The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smokescreens!

The market has once again stagnated, not bringing the unilateral rise or fall that everyone speculated, but instead bringing endless speculation. Why do tariffs affect the rise and fall of the coin circle? Today, Lao Cui will clarify the underlying logic of tariffs for everyone. Looking at the trade surplus from tariffs, we see that the trade surplus with the United States has reached 2.75 trillion. Many friends believe that a higher surplus indicates greater dependence of the U.S. on us. However, one needs to look at the industrial structure; much of the U.S. imports are low-end manufacturing. If we consider Trump's tariff situation, the profits are not high. Low-end manufacturing does not yield as direct benefits as high-tech industries. The increase in surplus is crucial for the U.S.; the 2 trillion market in tariffs will be a priority, and it is reasonable to expect that tariffs will continue to grow. This has formed a new round of trade confrontation, which will directly impact the foreign trade industry. The 2 trillion market is almost equal to the coin circle, but this market is formed every year, and its overall value is incalculable. This is an annual investment of 2 trillion, not the overall market value, which everyone should be clear about. Such a large amount of capital movement can be said to concern the global flow of funds, and naturally, its impact on the coin circle is undeniable.

This is merely the trade surplus value, not the total value of Sino-U.S. transactions. Economic confrontation will create competition in all financial markets. The underlying logic of the competition between the two is the underlying logic of finance; neither buyers nor sellers are willing to give up this market, so ultimately, tariffs are borne by consumers. The fundamental way to get capital moving is to increase consumer demand. It can be imagined that not only are our living costs rising, but the situation in the U.S. is even more pronounced, as they live in inflation. To eliminate inflation, one must think of interest rate cuts. You may have gained some understanding of Lao Cui's basic explanation regarding the U.S. dollar; the dollar is merely linked to the U.S. credit system, and the best manifestation of credit is the U.S. Treasury bonds. The continuous increase in yields attracts more people to choose to buy, and this system can be said to be flawless. At the same time, you can also keep an eye on U.S. Treasury yields; as long as the issuance continues to increase, it basically means that the demand gap is constantly expanding. The national debt has already accumulated to 36 trillion, which has forced Trump to issue gold cards to repay debts. This is somewhat reminiscent of the late Ming Dynasty in Chinese history; how long this situation can survive is highly questionable. This has also made the construction of a window for the coin circle increasingly urgent. To resolve debt, one must become strong. Whether regarding the future monetary attributes of the coin circle or the discussion of gray industries, it is the best window for repaying debts.

