Author: Frank, PANews

In a single week, $1 billion in staked funds has fled, and daily active users have plummeted by nearly 60%—the Solana ecosystem is facing its most severe test in the past six months. With platforms like Pump.fun dumping over $600 million in tokens and major validators losing confidence in staking due to the SIMD proposal, combined with the vacuum left by the waning MEME craze, the SOL token has plunged 57% in 40 days, leading the decline among mainstream coins.

As on-chain data anomalies intersect with a market sell-off, how will this public chain giant, once seen as an "Ethereum killer," navigate the dual stranglehold of ecological reconstruction and capital flight to survive?

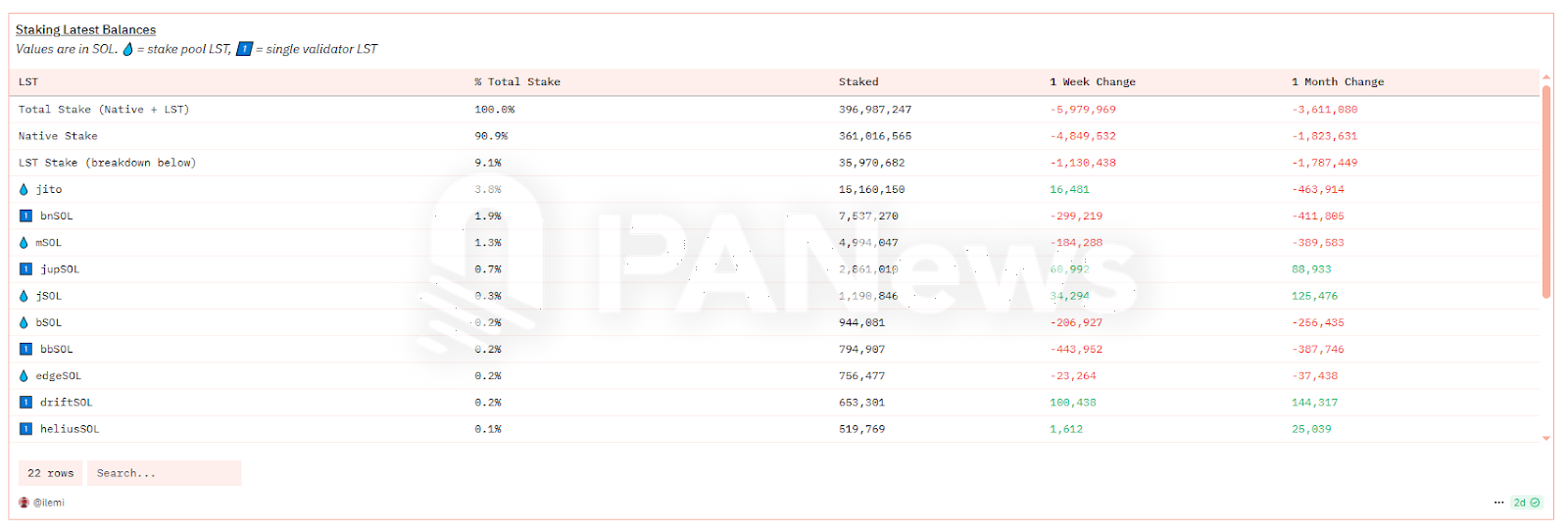

Accelerated Staking Exodus: $1 Billion in Funds Flee in a Week

In the past week, the amount of staked tokens on the Solana chain has decreased by 5.97 million, with a reduction of 3.61 million over the past month. This indicates that many large stakers have begun to withdraw their SOL funds to avoid the risk of further declines. The weekly decrease is approximately 1.5%, amounting to about $1 billion in staked funds.

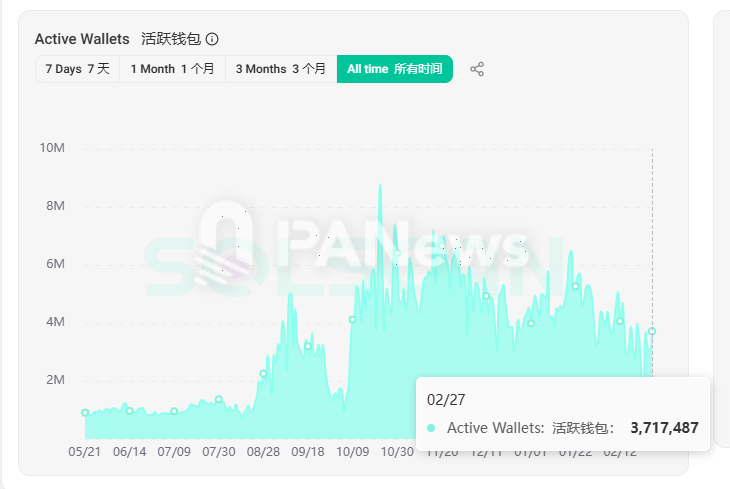

From the changes in the Solana network, on February 23, there was a dramatic shift, with daily active users and new wallet numbers dropping by about 90% on that day before returning to normal levels. This sharp fluctuation was likely caused by a collective failure or shutdown of certain trading bots on the chain, which also exposed the issue of an excessively high proportion of bots in the Solana network.

