Author: Frank, PANews

Since Trump, celebrity token launches seem to have become a new business model. On March 2, renowned retired football superstar Ronaldinho announced the launch of his personal token $STAR10 on the BSC chain. Despite the market downturn, the circulating market cap peaked at $32 million, but it was still far from the expected buying frenzy. Instead, numerous conspiracy theories about this token emerged on social media, with scandals involving a token issuance team from Shenzhen, an unlocked funding pool, retained minting rights, and insiders running off early. Even Binance founder CZ, who shared the launch information, faced a barrage of criticism from users. Is this celebrity token craze really a one-way ticket to wealth?

Football Genius Reduced to a Harvesting Tool? Doubts About Professional Team Management

Ronaldinho, once hailed as the most talented Brazilian football star of all time, is affectionately known as "Ronnie" by fans. He was beloved during his career and was nicknamed the "football elf." However, rising to fame at a young age, lacking self-discipline, and indulging in a hedonistic lifestyle led to the ruin of his career, followed by a lavish spending spree that resulted in bankruptcy, ultimately leveraging his fame to make money. Like many talented athletes from humble beginnings, Ronnie unfortunately chose this script.

After trying various ways to make money, the rapid harvesting ability of the crypto industry seems to have become his better choice.

On February 22, Ronnie tweeted, "Here, cryptocurrency looks good," beginning to preview his token issuance plan. However, due to the continued downturn in the crypto market, the final token was officially launched ten days later.

During these ten days, the crypto market experienced a significant decline, with the previously hot Solana chain showing signs of weakness, while the BSC chain attempted to become the new MEME hotspot through CZ's frequent interactions. Ronnie's final choice suggests that there may be a team behind him well-versed in the changing dynamics of the crypto market.

On February 28, Twitter user @R10coin_ revealed that a token issuance team from Shenzhen was behind Ronnie's token launch. This informant claimed to be from another professional token issuance company that had initially negotiated a $6 million cooperation agreement with Ronnie for the token sale. However, after another Shenzhen token team intercepted with an offer of $10 million, they chose to expose the matter and shared some email information and signed documents from Ronnie. The community generally views this as a black-eat-black farce, but such insider manipulation seems to have become commonplace, as evidenced by the previous token launch farce involving President Milei. As of March 4, the user's Twitter account has been suspended.

