Author: Tulip King, Crypto KOL

Compiled by: Felix, PANews

Key Insights:

- Enhanced Market Sensitivity: The market's response to different events is similar. Despite the varying content of events (ranging from risk parameter adjustments to technological integrations), broader market sentiment and liquidity conditions play a dominant role in shaping prices.

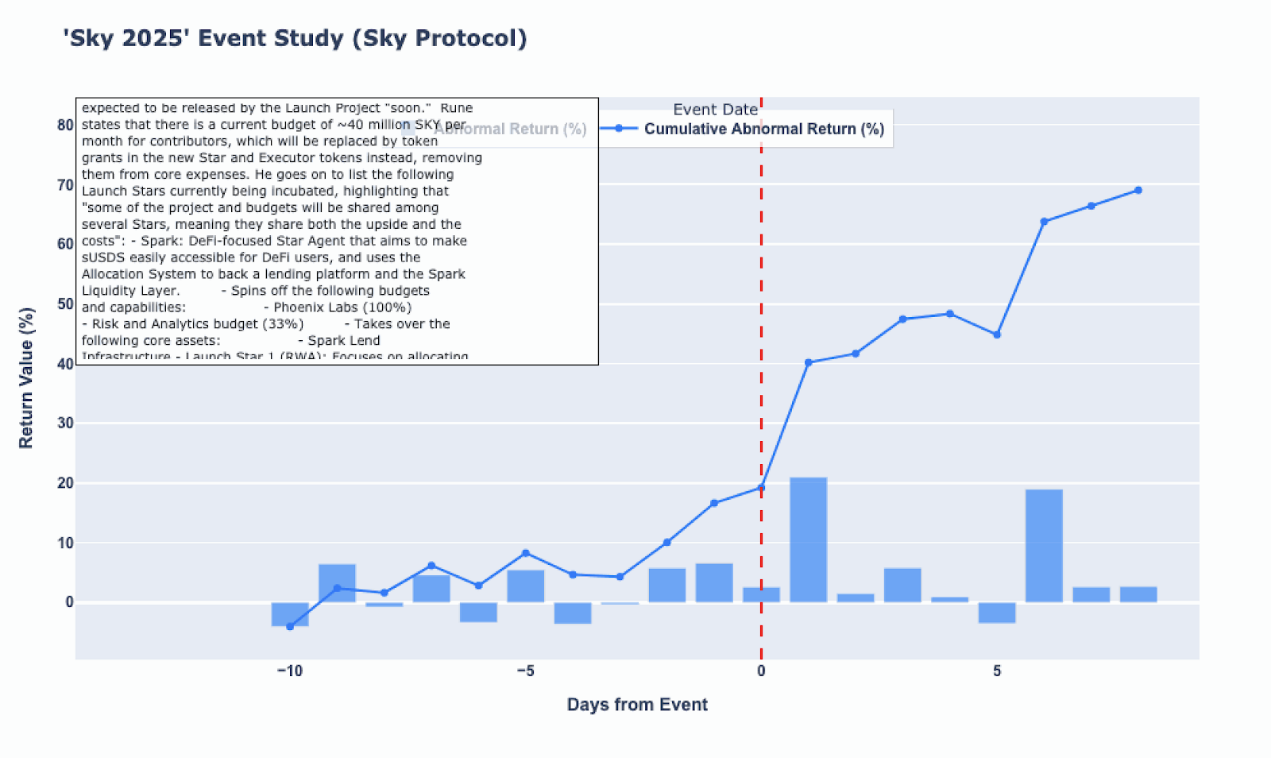

- Governance as a Core Driver: A significant portion of events relates to governance proposals and execution decisions, particularly around Maker and its associated protocols (including Sky Protocol). The market's cautious yet consistent response to these proposals highlights investors' focus on long-term risk management and strategic capital flows. Governance dynamics are seen as indicators of future stability and growth.

