Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

The market is warming up as the emperor of the river calls for orders.

A large bullish candle quickly masked the pain of the sharp decline, and the FOMO sentiment surged in the brain, with calls for "100,000" and even "new highs" starting to appear… How will this story end this time? The market is ever-changing and unpredictable; to steadily seek victory in an uncertain market, one needs to find those certain paths.

Last week, we shared the first issue of “A Financial Strategy for Lazy People (February 24)”, aimed at covering relatively low-risk (systemic risk can never be eliminated) yield strategies centered around stablecoins (and their derivative tokens) in the current market, helping users who wish to gradually increase their capital through U-based financial management to find more ideal earning opportunities.

This week, we will update the second issue as promised. From this issue onward, we will no longer elaborate on some repetitive sections (refer to previous issues if needed) and will focus on new opportunities from the previous week.

Base Interest Rate

- Coverage: Tentatively covering single-coin financial management plans from mainstream CEXs, as well as mainstream on-chain lending, DEX LP, RWA, and other DeFi deposit plans.

There isn't much to say about the base interest rate; this is indeed the least efficient financial management plan — the current APY for single-coin financial management within CEXs is dismal, and apart from the stablecoin pools of Fluid and Morpho, most mainstream DeFi protocols on-chain are also not ideal.

There are two points I want to mention.

One is that the Launchpad/Launchpool on the CEX side still has high participation value. For example, last week Binance launched the Launchpool for Redstone, and for the first time supported USDC for mining, with the current price of RED at $0.8 (with a price limit, it will actually be higher), the comprehensive yield for the USDC pool is approximately 33%.

The other is that some CEXs will launch limited-time subsidy activities to attract new users. For instance, Bitget is currently offering new users an 80% APY for 20 days (with a limit of 1500 USDT).

Pendle Section (Including RateX, Exponent)

In terms of fixed income, the real-time ranking of PT yields for various stablecoin pools on Pendle's mainnet is as follows. There are some higher pools on Base and BNB Chain (USR, asUSDF, etc.), with the highest approaching 20%.

In terms of LP, Pendle launched some new pools last week, with two main ones worth noting.

