Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.8 trillion, with BTC accounting for 59.74%, which is $1.68 trillion. The market cap of stablecoins is $224.1 billion, with a recent 7-day decline of 0.77%, of which USDT accounts for 63.6%.

This week, BTC's price has shown a downward trend, with the current price at $84,020; ETH has also shown a downward trend, with the current price at $2,226.

Among the top 200 projects on CoinMarketCap, most have declined while a few have increased, including: RAY with a 7-day decline of 45.22%, TAO with a 7-day decline of 27.15%, MELANIA with a 7-day decline of 32.18%, PNUT with a 7-day increase of 72.44%, and VANA with a 7-day increase of 41.04%.

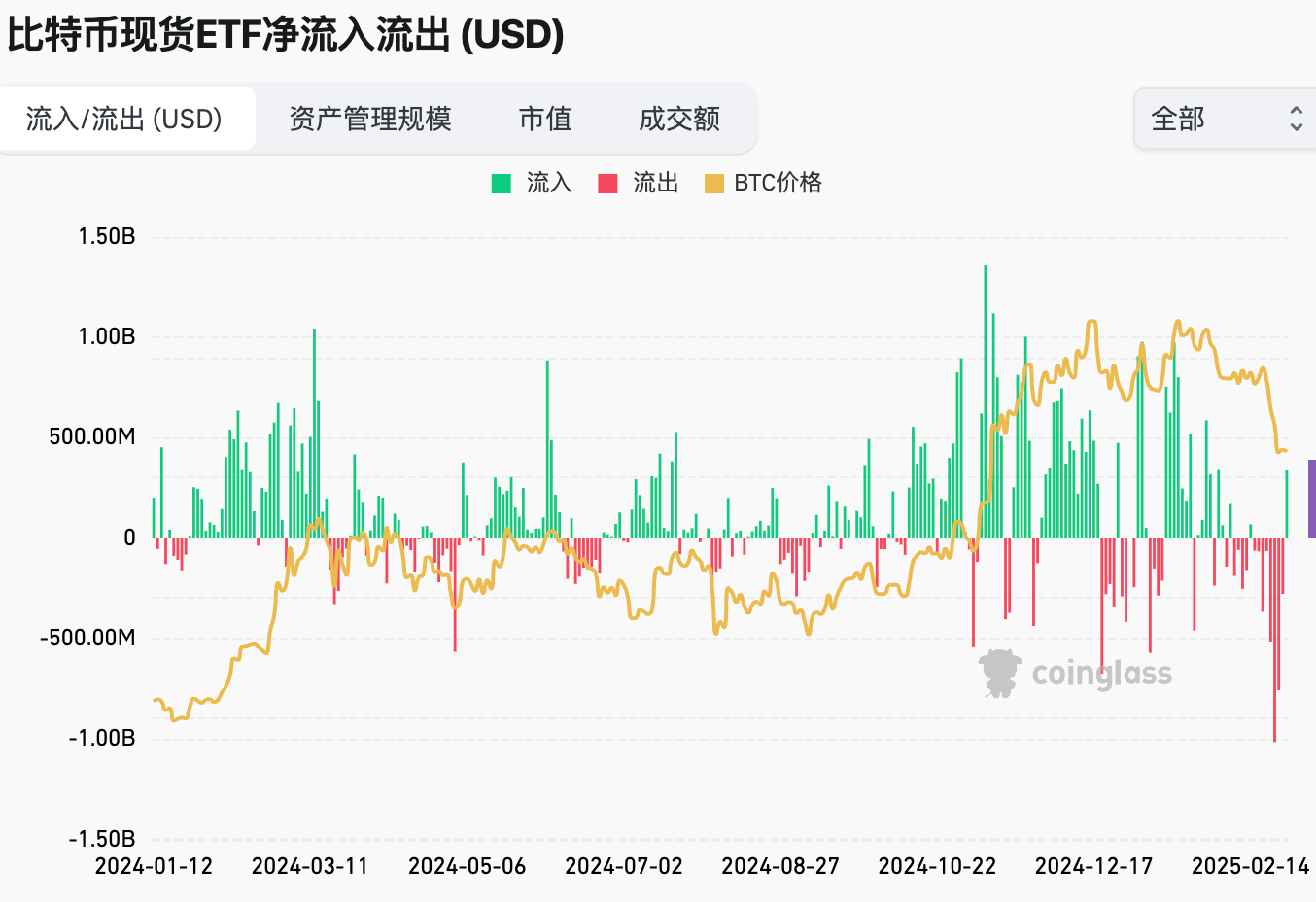

This week, the net outflow from the U.S. Bitcoin spot ETF was $2.146 billion; the net outflow from the U.S. Ethereum spot ETF was $305.3 million.

