Key Highlights

● The market continues to decline, and the U.S. stock market is similarly affected, primarily due to concerns over Trump's tariff policies and the latest unemployment data indicating a worsening economic situation. Bitcoin ETFs experienced the largest outflow of funds to date on Tuesday.

● The best-performing tokens are KAITO, VINE, and CHILLGUY, with increases of 45.7%, 30.1%, and 17.9%, respectively; while the worst performers are RAY, BROCCOLLI, and SOL, with declines ranging from 26.2% to 53.5%.

● In the trading strategy section, we will analyze the macroeconomic situation and attempt to answer: What are the signals of a market bottom? How to seize the buying opportunity during a $BTC pullback?

Data Overview

Best Performing Tokens

● $KAITO (+45.7%): As a newly listed token, KAITO has strong team support and currently stands out the most.

● $VINE (+16.28%): Vine is a social experiment meme coin initiated by its actual founder, aiming to gain support from Elon Musk. It is well-known that this goal has not yet been achieved—we believe this is more like a near-death rebound phenomenon.

● $CHILLGUY (+17.9%): Although Chillguy is in a loss state, it is still the third-best performing token on the BitMEX platform.

Poor Performing Tokens

● $RAY (-10.6%): Raydium fell over 50% due to its largest partner pump.fun announcing plans to establish its own decentralized exchange.

● $BROCCOLLO (-47.0%): Even CZ's dog cannot withstand this round of market crash.

● $SOL (-26.2%): With a large-scale unlocking coming in March, SOL continues to decline, becoming the worst-performing token among major layer one public chains.

Market News

Macroeconomics

● ETH ETF weekly outflow: -$242 million (source)

● BTC ETF weekly outflow: -$2.45 billion (source)

● Unemployment claims rise to 242,000, a three-month high (source)

● Trump threatens to double tariffs on China and states that punitive tariffs against Mexico and Canada will take effect on March 4 (source)

● SEC publishes stance on meme coins, echoing Hester Peirce's comments (source)

● Pakistan to establish a committee to regulate cryptocurrency policy: report (source)

● Hackers steal $1.5 billion from Bybit exchange, becoming the largest cryptocurrency theft in history (source)

● Infini suffers a $50 million loss due to an attack (source)

● Metaplanet seeks to raise over $13 million through bond sales to acquire more Bitcoin (source)

● SEC ends investigation into Gemini, Cameron Winklevoss seeks compensation (source)

Project Updates

● Aya Miyaguchi of the Ethereum Foundation leaves the executive director position to become president (source)

● SEC dismisses lawsuit against MetaMask developer Consensys (source)

● MetaMask will allow users to hold Bitcoin and Solana in wallet innovations (source)

● Blockchain restaurant loyalty app Blackbird launches alongside Flynet mainnet (source)

● PayPal-backed Raise secures $63 million in funding to expand blockchain-based gift card system (source)

● Crypto asset management firm Bitwise strengthens balance sheet with $70 million equity raise (source)

Trading Strategy

Note: The following content does not constitute financial advice. This is merely a compilation of market news, and we encourage you to conduct your own research before executing any trades. The following content does not represent any guaranteed returns, and BitMEX assumes no responsibility if your trades do not perform as expected.

Macroeconomic Factors and Bottom Signals Behind Bitcoin's Plunge

Bitcoin has recently plummeted sharply from a high of nearly $110,000 in mid-January to below $80,000, causing panic among many traders and retail investors. Many fear that the bull market has ended, while others are looking for signals that the market is about to bottom out. This article will explore the macroeconomic factors driving Bitcoin's recent decline and analyze potential signals indicating that the market is nearing a bottom.

Macroeconomic Factors

Uncertainty in Trump's Policies and Trade War Risks

● After Trump's victory in the 2025 U.S. election, the market initially had high expectations for his crypto-friendly policies, leading to a brief rise in risk assets, including Bitcoin.

● However, Trump's trade policies, particularly high tariffs and protectionist measures, quickly changed market sentiment. Investors began to worry that a new round of trade wars could negatively impact global economic growth and raise inflation.

● The result was a massive outflow of funds from higher-risk assets like Bitcoin, with Bitcoin ETFs recording the largest net outflow in history this week.

Federal Reserve's Hawkish Monetary Policy

● Despite earlier market expectations for interest rate cuts, the Federal Reserve maintained a hawkish stance in the face of persistent inflation and strong employment data.

