Trump is here to save the day.

The market's roller coaster ride continued last week, with no exceptions. Under the dual pressure of tariffs and theft, panic spread rapidly, causing even the traditionally strong BTC to drop below $80,000, while ETH hovered around $2,200. Altcoins like BNB and SOL were overwhelmed, returning to their explosive price points from the end of last year.

Amidst the cries of despair, the "savior" Trump delivered a shot of adrenaline. Perhaps due to the dismal performance of the second stock market, which reflects his political achievements, Trump posted on Sunday, once again putting the crypto strategic reserve on the agenda, stating that he would accelerate the establishment of a crypto reserve that includes five major cryptocurrencies. In other words, the crypto reserve is a done deal, and the market responded with a swift rebound.

However, establishing a reserve is not as simple as the president just talking about it.

After BTC fell below $80,000 on Friday, market sentiment plummeted, with discussions of a bear market replacing the bull market. A downward trend became the main theme for many cryptocurrencies, and the market even began to pay attention to the shutdown price of mining operations, indicating the extent of the downturn. But as the saying goes, "Success and failure both lie with Trump," and this phrase's significance continues to grow.

Just last night, the Bitcoin president of the United States, Trump, couldn't sit still. He posted on his platform, Truth Social, stating, "The U.S. Crypto Reserve will elevate this critical industry, freeing it from the corruption and suppression of the Biden administration over the years. Therefore, my Executive Order on Digital Assets directs the Presidential Working Group to advance the establishment of a Crypto Strategic Reserve, which includes XRP, SOL, and ADA. I will ensure that America becomes the global cryptocurrency capital. We are making America great again!"

The crypto strategic reserve has been mentioned in the U.S. before. Since Trump promised to establish a reserve at the Bitcoin conference last October, news about the crypto reserve has never ceased. Whether it was U.S. Senator Cynthia Lummis proposing to purchase 1 million BTC or the subsequent leaks about the so-called framework for building the crypto reserve, they have all contributed to the expectations surrounding the U.S. crypto reserve.

Although this matter was not prioritized after the president took office, and crypto was not included in the top 100 executive orders, on January 24, Trump still submitted a proposal regarding crypto. He signed an order titled "Strengthening America's Leadership in Digital Financial Technology," which established a Presidential Working Group. This group is required to submit a final report and proposal to the president within 180 days of the order's issuance, including the development of a comprehensive federal regulatory framework to regulate the issuance and operation of digital assets (including stablecoins) within the U.S. Additionally, it should assess the feasibility of establishing and maintaining a national digital asset reserve and propose standards for such reserves, which may come from cryptocurrencies legally seized by the federal government through law enforcement.

At that time, because the reserves would come from legal seizures rather than incremental purchases, and there was still some operational space, the market was quite skeptical, even expressing disappointment. As the liquidity crisis brought about by his issuance of coins and subsequent policy proposals unfolded, the crypto reserve gradually fell out of discussion, and industry insiders expressed extreme dissatisfaction with the president's money-grabbing tactics, turning former support into resentment.

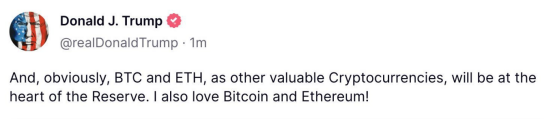

However, amidst the market's gloom, the reintroduction of the strategic reserve, now almost confirmed, successfully halted the downward trend. In this recent post, Trump unusually specified the cryptocurrencies, mentioning that SOL, ADA, and XRP would be included. Interestingly, at the beginning of the post, Trump did not even mention BTC and ETH, which angered ETH holders. However, he later followed up with another post, stating, "Clearly, Bitcoin and Ethereum will be the core of this currency reserve."

This move had a significant uplifting effect on the market. Following the announcement, BTC quickly rose from $85,000 to $95,000, peaking with an increase of over 10%, currently reported at $92,000. ETH also rebounded to $2,550, and the total crypto market cap increased by 9% to $3.254 trillion. The cryptocurrencies specified by Trump saw remarkable gains, with ADA's 24-hour increase exceeding 70%, pushing its market cap above $40 billion, ranking it 8th among cryptocurrencies. XRP briefly touched $2.99, fully diluting its value beyond ETH, while SOL emerged from the shadows of large unlocks and MEME, returning above $170.

In response, Consensys founder and Ethereum co-founder Joseph Lubin praised Trump's "call," stating, "This is an epic call; President Trump is a quick-reacting and confident leader. Thank you."

However, behind the call, there were numerous questions about insider trading. For instance, just before Trump's announcement, a whale leveraged 50 times to go long on BTC and ETH with about $4 million, controlling a total position of around $200 million, when Bitcoin and Ethereum were priced at approximately $85,000 and $2,210, respectively. That address has since closed all positions, making nearly $7 million in profit in less than 24 hours, yielding a 175% return based on the initial $4 million.

While insider information may not be accurate, it is not entirely unfounded. After all, Trump had never mentioned including cryptocurrencies other than BTC and ETH in the reserves before, but this time he was the first to release a list of altcoins, placing mainstream reserve currencies last, which is clearly a reversal of priorities. Looking at the new three coins entering the reserve—SOL, ADA, and XRP—they are all cryptocurrencies with capital lobbying, clearly raising suspicions of "advertising space," suggesting that interest transfer is not baseless.

