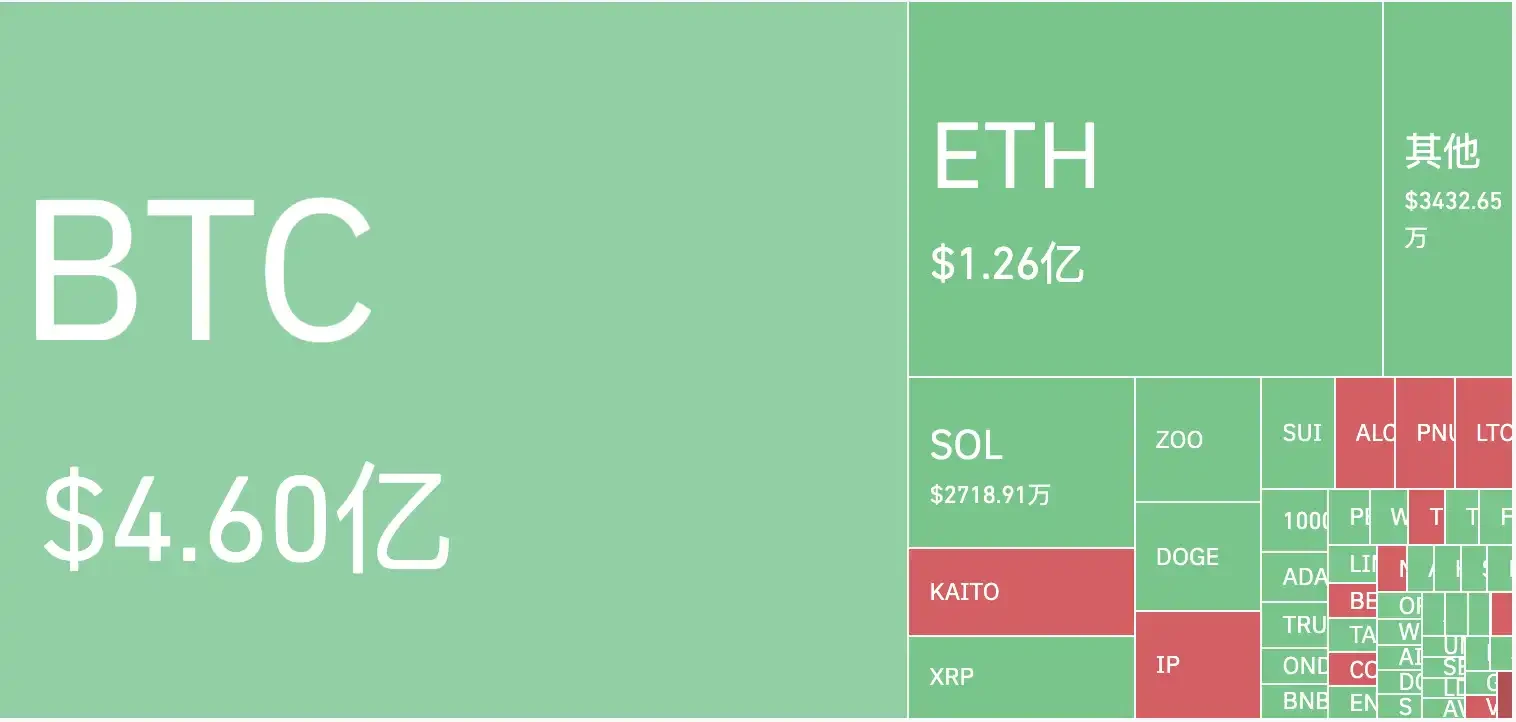

After a series of hacking incidents, market sentiment has plummeted, with Bitcoin falling for two consecutive days. This morning, it briefly dropped below $83,000, following a $1.5 billion liquidation across the network the day before, and another $700 million in liquidations in the past 24 hours, including $611 million in long positions and $154 million in short positions. Additionally, in the last 24 hours, a total of 184,998 people were liquidated globally, with the largest single liquidation occurring on Bitfinex - tBTCF0:USTF0, valued at $8.2054 million.

