Key Points

The total market capitalization of global cryptocurrencies is $3.24 trillion, down from $3.32 trillion last week, representing a decline of 2.4% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $36.94 billion, with a net outflow of $2.61 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.82 billion, with a net outflow of $335 million this week.

The total market capitalization of stablecoins is $232 billion, with USDT having a market capitalization of $142.1 billion, accounting for 61% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $56.4 billion, accounting for 24.3%; and DAI with a market capitalization of $5.36 billion, accounting for 2.3%.

According to DeFiLlama data, the total TVL of DeFi this week is $10.59 billion, down 4.8% from last week. By public chain classification, the top three public chains by TVL are Ethereum with a share of 52.58%; Solana with a share of 7.96%; and Bitcoin with a share of 5.92%.

On-chain data shows a significant decline in BNB's trading volume this week, down 64.60% from last week. In terms of transaction fees, SOL saw a significant increase, up 65% from last week. Most public chains show a significant decline in daily active addresses; in terms of TVL, ETH shows a significant downward trend, down 6.8% from last week. The total TVL of Ethereum Layer 2 is $3.68 billion, with an overall decline of 4.56% from last week.

Innovative projects to watch: fren.money has received support from @alliancedao, allowing traders to tokenize strategies, and investors to earn through trusted funds and validated alpha; ARES Alpha Labs: a free tool for discovering new crypto projects and Web3; Hand of God: a DeFi yield protocol based on Sonic, inspired by the original Tomb Finance model, with an AI agent at its core.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Capitalization Ratio 2

3. ETF Inflow and Outflow Data 4

4. ETH/BTC and ETH/USD Exchange Rates 5

5. Decentralized Finance (DeFi) 5

7. Stablecoin Market Capitalization and Issuance 9

II. Hot Money Trends This Week 10

1. Top Five VC Coins and Meme Coins This Week 10

III. New Developments in the Industry 12

1. Major Industry Events This Week 12

2. Major Upcoming Events Next Week 12

3. Important Financing and Investment from Last Week 13

I. Market Overview

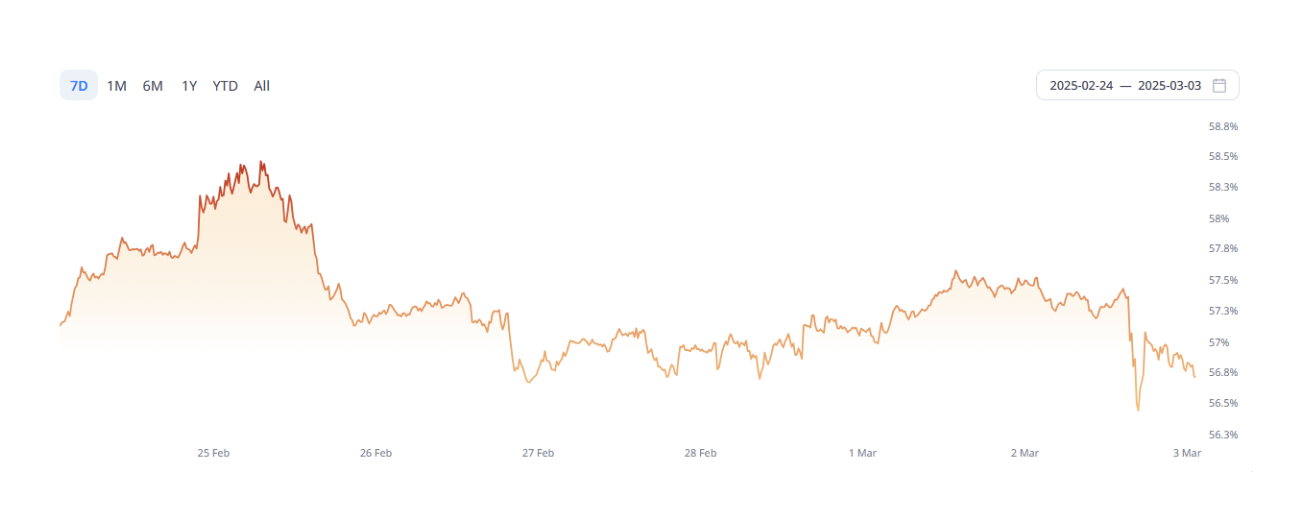

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Capitalization Ratio

The total market capitalization of global cryptocurrencies is $3.24 trillion, down from $3.32 trillion last week, representing a decline of 2.4%.

Data Source: cryptorank

As of the time of writing, Bitcoin's market capitalization is $1.85 trillion, accounting for 57.2% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $232 billion, accounting for 7.18% of the total cryptocurrency market capitalization.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is at 33, indicating fear.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $36.94 billion, with a net outflow of $2.61 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.82 billion, with a net outflow of $335 million this week.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $2,456, historical highest price $4,878, down approximately 49.67% from the highest price.

