Sonic is not just a small player in the future; it aims to make a significant impact.

Author: Zephyr

Introduction: The Ultimate Deconstruction of the Sonic Ecosystem

Sonic is a high-performance Layer-1 blockchain that has re-emerged in the market with a throughput of 10,000 TPS and EVM compatibility. The return of @AndreCronjeTech, along with a clear $200 million $S airdrop, has ignited enthusiasm within the community. I have studied articles from industry leaders like @0xAlexon, @Foxixyz, @DaPangDunCrypto, @ycryptoanalyst, @CyberPhilos, and @rich_adul, integrating my own exploratory experiences to create a comprehensive deconstruction.

This article will start from the technical origins of Fantom, analyze the current prosperous ecosystem driven by assets like $S and $Shadow, break down the Alpha opportunities within the Sonic ecosystem, and lay out the full picture of Sonic along with the most hardcore insights in the industry, helping everyone understand Sonic's past, present, and future potential!

(If looking for CA, please jump directly to II. and be sure to read through V.)

I. Origin Deconstruction

Sonic did not emerge out of nowhere; it traces back to the time of Fantom. In 2018, Fantom burst onto the scene with the Lachesis consensus and DAG technology, aiming to create something different.

Fantom utilized the ve(3,3) model to create a DeFi Flywheel, almost achieving remarkable success, which laid the groundwork for the later x(3,3) model. Back then, @AndreCronjeTech, the DeFi guru, launched $YFI in 2020, which skyrocketed from $6 to $95,000, a 2900x increase. In 2021, he introduced $FTM, dropping an $800 million airdrop, which surged 180 times, pushing TVL to $7 billion. Old OGs who tried the Fantom testnet all said the interactions were incredibly smooth, but unfortunately, later on, Solana and Avalanche crowded it out, and to make matters worse, the Multichain cross-chain bridge collapsed, causing TVL to drop to $90 million. The bear market hit, and in 2022, @AndreCronjeTech announced his retirement, leading the community to believe it was the end.

Until 2023, when @AndreCronjeTech returned, and in 2024, he launched the Sonic mainnet with upgraded Fantom technology. It went live on December 18, and in January, it was listed on major exchanges, with $S tripling in half a month and TVL skyrocketing 500% to $730 million in just one month. @0xAlexon mentioned last October that this was not just a skin change but a change of marrow, and indeed it was. During those days, X was filled with cries of 'Fantom reborn,' and the hype was off the charts, attracting significant attention. The foundation of Sonic was hard-earned through the technical fervor of @AndreCronjeTech.

Moreover, we must also credit @danielesesta, the god of cycles. In 2021, he worked hard on Fantom, bringing Popsicle Finance and Solid Swap, collaborating with @AndreCronjeTech to boost TVL from $5 million to over $6 billion. Popsicle's cross-chain liquidity optimization and Solid Swap's ve(3,3) model directly propelled the ecological flywheel, paving the way for Sonic's x(3,3). He proclaimed on X, "Fantom is my starting point," and now, with innovations from WAGMI and HeyAnon, he has injected new vitality into the Sonic ecosystem.

As of today, @SonicLabs' TVL remains around $700 million, having surged from $27 million at the beginning of the year to this height. I think everyone should ponder whether this hardcore rise of the Sonic ecosystem is worth diving into.

