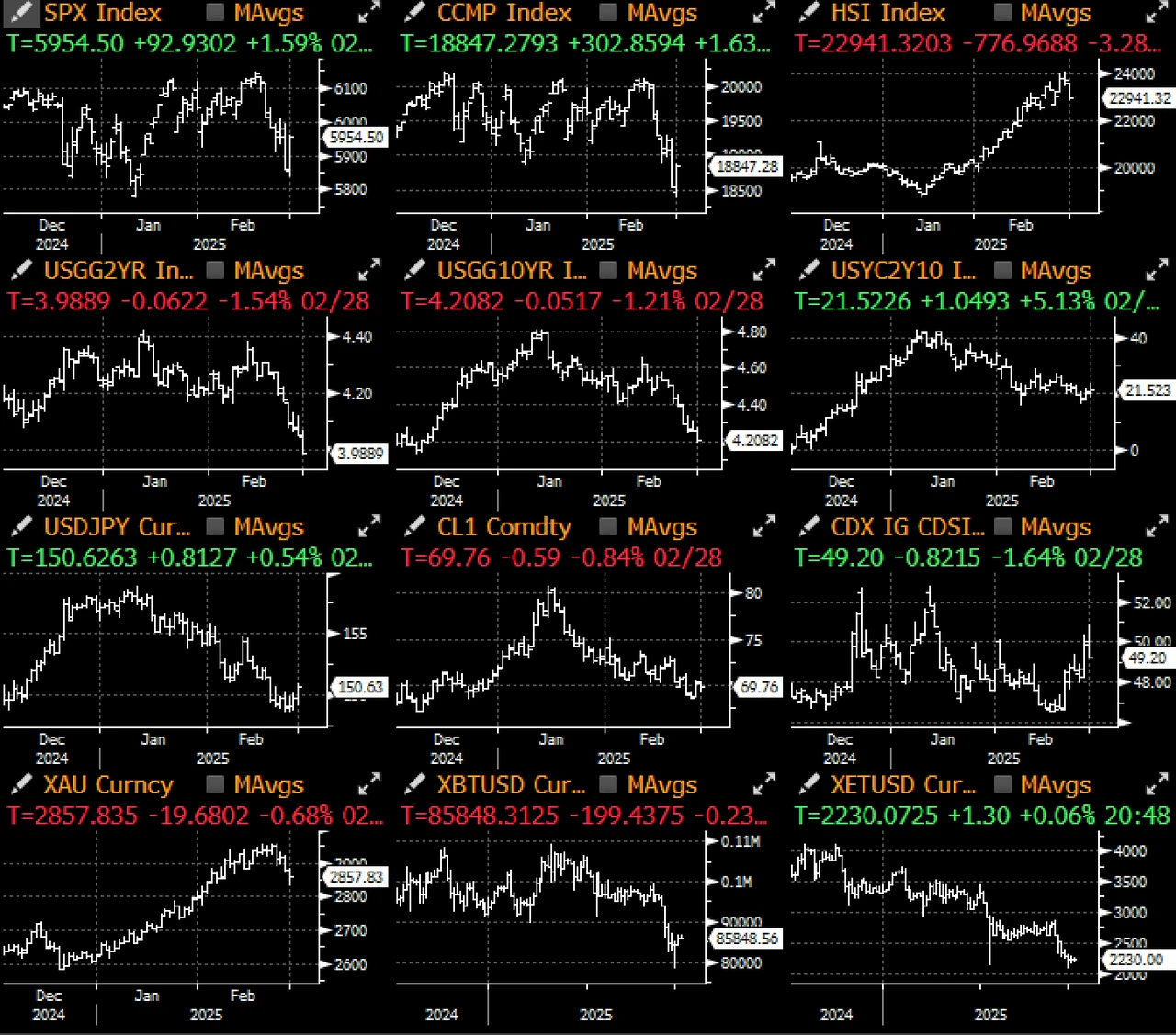

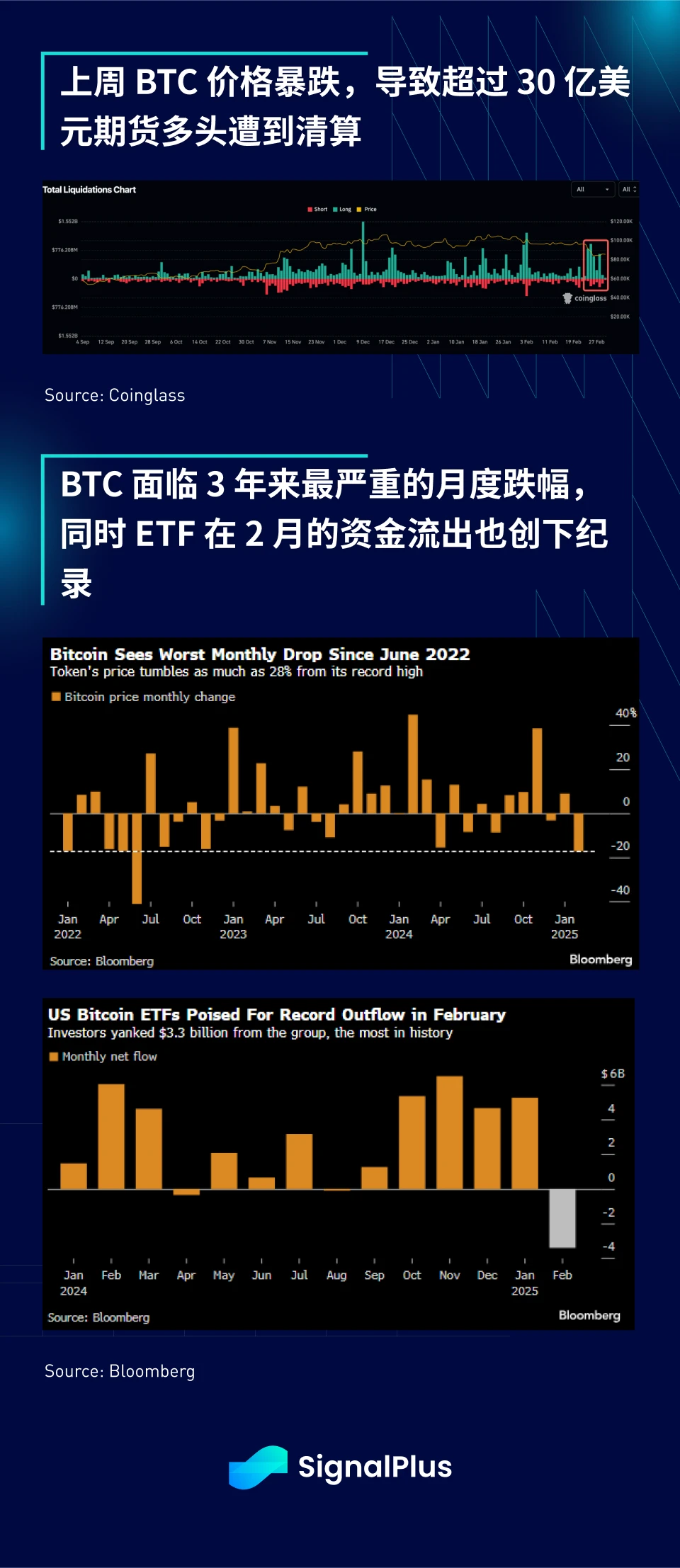

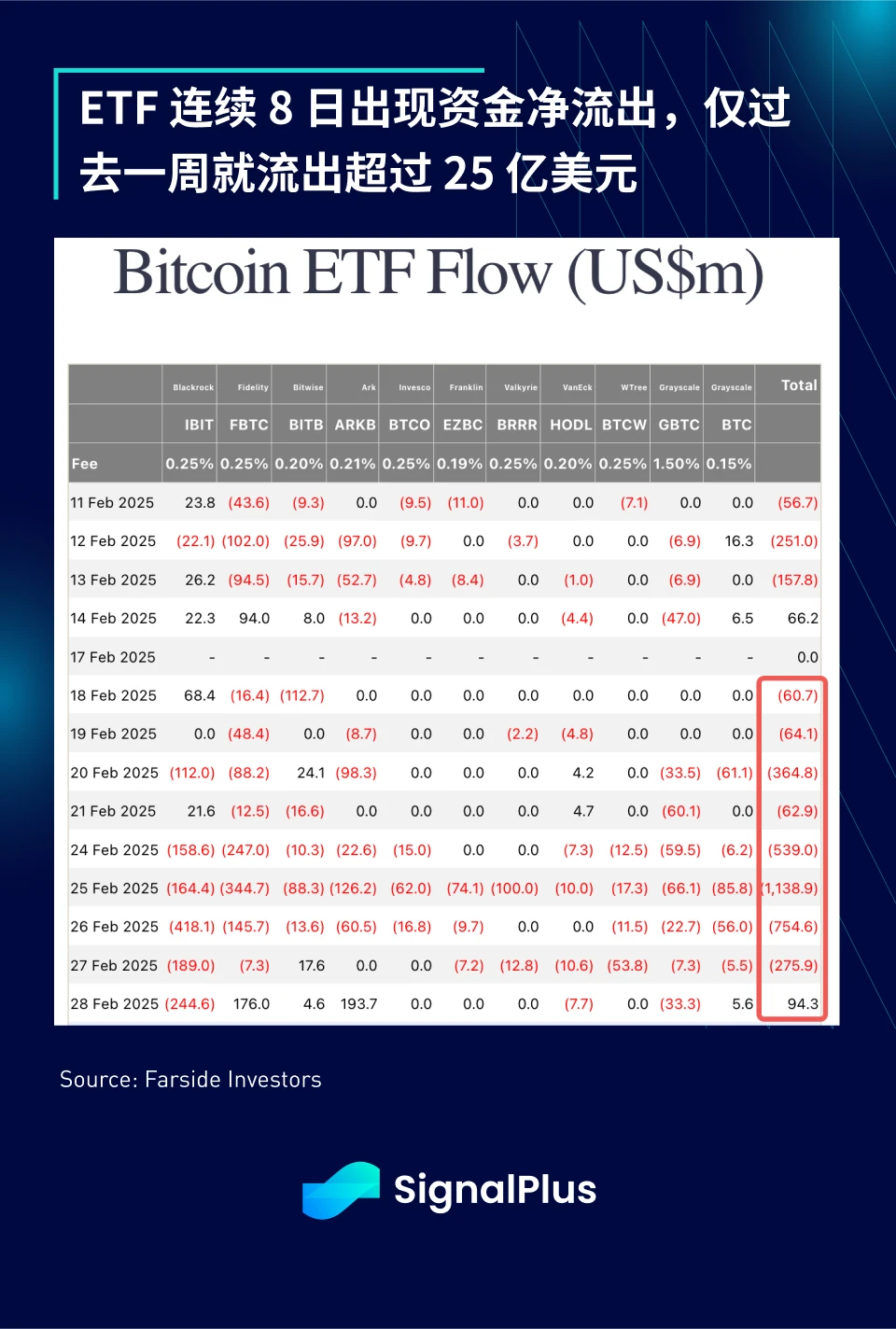

The market environment is chaotic, and it's hard to know where to start. First, regarding cryptocurrencies, the price of BTC plummeted to $78,000 last week. According to Coinglass, over $3 billion in futures long positions were liquidated, and BTC is set to experience its worst monthly performance since June 2022. At the same time, ETFs saw the largest monthly outflow in history (with $2.5 billion leaving just last week).

As prices crashed, market sentiment deteriorated significantly. Last Friday, Alternative's "Fear & Greed" index fell to an extreme low. Subsequently, the Trump administration intervened, bringing two pieces of good news: announcing a "Cryptocurrency Summit" at the White House this week and proposing to include five tokens in a new strategic reserve (BTC, ETH, SOL, XRP, ADA).

