If we look at AI large models from a developmental perspective, we can find that they face challenges similar to those encountered by previous technologies like the internet and mobile apps, particularly regarding the ambiguity of commercialization at their inception.

Author: Wuzhi

Image source: Generated by Wujie AI

The wildly popular DeepSeek has taken the lead in establishing a commercial closed loop.

Image source: DeepSeek

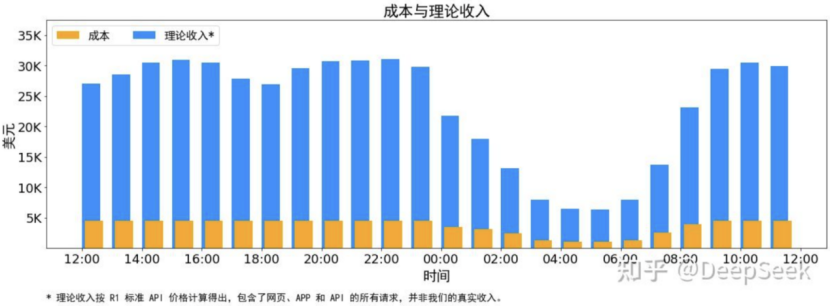

On March 1, 2025, DeepSeek published a technical article stating that from 24:00 on February 27 to 24:00 on February 28, the GPU rental cost was calculated at $2/hour, resulting in a daily average cost for the platform of $87,072 (approximately 630,000 RMB); all input/output tokens were priced according to R1, leading to a daily revenue of $562,027 (approximately 4.09 million RMB) for the platform, netting a profit of $474,955 (approximately 3.46 million RMB), with a cost-profit margin as high as 545%.

However, it is important to note that the financial data presented by DeepSeek is highly simplified and idealized, deviating significantly from the complex realities of actual operations. DeepSeek admits that due to the lower pricing of V3, with only some services charged and discounts during non-peak hours, the company's actual revenue is not as high.

Image source: WeChat

Perhaps seeing the immense commercial potential of the DeepSeek large model, many tech companies have recently been vigorously promoting their products that integrate with DeepSeek. For example, on February 16, Baidu officially announced the full integration of DeepSeek and the latest deep search capabilities of the Wenxin large model. On February 27, Tencent's new product "Yuanbao" entered the life service section of WeChat.

In fact, the explosive popularity of DeepSeek cannot mask the awkwardness of the limited commercialization capabilities of AI large models. Since the launch of ChatGPT in November 2022, which sparked the large model trend, AI large models have struggled to find ideal commercialization scenarios, with most AI large model companies mired in losses.

Due to the difficulty of charging for C-end products and the need for continuous cash burn for promotion, the commercialization of C-end AI large model products faces significant challenges.

One possible commercialization path is the commercialization of AI search.