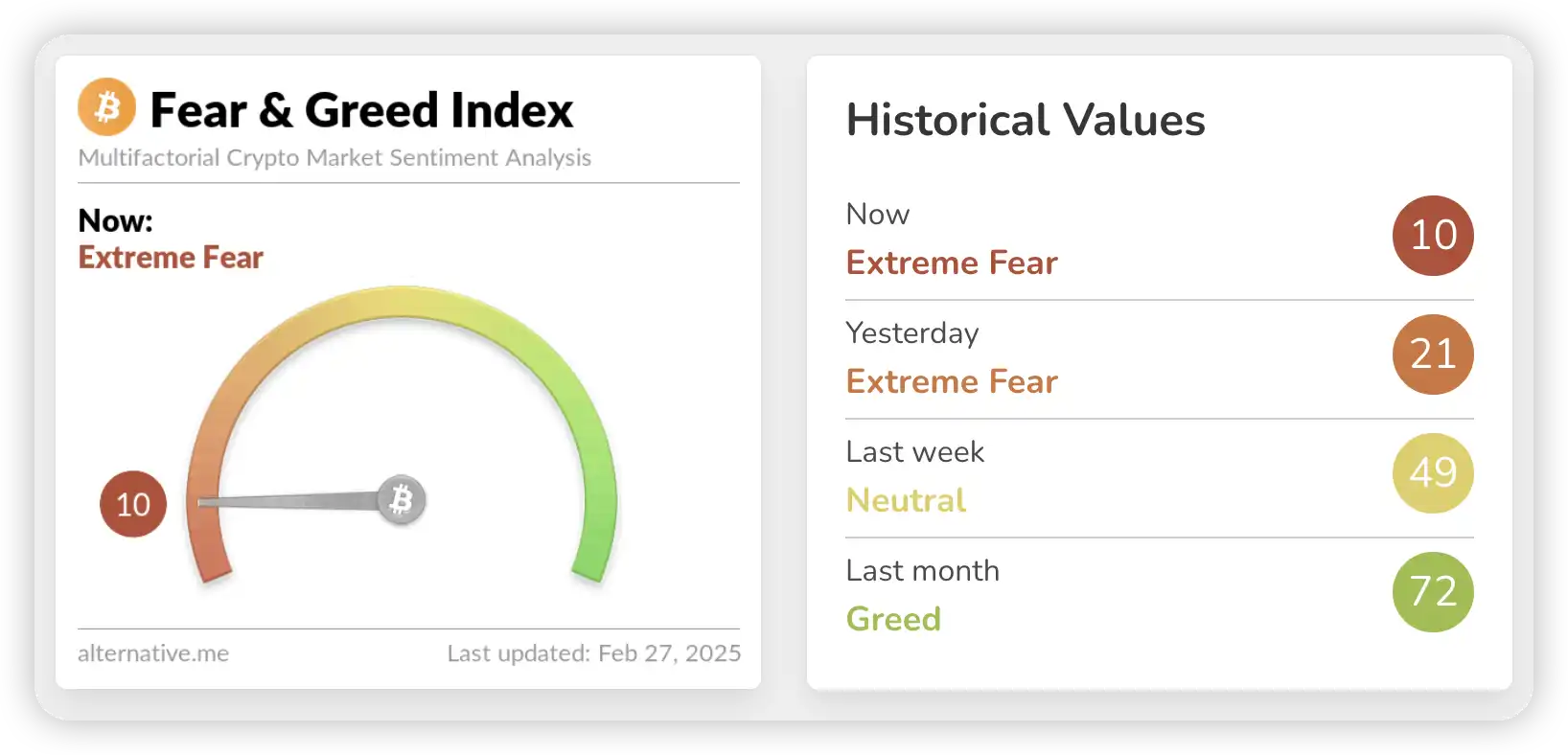

According to Alternative data, the cryptocurrency fear and greed index has dropped to 10 today (down from 25 yesterday), indicating that market sentiment has shifted from neutral to extreme fear, marking a new low since July 2022. Recently, Bitcoin has experienced multiple sharp declines. Below are the market reasons for Bitcoin's drop, compiled by BlockBeats for readers' reference.