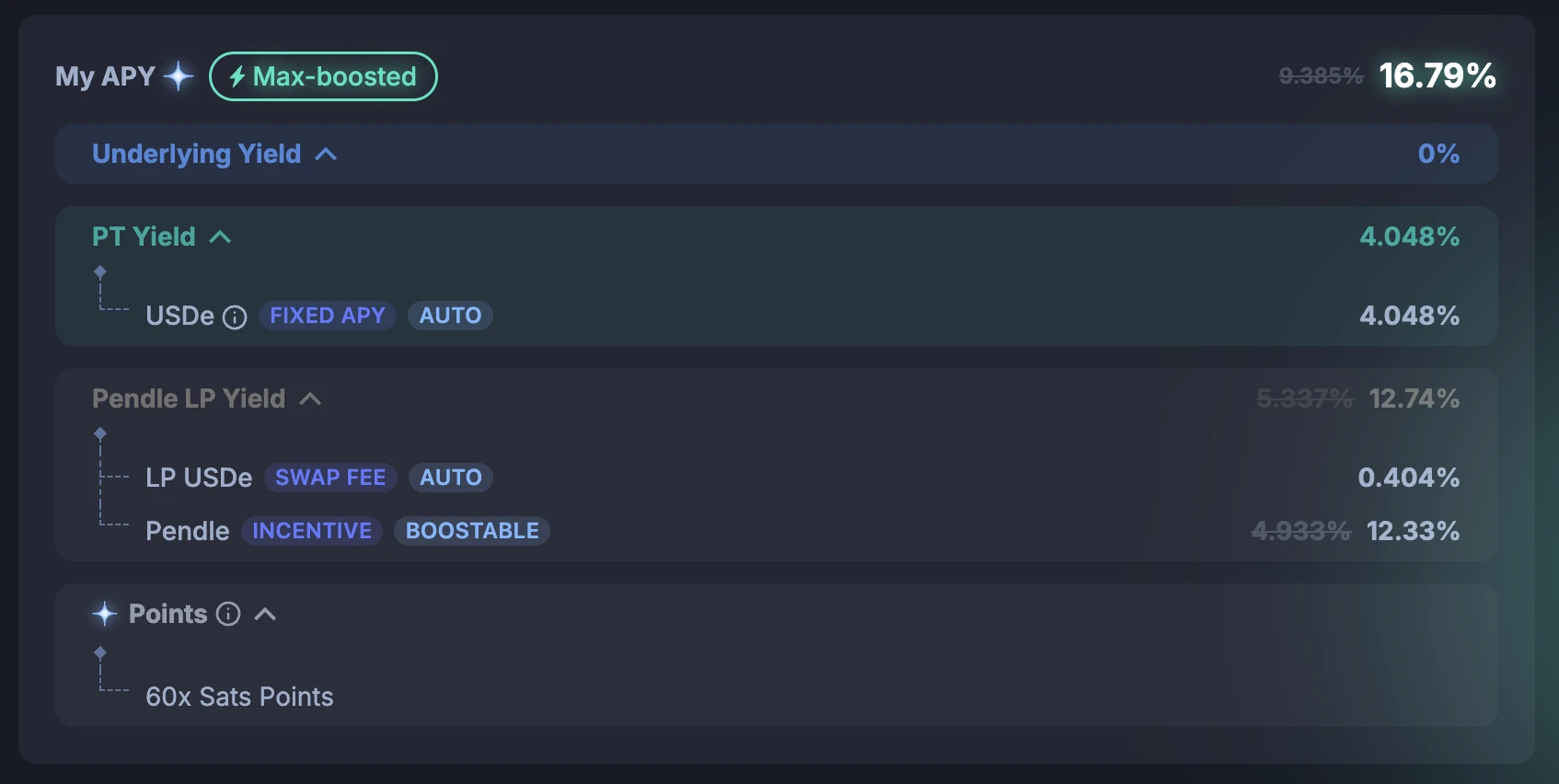

One is the USDe pool expiring on July 31, currently the base APY for LP in this pool is 9.385%, and with sufficient PENDLE staked, it can go up to 16.79%. The feature of this pool is that Ethena has provided a historical maximum of 60 times stas points bonus.

