Original Author: Penny, BlockBeats

In the cryptocurrency field, IDO (Initial DEX Offering) is becoming an important bridge connecting project parties and the community as a new financing method. IDO is a token issuance method based on decentralized exchanges, characterized by decentralization and instant liquidity compared to ICO (Initial Coin Offering) and IEO (Initial Exchange Offering). Project parties issue tokens directly on DEX through smart contracts, allowing investors to participate without intermediaries, and tokens can circulate immediately after the transaction is completed. The crypto community has long been dissatisfied with "high valuation, high FDV, low circulation" VC tokens, making IDO a popular choice for project parties to attract community support, which has also driven the rise of emerging IDO platforms like Echo, Legion, and Buidlpad. These platforms not only provide funding support for projects but also give ordinary users the opportunity to participate in early investments.

Echo: Elite Recommendations and Community Alliances

Echo was founded by crypto KOL Cobie (@echodotxyz) in March 2024. Cobie was the growth lead at Lido and hosted the popular Web3 podcast UpOnly, interviewing key industry figures like Vitalik Buterin, making his influence significant.

The core of Echo lies in the "lead investor recommendation mechanism": users can create investment communities as lead investors, share projects with members, and earn a share of the profits. This model is similar to an "elite alliance" for crypto investors, tending to choose high-potential projects recognized by a small circle. The highlight of Echo is its community-driven model, managing investments through smart contracts to ensure lead investors do not access user funds and allowing users to decide when to sell tokens. If lead investors succeed in their investments, they can earn a percentage of the profits from followers, incentivizing the sharing of quality projects. Although its elite orientation makes its user base relatively niche, this filtering mechanism ensures project quality, attracting investors who value trust. However, Echo's exclusivity also limits its scale, potentially making it difficult to meet the needs of a broader retail audience.