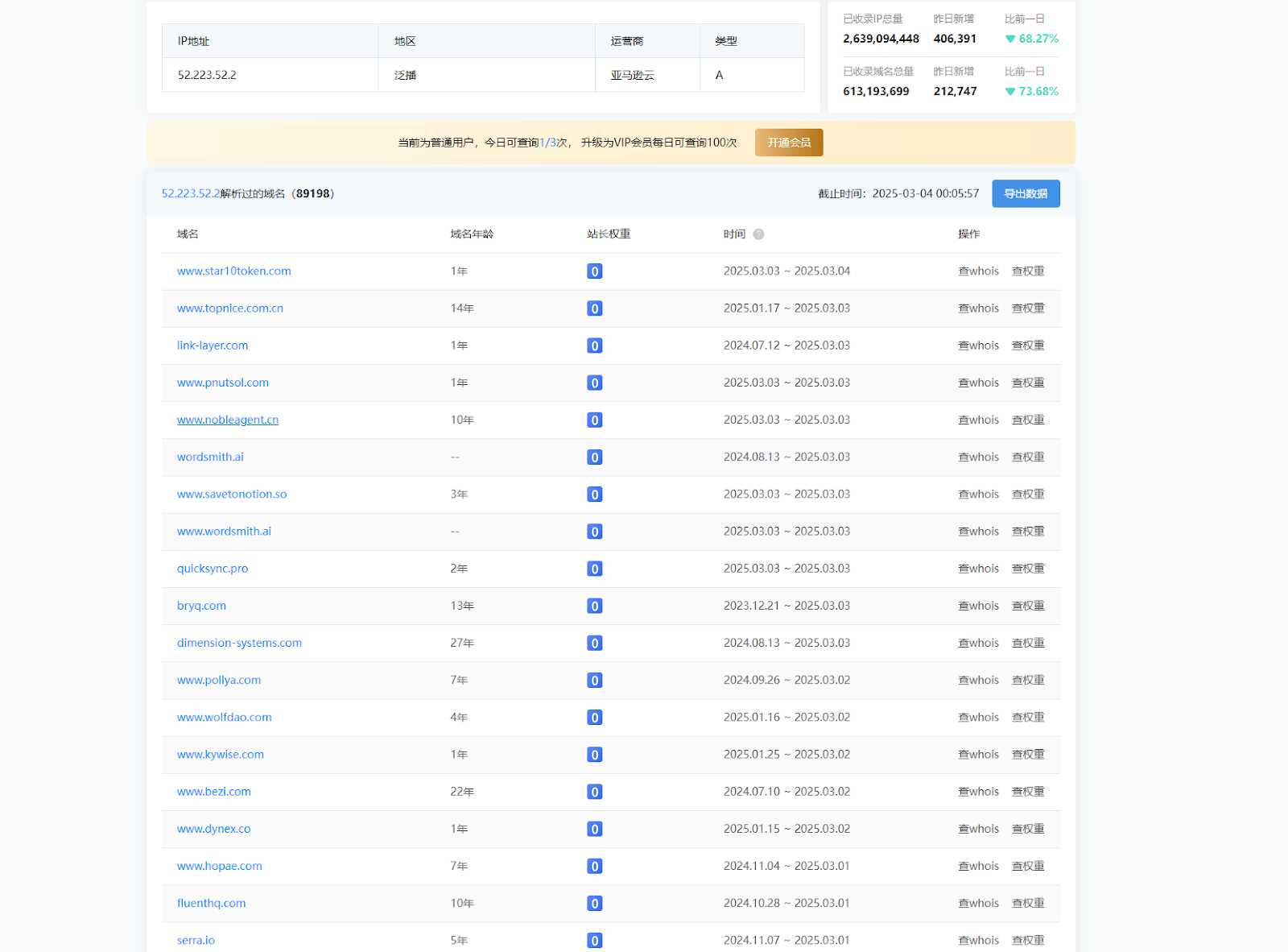

Since this user did not release more substantial insider information, the details about the team behind Ronnie's token launch remain unknown. According to PANews investigations, the official website domain of the $STAR10 token is hosted by the well-known domain service provider GoDaddy, and the deployed IP address has two entries. A reverse lookup of these IPs shows they come from Amazon Cloud Services, which has resolved over 80,000 domains, making it impossible to prove they are controlled by the same entity.

Interestingly, among the list of domains resolved by this IP, another well-known MEME coin, PNUT, also appears. PNUT was one of the MEME coins launched on Binance last year. However, based on the existing evidence chain, there is no direct proof that a conspiracy group exists behind the issuance of $STAR10 as claimed on social media.

Contract Hidden Secrets: Backdoor Permissions Trigger Trust Crisis

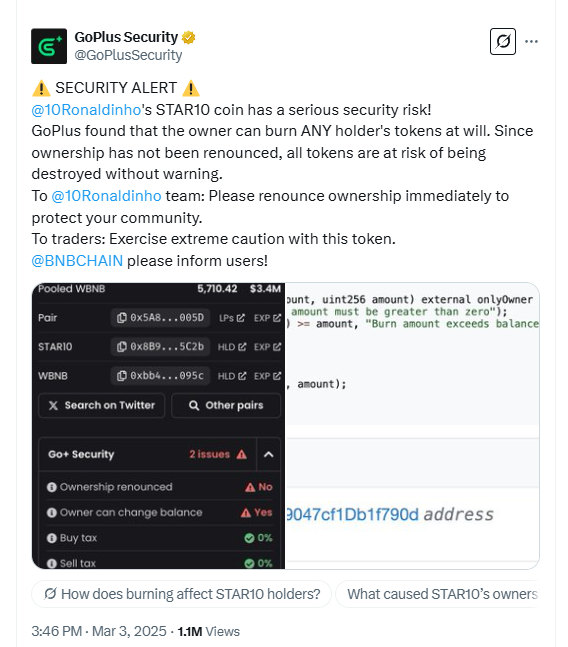

However, during the token issuance process, people still seem to feel the insincerity of the $STAR10 token launch. According to GoPlus Security monitoring, the contract owner of the $STAR10 token still retains the authority to burn tokens, and the funding pool's lock-up period is only one month.

This backdoor-style operation led many users to believe that the project team was preparing for harvesting. Consequently, it sparked a collective outcry on social media. Binance founder CZ initially retweeted Ronnie's token launch tweet without noticing this loophole, stating that this was not an endorsement but merely a thank you for choosing to launch on the BNB Chain, but he subsequently faced a collective backlash from users.