II. Ecosystem Dissection

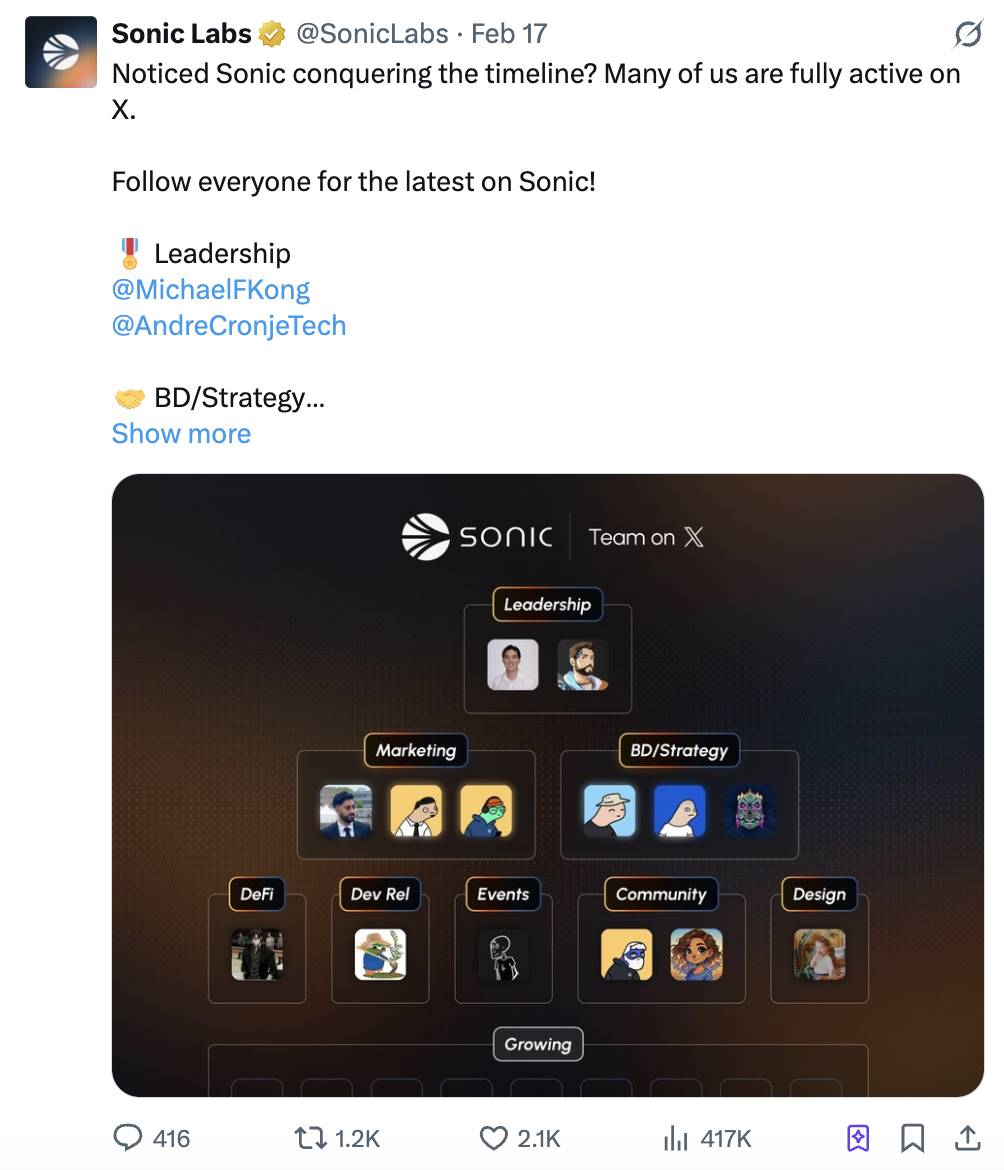

First, if you want to quickly learn about new projects and find official endorsements, be sure to follow the official team members. For accounts that have changed handles, you can find them in the affiliated accounts on @SonicLabs' homepage. Additionally, I personally found that @insiderSonic and @Sonichub also consolidate some quality projects and information, so you might want to follow them as well. By the way, the ecosystem dissection section is the longest, so please be patient while reading!

Based on the Dapps listed by @SonicLabs that can earn AP and currently have high popularity in the ecosystem, this section will be divided into five parts: Spot Dex, Lending and Yield, GameFi, Meme, and NFT.

For other projects in the ecosystem, you can visit https://my.Soniclabs.com/apps to check them out. This website also allows you to query your own Points, and you can filter projects that can earn AP by clicking the upper right corner.

Spot Dex

@ShadowOnSonic is based on the CLM (Concentrated Liquidity Pool Model). As of today, the TVL locked exceeds $100 million, accounting for one-seventh of Sonic's total TVL, with cumulative trading fees exceeding $9 million. Its token $SHADOW increased by 33 times within 20 days of its launch, with a circulating market cap of approximately $26 million. The core mechanism adopts the x(3,3) model, where users stake $SHADOW to generate Shadow, gaining governance voting rights and trading fee dividends, with peak APR reaching 5500%. $x33, as a liquid staking token, currently stabilizes at around 80% of the price of $SHADOW. Through an instant exit fee structure and automatic compounding design, it ensures the stability of holding value. The exit mechanism allows for the minting of $x33 for trading, with early redemption incurring a 50% penalty, incentivizing long-term participation. As of the end of February, the average daily trading volume remains stable at over $50 million.

