Original Author | Arthur Hayes (Co-founder of BitMEX)

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Ethan (@jingchun333)

Editor's Note: Last night, the market took a sharp turn, see "Trump's Call to Action: The Effect Lasts a Day, Crypto Market Turns Bearish Overnight." Arthur Hayes' latest article "KISS of Death" delves into how Trump's team may push the "America First" strategy through debt monetization, and discusses the potential policy game between the Federal Reserve and the Treasury in detail. He believes that Trump may actively create an economic recession through "creative destruction," forcing the Federal Reserve to loosen monetary policy, thereby providing new liquidity to the market, which also brings new opportunities for the cryptocurrency market.

Arthur predicts that Bitcoin will perform outstandingly in the upcoming financial storm, becoming a "safe-haven asset" amidst global liquidity fluctuations, potentially ushering in a new upward cycle. Specifically regarding price points, Arthur believes BTC may recently drop to around $70,000, but will likely rebound quickly and surge violently thereafter. Therefore, he suggests investors adopt a "non-leveraged dollar-cost averaging + doubling down on dips" strategy, and closely monitor two key data indicators—the U.S. Treasury General Account (TGA) balance changes and the foreign exchange operations of the People's Bank of China.

Below is the original content by Arthur, translated by Odaily Planet Daily. Due to Arthur's overly free-spirited writing style, there will be significant portions unrelated to the main content; for the sake of reader understanding, Odaily will make certain cuts during the translation.

KISS Principle: Simplicity is Key

Many readers, when faced with the massive policy information from the Trump administration, often overlook a basic principle—KISS (Keep It Simple, Stupid). Trump's media strategy essentially revolves around creating dramatic events daily, making you exclaim in the morning, "Oh my! What big news did Trump/Musk/Robert F. Kennedy make last night?" Whether you are excited or outraged by his actions, this "imperial reality show" narrative indeed has a strong emotional appeal.

This continuous emotional turbulence is particularly dangerous for cryptocurrency investors. You might hastily build a position due to a piece of good news, only to be shaken by subsequent reports and choose to sell. The market repeatedly harvests during violent fluctuations, and your assets quietly evaporate in this emotional trading.

Always remember: simplicity is key.

Who exactly is Trump? Essentially, he is a performative businessman well-versed in the real estate capital game. In this field, the core ability lies in leveraging massive amounts of debt with the lowest financing costs, and then exaggerating marketing to package concrete and steel as iconic landmarks. Rather than how he stirs public emotions, I am more concerned with how he uses financial engineering to achieve political ambitions.

I believe Trump is trying to implement the "America First" strategy through debt monetization. If not, he should allow the market to clear the systemic credit bubble, but this would trigger a depression far worse than the 1930s. History provides two reference points: Hoover, criticized for "slow printing," and Roosevelt, mythologized as the "savior of the economy." Clearly, the fame-seeking Trump would never choose to destroy the empire's foundation through fiscal tightening.

Andrew Mellon, the Treasury Secretary during the Hoover era, prescribed a "shock therapy" for the economic crisis:

"Let the labor market clear, let the stock market crash, let agriculture go bankrupt, let the housing market collapse—this will purify systemic corruption. When the cost of living and excessive consumption return to rationality, people will regain the virtue of diligence. After the value system is restructured, true entrepreneurs will rise from the ruins."

Such rhetoric would never come from the current Treasury Secretary Scott Bessent.

If my judgment holds—Trump will advance national strategy through debt expansion—what does this mean for risk assets like cryptocurrencies? To answer this question, we need to predict the direction of two core variables: the supply of money/credit (scale of money printing) and price (interest rate levels). This essentially depends on the policy coordination that will form between the U.S. Treasury (Scott Bessent) and the Federal Reserve (Jerome Powell).

Power Struggle: Who Controls the Dollar Faucet?

To whom do Bessent and Powell owe their loyalty? Do they serve the same political camp?

