Have you all seen the article from a couple of days ago? The day before yesterday, I mentioned that everyone would soon see BTC starting with the number 7. Yesterday, I provided a short position at 86000, targeting 83000—82000. As of this morning, the profit of several thousand points has been successfully realized. Friends who kept up with this surely got a piece of this juicy profit.

Since February 24, I have been telling everyone in the articles that as long as BTC drops below 95000, we should boldly short it. Currently, the price is fluctuating around 82000, and during these few days, I have provided short positions to everyone. This range has 13000 points; at the very least, you should have been able to secure a profit of five to six thousand points! If you didn’t manage to do that, or even incurred losses, think about why?

Alright, talking more doesn’t really help with actual operations. Because that’s how this market is; if some people make money, others will inevitably lose. I hope that friends who follow me can all gain something.

In terms of market conditions, yesterday's rebound peaked near 87000. We set up a short position around 86200, and when it dropped below 83000 this morning, it triggered a take-profit. I analyzed the reasons for this wave of decline a couple of days ago; new friends may not have seen the previous articles, so I’ll mention them again here.

In summary, there are several factors:

- Policy Factors, Impact of Trump's Tariff Policy: Trump announced tariffs on goods from Canada, Mexico, and the EU (up to 25%), exacerbating concerns over global trade friction, leading investors to sell high-risk assets (like Bitcoin) and turn to traditional safe-haven assets (like gold and U.S. Treasuries).

Expansion of EU Sanctions: The EU's new sanctions against Russia have for the first time included cryptocurrency exchanges, limiting liquidity in the crypto market.

Largest Hacking Attack in History: On February 21, the leading global exchange Bybit was hacked, losing nearly $1.5 billion in ETH and stETH. Although they promised to fully compensate users, the incident exposed security vulnerabilities in cryptocurrency storage and trading, increasing market panic.

Profit-Taking and Technical Correction: Bitcoin has risen over 300% in 2024, and after reaching a historical high in early 2025, a large amount of profit-taking occurred, creating a demand for market correction; technically, a "double top" pattern formed, triggering stop-loss selling after breaking below the key support level of 92,000.

Massive Outflow of ETF Funds: The U.S. Bitcoin spot ETF has seen continuous net outflows for several days, with a single-day outflow of $517 million on February 24. Hedge fund arbitrage strategies (long ETF + short futures) were closed due to narrowing basis, increasing selling pressure.

- Hawkish Signals from the Federal Reserve: The market expects the Federal Reserve may delay interest rate cuts or even raise rates, with a stronger dollar index suppressing the prices of risk assets.

Altcoins Dragging Down the Overall Market: Solana (SOL) plummeted nearly 50% due to FTX liquidation unlocks and the bursting of the meme coin bubble, while Ethereum fell over 10% due to unmet expectations for Bybit's margin calls, spreading panic to Bitcoin.

There are other factors as well; I’ve only mentioned a few key points. In short, this sharp decline is the result of a combination of policy risks, security incidents, market leverage liquidation, and macroeconomic fluctuations.

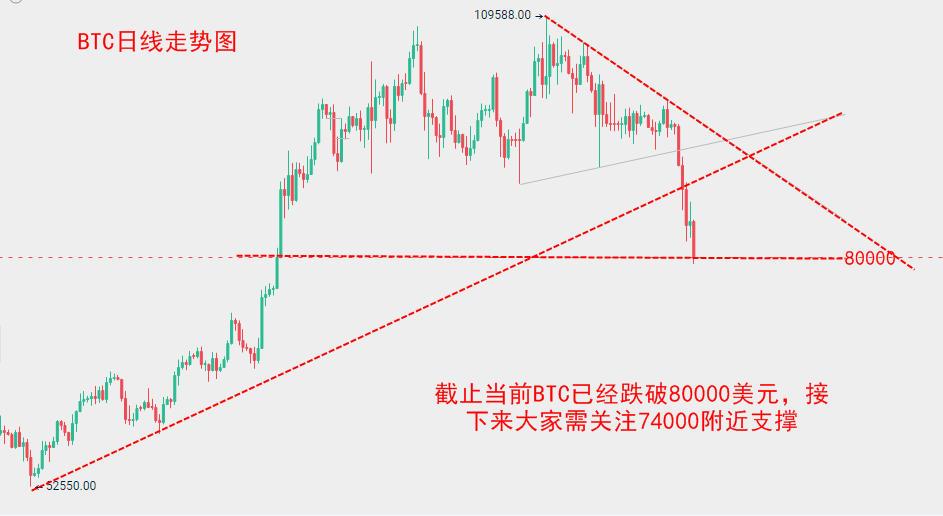

As of the time of writing, BTC has dropped below $80,000, with a low around $79,500, and is currently rebounding slightly, fluctuating around $81,000. For intraday contracts, we should still consider setting up short positions near the top-bottom conversion level around $82,500, with a stop-loss at $83,500 and a target of $80,000. If the price effectively breaks below $80,000, we can pay attention to the strong support at $74,000 in the future. In any case, do not have the idea of bottom-fishing to go long; so-called bottom-fishing should only be done in an upward trend.

The same reasoning applies to ETH. Although the decline is not as severe as BTC, it is also in a downward trend. For intraday contract operations, we still maintain the idea of shorting on rebounds. Consider setting up short positions around $2,250, with a stop-loss at $2,320 and a take-profit near $2,100.

This is the current plan for today; we will promptly inform everyone of any changes in the group chat.

Carnegie once said: "Facing life with a peaceful mindset, many problems will be easily resolved."

Everyone should maintain a calm mind when trading. A calm mind is a state of being unaffected by emotions, not swayed by fame and fortune, and understanding the essence of things, fully grounded in reality.

Do not be overly joyful with profits, nor overly sad with losses! Remain unfazed by market fluctuations, indifferent to gains and losses; this is a transcendent and ordinary mindset. Of course, this does not mean not taking your investments seriously, but rather understanding the importance of a calm mindset, which is essential for thriving in the cryptocurrency market! Unexpected gains will also come!

For positions that are already at a loss, cut losses when necessary, because that is part of investing. The market carries risks, and investments require caution! Afterward, do not become overly attached to a single position; otherwise, it will create a mental burden, limiting your thinking and judgment of the correct direction.

Market conditions change in real-time, and there may be delays in article publication. Strategy points are for reference only and should not be used as entry criteria. Investing carries risks, and profits and losses are your own responsibility. Daily real-time market analysis, along with an experience group chat and a practical discussion group, are available for real-time guidance. Evening live broadcasts will explain real-time market conditions.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。