On February 28, the "Fear & Greed Index" was at 20 (lower than last week), with the sentiment this week being: 3 days of extreme fear, 2 days of fear, and 2 days of neutrality.

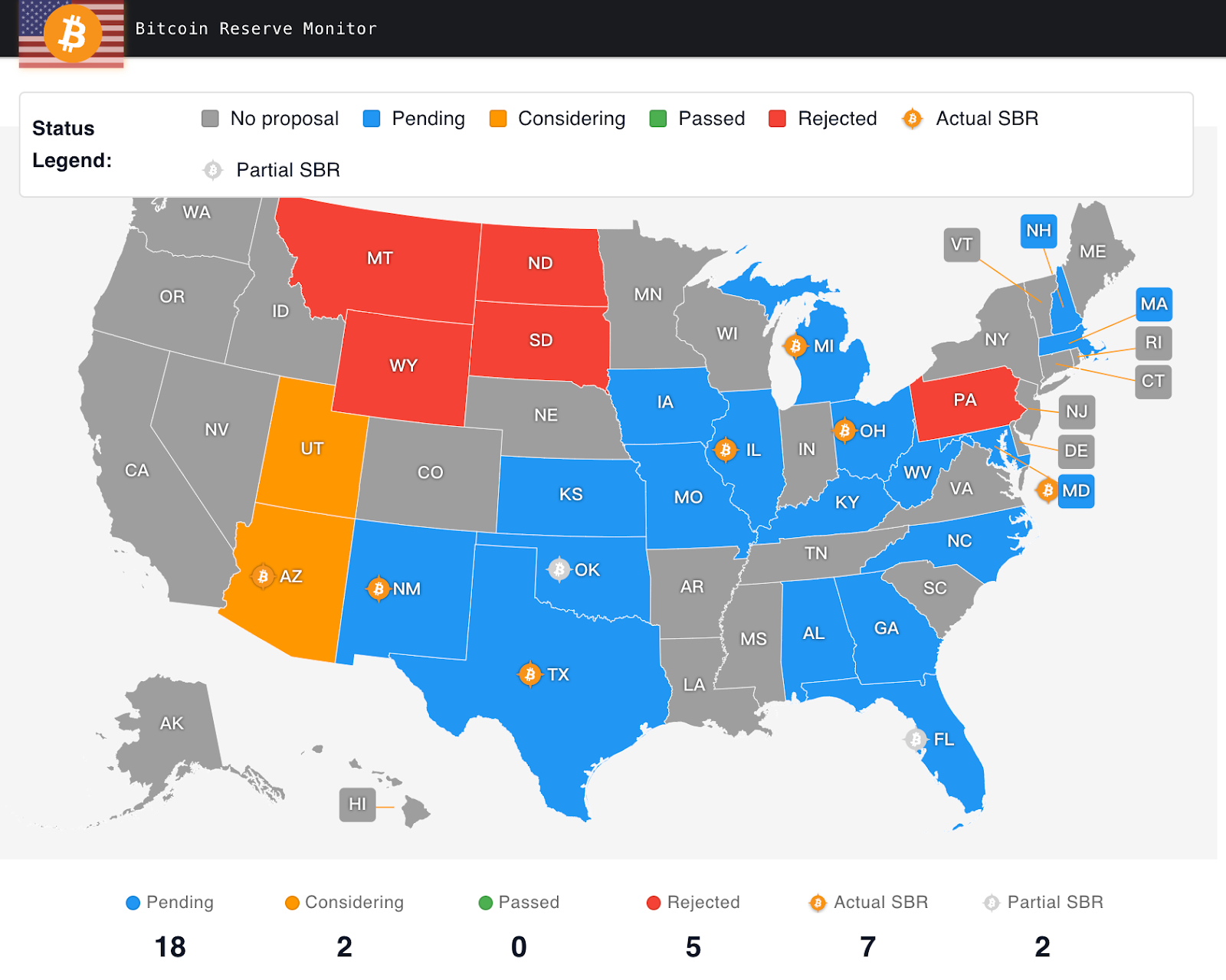

Market Prediction: This week, the market experienced a significant decline, mainly influenced by events such as celebrity coin fraud, increased tariffs in the U.S., the $1.4 billion theft from Bybit, and the upcoming large institutional unlock of SOL. Stablecoins have shown negative growth, and the U.S. spot ETF has seen the largest outflow of the week, with panic sentiment dropping to 10, a level not seen since the Luna crash in 2022. However, amidst extreme panic, crypto whales like Bitdeer are still increasing their BTC holdings. Some positive news includes: regarding the U.S. strategic Bitcoin reserve, 5 states have rejected it, 7 states have passed it, and 18 states are in progress; the January U.S. PCE price index met expectations; the SEC has reached settlements with several crypto companies; and the possibility of a Fed rate cut in June exceeds 81.2%. From this, it can be inferred that a bull market still exists, and we can still expect BTC to reach new highs within this year.