As the Treasury Secretary candidate for the Trump 2.0 era, Bessent's public statements and decision-making logic deeply align with "imperial strategy." In contrast, Powell—who was promoted during the Trump 1.0 era—has long since turned into a guardian of the Obama-Clinton political legacy. His forced 50 basis point rate cut in September 2024 was a political gesture: at that time, the U.S. economy was growing faster than expected, and inflation was still present, making easing unnecessary. However, to save the approval ratings of puppet President Harris, Powell chose to overdraw the central bank's credibility for political donations. Although it ultimately failed to change the election outcome, after Trump's victory, this "inflation fighter" suddenly announced he would remain in position and continue raising rates.

Debt Restructuring: The Art of Defaulting in Boiling Water

When the scale of debt surpasses a critical point, the economy will fall into a dual dilemma: interest payments consume fiscal space, and market risk premiums soar, blocking financing channels. At this point, the only way out is through extending debt maturities ("debt long-termization") and lowering interest rates for a soft default—both operations essentially reduce the present value of debt through discount rate adjustments. In my in-depth analysis "The Genie," I detailed this fiscal alchemy, whose core lies in: reshaping the balance sheet by trading time for space, creating conditions for a new lending cycle. Theoretically, the Treasury and the Federal Reserve should collaborate to complete this financial surgery, but the reality is that the two leaders belong to different camps, making policy coordination a luxury.

Credit Manipulation: The Federal Reserve's Toolbox

Powell, who controls the dollar faucet, has four major policy levers: reverse repurchase agreements (RRP), interest on reserves (IORB), and the upper and lower limits of the federal funds rate. The essence of these complex mechanisms is to grant the Federal Reserve unlimited money printing power and interest rate pricing power. If the two institutions could truly work together, we could easily predict the tides of dollar liquidity and the policy responses from China, Japan, and the European Union. But the reality is that Trump needs to solve an impossible triangle: he must force Powell to ease and cut rates to stimulate the economy while maintaining the central bank's credibility in fighting inflation.

Economic Recession: The Federal Reserve's Fatal Switch

There is an iron law here: when the U.S. economy falls into (or faces) recession, the Federal Reserve will inevitably activate the money printing machine or the rate cut button. The strategic choice before Trump is—should he actively create economic contraction to force the Federal Reserve to pivot? This "creative destruction," while painful, may become the ultimate weapon to break the policy deadlock.

