Author: Scof, who is speechless, ChainCatcher

Editor: TB, ChainCatcher

Last night, the cryptocurrency market went into a frenzy due to a post by Trump mentioning a "cryptocurrency strategic reserve." XRP, SOL, and ADA surged over 30% in a single day, with Bitcoin and Ethereum following suit, leading to a total market capitalization increase of $300 billion.

The "pump" effect was evident, but the market did not seem to exhibit the same enthusiastic cheers for a policy bull market as in the past.

The rationality of crypto is returning.

1. Crypto Rationalists: Rather than a strategic reserve, it's more like a strategic pump

Anyone familiar with the U.S. legislative system knows that the president does not have the unilateral authority to establish a national cryptocurrency reserve; this requires a long and complex negotiation with Congress.

Although the latest developments regarding the "cryptocurrency strategic reserve" have boosted market sentiment in the short term, some industry insiders are skeptical about Trump's reserve plan. More rational voices believe that the plan resembles a political gesture or negotiation tactic rather than a genuinely executable national strategy.

Crypto analyst Arthur Hayes bluntly stated on the day of the surge: "This is just an empty check; the U.S. Treasury has no budget to increase cryptocurrency assets."

Chris Burniske, a partner at Placeholder VC, shared the viewpoint of Taproot Wizards founder Udi Wertheimer on social media: so far, the best interpretation of the strategic reserve is that it is just typical Trump negotiation strategy. To achieve a true reserve, Trump must persuade Congress; he cannot decide on his own. Whenever Trump needs to convince other stakeholders, he always starts with an absurd proposal, from which he can then backtrack, such as the previous Gaza plan, the annexation of Canada, and now the ADA strategic reserve. So, in Trump's "chess language," this means he is telling Congress: if you don't agree to a Bitcoin reserve, I will propose even more outrageous conditions.

Alex Xu, a research partner at Mint Ventures, pointed out that since Trump took office, SOL, XRP, and ADA have frequently interacted with Mar-a-Lago and have publicly supported Trump, such as donating to the inauguration fund. The private interests may be more complex, and Trump's statement can be seen as a return for that support, providing them with a "advertising space" within the scope of presidential authority.

2. Incorporating assets like ADA and XRP into national reserves is not very "reliable"

In the long run, incorporating assets like ADA and XRP into national reserves not only lacks feasibility but also undermines the seriousness of Bitcoin as a strategic reserve asset, further reducing the likelihood of related legislation passing at the federal level. Having a working group study and promote it is one thing, but actual legislation is another. The Republican Party's slim majority in the House means they are almost unlikely to push for legislation to include SOL, ADA, and XRP in national reserves.

Currently, the only realistic possibility is that Trump bypasses Congress and uses executive action to have the Treasury directly establish a national sovereign fund to purchase these assets. However, the feasibility of this move is questionable; how much political and economic benefit do SOL, XRP, and ADA need to provide to prompt the president to order purchases with taxpayer money?

As Aave founder Stani Kulechov humorously remarked: "Good news: strategic crypto reserves are in preparation; bad news: lacking DeFi; ugly news: XRP, SOL, and ADA."

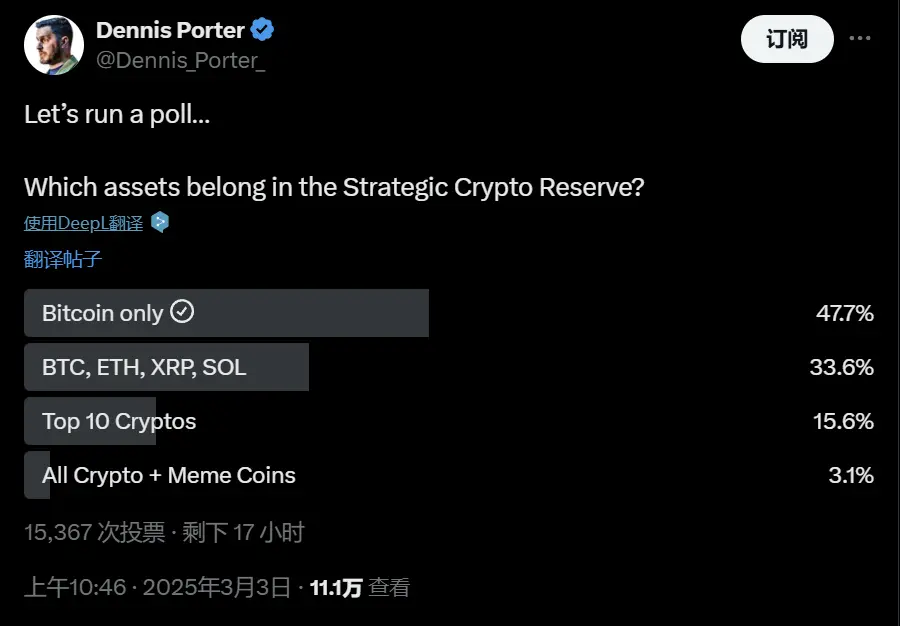

Dennis Porter, co-founder and CEO of the Satoshi Action Fund (SAF), initiated a poll on X asking, "Which assets belong to the strategic crypto reserve?" This survey aims to gather the crypto community's views on which digital assets should be considered as strategic reserves.

As of now, there have been 15,367 votes, with 47.7% supporting only BTC; 33.6% supporting BTC, ETH, XRP, and SOL; 15.6% supporting the top ten cryptocurrencies by market cap; and 3.1% supporting the inclusion of all cryptocurrencies and meme coins.

The public opinion trend speaks for itself.

3. Bull market return? But retail investors are not rushing back

In the face of such market conditions, while some shout "bull market return, hurry back!", retail investors who have experienced several rounds of bull-bear transitions have learned to remain cautious about sudden surges. They are also concerned that this overly manipulated market might encounter another black swan event.

According to crypto KOL @DtDt666, "Although the market is rising in the short term, the current crypto circle gives me chills. A flurry of operations like a tiger, with rises and falls all depending on Trump." This statement vividly captures the current market landscape—what was once a decentralized crypto world is being reshaped by capital and political forces, with the Trump family seemingly becoming the most important player in this game.

But the question is whether this market prosperity based on political cycles truly benefits the long-term development of the crypto industry. Although Trump's remarks briefly boosted market sentiment, they have led the crypto industry into deep reflection.

After all, the independent narrative and growth flywheel of crypto have yet to be established.

Recommended reading: "Trump 'saves the market,' a look at this week's most关注的 'macro events' and 'American coins'"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。