The current cryptocurrency market has retreated from its frenzy, with retail investors dominating the narrative, leading to increased volatility. However, this market adjustment may create opportunities for long-term investment and new narratives.

Author: Michael Dempsey

Translation: Baihua Blockchain

Today, the cryptocurrency market is at an interesting stage. It has only been 8-12 weeks since the peak of market euphoria, yet news continues to emerge that the governments once most criticized by the crypto market are now choosing to embrace this asset class and its technology. However, despite this, the market is caught in a kind of malaise that I haven't seen in a long time.

The old joke of "developers, do something" now seems rather weak. Because the "developers" have already acted; they have chosen to free the market by removing many restrictions and attacks on the crypto space. Therefore, the future of this industry, frankly, completely depends on us.

So, what exactly has happened? No one can be sure, but here are some of my thoughts from this morning.

1. Macroeconomic Perspective

I do not intend to review the cryptocurrency market trends of the past few months in detail, but I want to say that it is indeed quite interesting to watch the market psychology shift between our president and the factors influencing the market, trending towards moderation.

https://x.com/mhdempsey/status/1878788617004548287

In 2024, many people made money from the so-called "Trump trade," specifically betting that the market underestimated the likelihood of Trump's victory and the subsequent policy changes. However, it now seems that both in the mid-term market overall and in the short-term crypto market, the Trump trade is overbought. Trump's election (and the following weeks) may be a typical "buy the rumor, sell the news" event, after all, Bitcoin soared from the $70,000 range to $106,000 after his victory, and then the market entered a correction phase. Like many situations in the crypto market, the entire market once again ran ahead of reality.

I won't discuss the market trends here too much, but I suggest everyone pay attention to Smac and read his recent articles on volatility and other topics. From a mid-term perspective, I might be slightly more bearish than Smac, but he might be smarter than me, so I recommend checking out his views.

Now, let's talk about something not entirely related to price.

2. Stop Outsourcing Market Narratives to Retail Investors

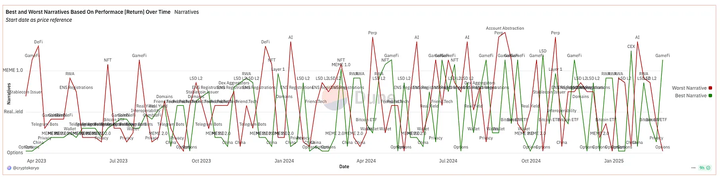

Crypto Market Narrative Dune Dashboard

This may sound a bit strange, but I believe that the crypto market has largely outsourced speculation and narrative building to the smallest participants (individual investors) and those at the very edge of the risk curve. This has led to a chain reaction where those who may not be mature enough and are easily deceived have become the leaders of market narratives, which often spread in the echo chambers of the crypto industry (Crypto Twitter, trader group chats, discrepancies between European and American markets and Asian markets, etc.), before it eventually reaches institutional participants. Moreover, some institutions' investment analysis methods are no different from those of retail investors, which further exacerbates this phenomenon.

These narratives have driven significant price volatility in the market and absorbed a large amount of capital, especially during periods lacking new market participants. Capital rotation occurs almost weekly, with tokens experiencing crazy surges followed by drops of over 80%. This market dynamic neither supports long-term investment nor attracts new capital inflows into the crypto market (aside from BTC), nor does it promote long-term industry building.

I believe what really needs to be done is for project teams to think more proactively about how to position their products in the crypto space. In other words, project teams should actively create new narratives rather than passively catering to existing ones.

Some may think that the only important thing in the crypto market is "gambling"—switching tokens in hopes of making more money. But even within this framework, different narratives can still be built around this core logic.

Typically, the largest projects (L1 and L2) will follow certain market narratives, hoping to drive long-term development through short-term TVL growth. However, the problem is that the adjustment speed of large projects is much slower than that of small projects, so when they finally turn towards a certain narrative, that narrative has often already faded. We recently saw an example with the AI narrative, where TAO captured most of the value early on and successfully shaped that narrative, while subsequent "GPT shell" small projects weakened the impact of that narrative.