@MetropolisDEX is based on the DLMM (Dynamic Liquidity Market Making Model). As of today, the TVL locked is $10.42 million, with cumulative trading fees reaching $500,000. Its token $METRO has a circulating market cap of $10.9 million, with an FDV of up to $220 million. Users staking $METRO can earn voting rights and APR rewards, with a lock-up period starting from 90 days, and peak APR around 30%. The core mechanism relies on segmented price ranges (Bins) to achieve near-zero slippage trading, with dynamic fee adjustments to combat impermanent loss, supporting unilateral liquidity injection. LPs can choose a simple mode to deposit assets or an advanced mode to adjust price ranges and distribution shapes (equal, curve, Bid-Ask). As of the end of February, the average daily trading volume is about $1.5 million.

@SwapXfi, based on the V4 AMM (Algebra Finance V4 Automated Market Maker) model, has a TVL locked of $55.59 million as of today. Its token $SWPx has a circulating market cap of $9.1 million, with a 24-hour trading volume of $1.33 million. The WBTC/scBTC pool has increased by 58.7% since its launch, with peak APR exceeding 80%. The core mechanism achieves low-slippage trading through V4 AMM, optimizing capital efficiency with concentrated liquidity pools and automatic liquidity management, supporting unilateral token deposits (ICHI ALM) and various pool types (Classic Volatile, Stable, CLAMM). Users staking $SWPx can earn voting rights and rewards, with lock-up incentives adopting the VE(3,3) model. As of the end of February, the average daily trading volume is about $2 million.

@wagmicom is based on the GMI (Multi-Layer Pool Model), with a TVL of $17.5 million as of today. Its token $WAGMI has a circulating market cap of $33 million, with a 24-hour trading volume of $950,000, and has increased by over 95% since its launch, with peak APR around 50%. The core mechanism optimizes liquidity through GMI's multi-layer pool structure, nesting multiple V3 sub-pools, automatically rebalancing market fluctuations. LPs can deposit assets unilaterally, with profits distributed according to the proportion of $WAGMI held, and 80% of newly added tokens are used to incentivize leveraged trading and GMI pools. Users staking $WAGMI generate sWAGMI, earning 20% of protocol fee dividends, with flexible lock-up periods, and the current lock-up ratio exceeds 60%. As of the end of February, the average daily trading volume is about $3 million.

Lending and Yield

@SiloFinance is based on an isolated lending model, with a TVL reaching $200 million as of today, making it the highest TVL protocol on the Sonic network, accounting for nearly one-third of the total TVL. The core mechanism provides high-leverage circular loans through isolated pools, with each pool operating independently to limit the risk spread of a single asset. Users can deposit $S or stablecoins like $ScUSD for circular lending to amplify returns, with deposits of $ScUSD earning an 18x SonicPoint score bonus, and USDE deposits yielding 12% APR. The TVL is highly inflated; I estimate that after removing the TVL brought by circular lending, the actual amount may be around $20 million, which is about one-tenth of the current figure. However, this protocol is very suitable for players looking to earn high Points, as circular lending essentially involves taking on interest rate spreads in exchange for Points.

@eulerfinance allows users to deposit assets (such as scETH, stS, scUSD, wstkscUSD, etc.) to earn interest or borrow other tokens by collateralizing these assets. It supports looping strategies that can be used from day one, enabling users to maximize returns through repeated borrowing and depositing. In simple terms, it is a one-click circular lending platform, but the optimization is poorly done, and I do not recommend using it. For similar needs, you can manually use @SiloFinance.

@OriginProtocol and @beets_fi allow users to stake $S to receive certificates $OS with a 12% APR and stake $S to receive certificates $Sts with a 4.75% APR. Both tokens have full liquidity and can be seamlessly used in DeFi to access lending markets, liquidity pools, etc., while stopping staking rewards. However, the ratio with $S is not a stable 1:1, so caution is needed regarding liquidation risks when using these two tokens to participate in other protocols.