ETHBTC: Currently at 0.026452, historical highest at 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama data, the total TVL of DeFi this week is $10.59 billion, down 4.8% from last week.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum with a share of 52.58%; Solana with a share of 7.96%; and Bitcoin with a share of 5.92%.

Data Source: CoinW Research Institute, defillama

Data as of March 2, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of March 2, 2025

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, BNB saw a significant decline in daily trading volume, down 64.60% from last week. Additionally, ETH, SOL, and SUI experienced some growth in trading volume compared to last week; this week, SOL's transaction fees increased significantly, up 65% from last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. Most public chains show a significant decline in daily active addresses, with SOL rebounding significantly, up 14.69% from last week; in terms of TVL, ETH shows a significant downward trend, down 6.8% from last week.

Layer 2 Related Data

● According to L2Beat data, the total TVL of Ethereum Layer 2 is $3.68 billion, with an overall decline of 4.56% from last week.

Data Source: L2Beat

Data as of March 2, 2025

- Arbitrum and Base occupy the top positions with market shares of 31.43% and 30.61%, respectively, but both have seen a decline in overall share.

Data Source: footprint

Data as of March 2, 2025

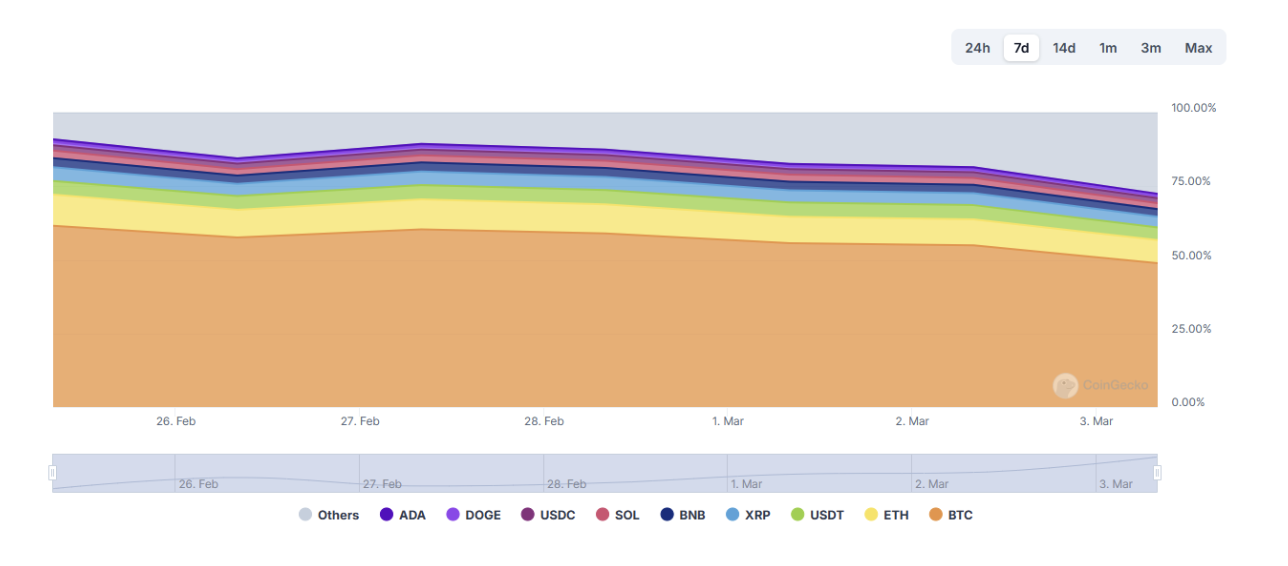

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $232 billion. Among them, USDT has a market capitalization of $142.1 billion, accounting for 61% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $56.4 billion, accounting for 24.3%; and DAI with a market capitalization of $5.36 billion, accounting for 2.3%.

Data Source: CoinW Research Institute, Coinglass

Data as of March 2, 2025

According to Whale Alert data, this week, USDC Treasury issued 800 million USDC, and Tether Treasury issued 1 billion USDT, with a total issuance of stablecoins this week reaching 1.8 billion, an increase of 36.36% compared to last week.

Data Source: Whale Alert

Data as of March 2, 2025

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins This Week

The top five VC coins with the highest growth over the past week.

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 2, 2025

The top five Meme coins with the highest growth over the past week.

Data Source: CoinW Research Institute, coinmarketcap

Data as of March 2, 2025

2. New Project Insights

fren.money: Supported by @alliancedao, it allows group chats to transform into investment funds. Traders can tokenize strategies, and investors can earn through trusted funds and validated alpha; the project has not yet officially launched.