Historical Validation: The Federal Reserve's Recession Response Mechanism

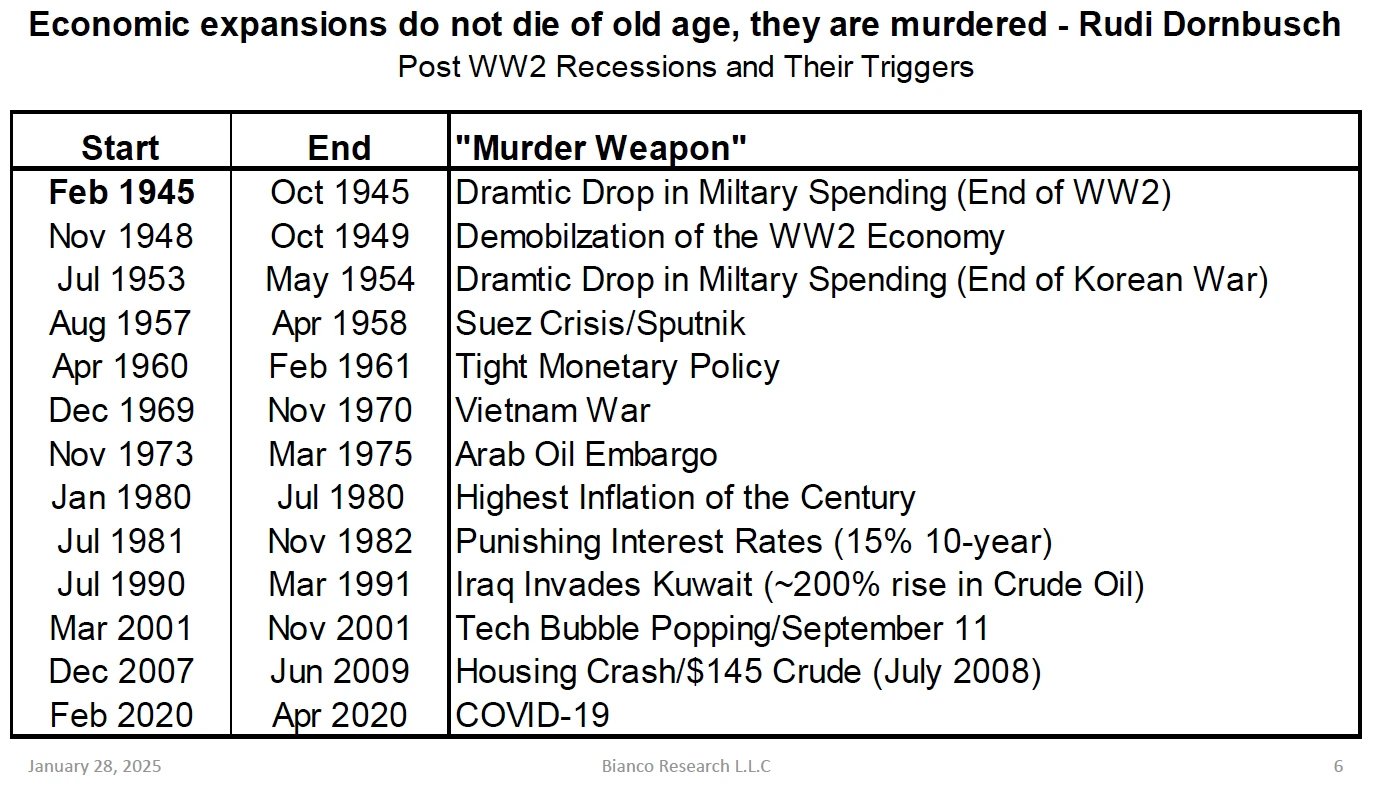

This is a list of direct causes of post-World War II economic recessions in the U.S. A recession is defined as a negative quarter-on-quarter GDP growth. I particularly focus on the situation from the 1980s to the present.