@Rings_Protocol allows users to participate in yield farming strategies managed by Veda Labs by creating meta-assets pegged to the US dollar, Ethereum, and Bitcoin (such as $ScUSD, $ScETH, $ScBTC) using stablecoins as collateral, generating high yields while providing passive income from staking, fixed interest rates, and yield leverage options. The meta-assets generated on this platform have Sonic point bonuses, especially $ScUSD.

@HandofGodSonic is inspired by Tomb Finance and uses AI @GodSonic_AI to automatically optimize emissions, bonds, and supply every six hours, pursuing an emotionless ecological balance. Its token system includes $HOG (pegged), $gHOG (governance/rewards), and $bHOG (bonds). Currently, its TVL ranks among the top ten in Sonic, and $gHOG is set to launch next week. (It looks good, but this Ponzi is not perfect; see V for details.)

@spectra_finance allows users to tokenize the future earnings of assets into Principal Tokens (PTs, ownership of principal) and Yield Tokens (YTs, future earnings), enabling users to sell earnings in advance or lock in principal. PTs can lock in fixed rates to avoid volatility, while YTs are used for speculation or monetizing future earnings; the platform's built-in automated market maker (AMM) supports YT trading, allowing users to speculate on yields and receive earnings distributions at the end of each cycle. Its permissionless design allows anyone to create yield pools based on ERC-4626 tokens, and earnings cannot be withdrawn early, enhancing composability with other protocols. (It's hard to use and can be confusing; it's recommended to start with small amounts to understand it and read the project documentation carefully.)

@eggsonSonic aims to establish $EGGS as a reserve currency, similar to OHM from the previous cycle. Users can mint $EGGS by depositing $S, redeem $EGGS for $S, borrow $S, and use leverage for circular lending. A total of 13.86 billion $EGGS have been burned, with borrowed $S amounting to $662,800 and a TVL of $73.95 million.

@HeyAnonai is an AI-driven DeFi protocol that simplifies DeFi interactions on Sonic through conversational AI and real-time data aggregation. Users can interact with HeyAnon using natural language to perform complex DeFi operations such as bridging, swapping, staking, and lending. The developer is the renowned @danielesesta, and $Anon can be purchased on popular public chains.

GameFi

@sacrafi launched in April 2022 and underwent three rounds of BETA testing, officially launching in Q2 2024. It has partnered with @SonicLabs to introduce a reward program of 500,000 $S. For more details, you can watch @richadul's video. The price of $SA peaked at $24 and has now fallen to around $0.08.

@FateAdventure previously featured @AndreCronjeTech's avatar as one of the characters in the game and received seed round investment from @SonicLabs, making it a favored project. This is a blockchain game with clear P2E elements, where players earn and spend $FA through tasks, battles, or NFTs. The price of $FA reached a high of $2 and is currently priced at $0.76.

Meme

Risk Warning: @AndreCronjeTech has publicly expressed disdain for meme coins.

@GOGLZ_Sonic is a leading meme coin with a goggles concept but has nearly been flipped multiple times.

@TinHat_Cat is a conspiracy cat, with a very volatile price trend, while its NFT floor remains high and trading volume stable, indeed a Cabal.

@derpedewdz Derp is the token corresponding to the NFT, and holders can receive free distributions and airdrops. Uppies is a project used by the Derp community to participate in meme competitions.

@MIMonSonic is a token issued on @wagmicom, which recently airdropped to Dero holders, valued at over $10, a wizard concept.

@PassThe_JOINT is a smoke-404 concept that previously sold blind boxes in the NFT market, where users would randomly receive tokens within a certain range upon opening. It was quickly sold out upon listing, but its market cap has remained around $200k.

@haunted_ice and @Memetoona are both projects that @danielesesta personally purchased using @HeyAnonai, and their market caps are still at a very low stage.

