Analyst Chen Shu: 3.3 Afternoon Bitcoin and Ethereum Market Strategy Report, Significant Profits from Long Positions, Perfectly Anticipating Intraday Corrections

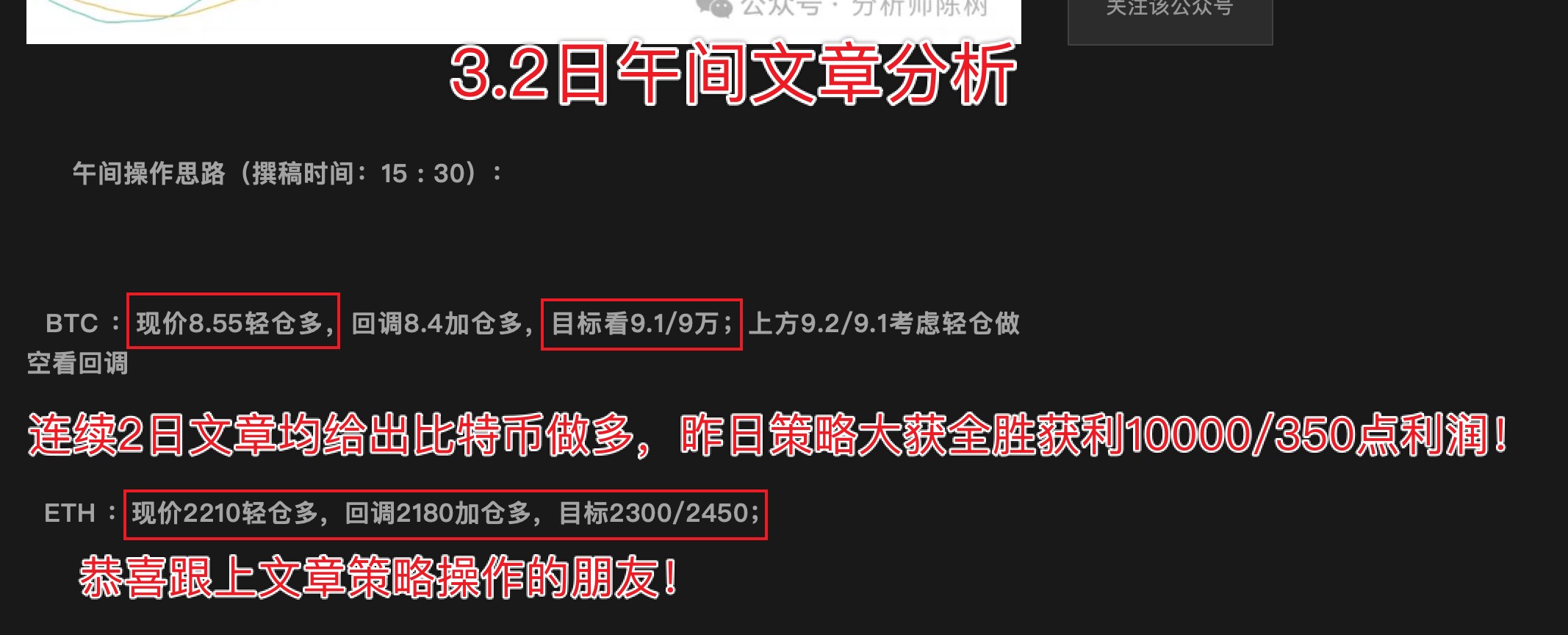

In the article analysis from the afternoon of March 2, strategies for Bitcoin and Ethereum long and short positions were provided. For two consecutive days, long position strategies for Bitcoin were given. Did you catch this violent surge? Bitcoin presented a long position idea at the current price of 8.55, while Ethereum provided long position ideas at 2210/2180. The strategies from the past two days yielded profits of 10,000/350 points. Congratulations to those who followed the article's operations for a great victory! After a surge, how to operate with a slight pullback is analyzed below.