Encouraged by this, cryptocurrency prices rebounded sharply, with BTC rising significantly. However, it faced resistance around $92,000 to $93,000, which corresponds to a long-term trend line resistance level. If the government is learning from the Federal Reserve how to "manipulate" asset markets—oh no, I should say "verbally guide" market trends—then so far, their timing and technical control have been impeccable. Does this mean we are witnessing the gradual formation of a "Trump Put" in the cryptocurrency market?

However, the news about the "strategic reserve" has not been accepted by all market participants. Long-term supporters and opinion leaders of decentralization (such as Naval Ravikant) do not support it, and discussions and controversies regarding the composition of reserve assets are likely to continue to brew for some time. If the Democrats choose to embrace BTC and become BTC extremists to oppose the Trump administration, it would be quite an ironic situation.

Our intuitive judgment is that this rebound may just be a corrective rebound within the trend, as the structural forces at the recent peak still exist (memecoin FUD sentiment, losses affecting trading accounts, excessive market leverage, overall risk aversion in the asset market, etc.). Not to mention that the legislative process for establishing a cryptocurrency strategic reserve is still long and full of uncertainties.

It is important to emphasize that the U.S. President does not have the power (or funds) to directly purchase cryptocurrency assets; relevant measures still need to be approved by Congress and follow legislative procedures. Moreover, before taking any substantial action, funds must be obtained through debt issuance by the Treasury.

