not a betrayal but a redefinition of 'revolution' itself."

Regarding the future path, Vitalik recently provided an answer in a Q&A with Tako. He believes that we are no longer in the era of infrastructure but in the era of applications. Therefore, these stories cannot be abstract concepts like "freedom, openness, and anti-censorship"; they need clear answers in the application chain. He proposed the concept of Ethereum as the world's finance, which will increasingly support application-layer products such as info finance, AI + crypto, high-quality public goods financing methods, and RWA. Interestingly, the two factions represented by ETH and Solana are becoming more similar in their development processes, like the two sides of a coin or the double helix of DNA. Only by transforming the human game into a verifiable core of public knowledge can blockchain evolve into a trustworthy value network.

a16z partner Chris Dixon believes that AI, the internet, and crypto all have their ups and downs. When we wait for conditions to improve before taking action, we often find ourselves doing the same thing as a large group of people. Therefore, when people think a technology has reached its end, the best opportunities are often hidden.

We are at a crossroads of horizontal and vertical paths. Whether we move to the "left" or the "right," the ultimate result will be to move forward. Perhaps the ultimate form of blockchain is neither the utopia of the "saviors" nor the hegemonic empire of the "apocalyptics," but a hybrid that finds a dynamic balance between openness and efficiency, ideals and reality. The future belongs to those who can embed "imperfect humanity" in code while still maintaining the robustness of the system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。