Why do we need to study token economics?

For various Web3 projects, a well-designed token economic model is key to success. Therefore, when developing a project, careful design of the token's economic model is essential to ensure the project's long-term sustainability.

For ordinary users, carefully evaluating a project's token economics before deciding to participate is a crucial step. Only by fully understanding the project itself can one increase the chances of successful investment.

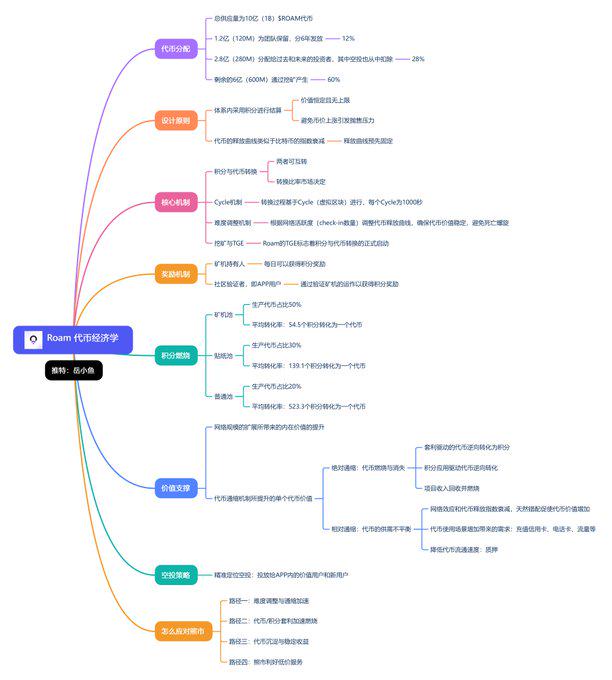

The leading DePin project Roam has released its token economics, which we can use to specifically analyze the strengths and weaknesses of a token model. @weRoamxyz

(The following mind map summarizes Roam's token economics)

Regarding the token economic model, it can mainly be analyzed through four dimensions: token supply (supply side), token utility (demand side), token distribution (holding situation), and token governance (long-term ecology).

1. Token Supply

To assess the token supply situation, there are four core indicators:

(1) Maximum supply: the upper limit of the number of tokens as defined by the preset code;

(2) Circulating supply: the number of tokens currently in circulation; (the circulating tokens are mainly influenced by two factors: the unlocking schedule of the development team and investors, and ecosystem incentives)

(3) Current market cap: current price * circulating supply

(4) Fully diluted market cap: current price * maximum supply (if a new project's price is highly inflated, even exceeding the industry benchmark Bitcoin in fully diluted market cap, it indicates that this price is difficult to maintain)

An important dimension affecting token supply is the token burn mechanism: continuously reducing token supply is deflationary; conversely, continuously expanding token supply is inflationary.

Now let's look at Roam,

The total supply is 1 billion (1B) $ROAM tokens;

120 million (120M) are reserved for the team, distributed over 6 years, indicating the team's intention to work on this project long-term;

280 million (280M) are allocated to past and future investors, with airdrops deducted from this, which is the actual initial circulating supply;

The remaining 600 million (600M) are generated through mining, indicating that there will be continued participation in this project, avoiding a wave of selling after the token is listed.

The project team also mentioned that they will later use business revenue to buy back tokens.

Overall, Roam is deflationary, which is also a very strong value support.

2. Token Utility

Token utility represents the value of the token, whether there are actual use cases, and whether it can attract more people to join, i.e., the demand side of the token.

Token utility can be divided into three aspects:

(1) Practicality: Gas fees (a typical representative is Ether, used to pay for computational consumption), real-world payments (a typical representative is Bitcoin, which can be used for actual payments)

(2) Value accumulation: Staking (security tokens can earn a portion of product revenue), governance (governance tokens allow holders to vote on changes to the token protocol)

(3) Meme and narrative: Meme refers to cultural ideas that spread widely on the internet due to popularity; Dogecoin is the most typical meme coin, which has no practical value and became popular simply because of humorous memes.

Now let's look at Roam; its token utility is mainly used for related services within the ecosystem, such as paying for network service fees, exchanging for free roaming data, or participating in other functions.

Relatively speaking, it still has strong value support and is not a worthless air token.

3. Token Distribution

There are two ways to launch and distribute tokens:

(1) Fair launch: A fair launch means that no one gets access or small-scale distribution of the tokens before they are minted and distributed to the public, a typical representative being Bitcoin;

(2) Pre-mined launch: Pre-mining refers to minting a portion of the cryptocurrency and distributing it to a specific group (founding team or investment institutions) before providing it to the public; Ethereum conducted pre-mining.

Now let's look at Roam; it is clearly not a fair launch but rather a pre-distribution, which aligns with the business logic of VC tokens, as investors still need to make a profit.

We also need to pay attention to the types of entities holding the tokens: large institutions and individual investors behave differently.

Understanding the types of entities holding the tokens can further infer how holders might trade, and their trading methods will influence the token's value.

On the other hand, we need to note whether the token distribution is even: typically, if a few large institutions hold the vast majority of tokens, it indicates higher risk.

If patient investors and the founding team hold the majority of tokens, the interests of the holders will be more aligned, making long-term success more likely.

The Web3 industry standard is to allocate at least 50% of the tokens to the community, which can effectively dilute the ownership that the founding team and investors can retain.

We also need to understand the lock-up and release schedule of the tokens: to see if a large number of tokens will enter circulation, thereby putting downward pressure on the token's value.

4. Token Governance

How to incentivize participants to ensure long-term sustainable development is the core issue of token economics.

Many Web3 projects also incorporate staking mechanisms into their token economic models.

Staking tokens can increase their value in two ways:

First, staking incentives mean locking tokens to earn passive income, so the minimum value of the token is a multiple of the future reward value;

Second, locking tokens prevents them from being exchanged, which helps reduce market supply and increase token prices.

Now let's look at Roam; to reduce selling pressure after launch and lower actual circulating supply, it also provides staking services, which can be considered standard.

In conclusion:

The economic model design of Roam is quite reasonable, overall adhering to the principles of long-termism and sustainability.

Only by controlling supply, increasing demand, and supplementing with governance mechanisms can the value of the token be maintained in the long term.

We can find that a good token economic model must have three key elements:

(1) A reasonable staking mechanism: Staking can bind users' interests to the project's value and adjust the token supply, where Curve's VE staking model has been proven to be relatively superior;

(2) More application scenarios: This is the biggest issue each project faces, and the expansion of application scenarios must be based on the growth of the business itself;

(3) Steady growth in business revenue: Although token incentives can attract new users, a Ponzi model will eventually collapse, so the key is whether the business itself can create value;

The token economic model is very important, but everything relies on the business value itself; otherwise, it is just a "air token" without any valuable support.

Currently, the token economic model is still rapidly innovating and changing very quickly, so everyone can continue to pay attention to whether new token models emerge in the market.

However, overall, despite the changes, the token economic model can always be analyzed from the four dimensions of supply, demand, distribution, and governance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。