The sluggish market, which has been washed over by a waterfall, finally received a shot in the arm. On March 2, local time in the U.S., Trump posted on social media, stating, "After years of suppression by the Biden administration, the U.S. cryptocurrency reserves will elevate the status of this key industry. That’s why my digital asset executive order directs the presidential task force to advance a cryptocurrency strategic reserve that includes XRP, SOL, and ADA. I will ensure that America becomes the world’s cryptocurrency capital. We are making America great again!" He added, "Clearly, BTC and ETH, along with other valuable cryptocurrencies, will be at the core of the reserves. I also like Bitcoin and Ethereum!"

The immediate effect of Trump's "call" was remarkable, with BTC and ETH both rising over 10%, SOL increasing by over 20%, and ADA surging over 70% to become the eighth largest cryptocurrency by market capitalization. XRP's fully circulating market cap surpassed Ethereum for the first time, and the total cryptocurrency market cap rebounded by 9% to $3.25 trillion.

With Trump announcing the "U.S. Cryptocurrency Strategic Reserve" plan, the most supportive U.S. Congress for cryptocurrencies in history was born. As a channel for traditional funds to flow into the crypto ecosystem, the SEC's attitude towards crypto assets has shifted from "strict regulation" to a "friendly" approach. Last month, the SEC confirmed several applications for ETFs from traditional U.S. giants for LTC, DOGE, SOL, and XRP. According to analysts James Seyffart and Eric Balchunas from Bloomberg, the current market has a relatively high probability of approval for LTC, DOGE, SOL, and XRP spot ETFs. Expectations for other mainstream crypto asset ETFs to launch in the U.S. capital markets have significantly increased.

Related reading: “Overview of the latest developments in multiple crypto ETFs: SEC accelerates review, SOL and LTC lead in progress”

Latest Confirmed Altcoin ETF Applications by the SEC

Looking back at the development of crypto ETFs, this process has been quite tumultuous. After being rejected at least 30 times over the past decade, the market finally welcomed the official approval of the U.S. Bitcoin spot ETF on January 11, 2024. On July 23 of the same year, the crypto market experienced another historic moment when the SEC officially approved the Ethereum spot ETF. The year 2024 can be considered the inaugural year for crypto ETFs. As of now, Bitcoin and Ethereum are the only two confirmed approved crypto ETFs.

From this perspective, the dense positive news last week is indeed rare and also conveys an important positive signal for the entire crypto market. If these ETFs are ultimately approved, they will bring enormous potential opportunities for these underlying assets and the entire cryptocurrency market. Investors will be able to enter the market more easily, driving a significant influx of funds, thereby enhancing market depth and stability.

Below is an analysis of the altcoins for which the SEC has recently confirmed ETF applications, covering expected approval probabilities, regulatory compliance assessment bases, application progress, and market data from the past 30 days, sorted by Bloomberg analysts' predicted approval rates from high to low.

