Compilation: Tim, PANews

Amid Market Crash, Community's Buying Enthusiasm Soars

The cryptocurrency market has been in a continuous downturn recently, and as Bitcoin fell below the $80,000 mark, discussions about buying the dip on social media have surged to their highest levels since July of last year.

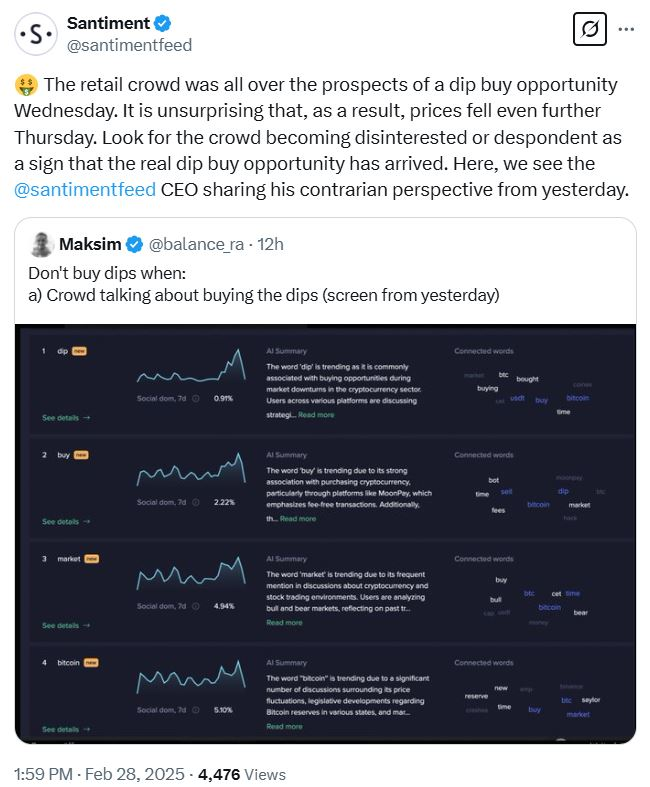

On February 28, the on-chain analysis platform Santiment noted on its X platform account that by monitoring trader discussions across social channels like X, Reddit, and Telegram from February 25 to 26, market sentiment showed strong confidence in this buying opportunity.

Interest in buying the dip has reached a seven-month peak.

Mysterious Whale Takes Action, Accumulates $340 Million in BTC

According to data disclosed by community members on February 27, a mysterious whale address accumulated 4,000 BTC while Bitcoin's price fluctuated between $82,000 and $85,000. At the current market price of Bitcoin, this position is valued at approximately $344 million.

Cryptocurrency analyst Saint Pump confirmed that this whale address is recognized as one of the largest market manipulators in the industry—“Spoofy.”

During the prolonged bear market triggered by the collapse of the Luna stablecoin and the FTX exchange in 2022, Spoofy continued to accumulate BTC. On-chain data shows that this whale purchased a total of 70,000 BTC as Bitcoin's price plummeted from $40,000 to $16,000.

Misfortunes Come in Threes, Macro Economy Sends Negative Signals Again

On February 25, Bitcoin fell below the $90,000 mark, coinciding with U.S. President Trump's announcement of a 25% tariff policy on Canada and Mexico the day before.

As Trump threatened to impose a 10% tariff on China on February 28, combined with other macroeconomic uncertainties, Bitcoin continued to retract its post-election gains, ultimately falling below the psychological support level of $80,000.

Santiment's sentiment tracking system filtered through cryptocurrency vertical social media channels to capture the ten keywords with the most significant increase in mentions over the past 14 days. Data source: Santiment

Market Reflexivity: Not Necessarily the Best Time to Enter

However, the analysis platform Santiment pointed out that the heightened enthusiasm for buying the dip may not be the best entry signal, as asset prices typically fluctuate in the opposite direction of expectations.

Santiment noted in its analysis: “Ideally, we are waiting for the market's euphoric sentiment to fade, which indicates that retail investors have endured enough losses to create conditions for a technical rebound.”

“Market trends often run counter to collective consensus, so when market optimism gradually cools and calls for buying the dip continue to weaken, it should be viewed as a potential bullish signal.”

Santiment's sentiment monitoring system, based on its methodology, scanned X (formerly Twitter) and Telegram and captured the top ten keywords with the largest week-over-week increase in mentions over the past two weeks.

According to CoinMarketCap data, Bitcoin has fallen over 21% in the past 30 trading days, with a further drop of 5% in the last 24 hours, currently priced around $80,400; Ethereum has seen a decline of over 30% in the same period, down 7.54% in the last 24 hours, currently around $2,139.

In subsequent analysis, Santiment stated: “If the price of current crypto assets continues to decline after retail investors rush to buy the dip, it would not be surprising.”

Source: Santiment

When is the Right Time to Buy the Dip?

Santiment emphasized in its latest analysis: “The best buying opportunities often arise when market interest wanes or even falls into despair, at which point it is crucial to pay special attention to unusual trading volume and large on-chain transfer signals.”

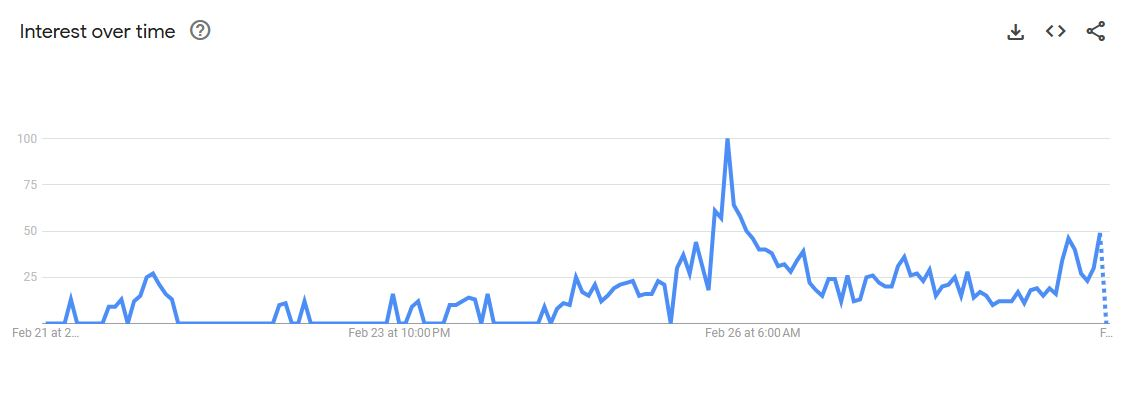

According to Google Trends data, in the week ending February 28, the search interest for “buying the dip” exhibited typical characteristics of a market sentiment reversal. The keyword peaked at a score of 100 on February 26 and has since fallen to 49 (on a scale of 100).

Google Trends data shows a recent surge in search interest for the investment term “buying the dip.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。