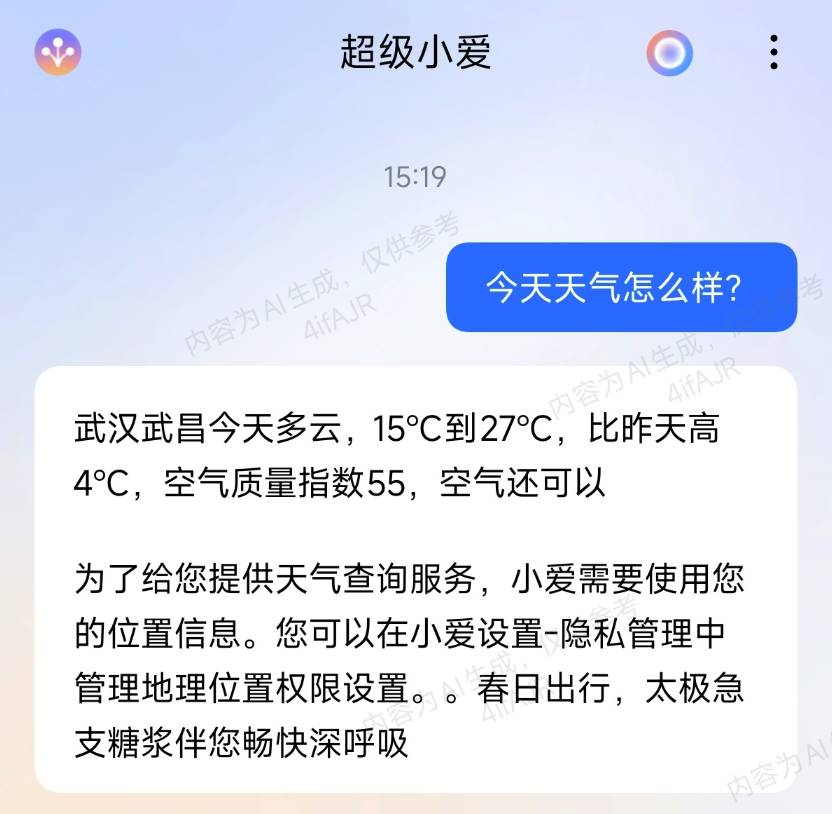

For instance, recently, some users discovered that when Xiaomi's Super Xiao Ai answered the question "How's the weather today?", it included a commercial advertisement at the end.

Image source: Weibo

On February 25, 2025, the Dark Side of the Moon underwent a business change, adding "Internet information services for pharmaceuticals," suspected to be preparing for Kimi's launch of pharmaceutical advertisements.

Meanwhile, during Baidu's Q4 2024 earnings call, it stated, "We expect our advertising revenue to gradually increase, thanks to our efforts to monetize the results of our AI transformation."

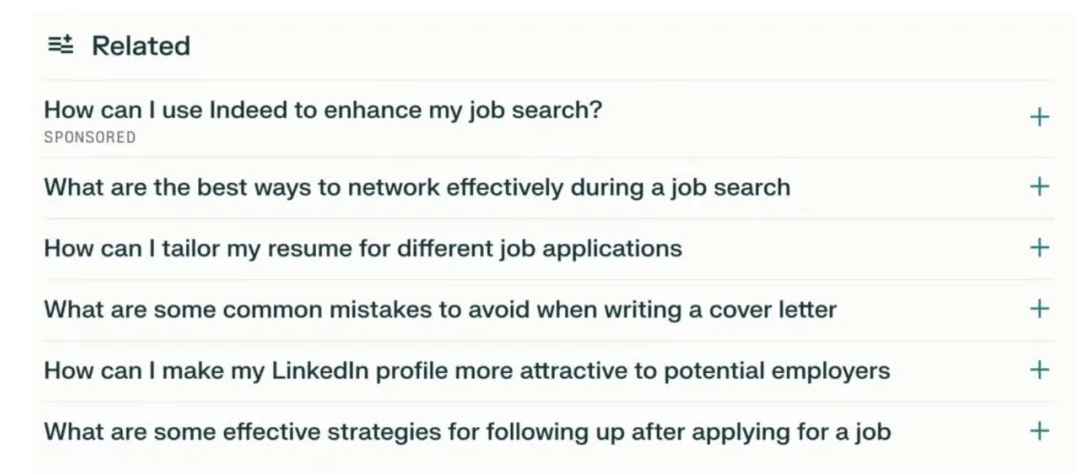

However, because the results provided by AI search have a strong uniqueness, the wealthiest advertisers may not necessarily provide the best solutions. On the contrary, due to the need to balance high marketing costs, the solutions offered by advertisers may lack cost-effectiveness and even harm consumer interests. After consulting people around, Zhuojiao Spicy found that many are cautious about AI search incorporating advertisements, fearing that AI search will lose fairness once ads are added.

Another commercialization path is for tech companies to act as "water sellers," generating revenue by providing AI infrastructure to B-end clients. For example, on February 20, iFlytek launched two full-stack domestic AI infrastructures: the Xinghuo DeepSeek tower-style all-in-one machine and the Xinghuo DeepSeek all-in-one machine, aimed at providing efficient and reliable large model deployment solutions for downstream clients.

However, not all tech companies possess the technical foundation to support the "water seller" business narrative. Drawing from the experiences of the PC and mobile internet industries, if AI large models want to close the commercial loop, they should deeply understand user demands and create entirely new interaction methods and transaction scenarios, rather than making minor innovations along existing business models.

The recent surge of DeepSeek in the tech industry is certainly due to its open spirit and complete open-source nature, but it is also attributed to its more efficient reasoning and lower costs. Official data shows that the reasoning cost of DeepSeek-R1 is only 17% of that of GPT-4 Turbo.

After DeepSeek became open-source, tech companies no longer need to spend huge sums to create closed-source models; by directly integrating with DeepSeek-R1, they can obtain top-tier AI large model capabilities at a lower cost, naturally welcoming them.