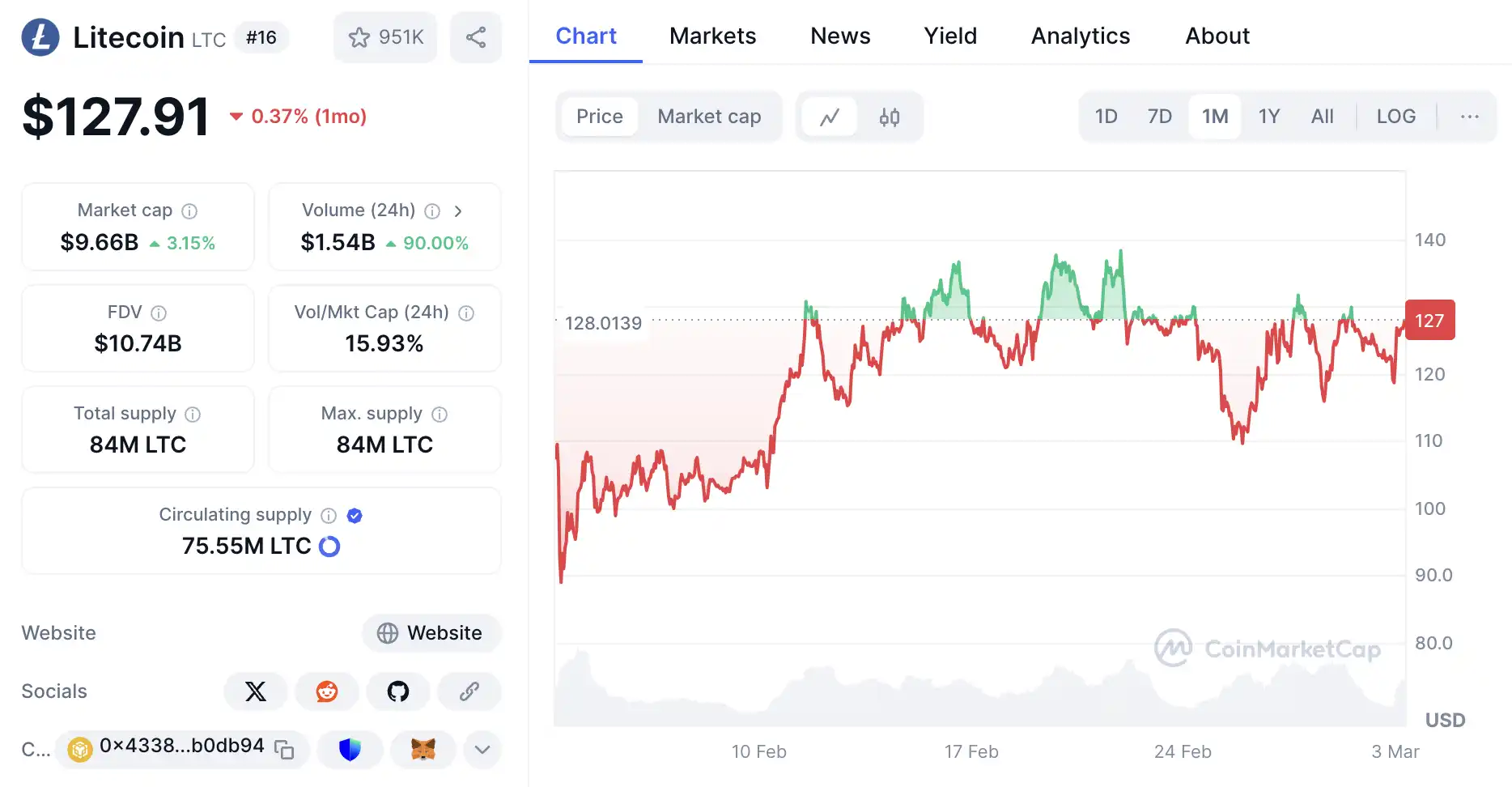

LTC (Litecoin)

ETF Approval Probability: 90%, viewed by the SEC as a clone of Bitcoin, with decentralized characteristics, likely to be classified as a commodity. It is currently the most advanced altcoin in the approval process.

Currently, Grayscale and Canary Capital have submitted applications for LTC spot ETFs, both of which have been accepted by the SEC. Bloomberg analyst Eric Balchunas believes that Litecoin will become the next crypto spot ETF approved by the SEC.