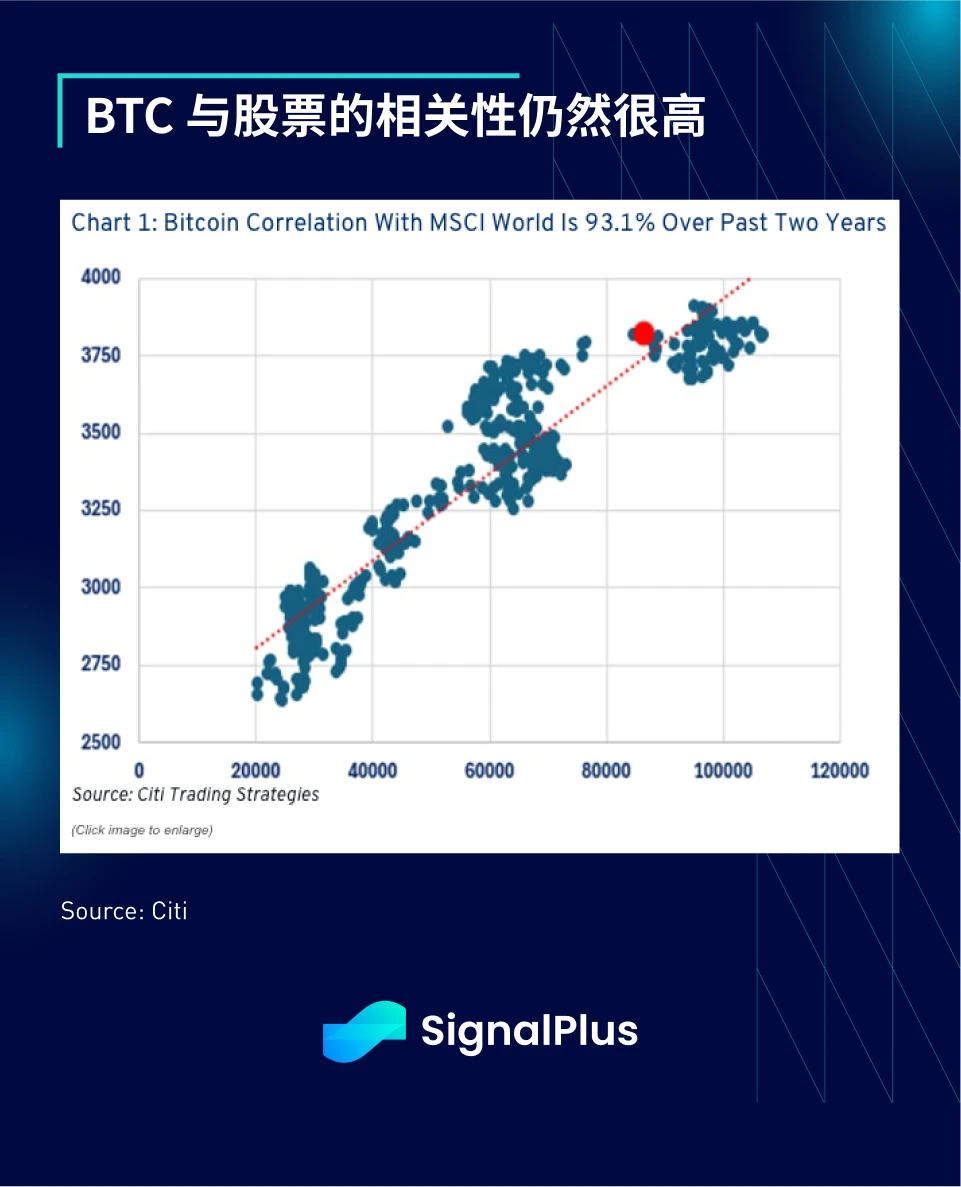

While we hold a positive outlook on the long-term development direction of market narratives, we must also remind that the market should not have overly optimistic expectations for short-term progress. In the foreseeable future, cryptocurrency prices will still be closely related to the macro market's risk appetite/aversion sentiment.