Understanding Now

Review of Major Events of the Week

On February 23, Slow Mist founder Yuxian stated that the hackers behind the CEX theft incident were the North Korean Lazarus Group, revealing their attack methods;

On February 25, crypto research firm Bernstein released an analysis report indicating that "the previous crypto market was forced to turn to 'useless' meme coins to avoid regulatory crackdowns on utility tokens and NFT projects, but with the Trump administration easing regulations, analysts expect liquidity to return to DeFi (decentralized finance), GameFi, and NFT-driven sectors";

On February 25, Bloomberg reported that traditional financial giant Citadel Securities, the largest market maker on the NYSE with a market value of $65 billion, plans to enter the cryptocurrency market-making field, betting that President Trump's support for the crypto industry will bring market prosperity;

On February 26, WSJ reported that the U.S. SEC has dropped its investigation into DeFi company Uniswap Labs;

On February 26, Ethereum Foundation Executive Director Aya Miyaguchi was promoted to Chair of the Ethereum Foundation. Aya Miyaguchi stated that she will uphold Ethereum's values, advocate for diversity, and expand the influence of Ethereum's vision and culture. She is committed to ensuring that Ethereum's technology and social innovations serve human values; in 2013, Aya Miyaguchi was responsible for operations in Japan at the trading platform Kraken. In February 2018, she joined the Ethereum Foundation as Executive Director, mainly responsible for coordinating and organizing the foundation's activities, including internal affairs and community member collaborations, such as education and event hosting;

On February 26, Cointelegraph disclosed that Ohio's "Strategic Bitcoin Reserve Bill" has passed the committee review stage, getting closer to approval;

On February 26, Cointelegraph reported that Solana's SIMD-0228 proposal is now open, aiming to shift SOL issuance to a market-driven model. Voting is expected to take place in about 10 days; the proposal sets a target staking rate of 50% to enhance network security and decentralization. If more than 50% of SOL is staked, the issuance will decrease, thereby suppressing further staking by lowering yields; if less than 50% of SOL is staked, the issuance will increase to raise yields and encourage staking. The minimum inflation rate will be 0%, while the maximum inflation rate will be determined based on the current Solana issuance curve;

On February 26, Cointelegraph disclosed that Ohio's "Strategic Bitcoin Reserve Bill" has passed the committee review stage, getting closer to approval;

On February 27, U.S. President Trump stated that the U.S. will soon announce tariffs on the EU. A 25% tariff may be imposed, applicable to cars and all other goods;

On February 27, market news indicated that Texas's Strategic Bitcoin Reserve Bill has passed the Business and Commerce Committee review stage and will be submitted to the Senate for consideration;

On February 27, BRN analyst Valentin Fournier stated, "President Donald Trump announced a possible 25% tariff on European goods, reigniting investor fears and causing the cryptocurrency fear and greed index to drop to 10, in the extreme fear zone.

While some are concerned about the start of a bear market, history shows that a 25% pullback is common in bull market cycles, and the U.S. efforts to establish a national cryptocurrency reserve remain an important long-term catalyst. We maintain a bullish stance and expect the market to rebound before the end of the week. We continue to accumulate Solana and maintain a neutral stance on BTC and ETH;On February 28, according to Spot on Chain monitoring, the Bybit hacker has successfully laundered 50% of the stolen ETH. In the past 5.5 days, the Bybit hacker has laundered a total of 266,309 ETH (approximately $614 million), accounting for 53.3% of the 499,000 ETH stolen, averaging 48,420 ETH laundered per day, mostly converted to BTC through THORChain. At the current rate, the remaining 233,086 ETH could be fully laundered in just 5 days.

On February 28, Reuters reported that Trump clarified the timing for the enforcement of punitive tariffs on Canadian and Mexican goods: starting March 4, a 25% tariff will be imposed on goods from Mexico and Canada, while the April tariff adjustments involve a "reciprocal tariff" policy. Additionally, Trump threatened to impose a further 10% tariff on Chinese goods.