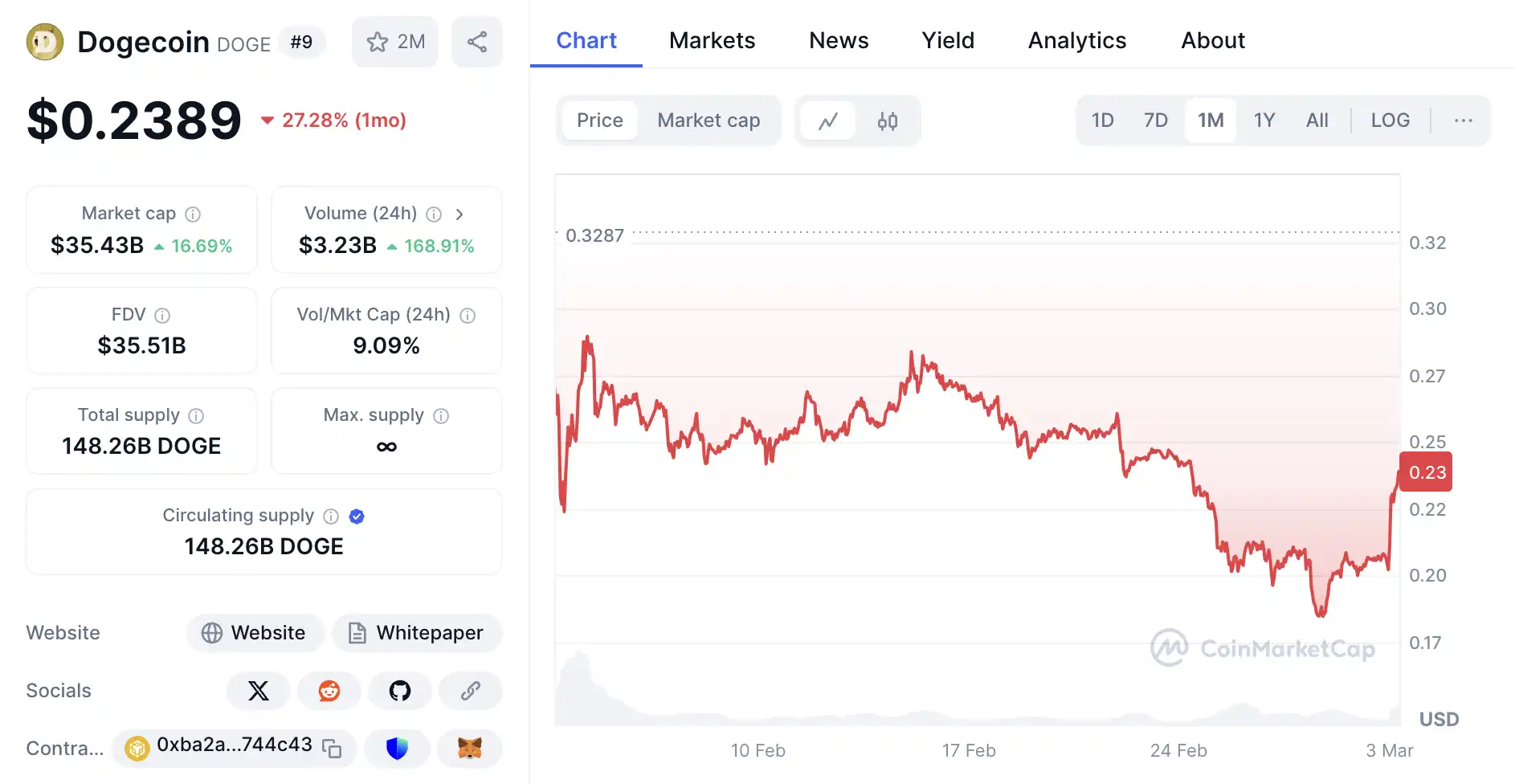

DOGE (Dogecoin)

ETF Approval Probability: 75%, viewed by the SEC as a clone of Bitcoin and Litecoin, likely to be classified as a commodity.

Currently, two institutions have submitted applications for DOGE spot ETFs, namely Grayscale and Rex, both of which have been accepted by the SEC.