As of February 28, data shows that the current level of active users has significantly decreased compared to the peak in October last year. On October 22, the number of daily active addresses reached a high of 8.78 million, while the data on February 27 dropped to 3.71 million, a decline of about 58%.

Five Major Whales Concentrated Sell-off: $317 Million in Tokens Impacting the Market

Recently, several large SOL holders have chosen to sell their tokens or unstake them. PANews has conducted an incomplete statistical analysis based on information exposed on social media. Five whales sold approximately 2.09 million SOL in a short period, valued at about $317 million, with an average selling price of around $151.

Among them, the address AMekyY73RJBd4urgZ2HvWV8yFzvk4nRsGmahuJcWiQri unstaked a total of 236,000 SOL, of which only 60,000 have been sold so far, leaving uncertainty about whether the remaining tokens will be sold in the near future.

In addition, Pump.fun has also been a major force in on-chain selling. As of February 28, Pump.fun has sold approximately 3.02 million SOL tokens, cashing out a total of about $610 million. In the past month, Pump.fun sold a total of 440,000 SOL, valued at about $78.39 million. This has exacerbated the already panicked market.

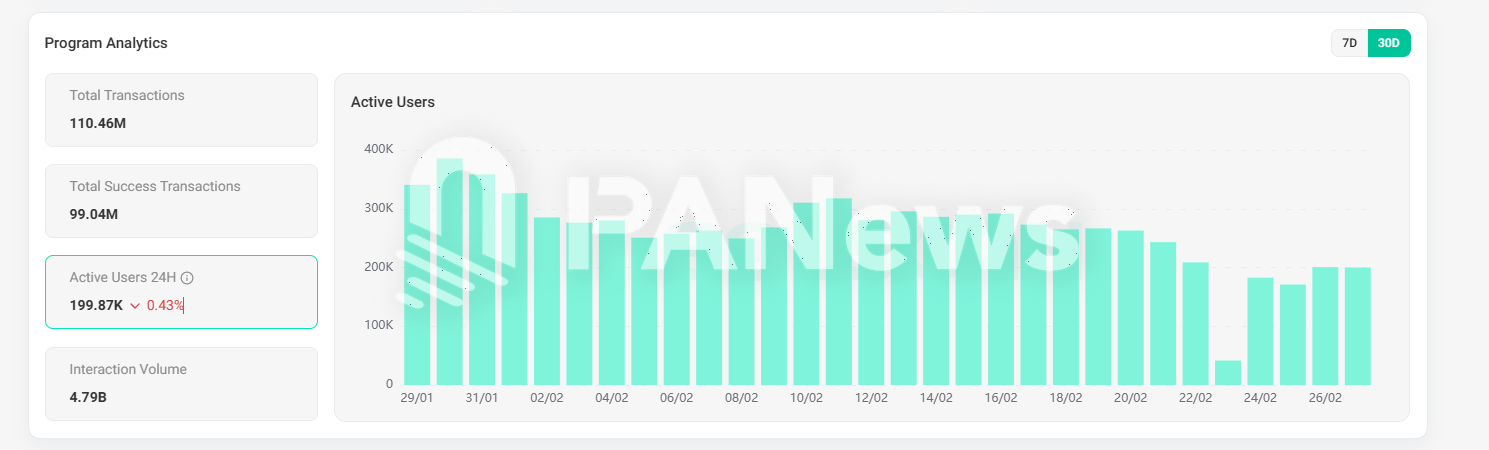

However, with the decline in MEME popularity, various metrics for Pump.fun have also been continuously declining. On February 23, the number of active users on Pump.fun dropped to a low of 41,000, recovering to around 180,000 the next day. Overall data has decreased by more than half in the past month.