However, it is important to note that while DeepSeek's reasoning costs are low, they are not completely free. As the number of downstream users increases, many companies struggling to close the commercial loop have begun to fall into a "scale trap."

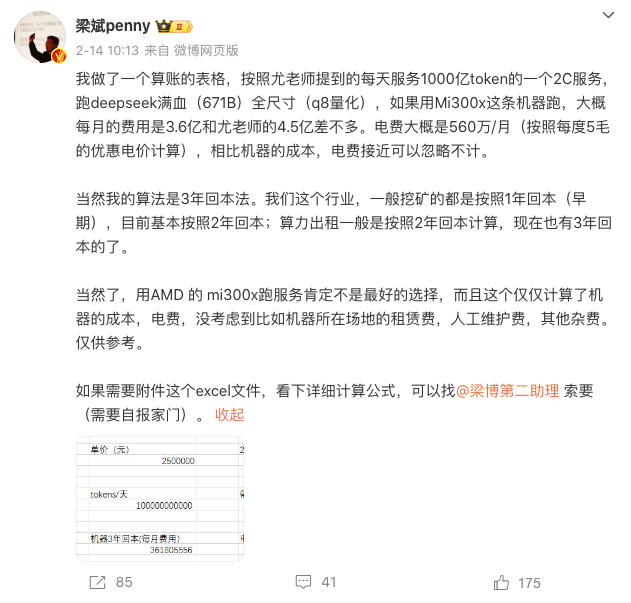

Image source: Liang Bin Weibo

On February 14, 2025, Liang Bin, Chairman and CEO of Beijing Bayou Technology Co., Ltd., posted on social media that a fully operational DeepSeek C-end service, if using AMD MI300X to provide 100 billion tokens output daily, would incur a total monthly cost of about 360 million RMB.

An AI practitioner told Zhuojiao Spicy that since costs are proportional to computational volume, current AI products do not exhibit the clear marginal effects seen in traditional internet businesses; "instead, the better the product performs, the higher the subsequent costs."

Given that most products integrating with DeepSeek have not broadened their revenue channels, most companies' AI-related businesses are indeed mired in losses.

For instance, the WeChat public account "Consensus Crusher" revealed that to support WeChat's AI search, Tencent ordered an additional 100,000 to 200,000 H20 units, with hardware costs alone reaching $2 billion.

Perhaps due to the exceptionally high upstream costs, AI search results are confined within the WeChat ecosystem, limiting their commercialization capabilities. To this day, WeChat has not opened the AI search function to all users.

In this context, Tencent is committed to promoting the fully integrated DeepSeek, which can search the entire network, Tencent Yuanbao.

Thanks to significant investment in platforms like WeChat, Bilibili, and Zhihu, on February 22, Tencent Yuanbao's daily download exceeded Doubao, ranking second in the App Store's free app download chart in China.

Coincidentally, recognizing the immense potential of AI large model technology, in 2024, 360 also began to ramp up its AI-related business, successively launching 360 AI Search, 360 Children's Watch A9 AI Red Version, AI Assistant, and other products.

Image source: 360 Q3 2024 financial report

Unfortunately, due to the high R&D and operational costs of AI-related technologies, and the difficulty of "opening up" downstream, 360's performance has been deteriorating. The financial report shows that in the first three quarters of 2024, 360's operating costs reached 2.608 billion RMB, a year-on-year increase of 31.92%. During the same period, 360's revenue was 5.609 billion RMB, a year-on-year decrease of 16.76%; the net loss was 579 million RMB.

In stark contrast to internet companies that face users and struggle to close the commercial loop in AI large model businesses, the performance of upstream players in the AI industry, such as chip manufacturers and cloud service providers, is steadily improving.

