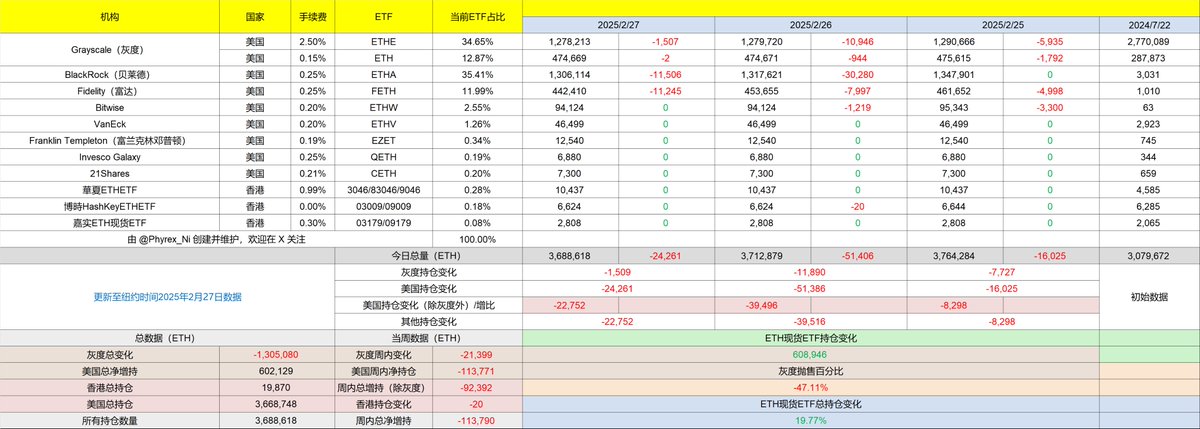

The data for ETH is not much different from BTC; it is also experiencing a net outflow, and the trend of outflow is starting to slow down. However, compared to #BTC, the outflow of #ETH is still quite large, with BlackRock and Fidelity being the main focus of the outflows. It seems that in terms of selection, the tolerance for BTC is higher among funds. However, the significant decrease in Grayscale's selling was unexpected for me.

Currently, ETH has already lost all the gains for 2024, and the current price is comparable to that of December 2023. It has not only erased the benefits from the presidential election but also the advantages brought by the approval of the BTC spot ETF. The most challenging aspect of this cycle should be holding ETH.

No need to say more; let's watch the market trends. As the second product to go through the spot ETF, ETH is not without opportunities, but this opportunity requires not only the participation of investors but also the involvement of the ETH Foundation. I must say that in this regard, Solana is doing better.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。