"Success and failure both depend on Xiao He"?

Author: Hedy Bi, OKG Research

On the evening of March 3 (Beijing time), U.S. President Donald Trump confirmed the imposition of tariffs on Canada and Mexico, starting on April 2, which dashed hopes of reaching an agreement with the two countries at the last moment to avoid comprehensive tariffs.

Before the market could digest the previous day's "cryptocurrency strategic reserve" sweetness, Bitcoin fell by 8% in less than 48 hours. Meanwhile, U.S. stocks also faced a tariff shock, with the Nasdaq index dropping by 2.6%. In just over a month since Trump took office, the cryptocurrency market's market value evaporated by 22%, and the Trump Media & Technology Group (DJT) fell by 34.75%. Even Elon Musk, who has consistently supported Trump, could not escape the fallout from the "brutal" practices of the DOGE department and excessive involvement in international politics, with Tesla's stock price dropping by 32.87%.

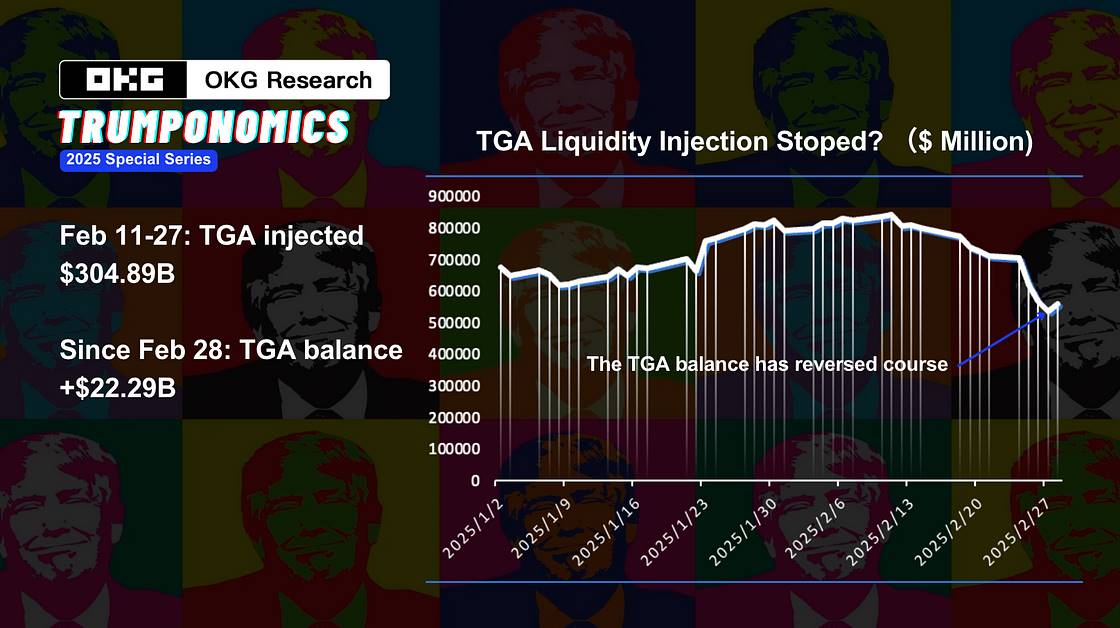

Trump's every word and action is tugging at the nerves of the cryptocurrency market, echoing the sentiment of "success and failure both depend on Xiao He." In 2025, OKG Research will launch a special topic on "Trump Economics," and I will continue to track the impact of the Trump 2.0 government on the cryptocurrency market. In the previous article of this topic, "A New Wave of Liquidity Approaches, Can the Cryptocurrency Market Break Through New Highs?" we suggested that the market should focus on real liquidity (in the short term, TGA can be monitored) rather than market news noise, and indicated that without real liquidity support, "talking without action" will not sustain false prosperity. Furthermore, according to the latest official data from the U.S. Treasury, since February 28, the TGA account has stopped injecting liquidity into the market, having previously injected a total of $304.89 billion.

As the first major blow, tariff policies are having a huge impact on the global risk market characterized by "American attributes." Why do both Trump 1.0 and 2.0 have a fondness for seemingly destructive policies? This article, as the fifth piece in the OKG Research 2025 special topic — "Trump Economics," will analyze the deeper meaning of Trump's "left hand tariffs, right hand cryptocurrency" with trade wars as the main axis.