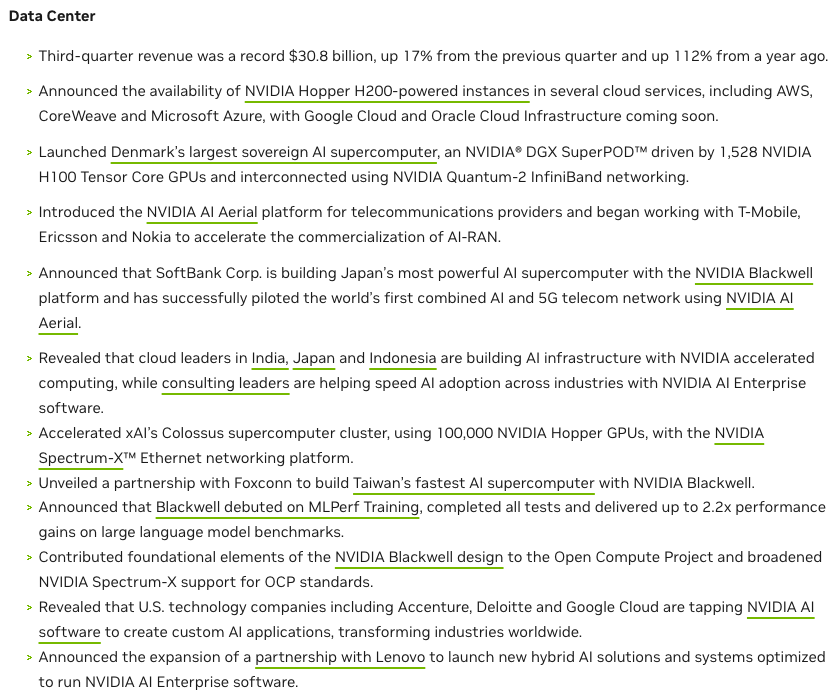

Image source: NVIDIA Q3 2025 financial report

For example, in the third quarter of fiscal year 2025, NVIDIA's data center business revenue reached $30.8 billion, a year-on-year increase of 112%, setting a new historical high. As a result, NVIDIA's net profit reached $19.309 billion, a year-on-year increase of 109%; the gross margin was 74.6%, up 0.6 percentage points year-on-year.

The reason for this is primarily that NVIDIA's AI chip performance is unparalleled and possesses strong irreplaceability. As the AI industry flourishes, NVIDIA can demand significant premiums from downstream clients.

In this regard, Louis Navellier, founder of market consulting firm Navellier & Associates, stated that regardless of NVIDIA's financial performance, he would never sell NVIDIA's stock because "he has never seen a stock with such strong monopoly power and influence."

Not only at the top of the pyramid with NVIDIA, but also downstream cloud service providers like Alibaba Cloud and Baidu Cloud have emerged from the losses thanks to AI technology.

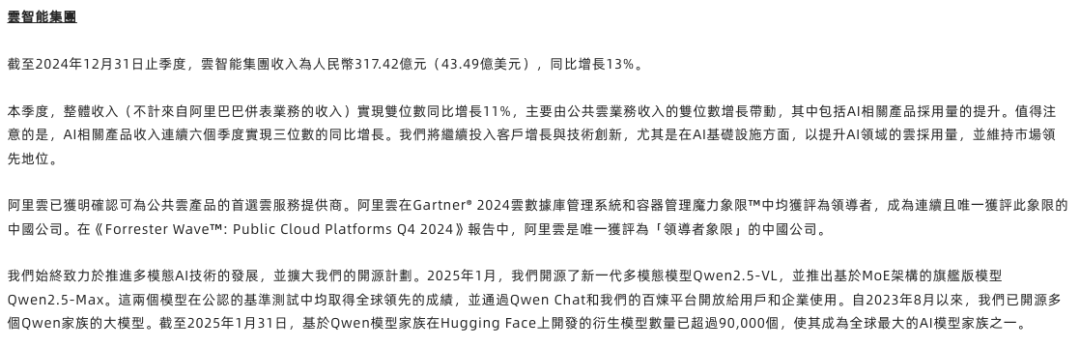

Image source: Alibaba Q3 2025 financial report

Alibaba's Q3 2025 financial report revealed that Alibaba Cloud's revenue reached 31.742 billion RMB, a year-on-year increase of 13%; adjusted EBITA was 3.138 billion RMB, a year-on-year increase of 33%, mainly due to "growth in public cloud revenue driven by AI-related products."

Recently, Morgan Stanley also stated in a research report that starting from Q4 2024, Baidu Cloud's profitability and profit margins have improved, and the trend is expected to be sustainable. In Q1 2025, Baidu Cloud's business revenue is expected to grow by 20% year-on-year.

Due to the promising prospects of AI technology, Alibaba Cloud is committed to increasing its investment in AI-related initiatives. On February 24, 2025, Alibaba Group CEO Wu Yongming announced that over the next three years, Alibaba will invest more than 380 billion RMB to build cloud and AI hardware infrastructure, with total investment exceeding the past decade's total.

