Macroeconomic Interpretation: In the six weeks following Bitcoin's historic high of nearly $110,000, its market value has evaporated by nearly a quarter. This asset price reconstruction, driven by political and economic factors, resembles the quantum entanglement between the cryptocurrency world and the real economy. The new tariff policy of the Trump administration is like a stone thrown into a lake, creating ripples that unexpectedly transmit to the digital asset realm. Bitcoin briefly dipped to around $78,000 during the day, marking not only its lowest level since last November but also pushing the electricity costs of 30W/T mining machines close to the breaking point—miners suddenly realized that their proud "gold mining technique" had become entangled with the economic policies of the White House.

The underlying logic of this value reconstruction stems from the reshaping of market expectations by Trump economics. When the new tariff policy meets stubborn short-term inflation expectations, the risk appetite in both traditional financial markets and the crypto market experiences a synchronous reversal. The weak performance of the S&P 500 index this week mirrors Bitcoin's 25% decline, as investors collectively retreat from the "Trump trade." This dramatic cross-market linkage is akin to Wall Street traders suddenly realizing they are cameoing in "House of Cards" while watching it—cryptocurrencies, once seen as safe-haven assets, are now dancing the tango of risk aversion with the stock market.

The shockwaves from policy changes have triggered a chain reaction in the crypto world. The ETH hacking incident was like a bolt from the blue, further exacerbating already fragile market sentiment. When digital assets worth hundreds of millions of dollars "vanish" on the blockchain, investors suddenly realize that this so-called "decentralized" realm still cannot escape the "Achilles' heel" of centralized exchanges. This trust crisis caused by security vulnerabilities resonates with the Trump administration's tough regulatory stance, leading market participants to adopt a wait-and-see approach amid the dual pressures of policy uncertainty and technological risk.

The survival status of the mining community has become an important barometer for observing the market. The latest economic model for mining machines shows that at the $80,000 price level, the electricity cost of 30W/T mining machines is nearing the critical threshold of 100%, leaving these "veterans of the mining field" gasping for breath in the competition for computing power. In stark contrast, the new generation of low-power mining machines still maintains a considerable profit margin, and this technological gap is leading to an industry reshuffle, akin to the "Darwinian evolution" of the crypto world—the law of survival of the fittest is vividly displayed in this policy winter.

Behind the dramatic turn of the market lies a deeper narrative logic. The economic policies of the Trump administration act like a "black swan" thrown into the crypto ecosystem, with a complex impact pathway that far exceeds traditional analytical frameworks: tariff policies raise inflation expectations → Federal Reserve monetary policy comes under pressure → risk asset valuations are reconstructed → crypto market liquidity contracts. This cross-dimensional transmission mechanism forces Bitcoin, the "digital gold," to temporarily shed its safe-haven halo, drifting along with the macroeconomic turbulence.

The current market turmoil resembles a "stress test" for the crypto world, exposing the deep connections between this emerging field and the traditional financial system. When the policy winds from Washington resonate with the fluctuations in mining power, and when the economic blueprint from the White House maps onto the candlestick charts of exchanges, we must acknowledge: that so-called "decentralized" crypto utopia ultimately cannot escape the gravitational pull of the real world. Perhaps, as Satoshi Nakamoto left as a metaphor in the genesis block—any technological utopia will find its historical coordinates in the collision with the real world.

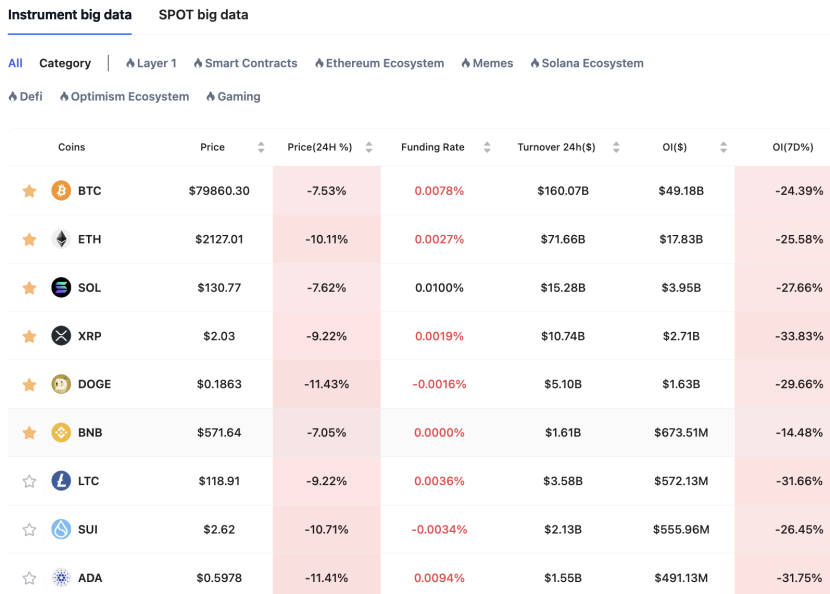

Data Analysis: According to Coinank data, #BTC has fallen over 25% from its historical high of $109,588, taking 39 days. #ETH has dropped 45% from its recent bull market peak of $4,107, taking 74 days. #SOL has decreased 55% from its historical high of $295.8, taking 40 days.

The differences in the magnitude and rhythm of the adjustments for Bitcoin, Ethereum, and SOL reflect the reconstruction of risk levels in crypto assets. Bitcoin's 25% pullback from its historical high (over 39 days) is relatively mild, confirming its anti-dip property as a "core asset," possibly related to the reluctance of spot ETF holders (holding 1.2 million BTC) to sell; Ethereum's 45% deep correction (over 74 days) exposes the weakness of its ecological narrative, as declining staking yields and competition in L2 have weakened the willingness to hold funds; SOL's 55% crash (in just 40 days) highlights the vulnerability of high-beta assets during liquidity contraction, with its excessive reliance on the popularity of meme coins exacerbating the selling pressure.

On the adjustment motivation level, the common pressure on all three stems from the tightening of global liquidity—under the accelerated balance sheet reduction by the Federal Reserve, the total leverage ratio in the crypto market has dropped by 37% from its peak, leading to a repricing of overvalued assets. The difference lies in: Bitcoin is buffered by a slowdown in daily net outflows from ETFs (last week -$560 million → -$120 million), Ethereum is burdened by the expected delay in spot ETF approvals, while SOL has suffered a collapse of confidence due to a 28% shrinkage in on-chain TVL and a wave of VC unlocks.

In terms of structural signals, Bitcoin's MVRV ratio has fallen to 1.8 (close to the historical neutral range), indicating short-term overselling; Ethereum's gas fees have dropped to 3 gwei (a new low for the year), reflecting a decline in ecological activity; SOL's active addresses on-chain have decreased by 54%, exposing user retention challenges. The current price level may enter a "strong hand takeover zone," with the proportion of long-term holders of Bitcoin rising to 76.3%, but the proportion of short-term holders of SOL selling at a loss has reached 81%, indicating an intensifying market divergence.

Future paths may diverge, with Bitcoin likely stabilizing first based on institutional holdings, Ethereum needing to wait for the Cancun upgrade and innovations in staking derivatives, while SOL must break through the "speculation-driven" model and rebuild ecological value through substantial applications like DePIN. The market is transitioning from broad-based β rallies to α exploration, making asset selection more strategically significant than position management.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。