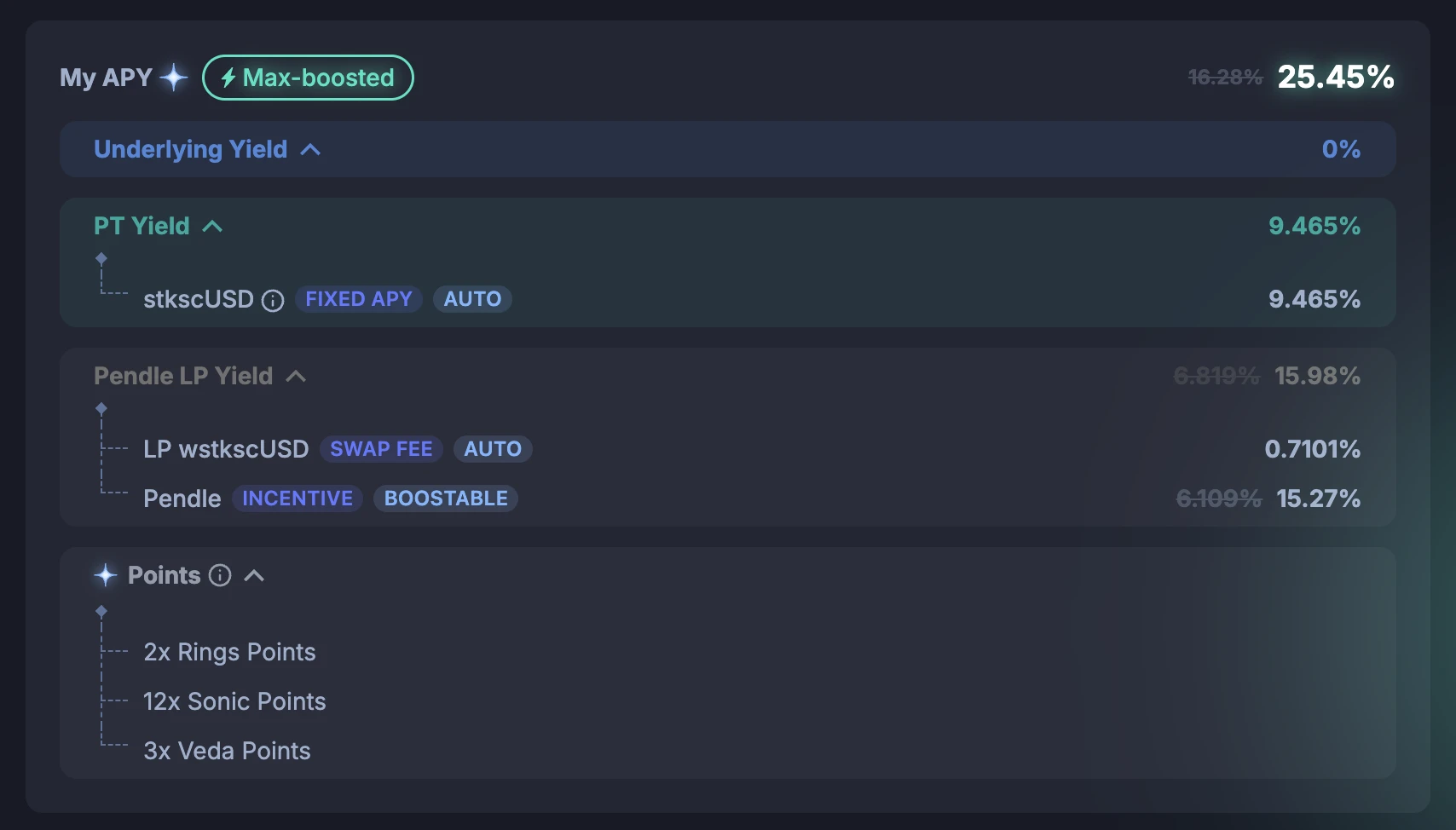

The other is that Pendle has recently expanded into the Sonic ecosystem, currently the only stablecoin pool is the wstkscUSD pool expiring on May 29, with a base APY for LP in this pool of 16.28%, and with sufficient PENDLE staked, it can go up to 25.45%, while also earning a 12 times Sonic points bonus.

Last week, some friends asked if there are similar products to Pendle in the Solana ecosystem, and there are indeed, such as RateX and Exponent, but currently, the overall TVL scale is significantly lower than Pendle, and there are not many pools available for mining.

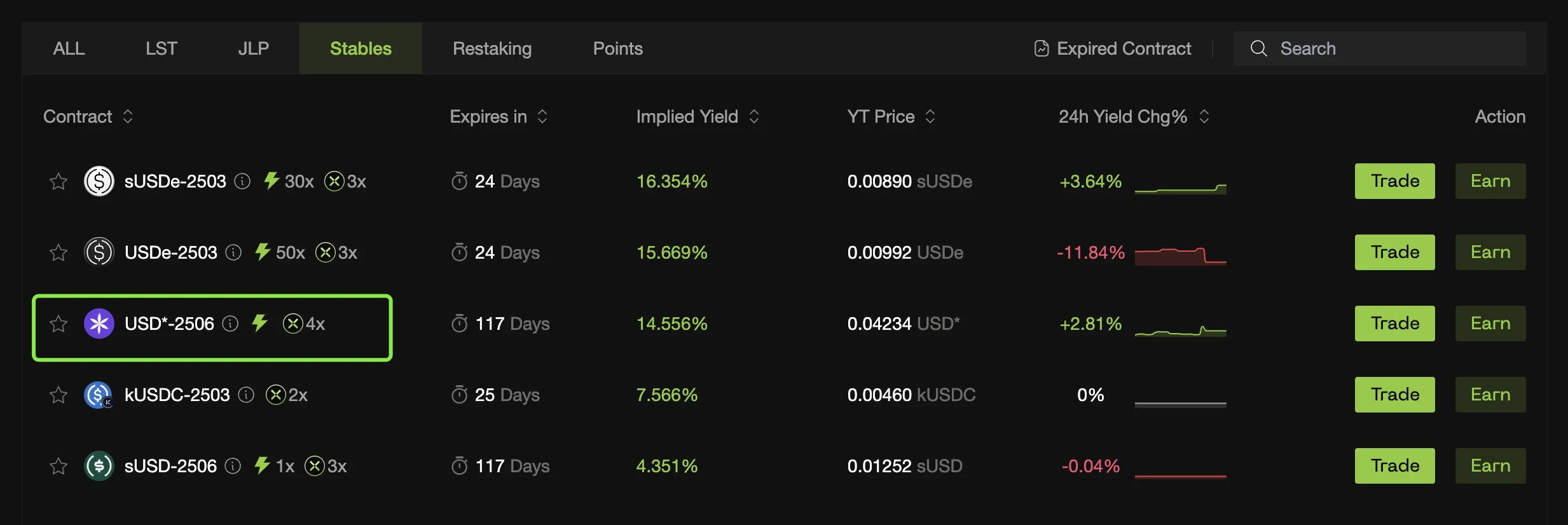

I personally have invested a small amount in the USD* pool on both RateX and Exponent (doing LP while earning yields and points), and the issuer of USD*, Perena, is suspected to be undergoing a new round of financing, with certain expectations of "double earnings."