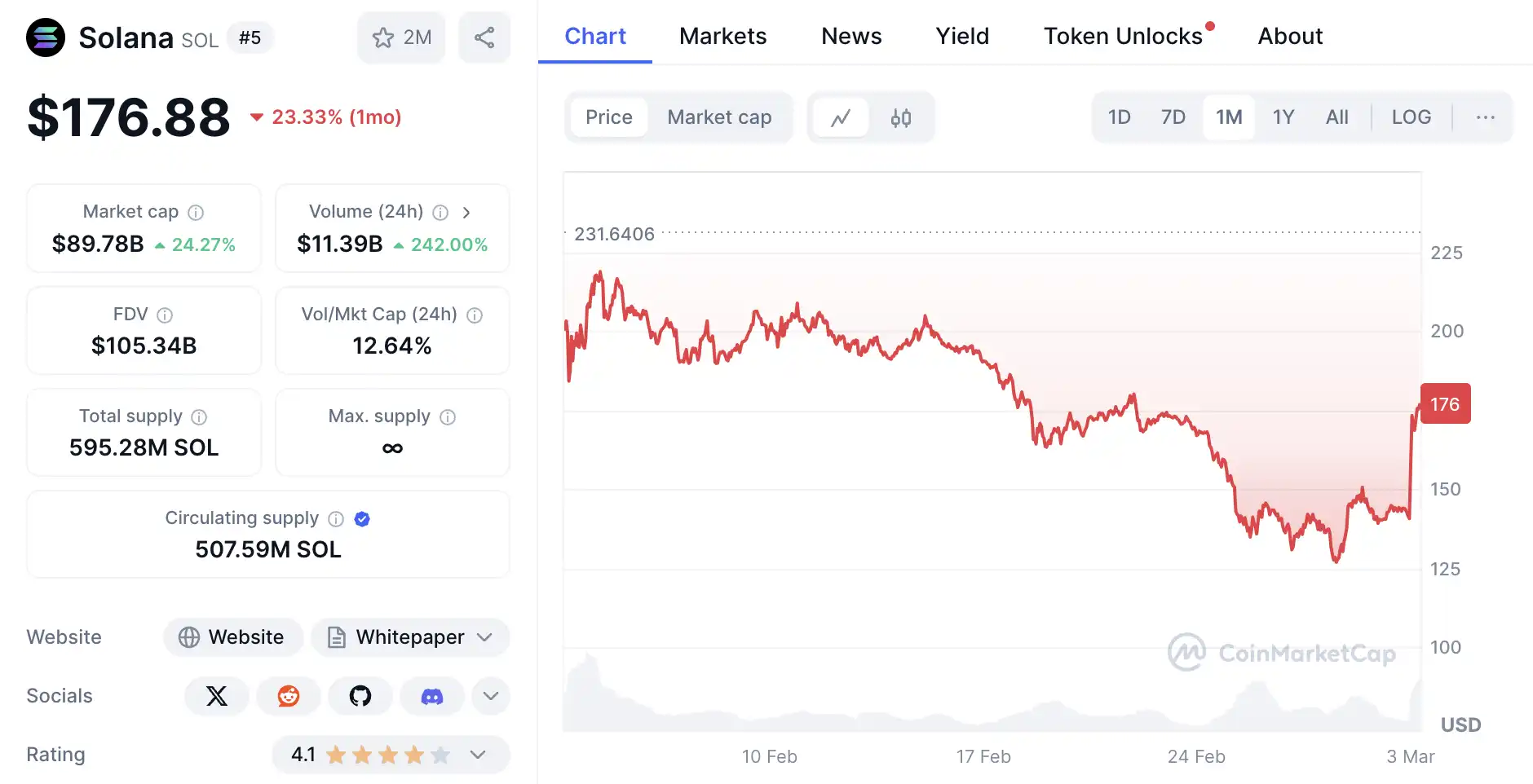

SOL (Solana)

ETF Approval Probability: 70%, currently still viewed by the SEC as a security.

Currently, five issuers have submitted applications for spot Solana ETFs, namely Grayscale, Bitwise, VanEck, 21Shares, and Canary Capital, all of which have been accepted by the SEC. This is the SEC's first acknowledgment of an ETF application for a token previously classified as a "security."