● The high-interest-rate environment increased the opportunity cost of holding non-yielding assets like Bitcoin, leading investors to shift funds toward more stable assets that can generate interest income.

● This tightening of monetary policy reduced market liquidity and caused Bitcoin prices to retreat as institutional investors and large funds reassessed their risk exposure.

Concerns Over Economic Slowdown and Stagflation

● Economic indicators show a slowdown in growth, raising concerns about potential stagflation (economic stagnation accompanied by high inflation).

● As these concerns spread, investors turned to safer assets, moving away from high-risk investments like Bitcoin.

● Ongoing inflation worries and economic stagnation continued to weigh on market sentiment, making investors reluctant to re-enter the Bitcoin market until macroeconomic conditions improve.

Stock Market Bubble and Spillover Effects

● The recent decline in the stock market, particularly in the tech sector, has had a ripple effect on Bitcoin.

● When risk appetite is low, Bitcoin prices often correlate with the broader stock market. Concerns over overvalued stocks leading to sell-offs in the stock market have also caused Bitcoin to experience similar declines.

● When investors withdraw from risk assets, Bitcoin is influenced by broader market sentiment, even though it is a unique asset class.

Summary: Trump's trade policies, the Federal Reserve's hawkish stance, concerns over economic slowdown, and stock market instability have collectively created a macroeconomic environment that exerts significant downward pressure on Bitcoin prices.

Bottom Signals

Although the current decline in Bitcoin can be attributed to these macroeconomic factors, investors can focus on several potential bottom signals. Understanding these signals can help retail traders seize entry opportunities as the market approaches a bottom.

Extreme Fear Levels in Market Sentiment

● The Fear and Greed Index is a powerful tool for measuring cryptocurrency market sentiment. When the index enters the "extreme fear" zone, it often indicates that the market may be oversold and a reversal could be imminent.

● Currently, the index is in the extreme fear zone, suggesting that investors are overly pessimistic. Historically, when sentiment reaches this level, it often marks the moment when Bitcoin prices begin to stabilize and rise again.

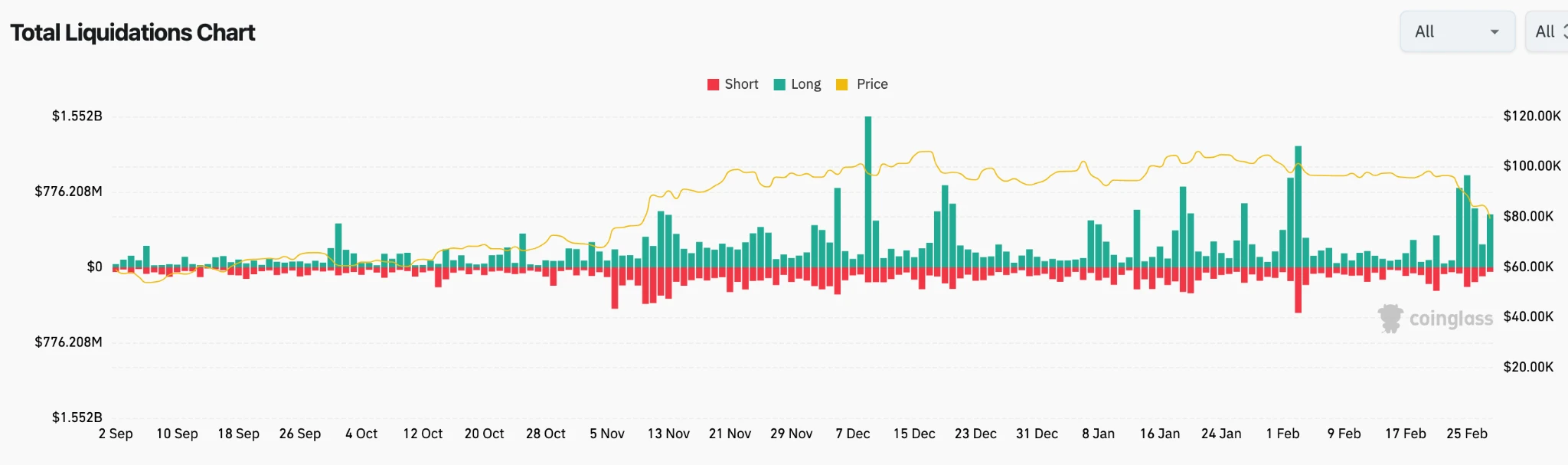

Large-Scale Liquidations and Deleveraging

● The cryptocurrency derivatives market has seen a significant number of leveraged positions liquidated as Bitcoin prices fall. When a large number of leveraged positions are liquidated, it creates additional downward pressure but may also indicate that the market is nearing a capitulation point.