IBIT Large Liquidations

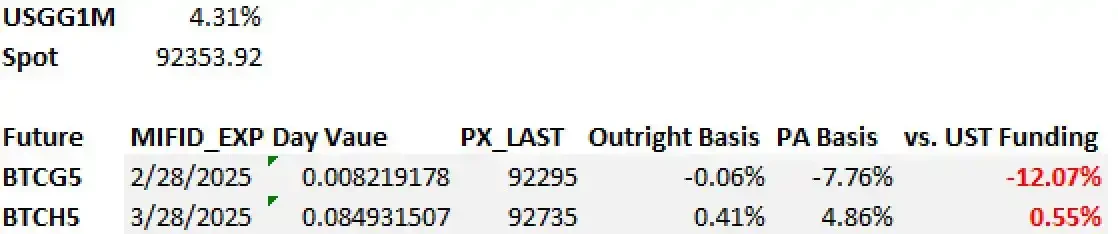

Arthur Hayes, co-founder of BitMEX, tweeted on February 25, suggesting that the BTC flash crash is related to the IBIT hedge fund. Many $IBIT holders are hedge funds that go long on ETFs and short on CME futures to achieve higher returns than the short-term U.S. Treasury bonds they invest in.

If the basis declines as $BTC falls, these funds will sell $IBIT and repurchase CME futures. These funds are in profit, and given that the basis is close to U.S. Treasury yields, they will close their positions during U.S. trading hours to realize profits, potentially causing Bitcoin to fall back to $70,000.

Previously, Arthur Hayes had published a blog post predicting that due to the lack of fundamental changes in U.S. politics following Trump's election, cryptocurrency prices might fall back to levels seen in the fourth quarter of 2024.

Therefore, Arthur Hayes still believes that Bitcoin will retest the $70,000 to $75,000 range. Only if the Federal Reserve, U.S. Treasury, Japan, and others print money in some form, or enact specific legislation allowing unlicensed cryptocurrency innovation, can the current market situation improve.

The Bitcoin strategic reserve policy is poor; "the fundamental problem with governments hoarding any asset is that they buy and sell assets primarily for political gain, not financial gain." This policy may change with shifts in the political landscape, altering Bitcoin's original trajectory.

Related Reading: "Arthur Hayes' New Article: Beyond Bitcoin's National Reserve, U.S. Crypto Hegemony Has Other Aims"

Delayed Expectations for Bitcoin Strategic Reserves

Trump's plan for a Bitcoin strategic reserve has been slow to materialize, eroding market confidence. Arthur Hayes mentioned in a recent tweet that the fundamental problem with governments hoarding any asset is that they buy and sell assets primarily for political gain, not financial gain. Those building truly decentralized technologies and applications lack sufficient financial resources to engage in politics at this critical moment in the cycle. Therefore, the desire for cryptocurrency regulation may be realized, but if it does, it will likely take a form that is overly complex and prescriptive, affordable only to large, wealthy centralized companies.

Indeed, on February 21, the probability of "establishing a strategic Bitcoin reserve within 100 days of Trump's inauguration" on Polymarket dropped to 10%, while on January 20, the day Trump was sworn in as president, that probability had risen to 48%.

Expectations for BTC strategic reserves have not been fully realized. At the national level, Trump has yet to introduce a bill for BTC strategic reserves, and he has even been absent from the cryptocurrency market for some time. At the state level, many proposals have been made but subsequently rejected.

On February 24, the Montana House voted against a proposal on February 22 that suggested making Bitcoin a state reserve asset. The bill proposed establishing a special revenue account to invest in precious metals, stablecoins, and digital assets with a market cap exceeding $750 billion, with Bitcoin being the only asset meeting this standard. The bill faced opposition from several Republican lawmakers, who argued it would lead the state investment board to engage in excessive speculation with taxpayer funds, posing too high a risk. Supporters argued that if the bill were not passed, the state government would miss the opportunity to enhance returns on funds. The bill is now essentially shelved, and if it is to be reintroduced, it will need to be submitted to the legislature for review again.