On February 28, Nir Kaissar, head of asset management firm Unison Advisors, believes that Trump may force the Fed to lower interest rates through fiscal tightening;

On February 28, market news indicated that the U.S. SEC has announced the termination of civil enforcement actions against Coinbase.

Macroeconomics

On February 18, the Reserve Bank of Australia lowered the benchmark interest rate by 25 basis points to 4.10%, marking the first rate cut since November 2020 and the lowest since October 2023, in line with market expectations. The AUD/USD pair briefly rose nearly 20 points, currently reported at 0.6346;

On February 27, CoinDesk reported that the U.S. SEC, Tron Foundation, and Justin Sun submitted a joint motion on Wednesday requesting a federal judge to pause the lawsuit against Justin Sun and his company Tron. This motion is similar to the SEC's request for a pause in the Coinbase and Binance cases, with all parties indicating they are working towards potential resolutions;

On February 28, the U.S. January core PCE price index year-on-year was 2.6%, in line with expectations of 2.6%, down from the previous value of 2.8%;

On February 28, the U.S. SEC's Corporate Finance Regulatory Division released guidance on meme coins, stating that they do not fall under securities but are similar to collectibles;

On February 28, according to Reuters, the Chicago Mercantile Exchange will launch Solana (SOL) futures on March 17, along with micro SOL futures, providing investors with regulated exposure to Solana;

On February 28, market news indicated that the U.S. SEC has announced the termination of civil enforcement actions against Coinbase;

On March 1, according to information from the SEC's official website, the U.S. SEC has postponed the approval of Fidelity's spot Ethereum ETF options.

ETF

According to statistics, from February 24 to February 28, the net outflow from the U.S. Bitcoin spot ETF was $2.146 billion; as of February 28, GBTC (Grayscale) has seen a total outflow of $22.249 billion, currently holding $16.567 billion, while IBIT (BlackRock) currently holds $48.728 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $99.12 billion.

The net outflow from the U.S. Ethereum spot ETF was $305.3 million.

Envisioning the Future

Event Preview

ETHDenver 2025 will be held from February 23 to March 2, 2025, in Denver, USA;

Crypto Expo Europe will take place from March 2 to 3, 2025, in Bucharest, Romania;

Digital Asset Summit 2025 will be held from March 18 to March 20, 2025, in New York, USA;

Southeast Asia Blockchain Week 2025 will be held from March 30 to April 5, 2025, in Bangkok, Thailand;

The 2025 Hong Kong Web3 Carnival will take place from April 6 to 9, 2025, at the Hong Kong Convention and Exhibition Centre, Hall 5BCDE.

Project Progress

The airdrop appeal deadline for the AI smart layer Rivalz Network is March 5;

The Ethereum testnet Sepolia plans to activate the Pectra upgrade on March 5. If the public testnet upgrade goes smoothly, Pectra will launch on the Ethereum mainnet on April 8;

The AI-based cryptocurrency data analysis platform Kaito AI has announced that it is open for ANIME claims to eligible ANIME yapprs and Kaito Genesis NFT holders, with claims open until March 9.

Important Events

11.2 million SOL from the FTX bankruptcy auction will be unlocked on March 1, valued at approximately $2.06 billion. FTX previously sold 41 million SOL in three auctions, with the top three buyers and auction prices as follows: Galaxy (purchased 25.52 million SOL at an average price of $64, with a return rate of 187%), Pantera and other buyers (purchased 13.67 million SOL at an average price of $95, with a return rate of 93%), Figure and other buyers (purchased 1.8 million SOL at an average price of $102, with a return rate of 80%);

A dual national man from China and Saint Kitts and Nevis involved in a $7.36 million cryptocurrency pig-butchering scheme will be sentenced in the U.S. on March 3, 2025;

All customer accounts and custodial assets of DMM Bitcoin will be transferred to the cryptocurrency exchange SBI VC Trade on March 8. Previously, DMM Bitcoin was attacked in May 2024, resulting in a loss of $304 million.

Token Unlocking

Sui (SUI) will unlock 22.97 million tokens on March 1 at 8:00, valued at approximately $7.877 million, accounting for 0.74% of the circulating supply;

ZetaChain (ZETA) will unlock 44.26 million tokens on March 1 at 8:00, valued at approximately $1.473 million, accounting for 6.48% of the circulating supply;

Alchemy Pay (ACH) will unlock 116 million tokens on March 7, valued at approximately $3.74 million, accounting for 1.17% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We build a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-weather market volatility monitoring. Combined with our weekly live strategy broadcasts of "Hot Picks" and daily news updates of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Relying on cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch X: x.com/Hotcoin_Academy Mail:labs@hotcoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。