NFT

The NFT trading market on the Sonic chain is:

@derpedewdz is a blue-chip NFT in the Sonic ecosystem, with official team members holding and changing avatars. @AndreCronjeTech also recently changed to a derp avatar. Its leading NFT status is unquestionable, with a total of 2,000 pieces. As far as I know, many group members hold dozens of them, and holders continuously receive airdrops, with the highest airdrop amount exceeding $10,000. Projects are consistently giving WL to derp holders. In summary, I recommend that players deeply involved in the Sonic ecosystem hold at least one NFT, as it serves as an OG verification and a form of community culture. (Didn’t you see I’m also a Derp?)

@MetropolisDEX, as one of the NFTs with high trading volume and a stable floor, was initially issued for Fairlaunch, allowing holders to obtain quotas for purchasing tokens. The number held can be combined for additional benefits. The initial Metro NFT could be obtained by completing simple tasks, and the current floor is 1400s. The official team continues to empower the NFT, and there may be new airdrop opportunities and WL permissions for other projects in the future.

@LazyBearSonic is a fairly minted NFT, with minting costs of less than 1s. Entering DC grants WL, and the minting lasted for four hours. The highest floor approached 500s, and the current floor is 300s. Many savvy group members and early participants in the ecosystem have seen hidden opportunities here, minting multiple accounts and sweeping the floor, with earnings ranging from thousands to tens of thousands of S.

III. Airdrop Opportunities

@SonicLabs has announced a clear airdrop of 200 million $S. Teacher Fat Dun's article provides a detailed analysis of the airdrop, so I won’t elaborate further here; I will only discuss how to maximize profits.

Sonic Airdrop Analysis

For a user looking to grab airdrops, is there an opportunity with Sonic?