● Once these liquidation waves recede and positions are cleared, it typically marks the end of panic selling, making the market environment more conducive to price recovery.

Technical Support Levels and Price Action

● Historically, Bitcoin tends to form solid support at psychologically significant price levels, such as $80,000 or $70,000.

● If Bitcoin prices approach these levels and show signs of consolidation or reversal, it may indicate that the market is searching for a bottom. Investors should pay attention to candlestick patterns, such as bullish engulfing patterns or candles with long lower wicks, which may suggest that buyers are gradually entering the market.

Macroeconomic Indicators: Fed Policy Shift or Easing Signals

● A key signal for a market bottom is a shift in Federal Reserve policy. If the Fed hints at pausing interest rate hikes or even cutting rates, it could drive funds back into risk assets like Bitcoin.

● Signs of slowing inflation or growth in key economic sectors could also reverse market sentiment, triggering a Bitcoin rebound.

● The market tends to reflect future policy changes in advance, so even subtle shifts in the Fed's stance could lead to significant volatility in Bitcoin prices.

Arthur Hayes Liquidity Indicator: Reverse Repurchase Agreements (RRP)

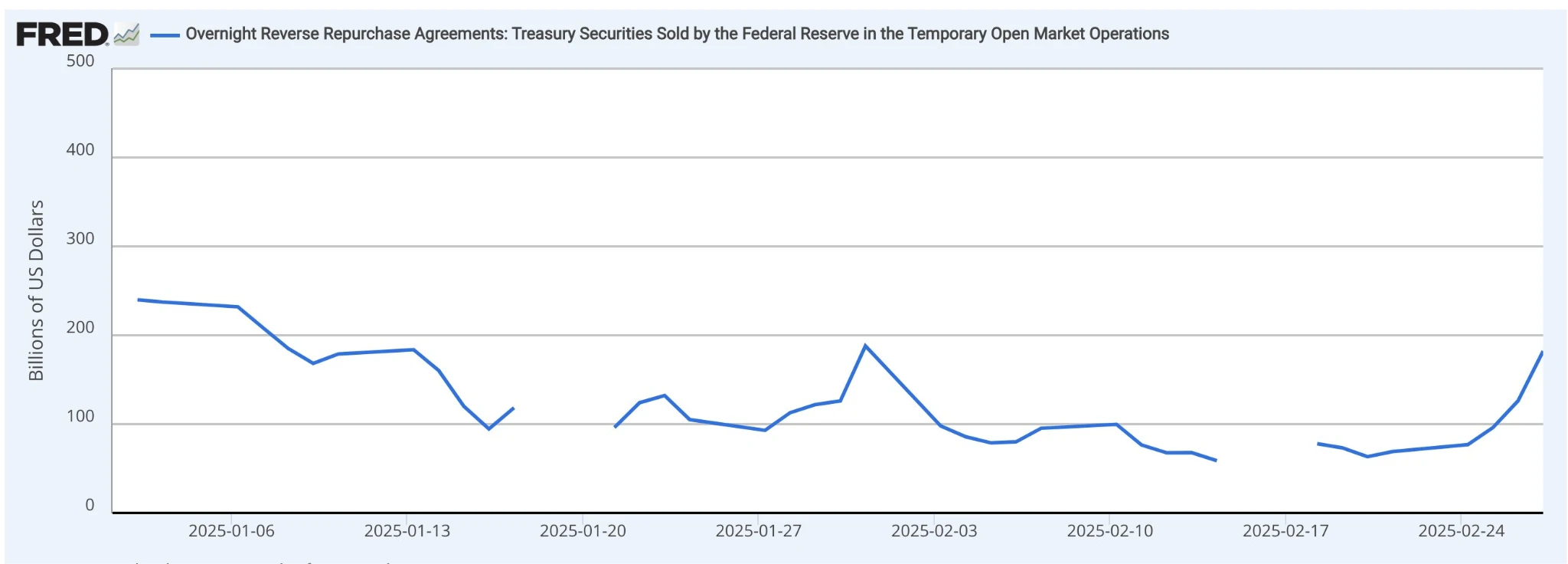

● Arthur Hayes emphasizes that "Reverse Repurchase Agreements (RRP)" are a key liquidity indicator. High RRP balances indicate that banks are holding cash rather than investing, typically occurring during periods of tightening monetary policy.