To add, there are still quite a few SOL-based fixed income opportunities on RateX and Exponent, with the highest reaching over 17%, which is significantly higher than direct staking, so everyone can assess the risks and participate accordingly.

Other Opportunities

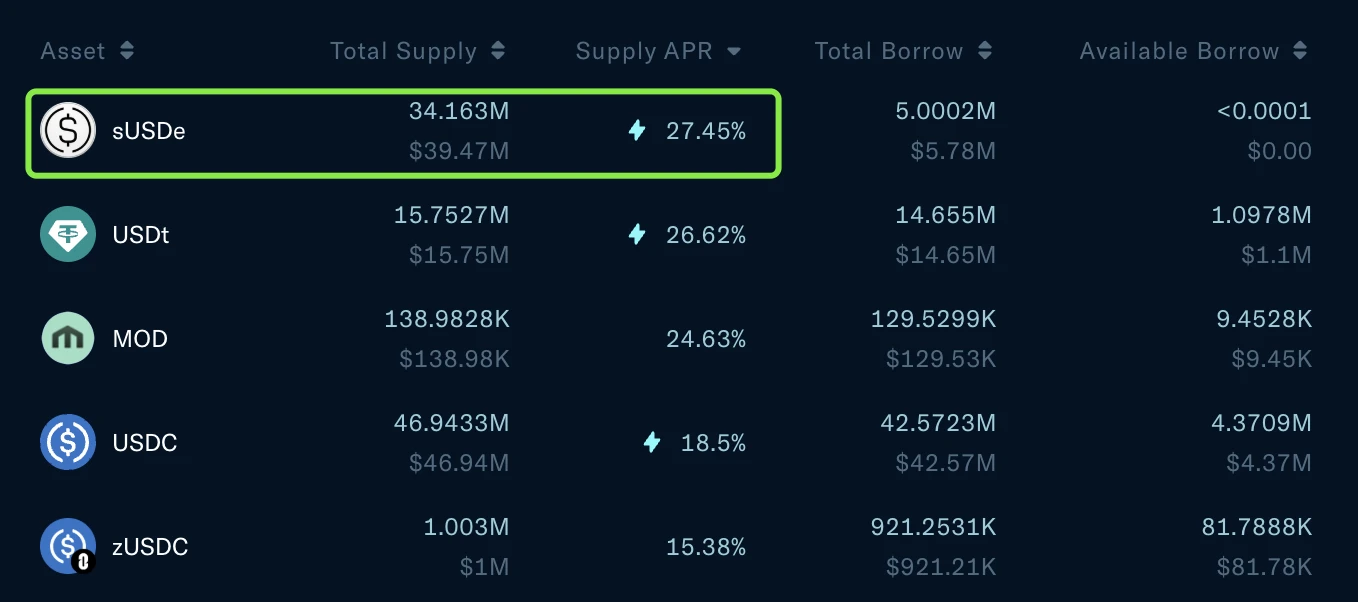

The most surprising pool last week was the sUSDe pool on Echelon in Aptos.

Ethena announced last week that it would enter the Move ecosystem, with the first collaboration project being Echelon. sENA holders will be able to share 5% of the Echelon airdrop in the future, and Echelon has already launched the sUSDe pool — under the official incentives from Aptos, the current APR (note it is APR) for this pool is reported at 27.45%, while also earning Echelon points.

Sonic's trend remains strong, and besides Pendle, Aave and Compound are also about to deploy, so users with a lower risk appetite can consider it, as besides the base interest rate yield, there is also an additional layer of Sonic points yield expectation.

Another neutral play around Sonic is the S-based term arbitrage, which KOL Stable Jack shared this strategy, and I even forwarded it — the general path is shown in the diagram, and it can yield approximately 25% - 28% (not personally tested).

In summary, there are still many earning opportunities in the current market. If you are tired of the fast pace of PVP, you might as well try a different speed.

Finally, I ask everyone to kindly give a follow. On-chain yield rates fluctuate rapidly; although this column attempts to update weekly, it still cannot match market movements in real-time. Interested friends can follow my X account @azuma_eth. Although I am quite lazy, I will still share good pools as soon as I see them.

Let’s make friends with time, one step at a time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。