We have also seen similar situations in other "X + crypto" concepts, such as:

NFT (Art + Crypto)

Investment DAO (Investment Fund + Crypto)

RWA (Traditional Finance + Crypto)

OHM (Fools + Crypto)

Recently, we have seen the rise of Memecoins on a larger scale ("cultural" speculation + crypto, or the meta-game of narratives + crypto). In the future, we are likely to witness similar cycles continuously.All crypto projects ultimately hope to establish a core user base (commonly referred to as a "community") that aligns ideologically and economically with the project. Based on this, if you are building a project, your goal should be to create an early "propaganda agency" that can spread the narrative. As an organization, foundation, or a small group with funding and influence far exceeding that of retail investors (after all, you have already issued tokens or raised funds), your task is to create a narrative you truly believe in and promote to the market why this narrative is important and why your project can dominate it. Rather than trying to carve out a share in an existing narrative that already has market recognition. Competing is a game for losers, and fighting over existing narratives is particularly difficult.

Bet on the future you believe in and become the "Schelling Point Protocol" for that future.

3. Power Law & Compounders

As an investor involved in areas ranging from venture capital to the crypto market and public market stocks, I have found that there are significant differences in consensus across different markets. Many people like to compare the public market with the crypto market, but there is a core misunderstanding that actually reveals the problems in today's crypto market—this is also why some people (perhaps only me) feel disappointed.

Over the past 5 to 15 years, **public market investors have gradually "discovered" the concept of long-term *compound* growth at the company level, especially that large companies can become larger than anyone expects, accumulating value far beyond market recognition.** These companies typically possess multiple characteristics, such as being able to fully leverage technological waves and having a broad vision from the start. This investment logic means that investing in high-quality companies that can grow steadily over the long term, with relatively controllable pullbacks, is a better choice compared to investing in companies that are highly volatile and may surge but also may retract over 80%.

**In the public market, this trend has made it increasingly difficult for *hedge funds* to survive.** The "Mag7" (referring to Microsoft, Apple, Google, Amazon, Meta, Tesla, Nvidia) and some companies with compound growth characteristics have created significant upward momentum in core indices, making it difficult for hedge funds to outperform the market without taking on higher risks. **As a result, many fund managers have begun to shift towards concentrated investment strategies with long-term holdings, often allocating a certain proportion of Mag7 stocks while claiming to achieve smaller pullbacks during the major *bear market* of 2022** (but the reality is that many fund managers still invested in speculative tech stocks and were ultimately eliminated by the market).

1) The Dilemma of Compound Growth in the Crypto Market

Crypto market hedge funds face similar challenges, especially Bitcoin. Bitcoin (in my view) has a very high risk/reward ratio and encompasses multiple core narratives such as "new currency," "anti-inflation asset," and "crypto market index." Bitcoin often serves as the benchmark index for all liquid crypto asset strategies. **Similar to hedge funds in the public market, many crypto hedge funds perform excellently during market upcycles but essentially rely on *leverage* long strategies, leading to severe pullbacks when the market declines, and their performance in risk-off years is far below that of Bitcoin, ultimately resulting in long-term underperformance against market benchmarks.**

In the crypto market, there have been almost no truly "compound growth" assets in the past, except for L1 public chains like ETH and SOL. This is because infrastructure projects are more likely to achieve long-term growth when expanding horizontally. However, some teams are now trying to break this limitation, but a pending question is: can the existing token economic models support this goal? Or, to truly build a project with compound growth characteristics, should one start from scratch to build a company rather than prematurely launching a token? (This may also be an important reason why project teams should not issue tokens too early.)

2) The Future of Compound Growth Projects

We have many thoughts on this, but in any case, we believe that this market dynamic will change in the crypto space. Some founders are beginning to view their projects as potential compound growth assets and possess broader strategic visions than in past market cycles. This shift is expected to bring more rationality to the crypto market and establish a set of core benchmarks. Currently, the crypto market lacks a batch of assets with good risk-adjusted returns, which forces market participants to choose highly speculative shitcoins and frequent capital rotations. If true compound growth projects emerge, the market investment logic may change accordingly.

4. Conclusion

As Bitcoin and the entire market slowly decline from about $95,000 to $80,000, I reflect on how to build lasting value in the crypto space, a somewhat idealized view that even carries a hint of utopianism, is somewhat ironic. This round of market correction is one of the most orderly sell-offs I have seen recently. However, when you witness the entire industry retreating from "faith," I believe this is precisely the opportunity to establish a new investment framework, shape new narratives, and establish a unique fundamental perspective in the "ruins" left after the market washes away low-confidence investors.

Article link: https://www.hellobtc.com/kp/du/03/5696.html

Source: https://mhdempsey.substack.com/p/february-2025-crypto-notes

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。