In the Hong Kong Consensus Conference of February 2025, there was no consensus. In the Q1 of 2025, the crypto market lacks a main narrative.

In 2024, Solana, by strictly implementing the Memecoin strategy set by Messari, surpassed the entire Ethereum ecosystem in trading volume for single chains, becoming the first L1 in history to win the block space war against the Ethereum ecosystem.

However, the foundation of Solana's victory is not solid. The Memecoin fundamentals, composed of attention-Fomo sentiment-liquidity, rapidly declined in on-chain trading volume due to the holiday effect, and the weak LP pool could not support a high FDV/LP ratio, leading to a retreat more significant than Dunkirk in February 2025.

The old king has fallen, and the new king is still behind the scenes. Standing at the threshold of March, a month historically full of changes, we make a blind guess about the future main narrative.

Amid the current chaotic market structure, a clue has emerged: funds are flowing from narrative-only on-chain PVP to yield farming supported by fundamentals.

There are three main categories of representative projects:

-- Sonic's neoclassical yield farming, an enhanced version of Ve(3,3);

-- BeraChain and Initia's (3,3,3) new model, a chain version of Olympus DAO's (3,3) mechanism;

-- DePIN projects represented by Aethir, which have real income and positive externalities as a variant of yield farming.

Sonic and BeraChain, Initia have a high market mindshare, while the DePIN track has seen a lack of market discussion after a year of silence.

However, the most bullish track in Messari's 2025 annual outlook report is DePIN, suggesting that Solana should refocus its strategic emphasis on DePIN in 2025.

As is well known, the secret to obtaining alpha returns lies in walking through narrow doors and cultivating thin fields. The more neglected DePIN is, the more it is worth our deep layout.

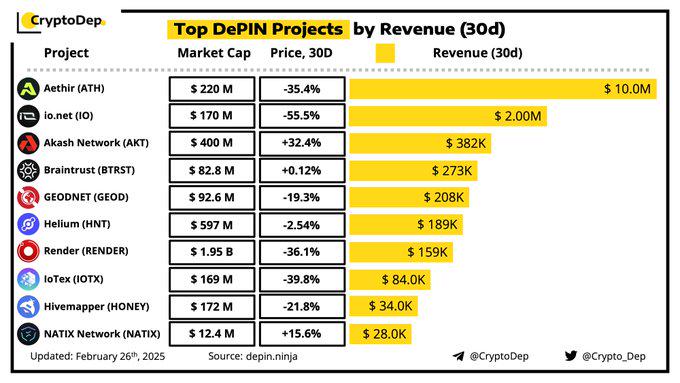

The above image is the TOP DePIN project data compiled by CryptoDep. Among the top 5 income rankings, in addition to the familiar Aethir, io.net, and Akash, two newcomers, Braintrust and GEODNET, have also made the list.

Among them, Aethir ranks first in the DePIN project with a 30-day income of $10M. I checked Aethir's GPU Dashboard, and the project has achieved an annual recurring revenue (ARR) of $105 million, providing 487 million hours of computing power and distributing over 3.6 billion ATH token rewards, with nearly 1 million on-chain transactions.

I initially thought that the real income model would take years to gain recognition in the crypto market, but seeing Aethir's growth trajectory, perhaps this day will come sooner than we expect.

Aethir's success is partly due to its differentiated competitive strategy. It did not follow the route of other DePIN projects that focus on edge device networks and long-tail market demands, but instead chose to build a decentralized cloud computing platform using NVIDIA high-performance GPUs (such as NVIDIA H100), providing enterprise-level GPU computing power for AI and game developers worldwide. On the other hand, the Aethir team successfully raised funds during the AI x Crypto boom in Q1 2024 and used it to purchase a large number of high-end GPUs, creating Aethir's moat and helping it quickly achieve network effects. Aethir's network effects, in turn, attracted more enterprise-level GPU computing power suppliers to join.

Recently, there has been a viewpoint circulating in the market that open-source low-cost models like DeepSeek will reduce the demand for NVIDIA high-end graphics cards, leading many investors to worry about the sustainability of Aethir's income. However, this viewpoint is actually market noise intentionally created by financial market manipulators, and feeling anxious about it is somewhat unfounded.

NVIDIA's "Jacket Yellow" has publicly refuted this viewpoint, and the "Jevons Paradox" is also at play. Simply put, open-source models like DeepSeek will not only not reduce the demand for high-end GPUs but will actually stimulate demand growth. After DeepSeek's explosive popularity, the domestic Maas (Model as a Service) inference market has surged, reviving many nearly defunct computing centers.

Moreover, paradigm innovation in the AI field is still in its infancy. Besides LLMs, embodied intelligence has become a hot spot for capital. Due to the need for low-latency, high-reliability computing power and a multi-layer network structure that coordinates edge devices with the cloud, embodied intelligence will become the engine that ignites Aethir's second growth curve.

Therefore, on the demand side, there is no need to worry about Aethir. The Aethir team's current focus is on the supply side, as they are trying every means to onboard more enterprise-level high-end GPU computing power suppliers into the network. To this end, Aethir has also launched the Aethir AVS network to provide compliance support and eliminate staking thresholds for GPU computing power suppliers.

In addition to Aethir, io.net, Akash, and other AI-related projects, GEODNET also has a solid fundamental basis, but its niche market of geographic information services limits its growth potential, so we will not analyze it in depth; interested parties can explore Grok3 themselves.

In summary, DePIN has evolved from the "epic scam" of 2023 into a physical device collaboration network with real income and positive externalities, but the market has yet to price this in. And this is precisely a good entry point.

That's all.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。