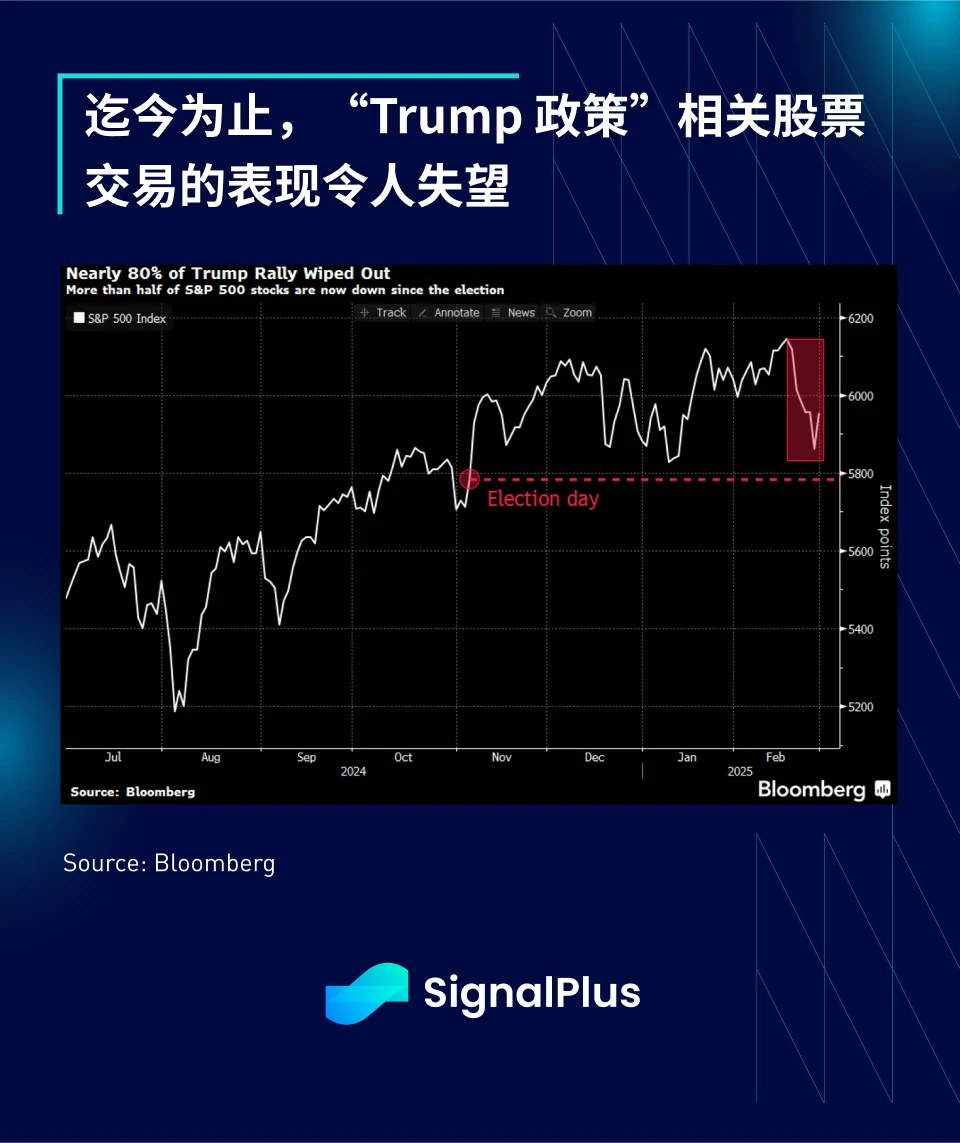

Returning to the macro market, although the stock market rebounded last Friday, stocks most affected by Trump’s policies have fallen about 80% from their election highs. His uncertain stance on tariffs and DOGE spending cuts has also begun to negatively impact market sentiment.

Although U.S. stocks rebounded (+1%) last Friday in an oversold condition, slightly narrowing February's trend, overall macro market sentiment has clearly become more negative, with most Economic Surprise Indices turning negative.

Notably, the Atlanta Fed's GDP growth forecast for the first quarter saw a record drop last week, revised down from +2.2% to -1.3%, primarily due to severe weakness in exports (from -$29 billion to -$250 billion) and consumer spending (from +2.2% to +1.3%).

