Last night, the Dow Jones Industrial Average opened up 300 points, but then the situation took a sharp turn, dropping 1,100 points within a few hours. Between 10:00 AM and 3:30 PM Eastern Time, the market capitalization of the S&P 500 index evaporated by $1.5 trillion. Meanwhile, the cryptocurrency market lost nearly $300 billion in value.

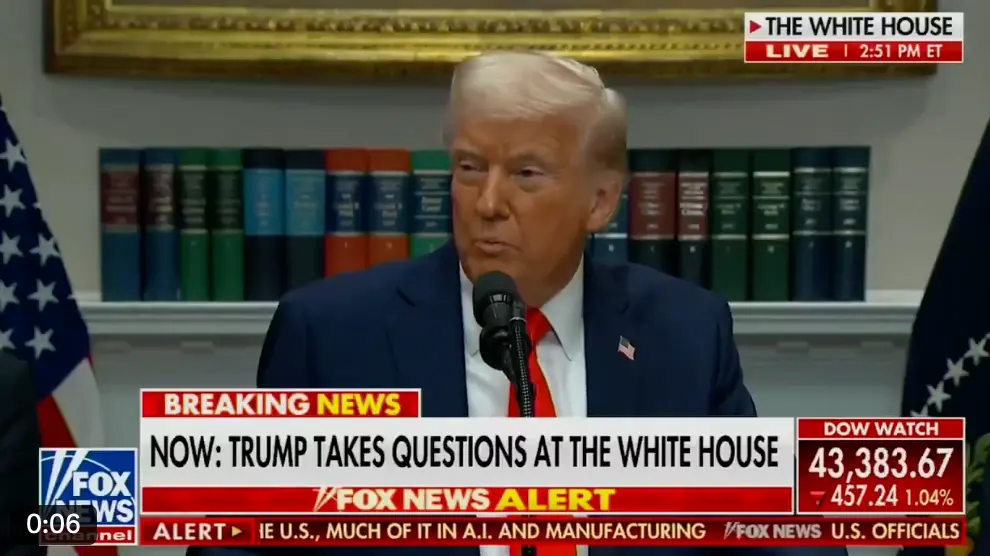

After the cryptocurrency market surged on Sunday due to Trump's announcement of establishing strategic reserves for cryptocurrencies like SOL, XRP, and ADA, Trump quickly delivered a "reverse wash" to the U.S. stock market, and the cryptocurrency market could not escape the significant drop. The entire capital market was once again "violated" by the president. What exactly happened? It seems that everything stemmed from a press conference called by Trump…

Investment in TSMC, Easing Sanctions on Russia

Last night, the S&P 500 index opened up about 30 points, continuing the trend from last Friday. However, shortly after, the Trump administration issued an "investment statement," leading to selling pressure in the market.

Trump announced that TSMC would invest $100 billion in the U.S., which includes:

- Establishing 5 factories in Arizona;

- Creating thousands of jobs;

- Bringing TSMC's total investment in the U.S. to $165 billion;

- Generating "hundreds of billions of dollars in economic activity."

Trump stated that this investment plan would promote the long-term goal of revitalizing the U.S. semiconductor industry. For the capital market, this will undoubtedly exacerbate concerns about the Taiwan Strait issue.

Meanwhile, as President Trump made his statement last night, The Wall Street Journal published a timely report on Ukraine, stating that the Trump administration had officially stopped funding for the sale of new weapons to Ukraine. According to subsequent reports from Reuters, the U.S. is also formulating a plan to ease sanctions on Russia.

Prior to this, the Ukraine crisis had stalled due to a "live argument" between the two presidents. At this time, the easing of policies against Russia is seen as favoritism towards Russia, which is not conducive to further negotiations.

Crazy Tariffs

After announcing the investment, Trump quickly moved to the Q&A session, leading to further panic selling in the market.

First, Trump confirmed that a 25% tariff would be imposed on Canada and Mexico starting March 4. A reporter then asked, "Is there still room for Canada and Mexico to reach an agreement before midnight regarding tariffs?" To this, Trump replied that there was no room for negotiation on tariffs with Mexico and Canada.

Trump then announced that tariffs on imported agricultural products would be increased starting April 2. Worse still, he stated that tariffs would be imposed on countries that "engage in currency devaluation." Minutes later, the White House issued a statement indicating that Trump had signed an executive order to raise tariffs on China to 20%.

This means that tariffs on China have increased by 20 percentage points within two months. In contrast, Trump took two years during his first term to raise tariffs on China to such a high level. Under the heavy blow of tariffs, the U.S. stock market instantly evaporated $1.5 trillion…

Strategic Reserves Hard to Realize

During this announcement, Trump did not mention the previously mentioned strategic reserves for cryptocurrencies. This has led the market to question his sincerity and the true capabilities of this administration.

BitMEX founder Arthur Hayes mentioned in a recent tweet that the fundamental problem with the government hoarding any asset is that they buy and sell assets primarily for political gain, not financial gain. Those building truly decentralized technologies and applications do not have enough financial resources to manipulate politics at this critical moment in the cycle.

Yesterday, Arthur further stated that he believes the government does not have the money to purchase the cryptocurrency assets needed for strategic reserves, saying, "There’s nothing new here, just empty talk. Let’s talk when the crypto working group gets congressional approval to borrow money or re-evaluate gold prices." Arthur believes that unless Trump uses "Bitcoin" as a national reserve, the market will trend in a worse direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。