However, perhaps under community pressure, Ronnie's team later stated on Twitter that they had relinquished the minting rights and extended the lock-up period from 255 years to 2281 years.

Yet, this last-minute fix seems to have gained little recognition from the community. As of March 4, the number of addresses holding the token was about 9,500, far less than TRUMP's 640,000 and even less than LIBRA's 27,000 addresses.

Insider Trading with 282 Times Profit, Are Internal Players Pre-Positioning?

Additionally, insider trading is also a common tactic exposed in celebrity token launches, and similar signs have appeared in the issuance of $STAR10. According to Onchain Lens, an insider purchased 20 million $STAR10 tokens before the token launch for 49 BNB (worth $29,000), and as of March 4, this address had sold $350,000 worth of tokens while still holding over $2.6 million worth of unsold tokens.

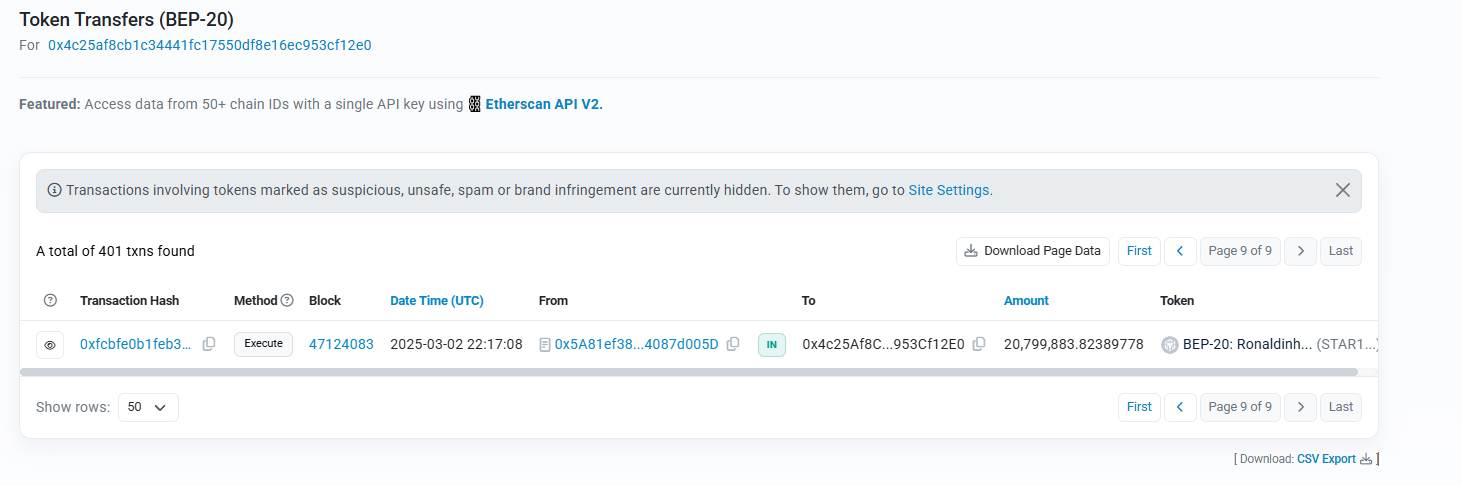

According to PANews calculations, the user's average cost was about $0.0014, with a peak increase of about 282 times, and the maximum holding value could reach $8.26 million, nearly a quarter of the circulating market cap. More suspiciously, Ronnie's token launch time was at 22:17 UTC on March 2, while this address's purchase time was 22:17:08. This timing even predates Ronnie's announcement. It raises the question of how this address's player chose to invest $29,000 in a gamble without confirming the token's source. PANews discovered that the initial funds for this address came from Binance's hot wallet.

Overall, Ronnie's token launch appears to be yet another failed case. Similarly, NBA legend Scottie Pippen, who launched his token last August, saw his token $BALL reach a market cap of only $4.5 million, with about 1,400 holders and a 24-hour trading volume of $2,300, resulting in just five transactions—a complete mess.

Recently, the much-discussed LIBRA and MELANIA were also revealed to be the work of conspiracy groups, and people seem to have become accustomed to this harvesting routine, no longer blindly buying in. As of March 4, the market cap of $STAR10 has dwindled to just $11.5 million, down 66% from its peak.

From an investment perspective, celebrity tokens to date have almost all "met their demise," and for those celebrities attempting to quickly monetize through crypto token launches, this exploitative harvesting model seems increasingly unsustainable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。