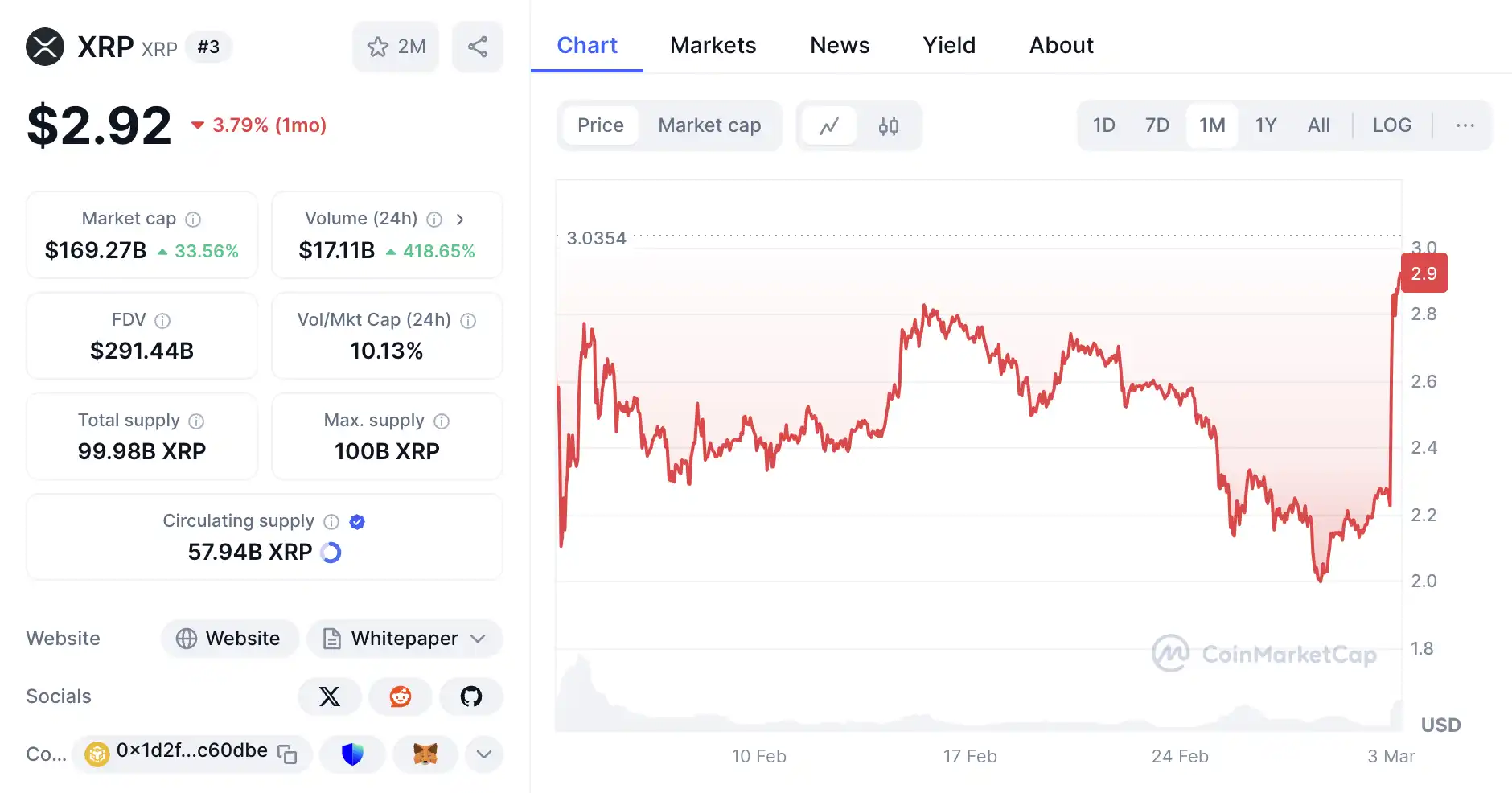

XRP (Ripple)

ETF Approval Probability: 65%, primarily affected by the SEC lawsuit, requiring resolution of regulatory disputes.

Currently, Grayscale, Bitwise, Canary Capital, 21Shares, and Wisdomtree have applied for XRP spot ETFs, possibly influenced by previous lawsuits, with only Grayscale's application having been accepted by the SEC.

Related reading: “Overview of the latest developments in multiple crypto ETFs: SEC accelerates review, SOL and LTC lead in progress”

How is the Ethereum ETF performing after approval?