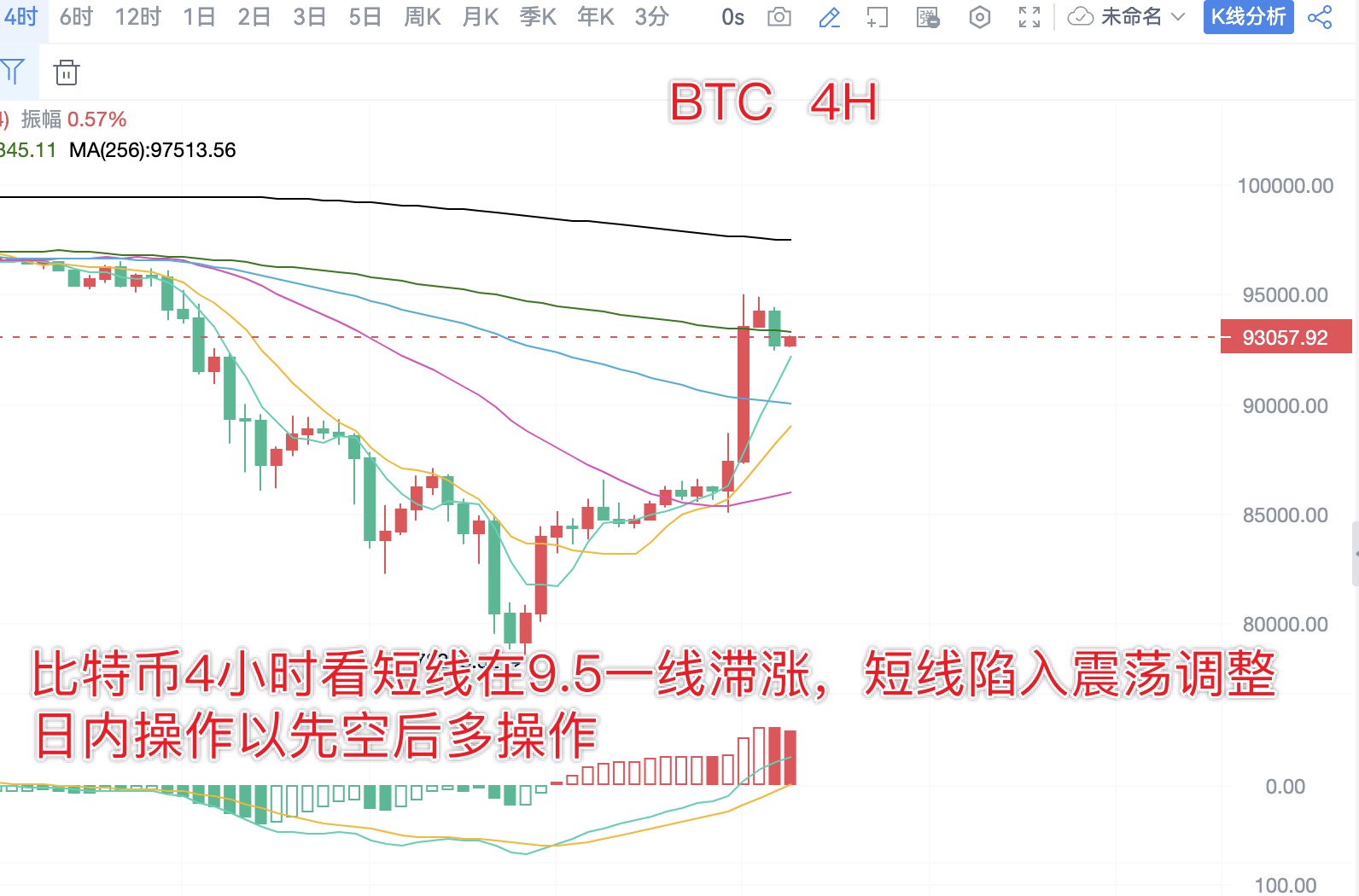

From the daily chart of Bitcoin, yesterday's daily candle closed as a large red K-line, with the price directly surging to the MA120 daily moving average near 9.56. With the positive news regarding the U.S. Bitcoin strategic reserves, the market surged strongly back into a bullish trend. On the 4-hour chart, after the price broke through the MA120 daily moving average, the last 4-hour K-line closed as a solid green K-line, with a short-term pullback. The price formed a small level of resistance around 9.35, while on the 1-hour level, the price began to stagnate and adjust after crossing the MA256 daily moving average. Intraday, we should first look for a pullback correction before operating long positions.

