Let go of that greedy yet fearful, impulsive yet hesitant heart.

Written by: Deep Tide TechFlow

Good morning, esteemed holders of BTC, ETH, SOL, XRP, and ADA.

Has the one-month crypto bear market come to an end?

From accepting the face wash of a waterfall decline to the market's sudden recovery, things have happened so unexpectedly.

Last night, U.S. President Trump posted a message on Truth Social that kept everyone awake --- the U.S. will enhance the status of the cryptocurrency industry through a "Crypto Strategic Reserve," explicitly mentioning the inclusion of XRP, SOL, and ADA in this strategic reserve.

In the post, Trump reiterated the phrase "ensure that America becomes the capital of the crypto world." This expectation from America, which easily excites those in the circle, seems to have rekindled market enthusiasm.

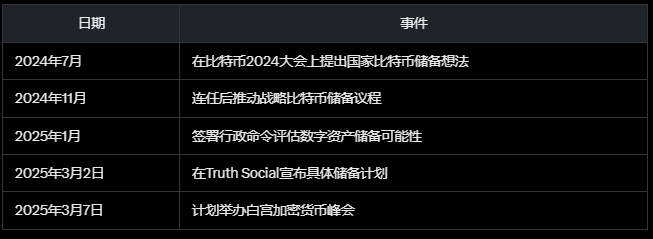

It is worth noting that Trump's focus on cryptocurrency reserves is not a new proposal; let me remind you of a series of his actions:

In July 2024, Trump proposed the idea of creating a national Bitcoin reserve at the Bitcoin 2024 conference and continued to promote this agenda after being re-elected in November 2024.

In January 2025, he signed an executive order requiring an assessment of the feasibility of creating a national digital asset reserve. Therefore, today’s post can be understood as a continuation and concretization of this long-term plan.

This time, although the post did not explicitly reiterate support for Bitcoin and Ethereum (which is already clear), it is the first time XRP, SOL, and ADA have been included in the strategic reserve.

The news quickly triggered a frenzied market reaction. According to CMC data, the prices of related cryptocurrencies surged significantly in a short time:

XRP rose 33%, Solana (SOL) rose 22%, and Cardano (ADA) skyrocketed by over 60%. Meanwhile, Bitcoin (BTC) and Ethereum (ETH) rose by 8% and 11%, respectively.

The total market capitalization of the entire cryptocurrency market also surged by $300 billion within hours. This wave of increase not only reversed the recent downward trend but also reignited expectations that the "crypto president" would save crypto.

Flowing leeks, solid core circle

But the question is, did you make money?

When Trump shouted, the most obvious was that ADA skyrocketed, while XRP's FDV surpassed ETH.

But the question is, before Trump released the news, would you dare to decisively heavily invest in these old coins like ADA or XRP, risking the continuation of the bear market and your bad mood?

For leeks, a classic situation might be like this:

For those trading contracts: The price is still there, but the position is gone. The severe fluctuations in the bear market may have already caused your leveraged position to be liquidated, leaving only the regret of "if only I had held on a little longer."

For those trading spot: **The price is still there, but it hasn't returned. If you cut losses in the midst of the decline, then when the market warms up, you may not have enough bullets; or perhaps you firmly held your position, but the previous losses have not been wiped out, so the so-called "resurrection" is merely a comfort on paper.

In the crypto circle, the power of news is unmatched, but truly seizing opportunities depends on the core circle.

Just because you didn't make money doesn't mean a few people didn't; those close to the core circle may have already made money before this news came out.

For example, just yesterday, before Trump announced this positive news, a big player on Hyperliquid very coincidentally and unusually went long on BTC and ETH with an extremely high leverage of 50 times;

Before the news came out, this big player was nearly liquidated due to the market price drop and was in a floating loss. But even in such a situation, he still added to his position midway and ended up profiting $6.83 million.

Behind the big heart, there may be a more significant information gap closer to the core circle. It's no wonder that some on social media have hinted or suggested that the big player going long on Hyperliquid may very well be from Trump's family or stakeholders.

However, it can be confirmed that the whales in this event must know things you don't, which gives them the confidence you lack.