SOL is already backed by Western capital, while Ripple has the advantage of experience, betting on both sides before the election, donating $45 million to the crypto political action committee Fairshake, and immediately showing loyalty after Trump's election by donating $5 million in XRP at his inauguration, and again donating $25 million to Fairshake before the U.S. midterm elections, indicating a close relationship with Trump. The inclusion of ADA was particularly surprising; this coin originates from Cardano and had not previously been emphasized by Trump. However, according to CryptoDoggyCN, the founder of ADA indicated in early February that he would meet with big figures in Florida. Mint Ventures research partner Alex Xu also analyzed that SOL, XRP, and ADA have been frequent visitors to Mar-a-Lago since Trump's inauguration.

On the other hand, the president's "heartfelt selection" seems quite arbitrary, even raising suspicions of disregarding regulations. SOL has previously been explicitly classified as a security by the SEC, and its status remains unclear, making ETF approvals slower than LTC's progress. Ripple is no better off, having been embroiled in a lawsuit with the SEC for nearly five years, which is still ongoing. The inclusion of ADA also lacks clarity; if not for interest transfer, it can only be seen as a random selection among the top 9 cryptocurrencies by market cap, as the president is not known for being "well-informed" in the crypto field.

It is evident that this call has some lobbying elements, and the president's top advertising spot is likely given to the cryptocurrencies with the most lobbying interests. Many industry insiders have expressed strong dissatisfaction, arguing that the president's actions not only undermine the legitimacy of the strategic reserve but also show irresponsibility towards taxpayers and cryptocurrency holders. AngelList co-founder Naval Ravikant stated, "American taxpayers should not be left holding the bag for those ostensibly decentralized cryptocurrencies," while Aave founder Stani Kulechov sharply criticized the inclusion of XRP, SOL, and ADA as ugly news.

Ironically, the implementation of the strategic reserve, based solely on the president's verbal promises, seems far from sufficient.

The core issue is, where will the money come from? Currently, Bitcoin exists as a reserve in the U.S., but to establish a crypto reserve, especially one that includes other cryptocurrencies, the issue of funding purchases cannot be avoided. According to the latest data from the Congressional Budget Office (CBO), the U.S. federal budget deficit for fiscal year 2025 is projected to reach $1.865 trillion, accounting for 6.2% of GDP. The massive deficit has prompted Trump to resort to various tactics, whether imposing tariffs externally or shutting down the government internally, and even previously announcing a new plan to buy immigrant golden cards for $5 million. These measures directly reveal the problem—there is really no surplus in the landlord's house.

Against this backdrop, whether for the government or himself, Trump, who has fallen into a financial bind, is executing all current policy paths in a "fool's errand" manner. Whether it is various antics in the crypto field or constructing a virtual world, monetizing traffic is Trump's ultimate goal. It is utterly impossible for him to invest real money into the crypto reserve or pump the market; it is more likely that he will have crypto companies step up first and then maintain the reserve, extracting funds from it.

BitMEX co-founder Arthur Hayes bluntly stated that this move is unoriginal, saying, "When they get Congressional approval to borrow or raise the price of gold, let me know. Without these, they have no money to buy Bitcoin and altcoins." Some industry insiders also noted that Trump frequently alternates between using "reserve" and "stockpile" in his policy language, making the specific implementation methods difficult to determine.

From a practical standpoint, if a federal-level strategic reserve is to be established, it must go through Congressional approval, rather than being decided solely by the president. Although the president has secured both chambers, it is not an overwhelming advantage, especially in the House of Representatives, where he won by just 5 votes. The tug-of-war between the two parties is far from over and is becoming increasingly intense, with the government shutdown causing quite a stir. On the other hand, increasing the number of cryptocurrencies in the reserve will inevitably complicate the approval process, as it is clearly unrealistic for currencies already embroiled in lawsuits to serve as strategic reserves, making the path to Congressional approval likely difficult. It is worth mentioning that in the past week, the SEC withdrew its lawsuit against Coinbase and terminated investigations into projects like Robinhood Crypto, OpenSea, Uniswap Labs, and Tron, but the lawsuit against Ripple remains unresolved.

If one seeks to bypass Congress, the only option would be to approach the national sovereign fund. However, the national sovereign fund has not previously mentioned crypto assets, and to join the fund, Trump, as a businessman president focused on interests, would inevitably have to pay more political donations, which would naturally be a heavy burden for crypto companies. Perhaps for this reason, despite the favorable news, Bitcoin and Ethereum, while experiencing rapid gains, have not broken new highs, merely hovering around the average line.

However, whether it is interest transfer or opportunistic calls, ultimately, Trump's statements have once again revitalized the market, which is a welcome relief for the crypto world teetering on the edge of a bull and bear market.

On March 7, Trump will hold the first White House cryptocurrency summit and deliver a speech. The summit will be hosted by White House crypto chief David Sachs and managed by the executive director of the working group, Bo Hines. Will Trump bring surprises or shocks to the industry at this summit? Ultimately, the market is still being led by Trump.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。