In this regard, Wu Yongming stated, "The AI explosion far exceeds expectations, and the domestic tech industry is in its infancy, with immense potential. Alibaba will spare no effort to accelerate the construction of cloud and AI hardware infrastructure, promoting the development of the entire industry ecosystem."

As He Xiaopeng, chairman of XPeng Motors, stated, "No one is really making money from language large models, except for NVIDIA, and Microsoft hasn't strictly made money either; companies like OpenAI have raised funds, not made profits, including Xiao Chuan." Analyzing the commercialization process of the AI large model industry, Zhuojiao Spicy found that there is a significant gap in the commercialization progress of upstream and downstream companies in the AI large model sector. The further downstream and closer to the user, the harder it is to make money.

As AI large model technology has become a major trend in the tech industry, many downstream companies are scrambling to lay out related technologies. The computing infrastructure provided by upstream chip manufacturers and cloud service providers, the "water sellers," is in high demand, allowing them to generate revenue by providing computing power to downstream clients, thus establishing a commercial closed loop early on.

Although many downstream B2C companies have integrated AI large models into their core products, they have failed to simultaneously broaden their revenue channels and must bear enormous operational costs, resulting in most of them "losing money while making noise."

For upstream "water sellers," it is indeed fortunate to have established a commercial closed loop first, but the healthy operation of the industry chain relies on both upstream and downstream companies returning to positive cash flow. The prolonged difficulty of downstream AI large model companies in achieving commercialization also determines that the commercial stories of upstream "water sellers" are merely built on shaky ground.

Due to the strong comparative advantage of AI large models in information retrieval, which not only generates content but also emphasizes semantic understanding and personalized recommendations, and the proven commercialization capabilities of traditional search engines, many internet companies are ramping up their AI search efforts, attempting to break through commercialization through search functionalities.

In this regard, Minsheng Securities stated in a research report that AI search is expected to become the first C-end super application to achieve commercialization, "the 'first ray of light' for the commercialization of large models."

As a result, major internet giants like 360, Baidu, and iFlytek, as well as newcomers like Dark Side of the Moon, Zhiyu Qingyan, and Mita Technology, have begun to compete in the AI search market.

Image source: AI Product Rankings

It has been proven that by addressing user needs, AI search products have indeed become the vanguard of AI technology implementation. In the January 2025 AI Product Rankings, three AI search products made it to the top twenty websites: New Bing, Nano AI Search, and Perplexity AI. During the same period, four AI search products occupied spots in the overall domestic top twenty: Nano AI Search, Mita AI Search, Zhihu Direct Answer, and C Knowledge.

A typical representative among them is Nano AI Search. As an "old player" in the internet industry, 360 entered the search market as early as 2012, launching a comprehensive search service in an attempt to divert Baidu's influence. However, due to limited search capabilities and brand recognition, 360's search business has struggled to gain market traction.

With the maturation of AI technology, 360 decisively increased its investment in AI search, launching Nano AI Search. This product has now become an industry leader. According to the domestic version of the AI Product Rankings, in January 2025, Nano AI Search's web access volume reached 308 million, ranking first.

As market influence expands, many AI search companies are also testing the waters of commercialization. Zhuojiao Spicy found that the commercialization of AI search companies currently has three main directions: subscriptions, advertising, and selling APIs.

As one of the first players to enter the AI search business, Perplexity AI chose the subscription model as its first step in commercialization. If users want to obtain more professional search queries, use custom AI models, or analyze documents, they need to subscribe to the Pro version for $20 per month.

The Information reported that by 2025, Perplexity AI is expected to have 550,000 premium subscribers, generating an annual revenue of $127 million. Even so, Perplexity AI still struggles to turn a profit. On its official blog, Perplexity AI stated, "Currently, the $20 monthly or $200 annual subscription fee is insufficient to support our ambitious goals and the growing revenue-sharing plans with publishers."

Yang Zhilin, founder of Dark Side of the Moon, believes that "charging based on user numbers cannot create greater commercialization value as the product evolves; subscriptions will not be the final business model."

Given that users in Europe and the United States have a strong payment habit, AI search companies find it difficult to turn a profit through subscription models. In the Chinese market, due to consumers' lack of payment habits, AI search products also struggle to establish a commercial closed loop through subscriptions.

Image source: Perplexity AI

Reluctantly, in November 2024, Perplexity AI launched an advertising strategy. When users search for questions using Perplexity AI, the "Follow-up Questions" section at the bottom of the search results page displays ads provided by sponsors.