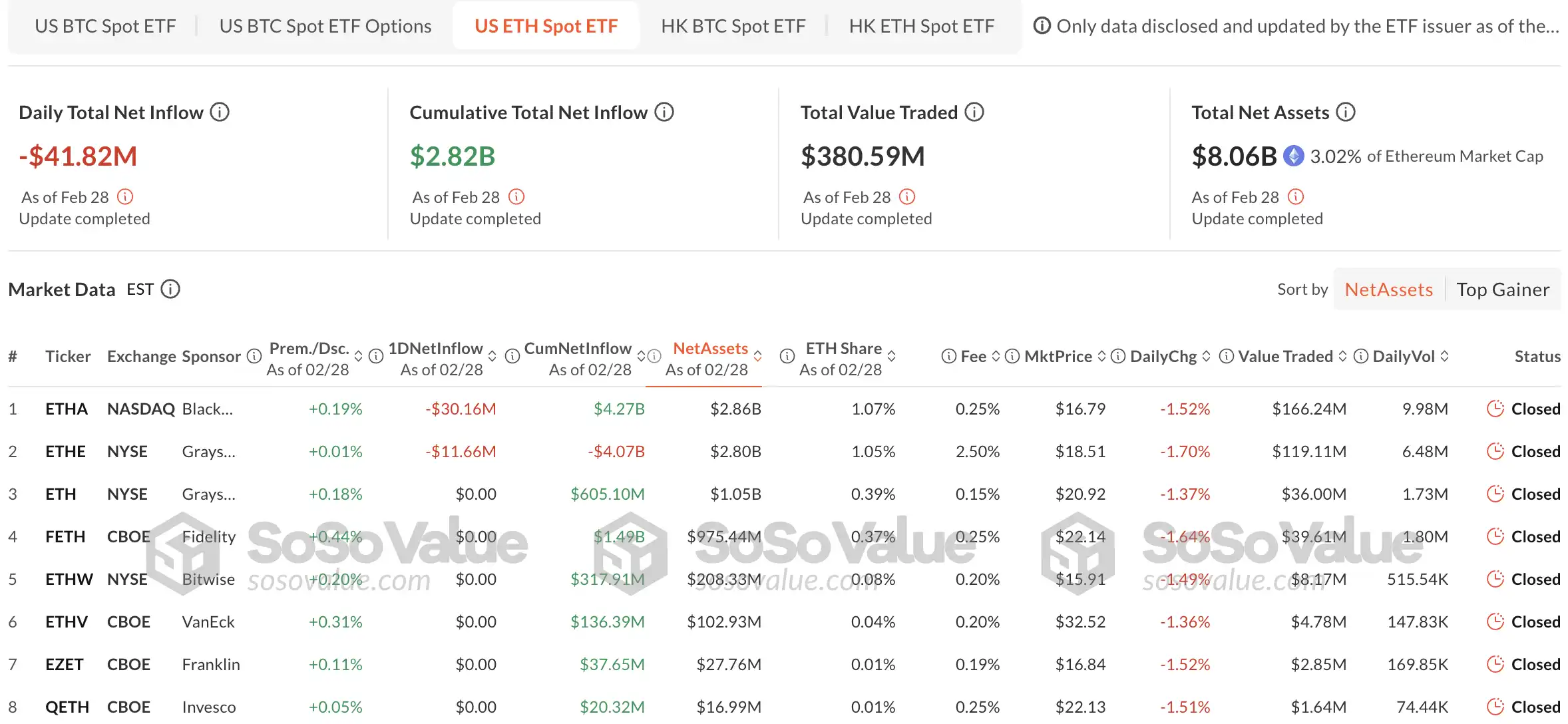

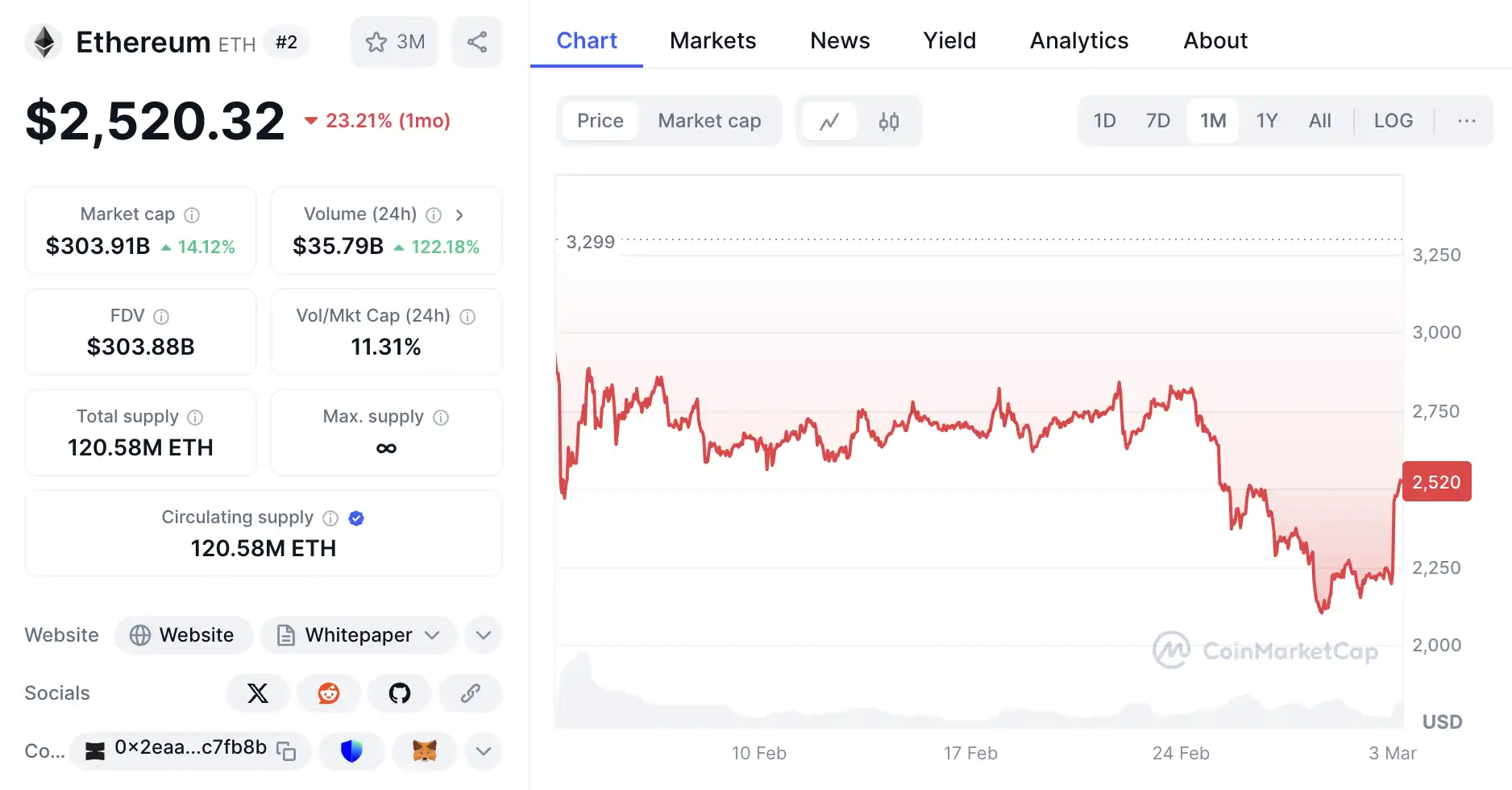

The Ethereum ETF officially launched in the U.S. capital market on July 23 last year, with Ethereum's price around $3,200 on that day. Market data shows that the net inflow for the Ethereum ETF has been $2.82 billion over the past six months, equivalent to Wall Street purchasing nearly 1% of Ethereum's volume, while Ethereum's price has now dropped to around $2,500.