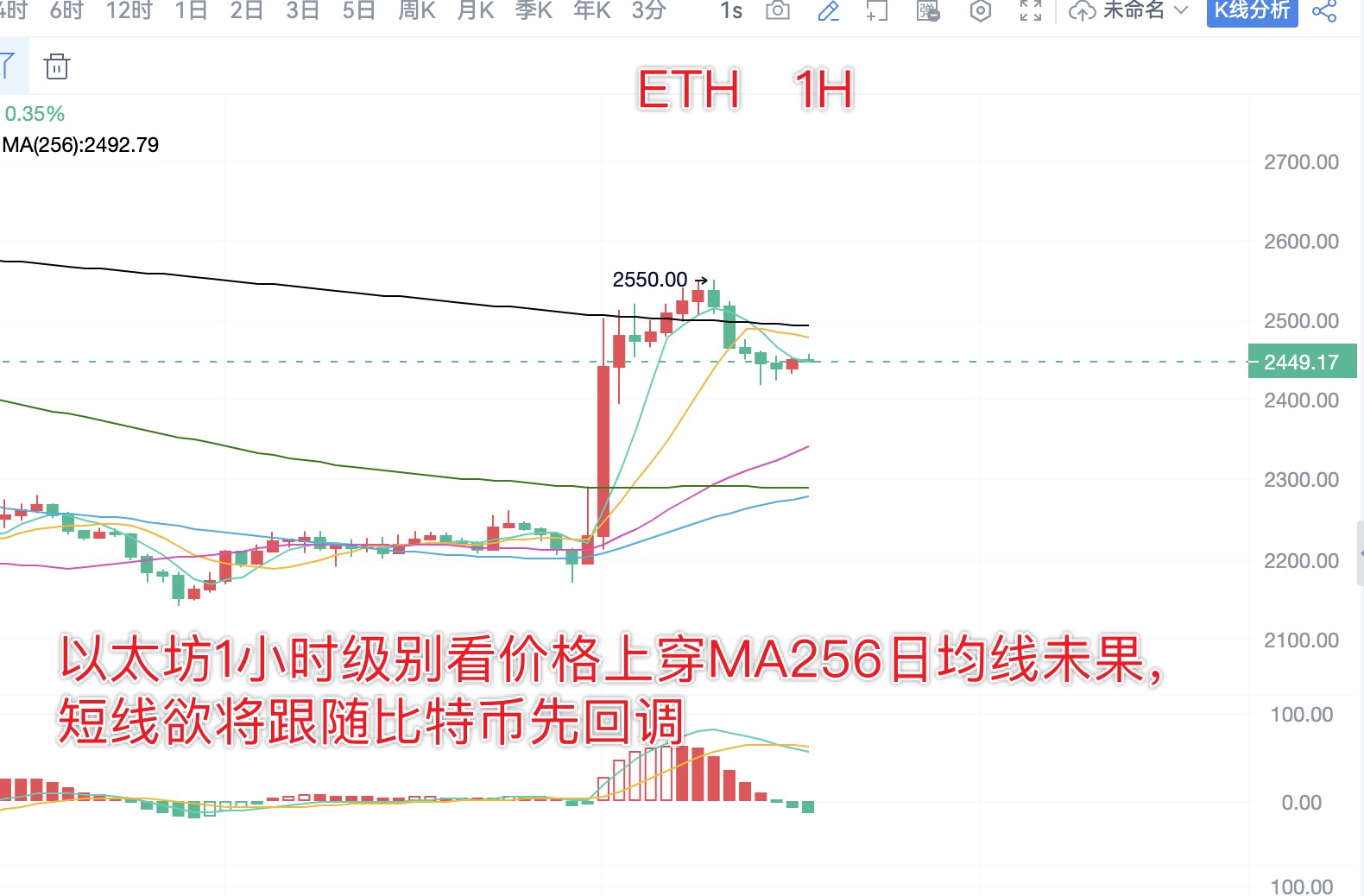

From the daily chart of Ethereum, yesterday also closed as a large red K-line, with the price piercing the daily MA10 moving average at around 2450. Although the increase was not as strong as Bitcoin, we still look bullish on Ethereum under favorable conditions. The intraday resistance level refers to the daily MA30 moving average at around 2600. On the 4-hour chart, after rising from the bottom yesterday, the price approached the MA120 moving average resistance level and began to stagnate with short-term horizontal adjustments. The short-term resistance level refers to the 1-hour MA256 moving average at around 2500.

Afternoon Operation Ideas (Written at: 13:00):

BTC: Light short at 9.33, add to short at 9.43 on rebound, target around 9.05; buy long at 9.05/8.9 with a bullish target above 9.3.

ETH: Light short at 2460, add to short at 2520 on rebound, target around 2350; long positions in sync with Bitcoin.

Daily analysis strategy has a very high win rate! Analysis is not easy, I hope everyone can give a free follow, bookmark, like, and comment. Thank you all, and feel free to leave comments below for discussion; I will reply to each one!

For real-time market strategy exchanges and inquiries about market issues, you can follow me, the top-ranked personal KOL in the original (Coin World), providing free guidance and answering trading questions. Everyone is welcome to communicate and exchange ideas!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。