On February 25, Cointelegraph reported that during the legislative session on February 24, the South Dakota House Business and Energy Committee decided to postpone the HB 1202 bill until the "41st day" of the current legislative session. However, the state legislative session lasts a maximum of 40 days, effectively vetoing the bill, meaning the state will not include Bitcoin in its official investment options for now.

Related Reading: "Arthur Hayes' New Article: Beyond Bitcoin's National Reserve, U.S. Crypto Hegemony Has Other Aims"

Is the Bull Market Still On?

On the other hand, the performance of cryptocurrency-related stocks in the U.S. stock market has been poor, leading to multiple constraints on risk liquidity. Liquidity is flowing from the crypto market to U.S. stocks, gold, and U.S. Treasury bonds, limiting the inflow of funds into the crypto market. Market expectations are also reflected in the trading data: Coinbase (COIN) fell 2.7%; Tesla (TSLA) fell 2.66%; Trump Media Technology Group (DJT) fell 5.59%; MicroStrategy (MSTR) fell 4.73%; MARA Holdings (MARA) fell 5.12%; Riot Platforms (RIOT) fell 4.67%; Hut 8 Corp. (HUT) fell 8.48%.

A significant reason may be the delayed but impending tariff issues. The Trump administration has stated it will implement tariffs on Mexico and Canada on schedule, further strengthening the dollar's position, which has bolstered the dollar index. This poses a risk of declining sales for the tech giants heavily weighted in the Nasdaq index due to tariff expectations, with liquidity potentially escaping and piercing the AI bubble.

Traders in the market have also presented data from the previous and the cycle before that, indicating that this cycle has not changed the inherent pattern due to Trump's election. Many traders believe we are currently in a correction phase within a bull market, but the outlook remains generally bearish in the short term.

cburniske believes the current market scenario is similar to that of 2021, arguing that this bull market is not fundamentally different from previous ones, and data indicates we are actually in the mid-phase of a bull market:

During the same period in 2021, Bitcoin ($BTC) fell 56%, Ethereum ($ETH) fell 61%, Solana ($SOL) fell 67%, and many other tokens fell by more than 70-80%. While various reasons can be cited to explain why this cycle is different from previous ones, the mid-phase of the bull market we are currently experiencing has historical precedents. Those who believe the market has entered a full bear market are, in fact, misled.