Tariffs, "Bargaining Chips"

Trump made many verbal promises before and after taking office, but the first major blow was tariffs.

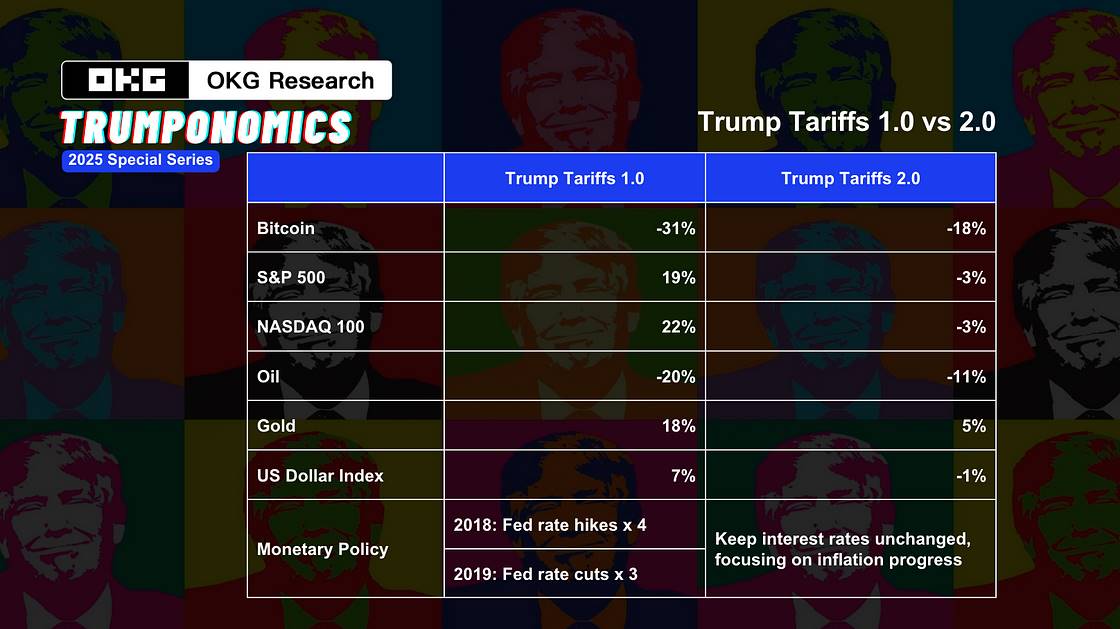

On the surface, Trump's tariff increases aim to reduce the trade deficit and boost employment and the economy. However, the trade wars of Trump 1.0 and the global trade war triggered by a tariff in 1930 show that this is not a "good business." The U.S. Congressional Budget Office (CBO) estimates that the trade war from 2018 to 2019 resulted in a 0.3% loss in U.S. GDP, approximately $40 billion. Data from the Peterson Institute for International Economics shows that the steel and aluminum tariffs alone caused the loss of about 75,000 manufacturing jobs in the U.S. in 2018. Additionally, many American companies did not return to the U.S. but instead shifted production to low-cost countries like Vietnam and Mexico (Kearney). Other presidents' trade wars have also not yielded good results: after the U.S. implemented the Smoot-Hawley Tariff Act in 1930, global trade volume fell by about 66%. U.S. exports dropped by 67%, leading to price imbalances that caused numerous farm bankruptcies.

Tariffs are just the beginning; the Trump administration uses them to create economic uncertainty in exchange for negotiation leverage. The core of this tariff game is not just the flow of goods but also involves technology blockades, capital flows, and currency competition. The essence of the trade war is no longer limited to tariff barriers but is a deep intervention in the global financial system. From the foreign exchange market to the stock market, from government bond yields to risk assets, no global capital market is spared.

Warren Buffett has rarely spoken out, warning that punitive tariffs could trigger inflation and harm consumer interests. Changes in expectations for the real economy could further complicate the Federal Reserve's dilemma — how to control inflation without triggering a severe economic recession. Damaged consumer confidence could drag down the economy, while inflationary pressures would limit the Fed's ability to cut interest rates, ultimately tightening liquidity further and putting the Fed in a difficult position.

For the cryptocurrency market, as an amplifier of global risk asset market sentiment, the performance of cryptocurrency assets is closely tied to the volatility of U.S. tech stocks. Whether it's Bitcoin's hash rate relying 70% on Nvidia GPU-driven mining machines or crypto-related companies like Coinbase and MicroStrategy being included in the Nasdaq 100 index, U.S. financial policies and regulatory orientations have deeply influenced the cryptocurrency market.

