The stock market is about to close, and it seems to have stabilized a bit. Today's tasks are somewhat easier to complete than yesterday's. As mentioned yesterday, the core PCE data has calmed market emotions and brought a slight warming to the market. However, the unfavorable voices in the market are still gradually echoing. One key point today is that the negotiations between Ukraine and the United States do not seem to be going smoothly. Of course, I believe that the war will eventually end in the long run, but when it will end and whether it can withstand the pressure of tariffs on the market is uncertain.

In fact, it's not just the war; monetary policy is the same. Everyone knows that the Federal Reserve has entered a phase of monetary easing. Regardless of whether there is an economic recession or a soft landing, we will inevitably enter a monetary easing environment in the next two to three years, but getting through these two to three years is not easy, especially for many who hold altcoins or are highly leveraged.

Many people are particularly obsessed with bull or bear markets, but whether in a bull or bear market, making money is the main principle; at the very least, minimizing losses is the priority. Therefore, those who are in cash always ask when they can buy the dip, while those who have positions are torn between when to exit and unwilling to leave with losses.

Unfortunately, the market is always difficult to predict completely, especially during Trump's administration. It seems that he always finds a different solution to things that appear to be within the rules. It's hard to say whether this is good or bad in the long run, but in the short term, the market's panic is certainly greater than its surprises, especially in the face of high inflation. Trump not only failed to provide relief solutions but also added fuel to the fire.

Monetary policy is the main issue now. The Federal Reserve's interest rate cuts have choked the lifeblood of the market, and the market ultimately has to comply.

Looking at the data for #Bitcoin itself, the turnover rate has shown a slight decline. Although investors' panic has eased somewhat, it is still not good, as a large number of short-term investors are exiting the market, while the sentiment of earlier investors remains quite stable, and there are currently no signs of early investors entering a state of panic.

However, the US dollar index has returned above 107, indicating that investors' expectations for interest rate cuts are beginning to decrease. The rise in the dollar index also represents a decline in investors' risk appetite, and the difficulty level is indeed continuing to increase.

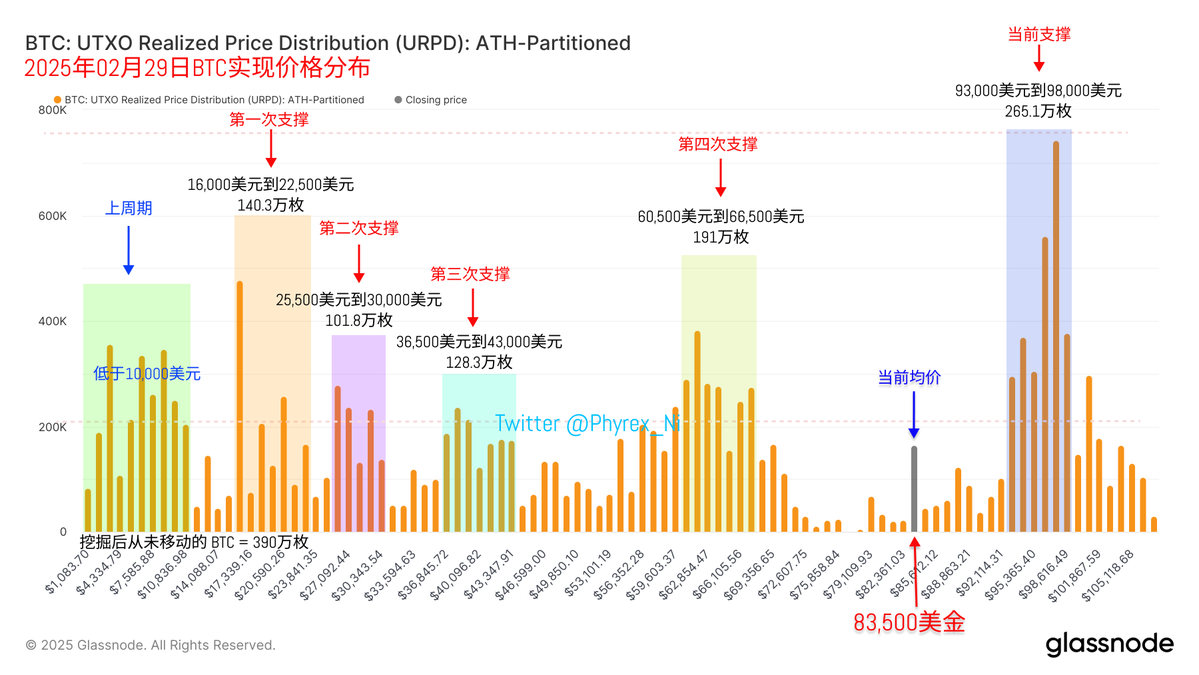

From on-chain data, there are currently no signs of breaking the concentrated chips between $93,000 and $98,000, which indicates that the support in this range is still quite strong. At least for now, there are no signs of the support breaking. I can already hear some saying that it has clearly broken, so how can there still be support? If you're interested, take a look at last year's tasks; I'm too lazy to explain it again.

Tomorrow is the weekend, and emotions will continue to dominate, with risks increasing, and fluctuations may not be ruled out.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。