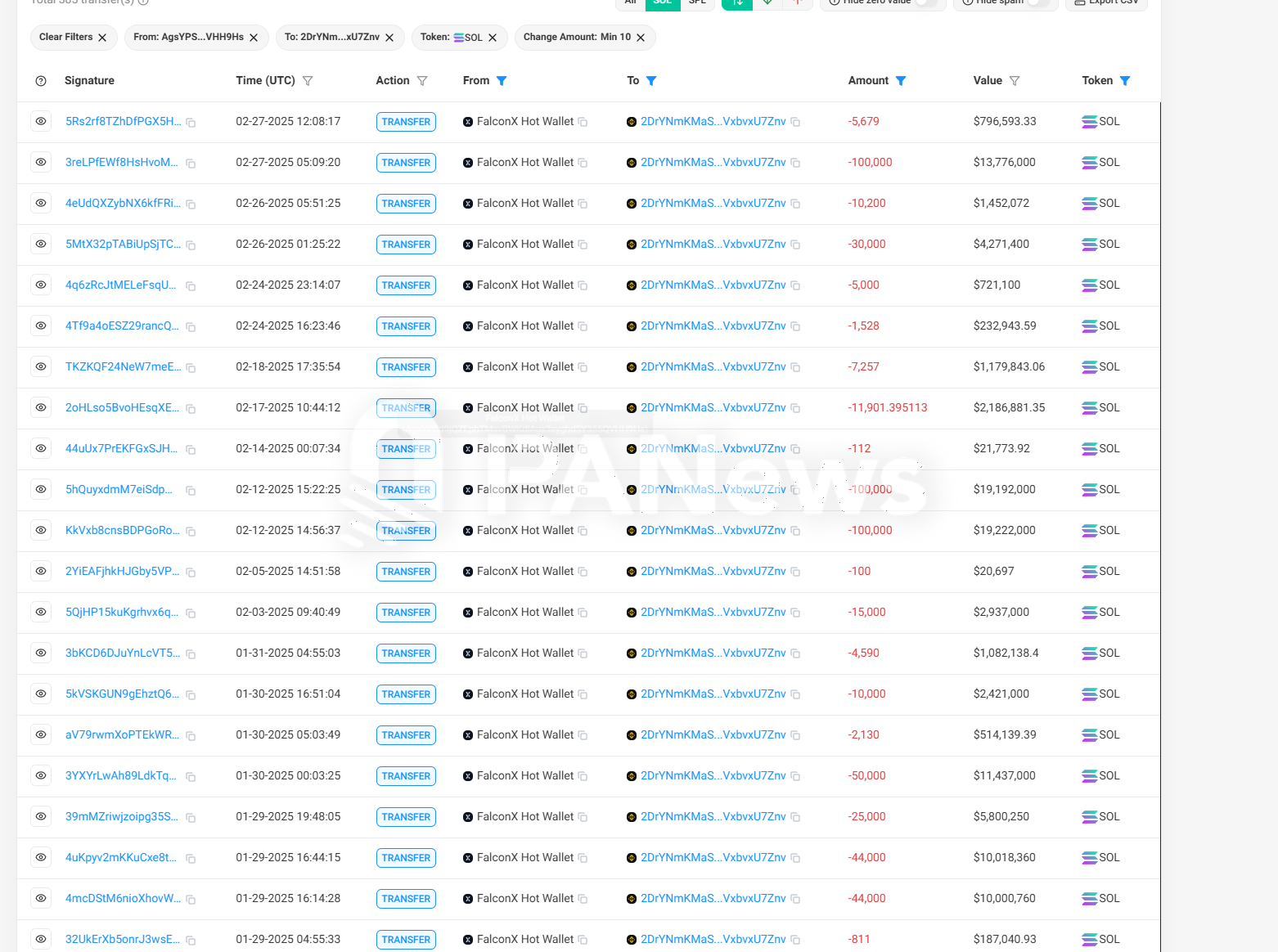

Cryptocurrency brokerage FalconX has also been an important channel for large holders to exit. According to PANews statistics, in February, the amount of SOL tokens transferred from FalconX to Binance reached 386,700, valued at about $66 million. However, further research reveals that large holders seemed to have started exiting as early as January, with 1.37 million SOL transferred from FalconX to Binance in January, valued at $315 million, with an average transfer price of about $229. This figure is significantly higher than in other months.

Of course, while some are leaving, others are rushing in. On February 27 and 28, a large holder with the address EhuKBFXyUYgwc4nUMJMQHjY4A7w5nTTrMtY6z4TtZSFK bought 83,000 SOL tokens, spending a total of $10.88 million, with an average entry price of about $134.

SIMD Proposal Impact: Staking Rewards Shrink Triggering Validator Panic

Overall, however, the incoming funds are still in the minority, with the majority being large sellers. The main reasons for this, aside from the overall macroeconomic changes causing turbulence in the financial markets, also include uncertainties within the Solana ecosystem itself. The recently launched SIMD-0228 proposal aims to modify the issuance curve of SOL tokens, reducing the inflation rate at the cost of lowering staking rewards. Therefore, for many large validator nodes, this has become a significant source of uncertainty in the short term. (Related reading: Solana's Inflation Revolution: SIMD-0228 Proposal Sparks Community Controversy, Hidden "Death Spiral" Risks Behind 80% Increase)

Amid internal and external pressures, both Solana's ecological data and token market prices are facing dual pressure. As of the afternoon of February 28, the price of SOL has dropped 57% over the past 40 days, making it the mainstream token with the largest decline recently.

Currently, with no new narrative emerging to lead the industry and the MEME sector gradually cooling down, how Solana can maintain on-chain activity may become its biggest challenge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。