This is partly because Grayscale has been continuously selling Ethereum ETFs, becoming the largest seller in the market, which has hindered Ethereum's rise; on the other hand, Ethereum is more severely affected by whale selling compared to Bitcoin, and it is still digesting the potential selling pressure from whales.

However, the good news is that Trump's related entity, World Finance Liberty, is continuously increasing its holdings in Ethereum. The net inflow of the ETF, along with the continuous purchases by Trump-related institutions, indicates that in an increasingly open market environment, long-term investors have a positive attitude towards Ethereum.

By analogy, if the ETFs for LTC, DOGE, SOL, and XRP are approved in 2025, although this category of ETFs will become a window for traditional funds to flow in, it does not necessarily mean that these tokens will show a significant upward trend.

Crypto ETF 2.0 under Trump

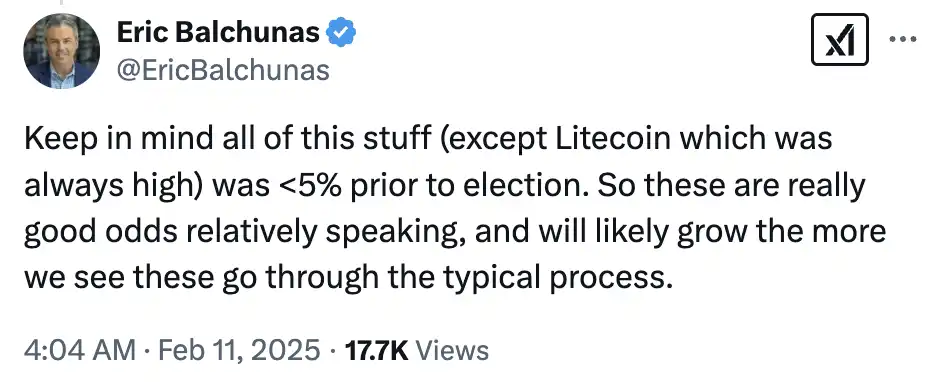

Looking at the history of crypto ETFs, it is not difficult to see the significant benefits for the entire market after Trump returns to the White House this year. Bloomberg analyst Eric Balchunas pointed out that before Trump wins the election, the approval probability for all assets, except Litecoin, remained below 5%. It is expected that as applications enter the approval process, the SEC's decision deadline approaches, and the approval probability for cryptocurrency ETFs will continue to rise.

Related reading: “Coinbase 2025 Outlook: More crypto ETFs will emerge; stablecoins remain a 'killer application'”

So the question arises: why has the process for cryptocurrency ETFs been so difficult? This can be traced back to the SEC's classification of cryptocurrencies.

Are cryptocurrencies securities or commodities?

In fact, the debate over whether cryptocurrencies should be legally defined as securities began as early as 2014.

At that time, sponsors of the Ethereum network raised funds by selling 60 million Ether to develop the network, which officially launched a year later. Due to its similarity to traditional common stock initial public offerings (IPOs), the ICO of Ether raised a fundamental question: do crypto assets meet the definition of securities under U.S. federal securities law?

To this day, this question remains a crucial criterion for determining whether cryptocurrency ETFs can be approved by the SEC. Its answer not only dictates whether and how crypto assets can be sold to the public but also determines whether we must hold and trade these crypto assets according to the existing rules and market structures established for securities over the past 80 years.

At the heart of this debate is the Howey Test, which originates from the U.S. Supreme Court's ruling in the 1946 SEC v. Howey case. The Howey Company rented out citrus groves and promised to manage the land and sell the fruit, with investors receiving a portion of the profits. In this lawsuit, the SEC won because the market regulator deemed these contracts to meet the definition of securities.

Thus, the famous Howey Test was born and became an important standard used in the U.S. securities legal framework to determine whether a transaction constitutes a "security." Its core logic revolves around four elements: first, investors must invest money or assets of monetary value (such as cash, cryptocurrencies, physical goods, etc.), known as "Investment of Money"; second, these funds must be pooled into a "Common Enterprise," meaning the investors' returns are closely tied to the overall success or failure of the project rather than operating independently; third, the core motivation for investors' participation must be based on "Expectation of Profit," meaning their goal is to obtain economic returns through investment rather than merely using the product or service; finally, the realization of profits must "depend primarily on the efforts of others," meaning investors do not directly participate in management but rely on the decisions and operational activities of third parties (such as project teams or promoters) (e.g., the value of tokens depends on team development rather than user mining). These four elements are interrelated and collectively form the criteria for determining whether an "investment contract" falls under the definition of a security. Especially in the cryptocurrency field, if project parties fail to avoid these conditions, they may face legal risks of being classified as unregistered securities.