In fact, many AI search companies in China are also targeting the advertising model.

However, it is important to note that, unlike traditional search engines that can sequentially return massive amounts of content and allow for bidding on higher-ranked content, AI search has the ability to integrate information, displaying results with exceptional precision. If manufacturers overly pursue commercialization, it may conflict with user interests.

For example, if a user searches for medical-related questions, AI search may include ads from the controversial Putian hospitals, easily triggering incidents like the "Wei Zexi case."

In fact, this is a key reason why internet companies are hesitant to let the advertising business of AI search venture into deep commercialization. At the end of 2024, Zhou Hongyi, founder of 360 Group, stated, "Actually, we find AI search quite painful; we also have self-disruption, and currently, we can't find a place to put ads."

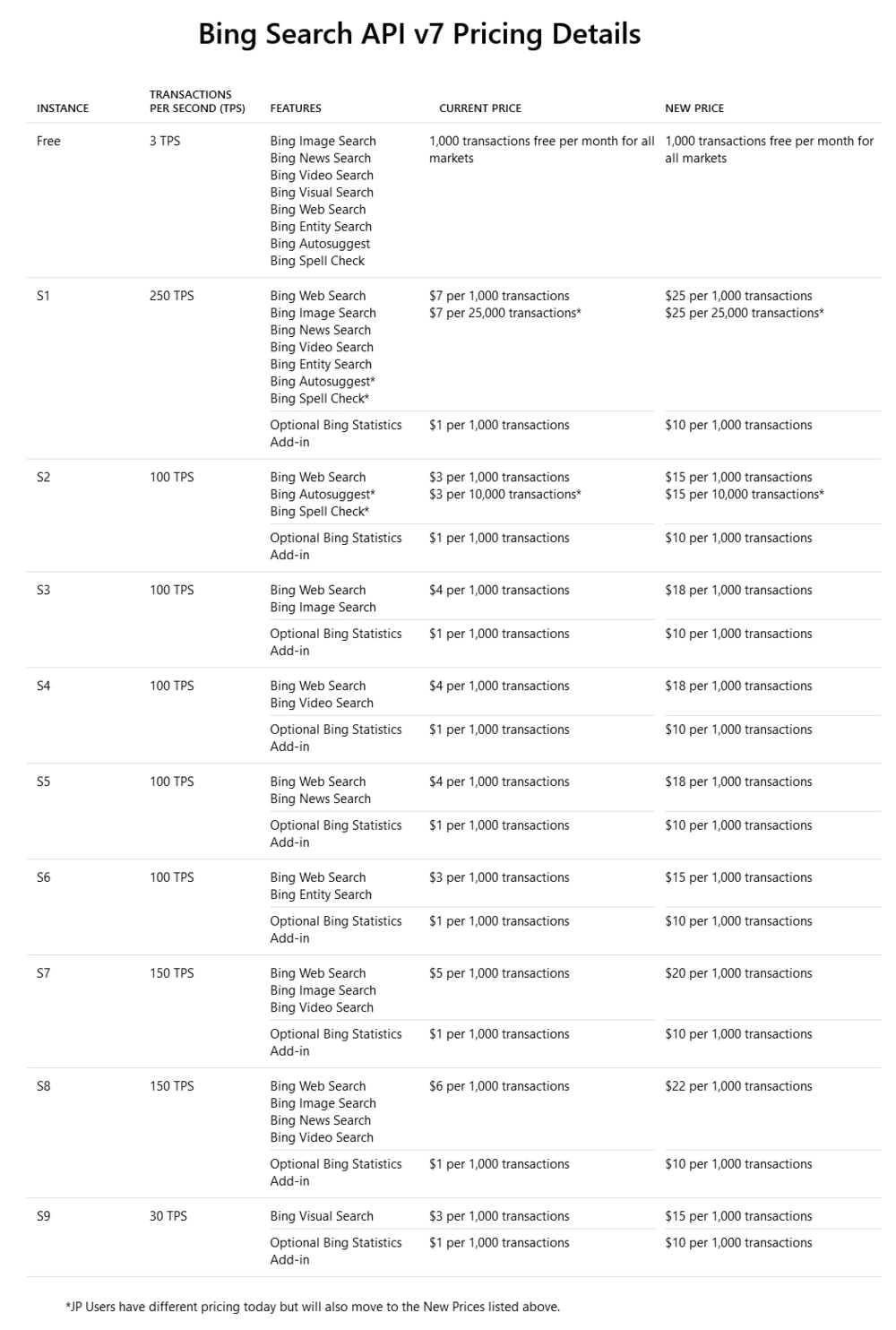

In addition to revenue models related to C-end users, such as subscriptions and advertising, AI search can also generate revenue by selling APIs to B-end clients. For instance, Bing offers the Bing Search API to enterprise clients, allowing them to provide search functionalities for their users by calling the relevant API.