Of course!…

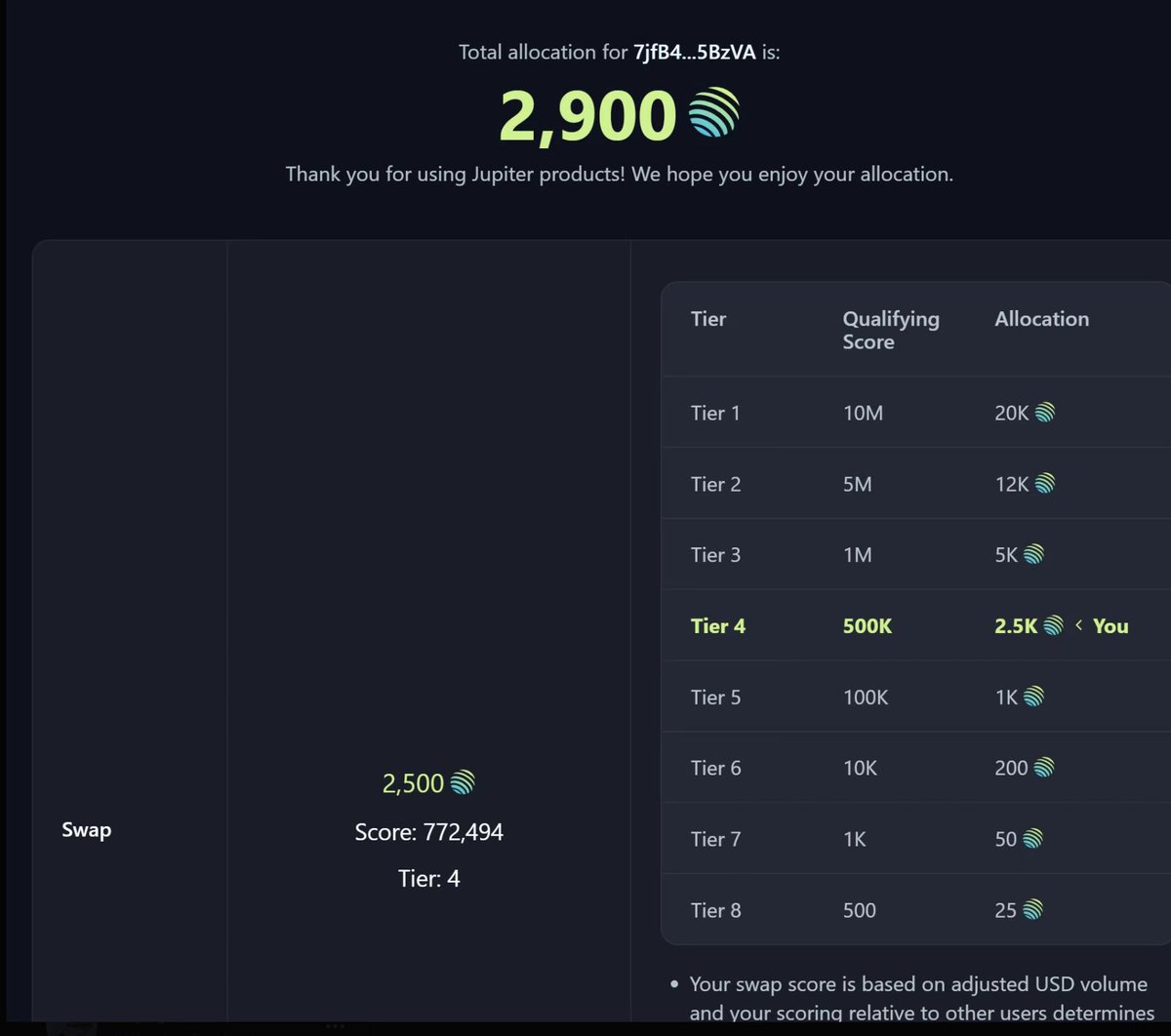

Here, I used the airdrop data from @JupiterExchange as a reference. Since the official points algorithm and ranking have not been disclosed, practical methods and strategies cannot yet be formed. If relevant data is published later, I will post it for everyone’s reference.

@JupiterExchange divides trading addresses into eight levels, calculating that the airdrop amounts for the last two levels account for 5% of trading volume, the sixth level accounts for 2%, and the fifth level accounts for 1%. The higher the level, the lower the proportion, with the first level's airdrop amount only accounting for 0.2% of trading volume. This reflects that higher trading volume does not necessarily lead to more airdrops; rather, the proportion of airdrops decreases as trading volume increases. This means finding a value close to the level edge and distributing the trading volume of a single address across multiple addresses will yield much higher airdrop value. However, due to the lack of relevant public data, and even the underlying algorithm for points has not been disclosed, AP is not yet displayed on the dashboard. However, the official team has buried a little Easter egg; the ranking of points can be seen on @ShadowOnSonic's dashboard, which can serve as a simple reference. For example, 510,000 points rank 14,000. Currently, the multi-address strategy ensures that each address is around 20,000 in rank, allowing the main addresses to reach around 10,000 or 5,000 in rank, which helps prevent being assigned to a too high level, thus lowering the weight of points in the airdrop.

Of course, this is just a reference; it is my personal speculation. The opportunities for small funds in the Sonic ecosystem still lie in discovering early alpha. However, as a DeFi chain, the scores on Sonic can often be boosted significantly, presenting us with a potential path to wealth.

IV. Future Blueprint

Here’s Grok's ultimate outlook on Sonic:

Sonic is not just about small plays in the future; it aims to make a significant impact.

@AndreCronjeTech's technical spirit is still burning. $YFI's 2900x and $FTM's 180x are just appetizers; he has a big move planned for Sonic. The Sonic mainnet has the highest TPS across all chains, with hardcore upgrades to FVM (Fantom Virtual Machine) and DB (LiveDB + ArchiveDB) directly enhancing performance.

Sonic has created an L1.5, splitting full nodes into Validator and Archive Node, allowing for a lighter setup. This technical foundation enables Sonic to carve out a niche in DeFi and GameFi, and the industry is waiting for it to outpace the sluggish chains. Keep an eye on Sonic Gateway; that cross-chain bridge is incredibly fast, competing with Ethereum for business. $S is revitalizing assets like stETH and wBTC, and a TVL explosion is just around the corner.

In this ecosystem, $Shadow and Metropolis are just the appetizers. Sonic's high-performance foundation can turn DEX around, and gameplay like x(3,3) and DLMM will become increasingly powerful. $Shadow's TVL has exceeded $150 million, and Metropolis's single-sided liquidity pool maximizes efficiency. In the future, more hardcore projects will emerge. With $140 million in incentives being poured in and a $200 million $S airdrop landing in June, developers will flock in. Sonic Labs also holds a $200 million Innovator Fund in $S, making AAA-level projects a possibility. I suspect AC has even more up his sleeve; the array of black technologies he mentioned (money markets, options, leverage) will eventually land on Sonic, causing the ecosystem to explode.