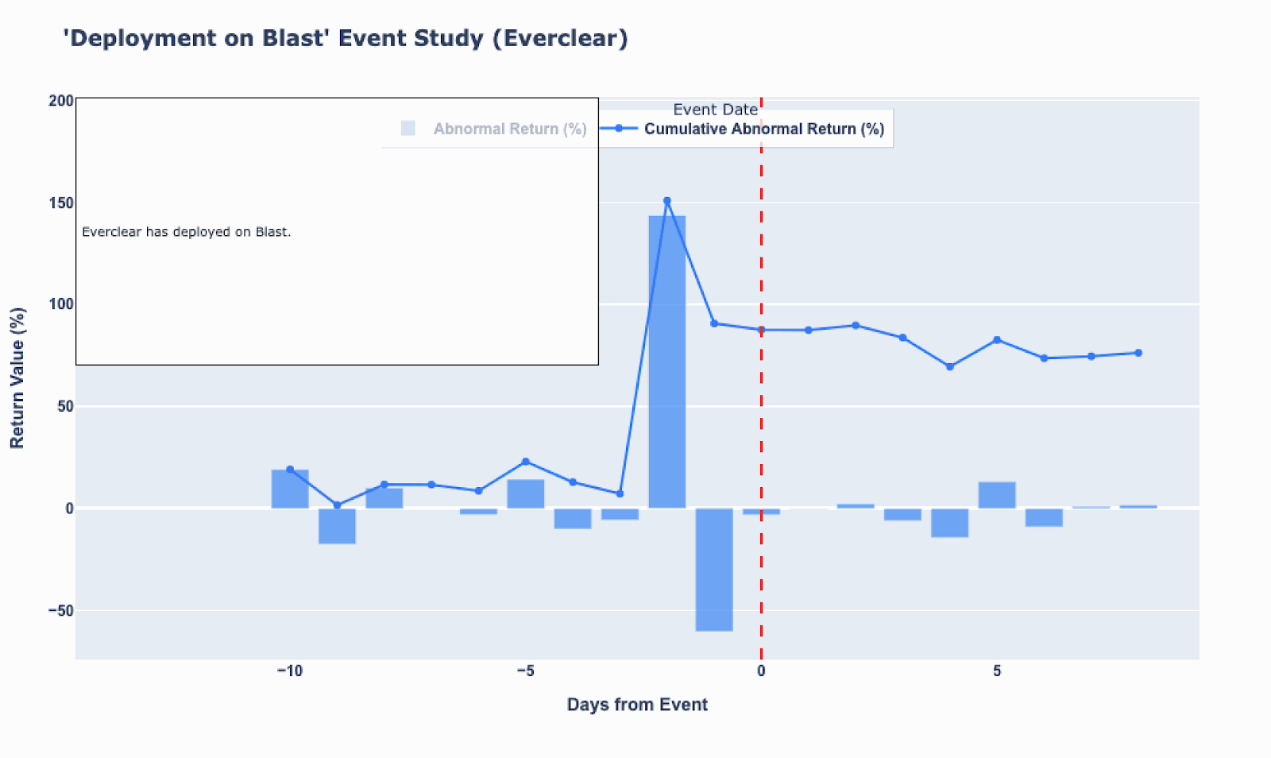

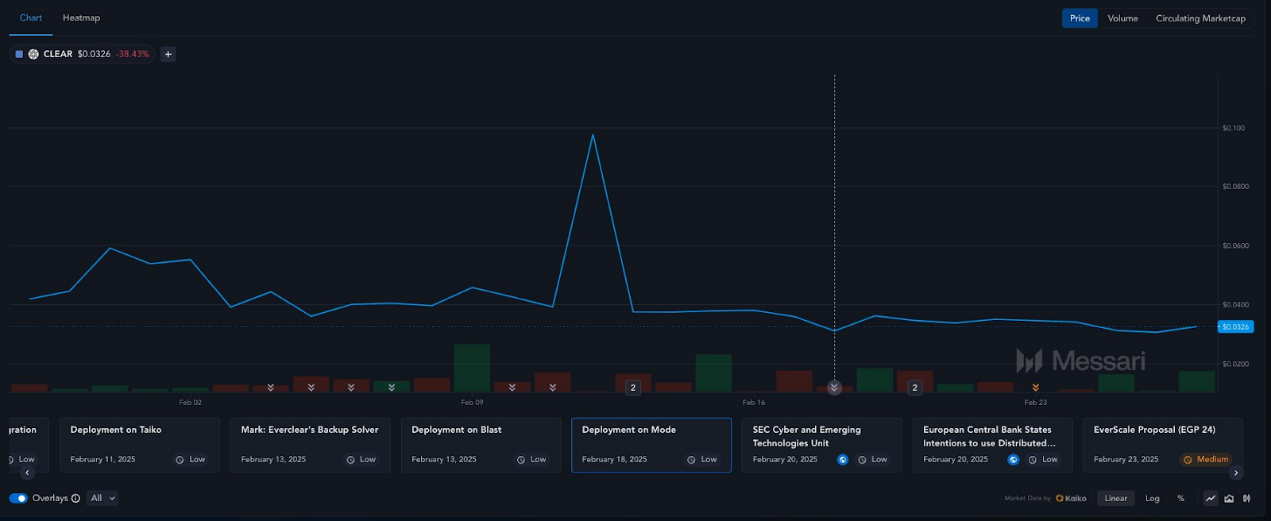

- Integration and Expansion are Equally Important: Technological announcements such as Everclear integration, Onyx's smart wallet, and Virtuals' AI staking program have also triggered responses comparable to governance dynamics. This consistency indicates that business expansions aimed at improving network efficiency and cross-chain liquidity are equally influential, strengthening the overall risk-return assessment of the market during this window.