ARES Alpha Labs: A free tool for discovering new crypto projects and Web3, the project has been operational for nearly a year and can identify the earliest innovative projects.

Hand of God: A DeFi yield protocol based on Sonic, inspired by the original Tomb Finance model. The core of the protocol is an AI agent that performs on-chain analysis every six hours, making informed decisions to optimize emissions, stabilize peg, and maximize protocol efficiency.

III. New Developments in the Industry

1. Major Industry Events This Week

The Solana Layer 2 gaming public chain Sonic SVM announced the official launch of the Mobius mainnet. The mainnet event, Mobius Season 1, will take place from February 27 to April 10, offering 2.4 million SONIC rewards. Additionally, Sonic SVM has a hackathon event with a total prize pool of $1 million, encouraging developers to explore the SVM ecosystem in depth.

The Babylon Foundation announced that its subsidiary Cuneiform Assets Limited has decided to expand the scope of its airdrop, emphasizing the importance of community feedback. After extensive evaluation, Cuneiform Assets has decided to remove the staking history requirement, allowing all NFT holders to qualify for the NFT airdrop, provided they meet all other airdrop eligibility requirements and comply with the airdrop terms.

The NFT trading tool Mintify announced the MINT token economic model, with a total supply of 1 billion MINT tokens to be unlocked and distributed over three years. Of this, 27.23% is allocated to investors, 39.1% to the community, 25.17% to the ecosystem, and 8.50% to the team. MINT claims will open in the coming weeks, with a 48-hour advance notice. Its Season 1 event will allocate 60 million MINT, with 20 million allocated to SZN1 staking rewards and 40 million to SZN1 XP rewards.

2. Major Upcoming Events Next Week

Story will officially launch its IP token release on March 4, releasing 55,555 IP tokens daily and simultaneously starting staking rewards. Currently in a singularity phase, users can stake but receive no rewards until the Big Bang Block takes effect. The staking reward mechanism adopts a time-weighted model, with flexible staking at 1x, 90 days at 1.1x, 360 days at 1.5x, and 540 days at 2x, while locked staking only enjoys a 0.5x reward (locked for 6 months). Story encourages long-term staking to enhance the security and stability of the decentralized AI native IP infrastructure.

The Solana re-staking platform Solayer announced the official launch of its native token LAYER's airdrop. For early and eligible community members, the LAYER tokens from the Genesis Drop will be unlocked immediately upon release and can be claimed for additional LAYER over the next six months through Epoch. The claim window is open from February 11, 2025, to March 4, 2025. Unclaimed LAYER will be reallocated for future airdrops. LAYER tokens that vest after the initial claim period will not be affected.

The White House will host the first cryptocurrency summit on March 7, with Trump scheduled to speak. Attendees will include industry professionals and members of the Presidential Digital Asset Working Group.

3. Important Financing and Investment from Last Week

Ethena, strategic financing, raised $100 million, with investors including Franklin Templeton and F-Prime Capital. Ethena is building a derivatives infrastructure that enables Ethereum to transform into a global internet bond through delta-neutral positions on stETH, creating the first crypto-native, yield-bearing stablecoin, USDE. (February 24, 2025)

Bitwise, raised $70 million, with investors including Electric Capital, Haun Ventures, ParaFi Capital, MassMutual, Highland Capital Partners, and MIT Investment Management Company. Bitwise is a crypto asset management company known for managing the world's largest crypto index fund (OTCQX: BITW) and pioneering products covering Bitcoin, Ethereum, DeFi, and crypto-focused stock indices. (February 25, 2025)

Raise, strategic financing, raised $63 million, with investors including Haun Ventures, GSR, Paper Ventures, Selini Capital, and Raj Gokal. Raise is an innovative gift card crypto platform aimed at revolutionizing the consumer shopping experience and enhancing their interaction with brands. Consumers purchase gift cards from participating retailers, deposit the money into Raise, which then deposits the funds into the retailer's escrow account using stablecoins or crypto pegged to the dollar. Once customers use the gift cards, Raise sends the money from the escrow account to the retailer via ACH or stablecoins. (February 26, 2025)

Figure, Series D financing, raised $200 million, with investors including Sixth Street. Figure is a fintech company using the Provenance blockchain for loan issuance, equity management, private fund services, banking, and payments, providing efficient savings features for consumers and institutions. Figure Equity Solutions offers a one-stop solution for private companies and startups to raise funds, manage equity, and trade shares on a single platform. Figure Marketplace is a blockchain-based investment platform providing access to various private companies and private equity funds. (February 27, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。