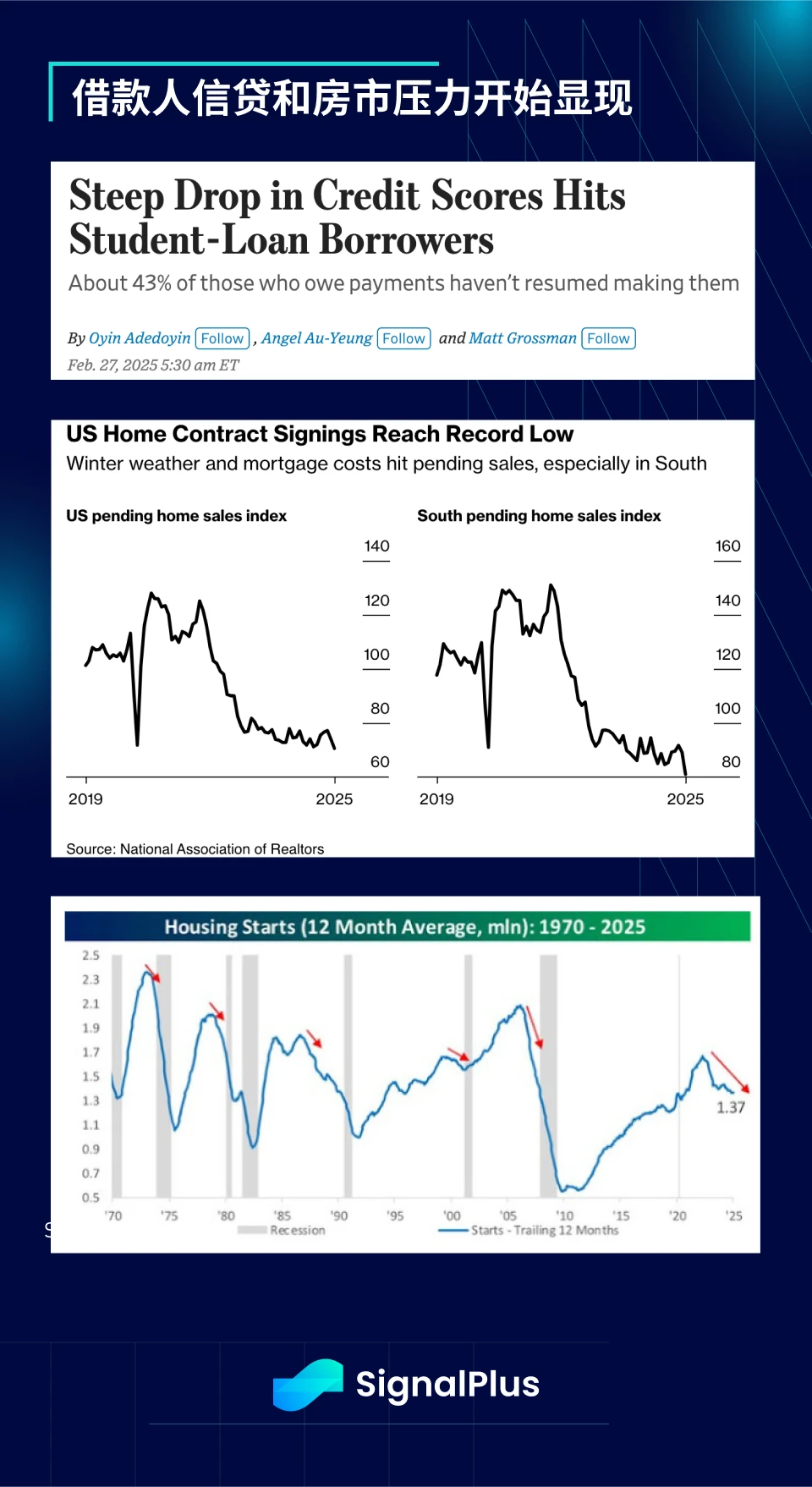

Consumer credit and housing market data continue to decline sharply, further exacerbating expectations of weak economic growth. New home sales hit a record low, while new housing starts began to decline after the post-pandemic boom.

Meanwhile, Treasury Secretary Bessent seems unconcerned about the current economic slowdown, attributing economic pressures to "Bidenflation" and the policies of the previous administration. More interestingly, he explicitly stated that "6-12 months from now" will be the real "Trump economy," suggesting that the government is not in a hurry to address the current economic downturn, which also implies that the stock market's "Trump Put" may not take effect until a year later.