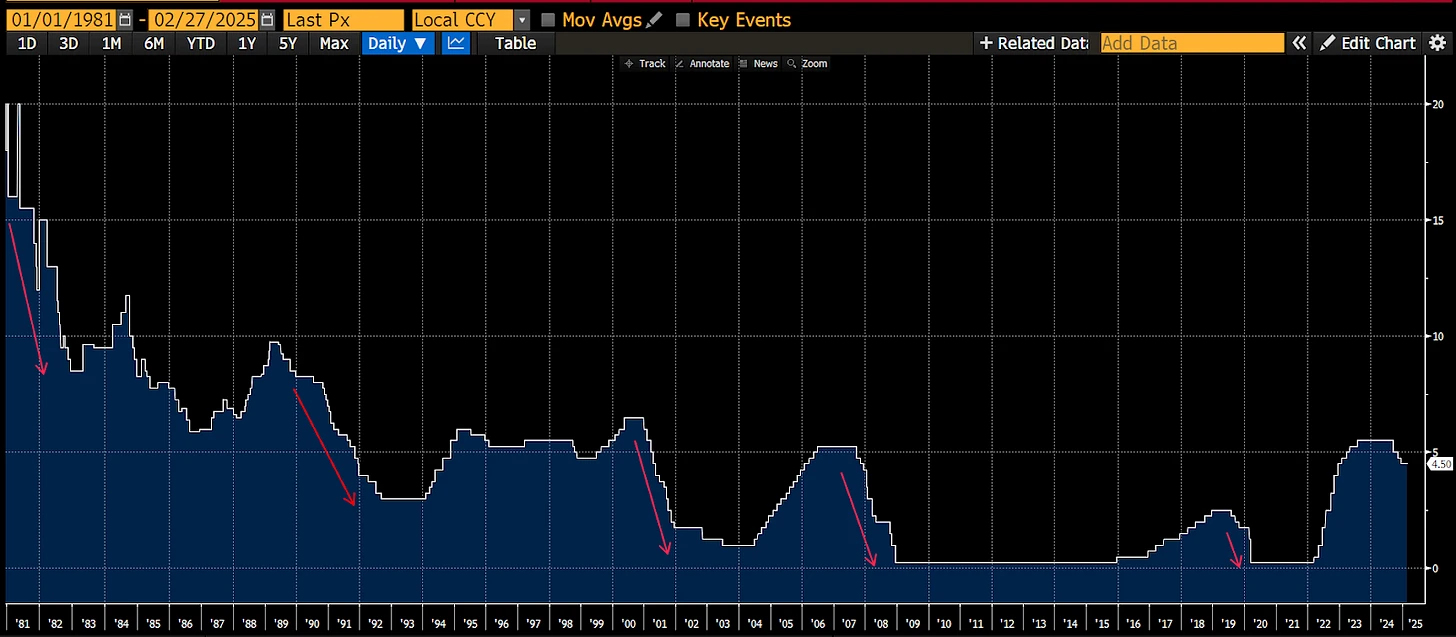

This is a chart of the lower limit of the Federal Reserve's funds rate. Each red arrow represents the beginning of a rate cut cycle, which coincides with recessions. It is clear that the Federal Reserve will at least cut rates during recessions.

Through historical data backtracking from Bianco Research (see chart), we can clearly see the Federal Reserve's recession response pattern post-World War II—whenever quarterly GDP turns negative (i.e., technical recession), the lower limit of the federal funds rate must open a downward channel (marked by red arrows in the chart). This policy inertia is particularly evident in the five economic cycles since 1980, forming an unbreakable "recession-easing" reflex.

The Fatal Weakness of Debt Economy

The modern U.S. economy is essentially built on three layers of debt powder kegs:

Corporate Side: S&P 500 companies finance their operations and expansions through bond issuance, and their debt certificates constitute core assets of the banking system. When revenue growth stalls, the risk of debt default will directly shake the foundation of the financial system.

Household Side: American households have a debt ratio as high as 76%, and consumption behavior heavily relies on leverage tools like mortgages and auto loans. Income fluctuations will trigger a chain of defaults, impacting bank balance sheets.

Financial Side: Commercial banks earn interest spreads through mismatched maturities of deposit liabilities and risk assets (corporate bonds/MBS, etc.), and any depreciation of asset sides will trigger a liquidity crisis.

The Central Bank's Prisoner's Dilemma

Faced with this structural fragility, the Federal Reserve has effectively lost its policy autonomy. When signs of recession appear (or the market forms recession expectations), it must immediately activate at least one of the following rescue toolkits:

● Rate cuts (to lower debt rollover costs)

● Stop quantitative tightening (to halt liquidity withdrawal)

● Restart quantitative easing (to directly purchase risk assets)

● Relax bank regulatory indicators (such as suspending SLR restrictions on Treasury holdings)

Trump's Crisis Game Theory

At this moment, the Trump team is well aware of the pitfalls of this mechanism. Their policy toolbox conceals two triggering methods:

Manufacturing a Substantial Recession: Actively bursting the economic bubble through trade wars, regulatory tightening, and other policies.

Expectation Management Manipulation: Using the presidential bully pulpit (media privilege) to reinforce the recession narrative.

Whichever path is taken, it will ultimately force Powell to open the monetary floodgates. This "creative destruction," while impacting the market in the short term, can win strategic space for debt restructuring—just as former Federal Reserve Chairman Bernanke said: "Sometimes you need to let the house catch fire to rebuild a stronger fire prevention system."