Image source: Bing

However, due to the high costs associated with AI large models, the usage cost of the Bing Search API is not low. In May 2023, Microsoft raised the pricing for the Bing Search API, with the cost for the Bing API supporting ChatGPT set at $28 per thousand calls for fewer than 1 million requests per day; for more than 1 million requests per day, the cost is $200 per thousand calls. In response, Microsoft stated, "The new pricing model more accurately reflects the ongoing technological investments Bing is making to improve search."

Due to the high usage costs, in April 2023, Brave Search severed all connections with the Bing API, opting to display search results using its own index and planning to launch its own Brave Search API.

Given that DeepSeek has already gone open-source, any organization can freely integrate it, making it difficult for downstream clients with certain technical capabilities to justify paying higher costs for their APIs.

In this regard, in May 2024, Wang Xiaochuan, founder and CEO of Baichuan Intelligent, stated, "API revenue and revenue from large models themselves are not the most attractive business models; they are not what we are chasing or comparing ourselves to."

In summary, due to differences in user needs, technical routes, result presentation, and traditional search engines, the three main commercialization directions of AI search—subscriptions, advertising, and selling APIs—face significant challenges, making it difficult for related companies to quickly become search giants in the AI era.

In fact, the commercialization difficulties faced by AI large models are not unique; during the early stages of PCs and mobile internet, many internet companies also encountered similar challenges.

Taking Tencent as an example, Wu Xiaobo's book "The Tencent Story" records that by the end of 1999, OICQ had over 1 million registered users. However, due to the enormous daily costs of OICQ and the difficulty in making money, Tencent once had only 10,000 RMB left in cash, teetering on the brink of bankruptcy. In desperation, Tencent founder Ma Huateng planned to sell the company for 3 million RMB.

However, after visiting multiple companies, Ma Huateng was unable to finalize the sale of Tencent. Most companies valued Tencent at only a few hundred thousand RMB based on tangible assets. Lin Jun, author of "Fifteen Years of Boiling," recalled that OICQ might seem like a rapidly growing project, "but no one in the world knew how it made money."

The subsequent story is well-known; based on a new IM interaction method, QQ created a usage scenario for online chatting, extending into advertising, QQ Show, QQ Games, and other businesses, allowing Tencent to reap substantial profits.

He Xiaopeng believes that after the transformation of interaction, the scenarios will change, and this process will bring enormous commercialization opportunities. Products like QQ, Didi, and Meituan under the PC and mobile internet have improved efficiency and created more user value through new interaction methods and transaction scenarios, thus closing the commercial loop.

Unlike the transition from PC internet to mobile internet, where only the content carrier changed, AI large models may involve entirely new interaction carriers, methods, and scenario transformations, leading to commercialization models that may differ significantly from traditional internet models.

Regarding the commercialization prospects of AI in the automotive sector, He Xiaopeng is optimistic, believing that "if L4 is achieved, it will definitely significantly increase the software or ecosystem revenue of the car. For example, automatic car washes are one form of ecosystem revenue; automatic parking is another; automatic charging is a third."

Of course, smart cars are just one vertical scenario for the implementation of AI technology. Beyond that, AI has even more imaginative potential. For instance, Meta's chief scientist Yang Likun believes that as technology matures, AI glasses may integrate AI Agent functions, allowing users to handle daily tasks through a pair of AI glasses, significantly enhancing work efficiency, creativity, and productivity.

In this process, AI glasses may experience their "iPhone moment," and AI technology may explore new commercialization models as application scenarios expand. For example, shopping, navigation, and watching immersive videos through AI glasses.

It is evident that if we view AI large models from a developmental perspective, we can find that, like previous technologies such as the internet and mobile apps, they face challenges of commercialization ambiguity at their inception.

Fortunately, user demand is certain, and many internet giants and startups are actively innovating functions and interactions based on user needs. Once new usage scenarios are explored, AI large models may be able to close the commercial loop.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。