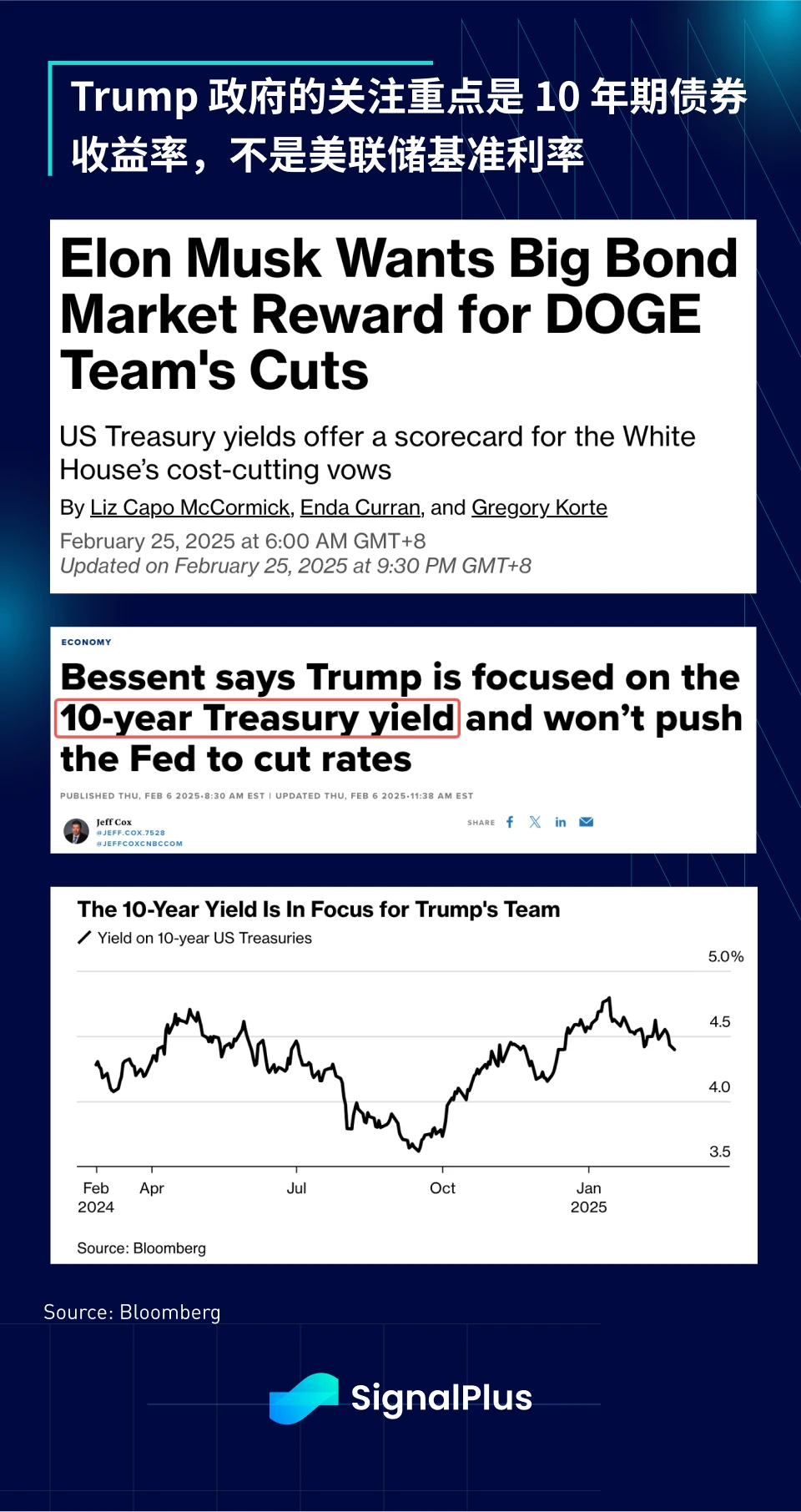

If the Trump Put in the cryptocurrency market is currently just verbal, and the Trump Put in the stock market will not take effect until next year, then where is the real Trump Put? We believe that the macro (and cryptocurrency) community has overlooked a key point: the real Trump Put has always been at work in the fixed income market.

Here are several observations compiled from the past month:

