🚨 According to monitoring, the address "0xde56…3a91" has been liquidated on-chain, with a liquidation scale of 626.63 WETH, valued at approximately 1.32 million USD——

Let's make a pessimistic assumption:

If there really is a liquidation waterfall, what potential transmission paths might follow?

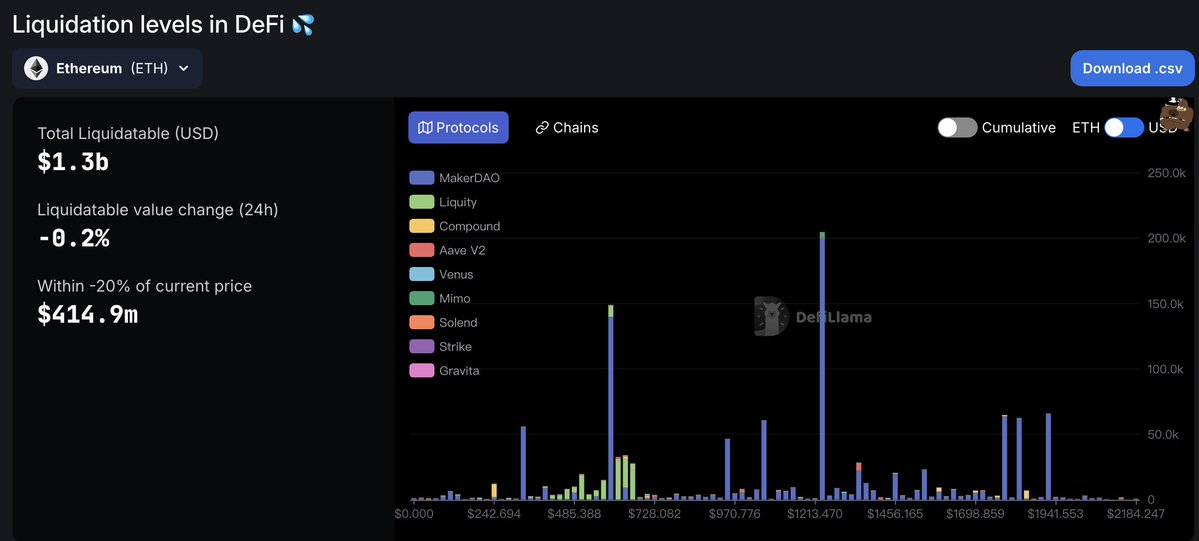

1⃣ If ETH falls below 1919 USD triggering the first round of liquidation, there will be a concentrated release of 66,000 ETH selling pressure, which may exacerbate short-term liquidity tightness and further lower prices.

2⃣ The spot sell-off caused by liquidation may lower the futures funding rate, attracting arbitrage funds to short perpetual contracts, forming a negative feedback loop of "spot decline → funding rate turns negative → shorts increase positions" (refer to the ETH liquidation waterfall case during the UST de-pegging in May 2022).

3⃣ Cross-protocol chain reactions, where some liquidated positions may trigger cascading liquidations in other protocols. For example, if a user collateralizes ETH on Aave to borrow MKR, and then deposits MKR into MakerDAO for secondary borrowing, it creates cross-protocol leverage nesting.

Currently, the $ETH price has fallen below 2100, with the next three key liquidation points: 1919, 1831, 1787.

We're just saying, whether we can have a comfortable weekend depends on today!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。