On the community side, Sonic Points and Gems are spinning like a flywheel. Users grabbing airdrops earn guaranteed PP, those providing liquidity get AP, and high-risk, high-reward mining opportunities abound, with easy plays doubling returns. In the future, Sonic aims to bind users and developers together; Points and Gems are not just rewards but engines driving the ecosystem.

Sonic needs to differentiate itself with Killer Dapps, and the community must engage more deeply, bringing LP, staking, and NFTs to the table. As the flywheel spins, Sonic can siphon liquidity from other chains.

And it doesn't stop there; Sonic's ambition goes beyond L1. AC has been holding back on technical designs for eight years, including forex AMM, leveraged spot trading, and options mining. With upgrades to Sonic Gateway, it will pull in Ethereum's TVL, solidifying $S's status as hard currency.

Sonic's high performance can turn the tide; in the future, Sonic will not only engage in DeFi but also conquer GameFi and NFTs, creating a new frontier. The industry is watching; if Sonic turns the tables, it could shake the entire Web3 landscape.

V. Practical Deconstruction

From my personal perspective, @SonicLabs embodies what @CyerPhilos describes as having grown from a small market cap with early low-cost airdrop opportunities, possessing real value and applications or community. Early investments in a growing ecosystem are key.

Looking back, the Mint price of the Derp NFT was 100s, and it has already reached 2000s. Holding a Derp NFT also airdropped $xshadow, which peaked in value at over $10,000. Even now, various projects continue to airdrop to Derp holders, and I believe this will only increase in the future. A few days ago, the free Mint of LazyBear required just filling out a form in DC to receive a whitelist, peaking near 500s. Even the Metro NFT, which was given away for completing tasks, is now over 1000s. I believe the Sonic ecosystem is still in its early stages, with numerous Alpha opportunities available, and I am willing to build alongside the teachers!

Recommended Reading: Why I believe SONIC is still in its early stages?

Recommended Reading: Reasons to be Bullish on the Sonic ecosystem

So how should small investors participate in the Sonic ecosystem?