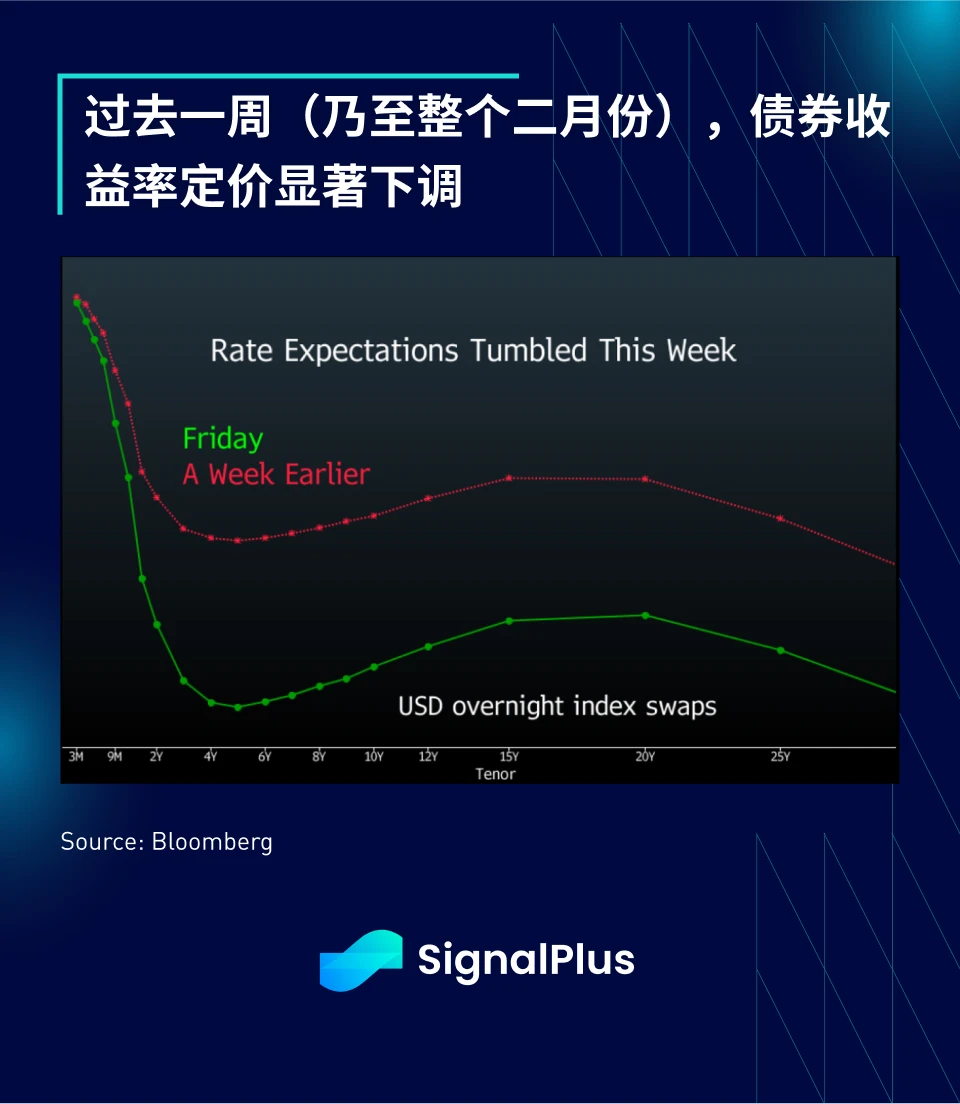

Bond yields have significantly declined, with expectations for the first rate cut of the year moved up from the end of the year to early summer.

Core PCE has quietly decreased, reaching its lowest level since March 2021 (3.096%).

Elon Musk has explicitly stated that the bond market should thank the government for the DOGE spending cuts.

In a January X conference call, Elon Musk stated:

"If you are shorting bonds, I think you are on the wrong side."

- Treasury Secretary Bessent stated in a public interview with Bloomberg TV:

"We are not focused on whether the Fed will cut rates… After the Fed's massive rate cuts, the 10-year bond yield rose, raising questions about whether monetary policy can effectively impact the overall economy."

- Bessent further emphasized:

"The President wants to see lower rates… In our discussions, we mainly focus on the 10-year bond yield."

"The President did not ask the Fed to cut rates; he believes that as long as we relax regulations on the economy, push for tax reform, lower energy costs, etc., then interest rates and the dollar will adjust on their own."

It is clear that the Trump administration has a deep understanding of how financial markets operate and recognizes how declining long-term interest rates can benefit the economy. In fact, focusing on long-term interest rates rather than overnight rates aligns with the logic of the Federal Reserve's QE (Quantitative Easing) or Operation Twist, just expressed differently.

That is to say, the current strategy of the Trump administration is clearly to suppress long-term interest rates, allowing the benefits of lower funding costs to spill over into the dollar, stock market, and cryptocurrency market. Therefore, we believe that the real "Trump Put" in the current market is in the bond market, not the stock market, and investors can adjust their investment strategies accordingly. (Disclaimer: Please do your own research, not investment advice)

This week, the market's focus will be on whether the U.S. will impose a 25% tariff on Mexico and Canada as scheduled, followed by the European Central Bank meeting and Friday's non-farm payroll report. After experiencing significant volatility last week, risk assets may take a breather, and a consolidation pattern may be maintained in the near term, with potential upside limited.

Wishing everyone successful trading!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat, please remove the spaces between the English and numbers: SignalPlus 123), Telegram group, and Discord community to interact and exchange ideas with more friends. SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。