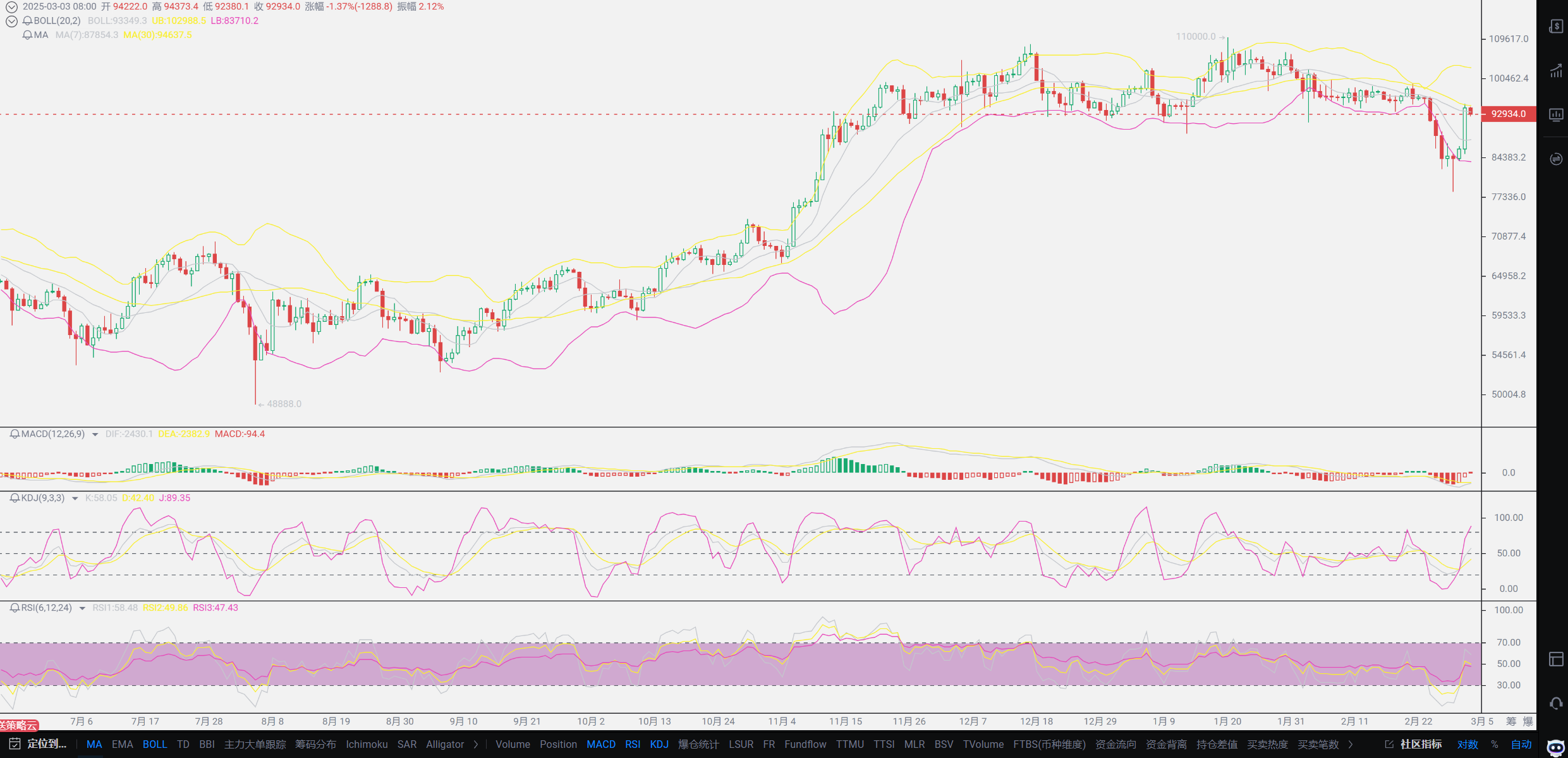

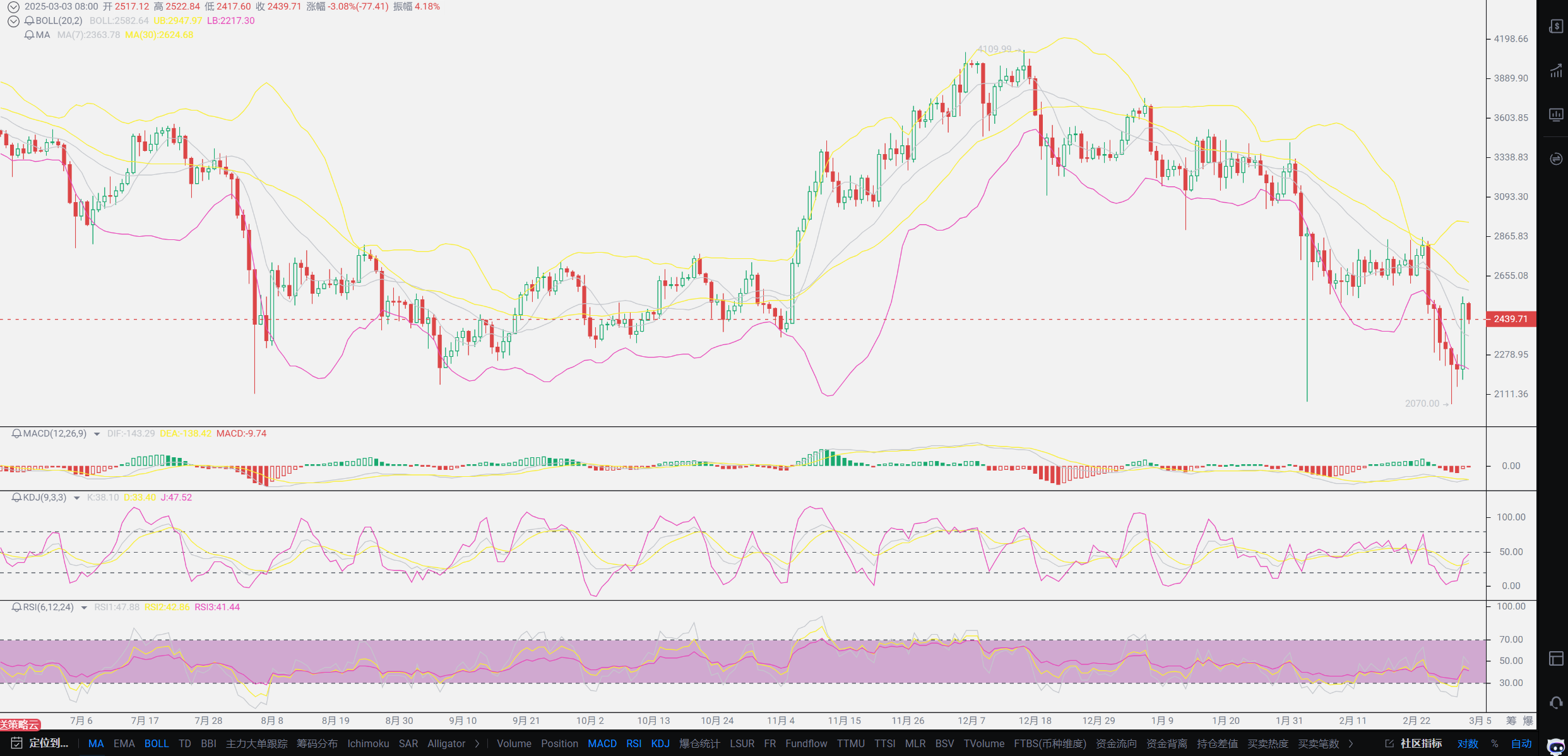

The U.S. attitude towards tariffs is not only aimed at us but is synchronously increasing globally. The increase in tariffs will inevitably raise the cost of foreign capital in the U.S., meaning that starting in March, there may not be much capital flowing into the coin market, including other financial markets. The only stimulus will definitely increase for U.S. stocks, as can be seen from the performance of the past few days, but both markets have significant capital gaps, which the U.S. is also very aware of. Therefore, the increase in tariffs will only widen the capital gap in the financial market. From the source, it will be very difficult to initiate a bull market at the beginning of the year; even if there is a rebound, it will be within a controllable range and cannot break the previous high. Unless there is a continuous stream of positive news, but the biggest positive news has basically all been released in 2024, it will be somewhat difficult to see explosive growth like last year. I still want to remind everyone that the bull market will not return to the right track; all financial markets are currently in a downward phase, and the coin circle can also see signs of this. At this stage, Bitcoin has already declined nearly 10,000 points and is in a repair phase, not a bull market phase. In the first half of the year, the probability of decline is still greater than that of rise. The only person who can save this trend is the implementation of Trump's strategy. Even if all measures are mentioned in this meeting, it depends on the specific implementation timeline. If it is realized in the second half of the year, then the market will fall again. Unless there are states that officially implement measures in the first half of the year, there will be a chance for the market to reverse, and a true bull market will not come directly; at most, it will fluctuate around 100,000 to 110,000, and breakthroughs will still be very difficult. (Again, I remind you that the probability of the market stabilizing is low, but there is still a chance for a breakthrough above; at this stage, it is still in a bull market fluctuation phase, and a bear market has not yet arrived.)

The implementation of Trump's strategy will drive the growth and stabilization of the coin circle. Other rumors can only lead to market breakthroughs, but once the smoke clears, the market will still adjust downwards. This section will focus on explaining the ways for beginners to break free from their positions. Many beginners do not grasp the timing, which is the biggest problem. When it fell below 80,000, many long position users came to consult Lao Cui. Indeed, there were too many people, and I could not reply to everyone. By the time Lao Cui replied, many friends had already cut their losses and left the market. The competition for key points is indeed crucial; the 80,000 point is seen by