Weekly Themes

This week, the market's attention is focused on governance and risk management proposals, reflected in the repeated presentation of execution proposals and adjustments to key protocol parameters. Discussions around reducing core fees, changing liquidity parameters, and modifying stability fees are not just routine updates; they reflect a general investor desire to make informed decisions, balancing short-term tactical moves with long-term strategic positioning.

Another important theme is technological integration and ecosystem expansion. Announcements regarding integration with new networks (such as Linea, Polygon, Chain XCN Ledger) and new products (such as AI staking and smart wallet deployments) indicate that market participants are actively rewarding projects that enhance interoperability and operational efficiency, driving optimism about future network scalability.

Finally, there is a potential narrative regarding expected pricing behavior. With many events concentrated around mid-February, the price increase before events and rapid stabilization afterward suggest that news may be partially digested by the market before formal announcements. This anticipated trend reinforces the view that regardless of specific events, the overall market environment is in a passive sentiment, with each event likely to trigger similar adjustments.

Key Assets

Maker and Sky Protocol: Maker stands out due to its regularly scheduled key governance events (including execution proposals and parameter adjustments). Sky Protocol is often mentioned alongside Maker, showing a consistent abnormal response that highlights investors' emphasis on governance narratives and capital flow systems.

Everclear: Everclear has gained market attention through its integration announcements and EverExpansion plan. The stable response surrounding Everclear integration events indicates that investors are enthusiastic about cross-chain interoperability and expect these technological collaborations to improve liquidity management and enhance operational efficiency.

Virtuals Protocol and Onyx: Virtuals Protocol's entry into the AI staking space and Onyx's announcement of a smart wallet mark them as assets driving innovation. The unique product enhancement features indicate that, in addition to governance, investors are also focusing on operational innovation tokens, diversifying their risk exposure and anticipating long-term usability improvements that translate into sustained value growth.

Looking Ahead

In the coming week, it is advisable to remain vigilant regarding developments in governance structures and risk management frameworks. As protocols finalize adjustments and new proposals enter the voting phase, pay attention to voting sentiment and liquidity changes, as these may have broader implications for market stability. Keep a close watch on announcements from Maker and Sky Protocol, as they will continue to adjust risk parameters and develop their capital flow systems.

On the technological front, continue to monitor announcements related to cross-chain integration and innovative product launches, such as further updates from Everclear and progress on on-chain liquidity channels. These developments may not only drive incremental gains but could fundamentally alter network dynamics. Investors should assess whether these initiatives begin to exceed market expectations or trigger risk repricing relative to Bitcoin.

Additionally, the observed anticipated behavior suggests that the market may be pricing in events ahead of time. This means that any deviations or surprises in upcoming announcements could lead to more volatile repricing. Investors may consider focusing on assets that can leverage stable governance frameworks and those improved through innovative operations.

Conclusion

The market paradigm in February is defined by governance-driven re-adjustments and integration/expansion events. The trend of abnormal returns indicates that regardless of the category of events (whether risk parameter adjustments or technological innovations), the market's responses are similar, suggesting a broader and more systematic sensitivity to significant events. This underscores the importance of tracking governance proposals and innovation-driven events, as they collectively shape investor sentiment and asset pricing in a seemingly homogeneous manner.

For investors and market participants, it is crucial not to view these events in isolation. Instead, understand that the crypto ecosystem is currently in a phase where programmatic re-adjustments (governance changes) and operational advancements (integration and product enhancements) are closely intertwined. Therefore, it is recommended to stay well-informed about governance voting and integration updates, particularly for assets like Maker, Sky Protocol, Everclear, Virtuals Protocol, and Onyx, as they are at the core of the market's evolving narrative.

By simultaneously focusing on governance stability and technological innovation, stakeholders can better predict future market trends and identify assets with long-term upside potential. This comprehensive perspective can not only guide investors in assessing immediate price reactions but also help evaluate which projects will lead the next phase of development in the crypto market.

Related Reading: MakerDAO's Urgent Governance Proposal: Are Borrowing Limits and Collateral Ratios Defensive Measures or Power Struggles?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。