In the Howey Test, all four conditions mentioned above must be met simultaneously; if any one is missing, the transaction does not constitute a security. This standard can be seen as providing compliance guidance for cryptocurrencies: if project parties want to avoid being classified as securities, they must break at least one of the conditions, such as emphasizing decentralization or user contributions.

In terms of actual cases, the SEC has stated that Bitcoin and Ethereum are "sufficiently decentralized," thus not meeting the fourth condition and therefore not classified as securities. In contrast, the institutional sale of XRP was deemed a security, while the Ripple coins circulating in the secondary market were classified as commodities.

As it stands, Bitcoin and Ethereum have been classified as commodities. The high probability of approval for Litecoin stems from its PoW model, similar to Bitcoin, while Dogecoin's protocol is a clone of the Litecoin protocol, which in turn is a clone of the Bitcoin protocol, thus also having a high probability of being recognized as a commodity. The classification of Solana and Ripple's attributes has yet to reach a conclusion, especially with the ongoing lawsuit between XRP and the SEC.

For those interested in a deeper understanding of the tug-of-war between crypto projects and the SEC, as well as more detailed judgment criteria, you can check out several notable cases: “Why are these five tokens considered securities? The SEC provides answers”, “ConsenSys counters the SEC point by point, explaining why Ethereum is not a security”.

What impact does this have on the crypto market?

Bloomberg analysts expect the SEC to make a decision on proposed altcoin ETFs in October this year. It is foreseeable that if altcoin ETFs are approved in succession, various positive developments will likely continue to attract more conservative and institutional investors, thereby changing the investor structure of the market. Under this policy environment, the crypto market may experience increased liquidity, rising prices, and changes in the investor structure. Therefore, the approval of more ETF products will also bring more funds into the crypto market, enhancing market liquidity and reducing price volatility.

Moreover, due to the existence of regulatory arbitrage, the ETFs launched in the U.S. may directly prompt other countries and regions around the world to follow suit. This imitation could, to varying degrees, promote the global adoption of cryptocurrencies, especially in regions with more lenient regulations, where the adoption of cryptocurrencies may see rapid growth. The convergence of policies globally can effectively reduce the compliance costs of cross-border transactions and further eliminate investors' concerns about legal risks, thereby promoting greater participation from both institutions and individuals. This trend may accelerate the transition of cryptocurrencies from marginal assets to mainstream financial instruments, continuously elevating their status in the global economy.

As the Trump administration further supports the crypto industry, various states in the U.S. are gradually introducing "strategic Bitcoin reserve" legislation, and with the Republican Party controlling both houses of Congress, there may be an opportunity for Congress to pass cryptocurrency-related legislation. Once legislation is passed, cryptocurrencies may have the potential to become a new asset class that is neither classified as securities nor commodities, which would be of epoch-making significance for the crypto market.

Where will crypto ETFs go this year?

Here are predictions from industry institutions and KOLs regarding the development of crypto ETFs in 2025 (the original text is compiled from ChainCatcher, “2024 Crypto ETF Panorama: Asset Scale Exceeds $120 Billion; From Marginal to Mainstream”):

Forbes predicts that the Ethereum ETF may first integrate staking features, while spot ETFs for mainstream tokens like Solana are expected to accelerate their launch, and there may be weighted crypto index ETFs to cover a broader range of assets.

Research firm Messari emphasizes that with the fund flows of Grayscale's GBTC turning positive, the launch of a spot Solana ETF in the next year or two is "almost inevitable," and the overall fund inflow for ETFs will continue to rise.

Coinbase believes that although issuers may attempt to include more tokens such as XRP, SOL, LTC, and HBAR in the ETF asset range, such expansions may only yield actual benefits for a few tokens.

ETF issuer VanEck has proposed a more specific regulatory outlook, predicting that the new leadership of the U.S. SEC or CFTC will approve multiple spot cryptocurrency ETPs, including the VanEck Solana product, while the Ethereum ETP may enhance its practicality by supporting staking features. Both Bitcoin and Ethereum ETPs may adopt a physical creation/redemption mechanism, and if SEC rule SAB 121 is abolished, it will further promote deep participation of traditional financial institutions in cryptocurrency custody.

Another issuer, Bitwise, holds an optimistic view on Bitcoin ETFs, expecting that the inflow of funds in 2025 will surpass that of 2024, attracting trillions of dollars in institutional funds.

Overall, multiple institutions predict that cryptocurrency ETFs will see significant development in 2025, with the diversification and innovation of ETF products, regulatory adjustments, and the entry of mainstream funds becoming the core driving forces of the crypto market in the next two years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。