● A decline in RRP balances suggests that liquidity is returning to the market as banks begin to deploy reserves into risk assets like Bitcoin.

● A decrease in RRP balances may signal a market bottom, presenting a good opportunity to enter Bitcoin before a rebound begins.

Historical Lessons: When Has Bitcoin Rebounded from a Bottom?

Studying historical patterns can provide valuable insights into when Bitcoin may hit a bottom.

2018 Bear Market: Trade War and Rate Hike Cycle

● In 2018, the dual pressures of the U.S.-China trade war and the Federal Reserve's aggressive rate hikes caused Bitcoin to plummet from $20,000 to around $3,000, a decline of over 80%.

● The market only found a bottom in early 2019 when the Fed paused rate hikes and economic conditions improved.

● This indicates that when macroeconomic conditions improve (such as lower interest rates and improved trade relations), Bitcoin tends to recover rapidly.

2022 Bear Market: Soaring Inflation and Fed's Aggressive Rate Hikes

● In 2022, rising inflation and the Fed's active tightening of monetary policy led Bitcoin to drop from a high of $69,000 to around $20,000 by the end of the year.

● The market found a bottom when the Fed slowed its rate hikes and inflation showed signs of peaking. Bitcoin rebounded from $16,000 and reached new highs in 2023.

● This highlights that when inflationary pressures ease and monetary conditions loosen, Bitcoin often experiences a bottom reversal.

Experience Summary: When Bitcoin faces significant downward pressure from macroeconomic factors (such as rate hikes and trade tensions), the market typically undergoes severe adjustments. However, once these factors improve, Bitcoin often reverses quickly, marking the beginning of a new bull market.

Future Outlook: When Will Bitcoin Hit a Bottom?

While Bitcoin prices are currently under pressure, several signs indicate that the market may be approaching a bottom.

Short-Term Further Downside Risk

● Bitcoin may still have room to decline in the near term. Key price levels to watch are around $80,000 and $70,000, which have previously shown significant support.

● If Bitcoin falls below these levels and fails to recover, the next major support level may be at $60,000. However, even if Bitcoin declines further, it could still present an excellent buying opportunity for long-term investors.

Recovery Signals: Macroeconomic Condition Changes

● A shift in the macro environment, particularly changes in Fed policy, could serve as a catalyst for Bitcoin's recovery. If the Fed hints at pausing or slowing rate hikes, Bitcoin is expected to find strong support and begin to rebound.

● Similarly, positive improvements in trade relations or easing geopolitical tensions could help restore market confidence.

Long-Term Outlook: Bullish Fundamentals

● Despite the current downturn, Bitcoin's long-term fundamentals remain strong. With Bitcoin's scarcity, institutional adoption, and the continued development of global government Bitcoin strategic reserves, Bitcoin remains a strong candidate for long-term growth.

Retail Investor Guide: Identifying Bottoms and Risk Management

Dollar-Cost Averaging: Avoid Full Positioning at Once

● Precisely timing the market bottom is difficult, so consider dollar-cost averaging.

● Diversify investments by purchasing at different price levels during Bitcoin's continued decline. This can average the entry price and reduce the risk of missing the market bottom.

Monitor Key Indicators and Look for Confirmation Signals

● Pay attention to the Fear and Greed Index; when it reaches the "extreme fear" zone, it may signal potential buying opportunities.

● Closely monitor macro indicators, such as the Fed's stance and inflation data, to assess when the market may turn bullish again.

Risk Management: Position Control and Stop-Loss Strategies

● Only invest funds you can afford to lose. If trading in the short term, use stop-loss orders to protect against larger losses.

● Avoid using leverage in uncertain markets and ensure your portfolio is sufficiently diversified.

Stay Rational and Patient

● Do not let fear drive your decisions. Historically, when the market reaches a panic bottom, it often recovers quickly.

● Trust in Bitcoin's long-term fundamentals and hold your positions through volatility.

Conclusion

The recent plunge in Bitcoin is primarily driven by macroeconomic factors such as Trump's trade policies, the Fed's hawkish stance, and concerns over economic slowdown. However, historical patterns suggest that once these factors improve, Bitcoin may find a bottom and begin to recover. For retail investors, identifying bottom signals is crucial, such as extreme fear, the end of liquidation waves, and key technical levels. By remaining patient and managing risks, investors can prepare for significant gains following a Bitcoin rebound.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。