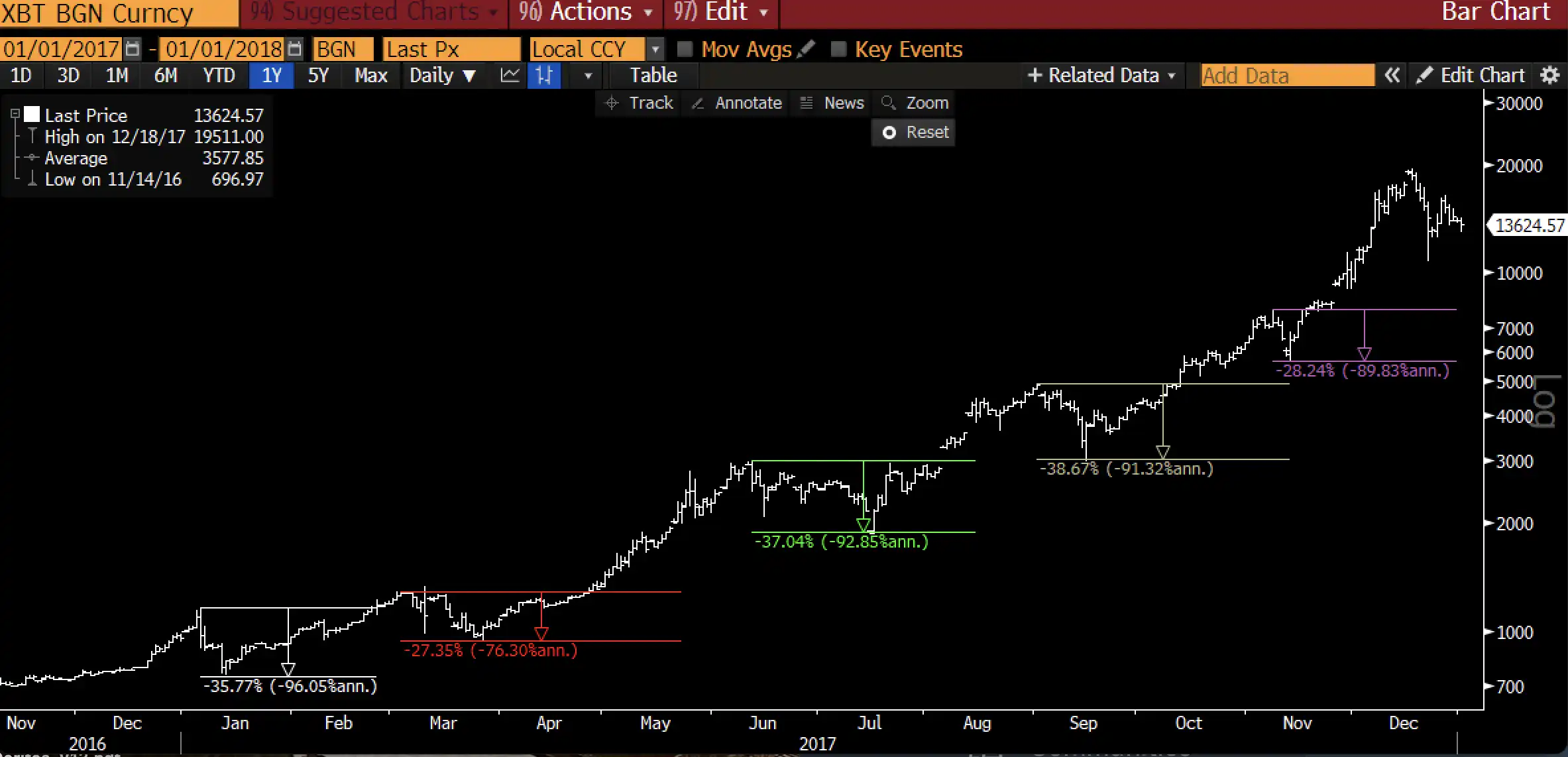

@RaoulGMI compares the macro structure of BTC in 2017, suggesting that we will likely experience a 2-3 month correction before reaching new highs:

Everyone needs to be patient; this market environment is very similar to the macro structure of 2017: Bitcoin experienced five corrections, each exceeding 28%, and most corrections lasted 2 to 3 months before new historical highs were reached. At the same time, other altcoins experienced corrections of about 65%. During this phase, the market is filled with various noise and uncertainty. Therefore, we should focus our energy on more constructive activities rather than being troubled by market fluctuations.

Technical analyst @CryptoPainter_X believes:

The current short-term trend in the market has some support, but the overall situation remains in a consolidation range. After reaching the secondary demand zone on the 4-hour chart, there may be short-term support, especially as the spot premium oscillates near the 0 axis without fully breaking the consolidation range. Given that small support zones in a consolidation are usually easy to break, it is essential to monitor whether the previous rhythm continues. If small support is broken, it may indicate a continuation of the downward consolidation.

Additionally, the current price has broken below the lower limit of the consolidation channel at 91400 (cyan line), and the K-line has not shown long wicks. The strength of the short-term rebound will determine the subsequent trend. The cyan line coincides with the core demand zone, theoretically providing short-term support. However, as the channel is about to decline and may turn, the long-term trend still leans bearish, indicating that the market may face further downward pressure.

Overall, while a short-term rebound may occur, if it cannot break through the midline or the consolidation range, the market may still maintain a weak consolidation trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。