In other words, the cryptocurrency market is more like a derivative variable of U.S. financial policy rather than a hedging tool (see OKG Research article "Repositioning the Cryptocurrency Market: The Pain of Transformation in the Global Liquidity Dilemma," July 2024). In the future, assuming macro expectations remain unchanged, the market's reaction to tariffs: if other countries choose to compromise, the current performance of the cryptocurrency market is merely short-term volatility; in the medium to long term, it will benefit risk assets with American attributes, including the U.S. stock market, and the U.S. will achieve its true goals at the negotiating table through tariffs; if other countries firmly retaliate, including but not limited to retaliatory tariffs, it would be bearish for risk assets.

Cryptocurrency Assets May Become Unconventional Strategies in Extraordinary Times

Unable to achieve the superficial goals and failing to benefit Trump's supporters, the destructive tariff policy, with companies dropping 40% behind it, how can Trump 2.0 use "left hand tariffs, right hand cryptocurrency assets" to make America great again?

In the past month, the turmoil in the U.S. financial markets reflects the accelerated loss of "national confidence." As Nobel laureate in economics Paul Krugman recently wrote in his blog, "Since Elon Musk and Donald Trump took power five weeks ago, they have recklessly destroyed on multiple fronts — including rapidly undermining America's influence in the world. The U.S. has suddenly redefined itself as a rogue nation that does not fulfill commitments, threatens allies, attempts mafia-style extortion, and interferes in the elections of democratic countries."

History tells us that when a national credit system begins to collapse, capital does not remain still but seeks new circulation methods.

Looking back to the last century, Japan's economic rise led to trade friction due to the U.S.-Japan trade imbalance. The U.S. forced the yen to appreciate sharply through the Plaza Accord, severely damaging Japan's export-oriented economy, leading to turmoil in its financial system. The asset bubble burst, and the Japanese government tightened regulations, prompting the market to quickly seek alternative channels, giving rise to a black market economy — smuggling of gold, a surge in offshore dollar transactions, and a booming informal foreign exchange market. According to Nikkei statistics, there were as many as 17,000 black markets in major Japanese cities. This "underground financial system" became a spontaneous hedge against the collapse of the traditional financial system. After containing Japan, the U.S. supported its economy through wartime orders and currency liberalization, creating a scenario where "one Tokyo could buy the entire U.S." However, the subsequent excessive interest rate cuts led to the bubble bursting, and Japan's economy shifted from boom to bust, witnessing the rise of its grand buildings and the gathering of guests, only to see them collapse.

Reflecting on this history, both the "black market" and "financial liberalization" played key roles in the trade war. Translating this to the present, the Trump administration's announcement to establish a national reserve of cryptocurrency assets appears to be financial innovation, but it is more likely an "unconventional strategy in extraordinary times."

There are two reasons for this: facing the erosion of dollar credit, the Federal Reserve's monetary policy has reached its limits, and the U.S. urgently needs new bargaining chips to maintain global capital trust. Cryptocurrency assets may be this "quasi-financial weapon": once strategic reserves are controlled, the government will have greater maneuverability in global capital flows; the market's trend of "de-dollarization" has already shown signs. If the trade war escalates, countries will inevitably accelerate their allocation of non-dollar assets to hedge against risks in the dollar system. The steady rise in gold prices since the beginning of 2025 is clear evidence of this. Against the backdrop of accelerating "de-dollarization," if cryptocurrency assets can maintain true decentralization rather than being controlled by a single country, they may gain new geopolitical premiums in the global financial game.

Trump 2.0 has a more pronounced attitude towards the U.S.'s dominance in the global economic system, as the Trump administration attempts to break the international political and financial order established since World War II. Compared to directly strengthening the dollar credit system, establishing a reserve of cryptocurrency assets can provide the government with more "non-direct intervention" means in the market. With the continuous promotion of cryptocurrency assets and technology, a new cross-border payment system could emerge in the future, potentially forming a state-led cryptocurrency financial network.

In "The Trump Biography," Trump's family hails from Germany, and he is described as a "fighter," believing that passion is far more important than intelligence and talent. For him, the thrill of "impatiently" reaching deals and defeating competitors is his greatest driving force. However, in the trade war, "impatiently" reaching new deals and "defeating competitors" may not necessarily lead to the best outcome for the Trump administration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。