There are no constant strategies in warfare, nor constant forms in water. Fear is not terrifying; what is terrifying is being controlled by fear. We must learn to face our fears, not to evade them, and to adjust our state under different emotions. Like water, we should be able to change with the environment while always maintaining our essence.

Hello everyone, I am trader Gege. Continuing from the last article, when Bitcoin violently dropped after breaking key support on the 25th, I have been emphasizing the need to wait for a gap fill and a strong rebound, continuously instilling faith in the bulls. On the 27th, I advised others to be greedy when others are fearful and to enter the market on the left side. On the 28th, I reminded everyone that all positions had been filled and to be patient and not to panic. As expected, on the 28th, the market hit the absolute bottom area I provided of 79000-77000 and began to rebound. Yesterday morning, it continued to rise strongly, at least realizing the space for a ten-thousand-dollar trend to start. Congratulations to those who overcame fear during the crash, believed in Gege, and followed the bullish trend of Bitcoin.

In such a short time, Bitcoin completed a V-shaped reversal, directly rising to the 95000 level, which was beyond expectations. I had estimated that the market would linger around the 90000 level for a while. The trend's rapid movement allowing us to secure profits is thanks to Trump's statements. Overall, this bull market belongs to policy and news-driven trends. Trump's policies regarding the crypto space could trigger significant market movements at any time; it truly is "Trump stomps his foot, and the crypto world shakes," haha! Success and failure both hinge on him. During his four-year term, the market is still worth looking forward to, but we must also have a respectful attitude towards the market and not act blindly.

Long-time fans of Gege's articles know that I am a technical trader, focusing more on technical analysis, combined with market sentiment, historical trends, and long-term research on products to judge the trend. Some people often say that technical analysis is useless, which is incorrect. When we enter the market, we need some basis for judgment; technical analysis is the knife in our hands to cut through the market. If you say you rely entirely on news, that is unrealistic for us small traders. Just like Trump's statements last night, could you have predicted them in advance? If you claim to be friends with big players like Trump or Ma, I have nothing to say; they might tell you in advance.

Returning to the technical analysis, let's discuss the market. Today marks the end of the weekly candle. The previous weekly candle for Bitcoin has a long lower shadow, returning to the middle track, currently testing near the middle track. We still need to pay attention to the resistance around MA7 and MA14 mentioned earlier. If it can break through and stabilize above 98000, then there is still room for the bulls to continue. Conversely, it will enter a large range of oscillation and adjustment structure. As shown in the chart, the weekly level is currently undergoing a fourth wave pullback. If the fourth wave completes, it will initiate the fifth wave upward to break the previous high. From a longer-term perspective, if the upward trend continues to test the previous high, we need to observe carefully, as there is still a probability of a double top pullback trend line before starting the fifth wave upward. I hope the market oscillates and adjusts a bit more; this way, the subsequent upward momentum will be better and stronger.

The daily level shows a large bullish candle that can be seen as a reversal. My understanding is that this wave of decline has already bottomed out. Even if there is a pullback, the probability of breaking below 80000 is very low. If the market does fall below the previous low, the bulls have nothing to fear; it is also a good opportunity for you to accumulate positions. Currently, my only slight concern is that this wave of rise is driven by Trump's statements, which is not a healthy trend. I worry that the continuation of this momentum may weaken. Observing while walking is not a problem, after all, the trend's chips are near the absolute bottom, and the initiative is in our hands.

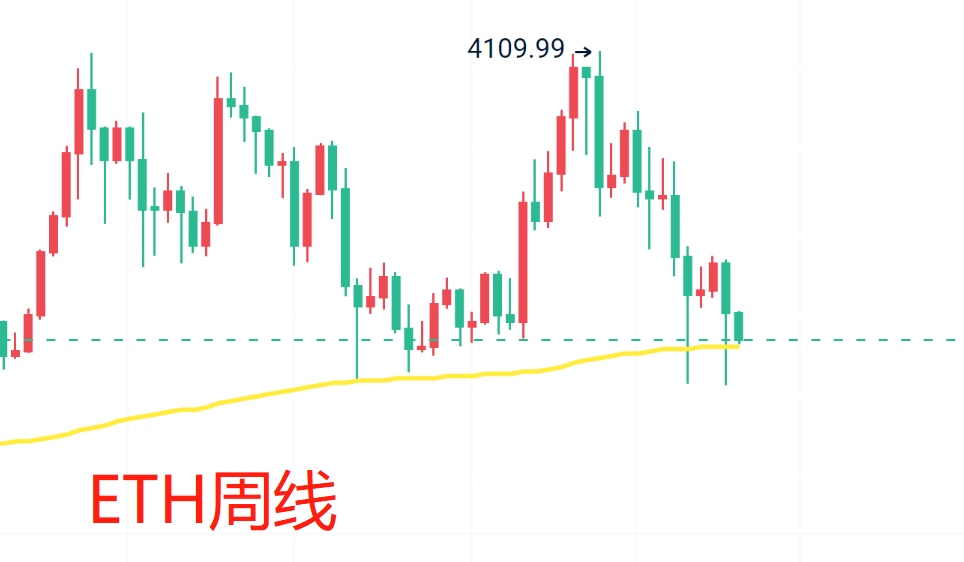

In the short term, Bitcoin needs to focus on whether it can break and stabilize in the 96800-98800 range, while paying attention to the support around 89000-88000. For Ethereum, the short-term focus is on the support around 2300-2250, which is also near the EMA200 on the weekly chart. The upper focus is on the 2500-2550 range; if it breaks and stabilizes, we need to pay attention to the key 2700-2800 range. Today's article does not provide specific short-term suggestions; I will update tomorrow, and you can consult me.

The suggestions are for reference only. Please manage your risk when entering the market, and grasp the profit and stop-loss space yourself. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone success in their trading and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by / I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。