many users as the point where a bear market will begin if it falls below. The typical analysis of Lao Cui's trend shows a lack of confidence, and the depth of the lower space has always been mentioned as limited. The way Lao Cui provides for everyone to break free from their positions is mainly through averaging down. All the points where you cut losses are below 80,000, and looking back, it is indeed very painful. Even choosing to lock in positions is better than directly cutting losses. This is also a common problem for beginners, heavy positions combined with high leverage, which affects their judgment of trends. There will be no bear market in 2025, only large fluctuations. The support point for long positions in Bitcoin can be set at 30,000 points, which is not a problem at all. Everyone should not underestimate themselves. Long positions are still not able to hold, and one must manage their positions well; only short positions need to be noted.

Lao Cui summarizes: This article has also been written for three days, and the market trend may have deviated, so please bear with it. The past two days have also been busy helping users break free from their positions, thus neglecting the writing of the article. If you have investment needs, you can pay attention to other analysts; Lao Cui cannot guarantee daily updates. The overall trend is basically clear, and the points and ranges provided to everyone can also be focused on. At the same time, users who are stuck in short positions need not worry too much. This time, falling below 90,000 or even 80,000 has indicated that the next wave of adjustments will still return to this position; it is just a matter of time. However, in the short term, it is greatly affected by news, especially Trump's endorsement, leading to a reverse adjustment in the coin circle. Once the news ends, the market will still enter the adjustment range. Secondly, the tariffs coming tomorrow may provide an opportunity for short positions to exit. Users who short are fundamentally contrary to Lao Cui's philosophy and are not advised to rely on short positions for profit; breaking even is enough to exit. Long position users should seize this opportunity; the realization of Trump's news itself has the potential to break through 100,000, and the short-term probability is gradually increasing. After the stimulus, a direction will be chosen again. The three key elements of this year's trend remain unchanged: strategic deployment, the listing of small coins, and interest rate cuts. Achieving these three will surely create a new round of highs. The current stage is the digestion of strategic deployment, with a high probability of breaking through previous highs. This also includes the spot market mentioned earlier; Lao Cui has not exited, and any changes will be notified to everyone!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one territory, but aiming to win the game. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。