DOGE Shockwave: Trump's Recession Manufacturing Techniques

Government Spending: The Double-Edged Sword of the U.S. Economy

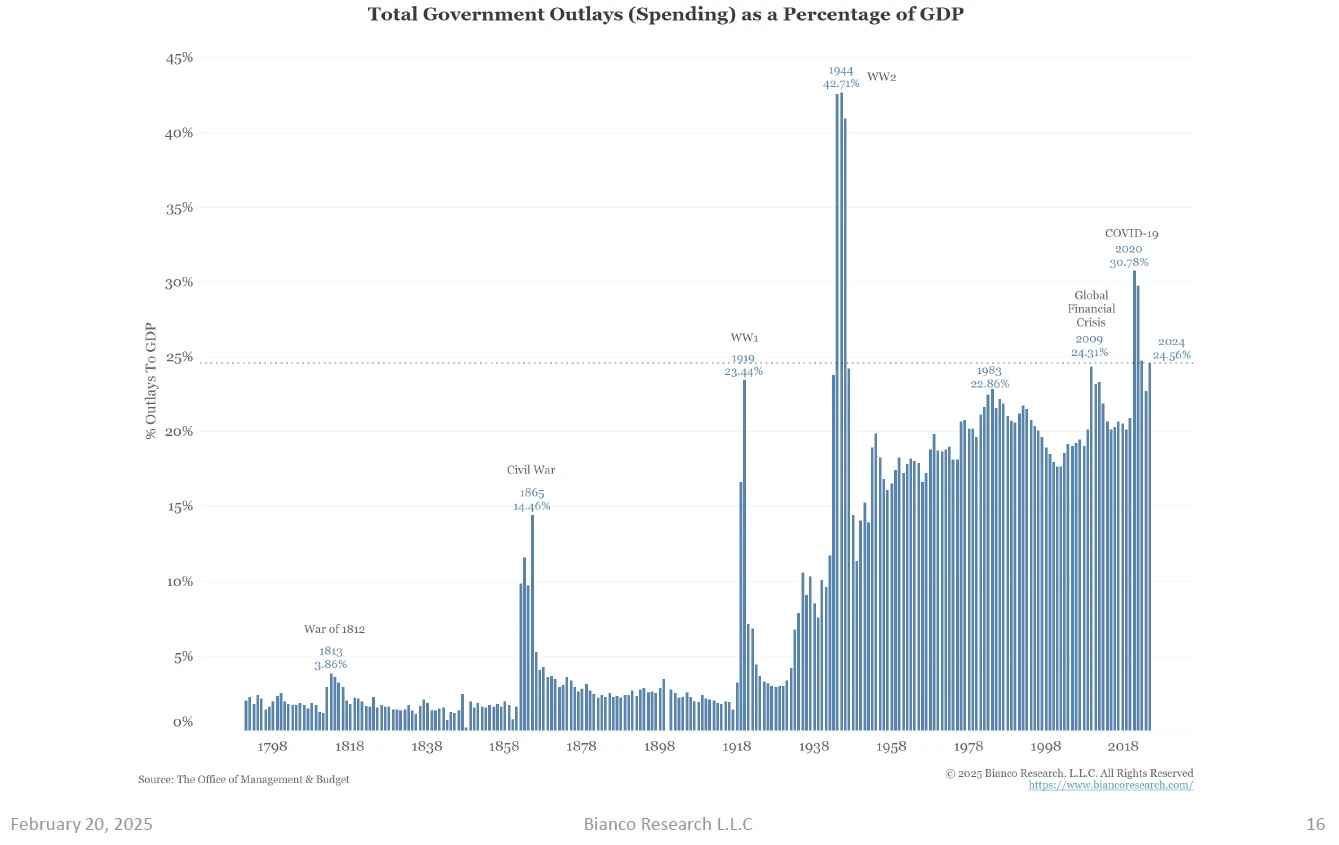

The engine of U.S. economic growth is shifting from the private sector to government spending—whether these expenditures are necessary infrastructure or "zombie projects," they are creating a facade of GDP prosperity. Washington, D.C., with a median household income of $122,246 (top 4% in the U.S.), serves as a living specimen of this fiscal-driven model. Here, the "policy rentier class" constructs a uniquely American "revolving door economy" through complex fiscal transfer mechanisms.

DOGE Scalpel: Precision Fiscal Surgery

Led by Musk, the "Department of Government Efficiency (DOGE)" is implementing unprecedented fiscal purges:

● Fraudulent Spending Targeting: The Social Security Administration (SSA) is targeting nearly a trillion dollars in "ghost payments" annually, tracing deceased beneficiaries' accounts through AI auditing systems.

● Bureaucratic Slimming: A projected reduction of 400,000 federal employees by 2025 has already led to an 11% drop in housing prices in Washington, D.C. (Parcl Labs data).

● Expectation Management Deterrence: Establishing a "digital firewall" monitoring system to encourage gray income practitioners to voluntarily cease violations.

This "creative destruction" is already showing economic transmission effects:

● A surge in unemployment claims in Washington, D.C. (Fox Business).

● A contraction in the discretionary spending market (23% below analyst expectations).

● Economists warning of a potential technical recession in Q3 (Economic Times).