If the whales are in the dark, then there are also those in the light with ulterior motives.

For example, crypto czar David Sacks revealed two years ago in a podcast:

"At the beginning of the year, SOL was $9, and now it has risen more than tenfold… Online haters say we bought SOL at a discount and then dumped it on retail investors, which is nonsense. Let's put it this way, those of us who still hold Solana are overjoyed."

Now, he is the White House's head of artificial intelligence and cryptocurrency affairs, infinitely close to the center of power, theoretically having unlimited operational space.

After all, the president has issued coins; can the SOL I hold be gradually sold off after unlocking at the beginning of the month, in conjunction with the positive news from the crypto summit on the 7th?

There is no way to confirm, but also no way to falsify.

However, it can be certain that his probability of making money is higher than that of leeks.

So while browsing Chinese CT, you can see a popular self-deprecating sentiment:

"I knew Trump would announce ETH as a strategic reserve long ago; luckily, I bought it when it was $4,000."

Flowing leeks, solid core circle. If you don't know where the profits come from, then you are the profit itself, whether the market is bear or bull.

When the market becomes a matter of a single sentence, some rejoice while others worry

When the market becomes a matter of a single sentence from President Trump, the entire crypto circle inevitably becomes Americanized or politicized.

And the president and his team, to some extent, represent centralization and hegemony; the underlying message of centralization is that I will do it this way, and the market is merely the acceptor.

Question centralization, understand centralization, become centralization.

Now, who doesn't want to be the embodiment of supreme power that influences asset prices? Who truly reminisces about the blood and passion of cypherpunks shouting for decentralization and pursuing the original intention of free finance decades ago?

Driven by reality, the focus of attention both inside and outside the industry has long shifted from ideals to interests — whether positions recover, whether personal wealth grows, is the focal point for most people. Idealism may have once been a belief, but today, it seems pale and powerless in the torrent of market fluctuations.

In short, what everyone cares about is their own positions and development.

Once the news broke, Ethereum's co-executive director Tomasz K. Stańczak tweeted that due to the impact of the crypto strategic reserve, it is currently a brief opportunity to showcase the Ethereum ecosystem.

Your Ethereum development actually relies on a brief window of opportunity given by the president; that clearly indicates that you haven't done well enough before.

Arthur Hayes stated that the crypto reserve is currently just talk; the U.S. has no budget to increase its holdings of Bitcoin or altcoins; he remains bullish in the long term but will not buy at the current position.

When the entire market is swayed by one person, one sentence, and one document, this so-called "resurrection" cannot be seen as a comprehensive benefit to the industry, but more like a zero-sum game: some cheer while others fall into a hellish scene.

For leeks at the downstream of the industry, the quality of policies seems never to have truly changed their situation; just ask yourself:

How is your position? Is it floating profit that hasn't been locked in, or are you still trapped?

Has your status improved? Are you closer to the core circle?

If the answers are mostly "no," then even if the market resurrects, what you may earn is just a temporary floating profit.

When another black swan arrives, and the scythe falls again, profits are given back, you may still not have outperformed the market. History repeatedly proves that the greed, fear, and anxiety of human nature make it difficult for us to learn from past lessons.

My loss experience tells me that rather than chasing the illusory dream of getting rich in the torrent of information, it is better to learn to accept my limitations — let go of that greedy yet fearful, impulsive yet hesitant heart.

Acknowledging that you are easily swayed by KOLs and take every rumor as truth is the first step toward maturity.

If you cannot accurately grasp the market rhythm, holding BTC (Bitcoin) may be a more prudent choice: while it may not bring dozens of times the floating profit of altcoins, a real profit of one time can at least keep your investment standing firm in the market's storms.

After all, in this uncertain industry, stability often triumphs over risk.

What about you?

In the market frenzy triggered by Trump's words, are you the cheering winner or the bystander in the hellish scene? Perhaps the answer has long been hidden in your attitude toward your position, the market, and yourself.

The charm of the crypto world lies in its unknowns, but precisely because of this, it tests the wisdom and determination of every participant.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。