In the afternoon, I kept looking at the data and didn't see anything particularly meaningful. However, from the perspective of Bitcoin's open interest, the current open interest has dropped to the level of September 2024, when the price of $BTC was around $64,000. This time, the leverage clearing is quite high. Whether BTC's price can continue to rise and whether Q1 is worth looking forward to depends, in my opinion, on several key factors:

To conclude, I still have a positive outlook for Q1.

On March 4, the U.S. officially imposed a 25% tariff on Canada and Mexico, which may cause some fluctuations in sentiment, particularly regarding expectations of rising inflation in March. This may not be favorable for the overall risk market.

On March 7, the U.S. non-farm payroll data will be released, focusing on the unemployment rate, employment numbers, and wage growth.

aa: If the unemployment rate rises significantly, it may increase the recent sentiment of trading recession.

ab: A decrease in the unemployment rate may counteract the Fed's interest rate cuts. Although the first data for rate cuts is already the housing inflation index, the unemployment rate remains a key focus for the Fed.

An increase in the unemployment rate may lead the Fed to consider more rate cuts, which also indicates a decline in the U.S. economy. Therefore, significant increases or decreases are not good for the current situation. Maintaining expectations near the previous values with slight fluctuations is relatively good. If there is indeed a direction, a decrease would be better than an increase, as it represents a strong economy.

b: Employment numbers are essentially similar to non-farm data, but overall, an increase in non-farm employment numbers would be favorable.

c: Wage changes follow the same logic; continued wage increases indicate a good economic situation, while wage decreases indicate the opposite.

Therefore, from the non-farm data perspective, maintaining the current market expectations would be good. Not having too much volatility would actually be a good thing, as the main impact of non-farm data will be on the U.S. stock market, followed by cryptocurrencies.

On March 8, Trump will hold a cryptocurrency summit at the White House. The content of the discussion is currently uncertain, but it is likely to focus on stablecoins and may involve the progress of Bitcoin's strategic reserves. If possible, adjustments to electricity prices, the application of national sovereign funds, and even RWA may be part of the summit discussions.

One could even speculate that since it is a summit and many industry professionals have been invited, there may be discussions and Q&A sessions, which could be a positive addition.

These three events will be the key highlights of the first week of March. In my personal ranking, the cryptocurrency summit definitely has the most weight. Even if the non-farm data is slightly unfavorable, it may be offset by the positive effects of the summit, alleviating the negative sentiments from macroeconomic factors and tariffs.

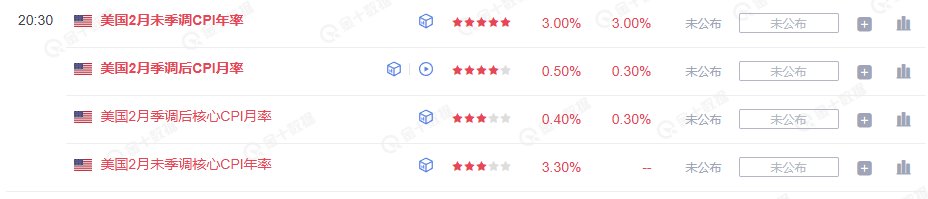

In the second week of March, there will be two important data releases on the 12th and 13th, namely CPI and PPI, with CPI being the focus. After all, the general public does not differentiate too much about what inflation is, and CPI represents inflation. Therefore, a decrease in CPI will emotionally lead investors to interpret it as a decrease in inflation.

Currently, the market expectation is below the previous value, and if this can be achieved, it will undoubtedly be favorable for market sentiment.

The third week of March also has important meetings on consecutive days. On the 19th, the Bank of Japan will hold a monetary policy press conference. The probability of Japan continuing to raise interest rates in March is very low, but if they unexpectedly choose to raise rates, it would still negatively affect market sentiment. However, it is indeed very likely that there will be no adjustments. The next day, on the 20th, is the U.S. interest rate meeting.

The focus of this interest rate meeting will be the dot plot. The dot plot has been discussed many times, and the conclusions are almost threefold:

a. Maintain the expectation of two rate cuts in 2025, which would have a relatively small negative impact on sentiment, especially with the expectation of tariffs.

ba. The expectation of rate cuts in 2025 being greater than two would have a significant positive impact on sentiment, indicating that Fed officials believe multiple rate cuts would be beneficial for the U.S. economy and inflation.

bb. Some may ask if the Fed considers the probability of economic recession increasing and increasing the number of rate cuts is good or bad. In my personal view, even if the Fed has such expectations, it is unlikely that Powell will express unfavorable expectations for the economy, such as economic recession. If a reporter asks, he would likely say, "We will pay attention to economic trends," so the rationale for increasing rate cuts is unlikely to be based on expected recession, especially since the U.S. economy is still doing well.

c. If the number of rate cuts in 2025 is less than two, it may have a greater negative impact on sentiment, as it would mean maintaining high interest rates for a longer period.

However, if the Fed truly anticipates economic danger, the probability of option c is still quite low. Whether it is option a or b will depend on recent economic data, such as PMI, retail data, etc.

There is currently no meaningful discussion for the fourth week of March, as the dot plot may serve as a dividing line for the general direction of Q2. Further analysis will have to wait until the dot plot is released.

Summary:

In summary, the recent decline in Bitcoin is mostly related to Trump's tariff policy, which affects inflation, and inflation impacts the number of rate cuts by the Fed. Therefore, the dot plot in March is the key focus of the game. The additional White House cryptocurrency summit is likely to be favorable for the industry. I don't believe Trump will make statements unfavorable to BTC at the summit, and after all, it's just talk. Although investors have already anticipated Trump's "verbal support," this is the first time a president has held a cryptocurrency summit at the White House, so there is still some reason to look forward to it.

My personal approach is that I did not choose to bottom fish when it fell below $80,000 because investor sentiment was too tense. The core PCE data and the Russia-Ukraine conflict have already allowed investors to start relaxing from a tense state, and the cryptocurrency summit also contributes to this emotional relaxation.

(From a god's perspective, bottom fishing might be correct, but unfortunately, I am just a mortal.)

Therefore, before March 20 in Q1, I still maintain an optimistic outlook. I have high expectations for Q1, as I mentioned before, the difficulty of Q1 still seems quite low from the current perspective. As for whether there will be new highs, I am not sure; it depends on the accumulation of events.

The best expectations are good non-farm data, a successful cryptocurrency summit, favorable CPI and PPI data, a dot plot greater than 2, and the end of the Russia-Ukraine conflict. If all these align, it is possible. However, if things do not go in the best direction, it will naturally be difficult to continue breaking new highs.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。