The Federal Reserve's Moment of Redemption

Faced with the impending refinancing pressure of $2.08 trillion in corporate debt and $10 trillion in government bonds, Powell is forced to activate the "triple liquidity engine":

Interest Rate Arsenal: Each 25 basis point cut ≈ $100 billion in QE; if rates drop to zero, it could release $1.7 trillion in liquidity.

QT Brake Mechanism: An early termination of quantitative tightening could release $540 billion in existing funds.

Regulatory Easing: Restarting QE + SLR exemption combo, allowing banks to leverage unlimited purchases of government bonds.

Liquidity Tsunami Simulation

Conservative estimates suggest that $2.74-3.24 trillion in liquidity will be injected by 2025, equivalent to 70-80% of the COVID stimulus scale. Referring to historical patterns:

● The $4 trillion stimulus in 2020 propelled Bitcoin to a 24-fold increase.

● The current $3.2 trillion injection could catalyze a 10-fold increase (corresponding to Bitcoin reaching the million-dollar mark).

Key Hypothesis Testing

Debt monetization becomes the core fuel for "America First" ✔️

DOGE policy successfully manufactures a controllable recession ✔️ (Washington, D.C. has become a testing ground)

The Federal Reserve is forced to initiate crisis response procedures ✔️ (historical patterns + political pressure)

Strategic Reserves: Political Declaration vs. Market Reality

On Monday morning, Trump's "Cryptocurrency Strategic Reserve Plan" posted on Truth Social triggered market fluctuations. Although this was merely a rebranding of existing policies (similar statements have appeared in his campaign platform), Bitcoin still surged 12%, with Ethereum and several meme coins experiencing over 30% "violent surges." This reveals a deep-seated market psychology: in times of turmoil in the traditional fiat currency system, any sovereign-level cryptocurrency endorsement signal will be magnified exponentially.

However, we must be clear about the thresholds for policy implementation:

Fiscal Constraints: To establish substantial reserves, the U.S. needs to raise the debt ceiling or re-evaluate gold reserves (current book value vs. market price shows a trillion-dollar difference).

Legal Barriers: Congressional approval is required to classify digital assets as official reserve asset categories.

Execution Lag: It will take at least 18-24 months from legislation to building reserves.

This leveraged-driven rebound may quickly fade, but in the long run, this move signifies that cryptocurrencies have officially entered the great power game.

Bitcoin: The Prophet of Global Liquidity

The current cryptocurrency market has become the most sensitive liquidity monitor:

● Bitcoin peaked at $110,000 in January before Trump's inauguration.

● It then retraced to $78,000 (-30%), providing an early warning of liquidity contraction.

● Meanwhile, U.S. stocks reached historic highs, creating a dangerous divergence.

This divergence suggests that smart money is hedging against the tail risks of the fiat currency system in the cryptocurrency market.

Crisis Simulation and Tactical Layout

Scenario One: Soft Landing

● The Federal Reserve timely injects $3 trillion in liquidity.

● Bitcoin bounces off the $70,000 previous high support and begins a major upward wave.

● Future target (rapid rebound): $1 million or even higher.

Scenario Two: Hard Landing

● The S&P 500 plummets 30%, triggering a comprehensive liquidity crisis.

● Bitcoin temporarily dips to $60,000-$70,000.

● After the central bank initiates an epic rescue, a violent reversal occurs.

Regardless of the path taken, it is recommended to adopt a "non-leveraged dollar-cost averaging + doubling down on dips" strategy. Focus on two key signals:

Changes in the U.S. Treasury General Account (TGA) balance (immediate liquidity indicator).

Foreign exchange operations of the People's Bank of China (to prevent competitive devaluation of the yuan).

Geopolitical Undercurrents

We must be wary of China's counteractions: if the Federal Reserve begins printing money, China may simultaneously inject liquidity to maintain exchange rate stability, creating a global liquidity resonance. At that point, Bitcoin will not only be an anti-inflation tool but also the ultimate hedge against the collapse of fiat currency credibility.

Ultimate Rules

Navigate through policy noise and grasp the core logic:

Sovereign debt monetization is irreversible;

Cryptocurrencies are the only non-sovereign high-liquidity assets;

Every deep correction is an opportunity to enter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。