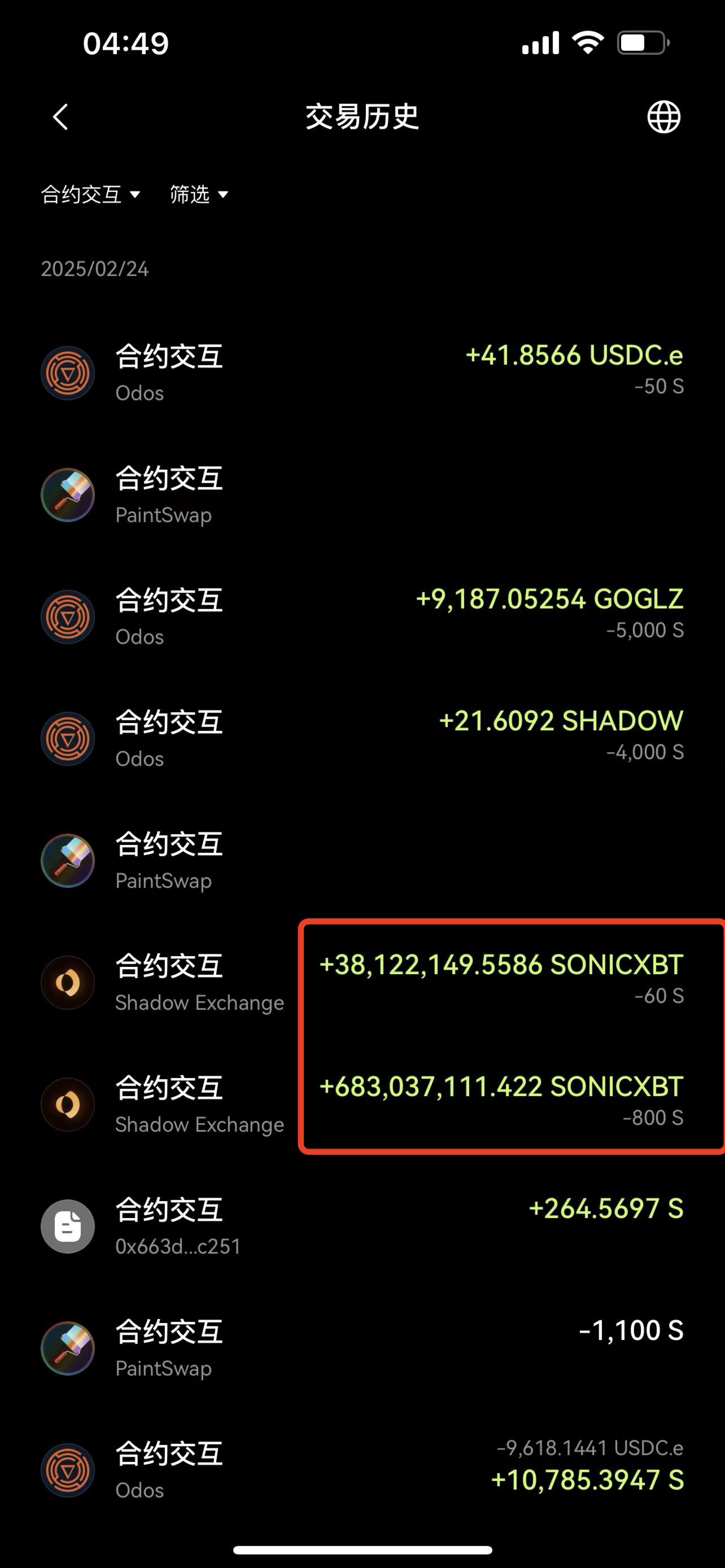

First and foremost, safety is the most important aspect on-chain. There are various reasons for losses and theft of funds. The infrastructure on Sonic is not yet perfect, and purchasing tokens without official backing cannot guarantee whether contract permissions have been compromised. I, unfortunately, bought a Pi Xiu coin ($Sonicxbt) after seeing a group member post about it. I noticed its market cap was low and thought of the previous bnbxbt, so without a second thought, I bought over 800s, successfully giving the scammers a performance boost.

When participating in the myriad of protocols on-chain, one must be cautious. Start with small amounts to understand the processes and principles. Many DeFi projects do not advocate for quick in-and-out trades, so doing so can incur significant slippage or taxes, especially on staking platforms. Speaking of @spectra_finance, it can be quite harsh; happily entering with scu, I found myself redeeming for wstkscu, sw-wstksc, and other confusing tokens, and the official conversion entry was not clear, requiring patience to find or read through lengthy documents. This is why it's advised to test with small amounts; encountering such situations can be very frustrating.

If small investors want to become the future OGs or whales, playing these DeFi games may not be cost-effective. We must seek Alpha opportunities within the ecosystem and continuously grow our funds. Therefore, diving into new projects is essential, but we must also be vigilant, assessing the risk of projects running away while carefully reading each project's documentation (if you're too lazy to read, just follow me; I'll post about quality new projects).

Taking @HandofGodSonic as a recent example, in the first cycle, everyone deposited to mine $hOG, but the token price skyrocketed to over a thousand dollars at the start. When the project began distributing tokens, the price plummeted. However, according to the official statement, $hOG is soft-pegged to $os, meaning its price will eventually return to around $1. At that time, I warned the group about the risks, stating that $hOG's price was artificially inflated and that it was better to mine, withdraw, and sell. Additionally, the official charged a 1% tax on deposits, and before the token distribution began, $hOG's price remained high, leading to an APR that peaked at hundreds of thousands of points daily. As distribution began, it gradually decreased, and some trading pairs' daily returns fell to a thousandth, meaning it would take ten days to break even. There were even cases where group members added LP trading pairs that could not be withdrawn, effectively locking their funds. Looking back, one might speculate that the project team set up trading pairs for depositing os\hOG without tax, which had the highest daily returns but could not be withdrawn. The projects with the best yields were all collaborations with the official team, using $os as the trading pair, and $Swpx as the partnered DEX. These projects distributed nearly 30,000 $hOG daily at their peak, with a minimum of 10,000, while other lesser pairs only had 2,000.

Thus, when diving into new projects, it is crucial to read the documentation carefully; often, a single piece of information can determine a lot.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。