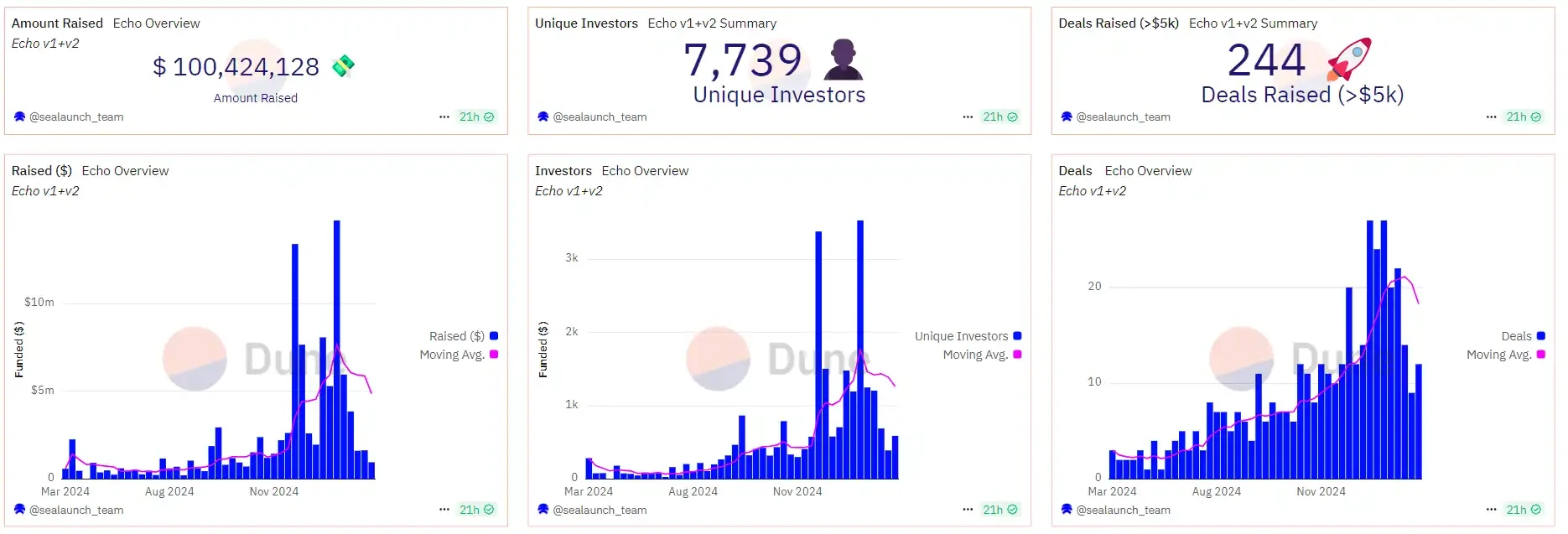

Since its launch in April 2024, Echo has invested $100,000 in new startups in less than five months, covering over 40 investment groups. Notable investment cases include Ethena's $300,000 financing and MegaETH's $10 million rapid financing.

As the first project Echo invested in, Ethena allowed participants to buy in at a valuation of $300 million (the most recent private placement valued Ethena at $600 million), minus a 5% royalty fee from the Echo platform.

In the MegaETH financing case, the initial target of $4.2 million was reached in 56 seconds, ultimately raising $10 million in 3 minutes. Shuyao Kong, co-founder of MegaLabs, stated that this round of financing was structured as equity plus token warrants, similar to MegaLabs' $20 million seed round financing in June, with both rounds having valuations in the "hundreds of millions."

According to Dune data statistics, as of now, 7,739 independent investors have facilitated 244 transactions using Echo, with a total financing amount exceeding $100 million.

Legion: Innovative Financing Based on Reputation

Legion is incubated by Delphi Labs and positioned as a "reputation-based" IDO platform. In August 2024, Legion completed a $2 million seed round financing led by Cyber Fund.

The biggest highlight of Legion is the introduction of the Legion Scores rating system, which evaluates users' value and capabilities by aggregating on-chain activities (such as trading activity, project participation) and off-chain data (such as social media influence, community contributions). Project parties can allocate investment amounts and discounts based on Legion Scores, aiming to reward truly contributing users rather than relying solely on the scale of funds. Legion does not require users to perform traditional tasks (such as staking or social tasks) but relies on the scoring system as the main allocation criterion.

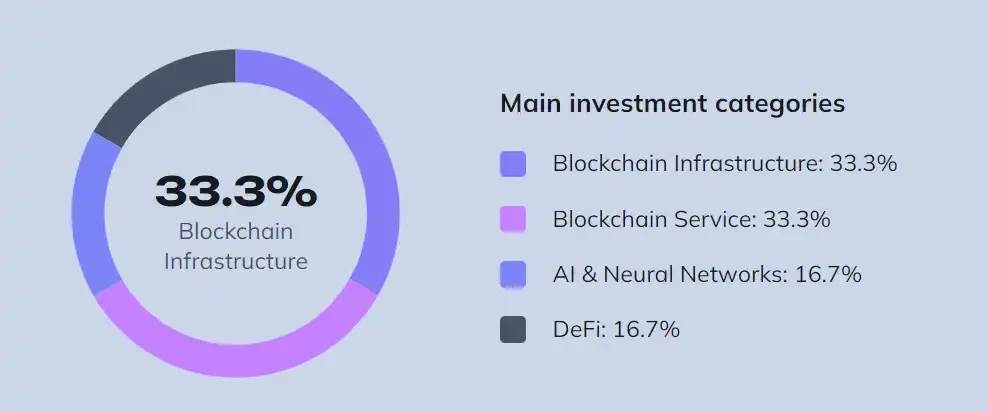

Legion has supported multiple projects for financing, totaling approximately $3.5 million, with about 1/3 of the supported projects being blockchain infrastructure, 1/3 being blockchain services, 1/6 being AI and neural networks, and the remaining 1/6 being DeFi projects. According to CoinLaunch data, recent projects supported by Legion include Fuel Network, Corn Crypto Network, Giza Crypto, Hyperlane, and eOracle. Among them, Fuel Network performed particularly well, reaching a price of $0.08 after launching on Bitget in December 2024, significantly enhancing Legion's recognition in the community.

Legion's innovation lies in its decentralized and compliant financing model, with its reputation system providing more opportunities for non-accredited investors, breaking the traditional VC-dominated financing landscape. Its vision is to address the drawbacks present in the traditional ICO market, such as fraud, bot participation, and regulatory pressure, allowing more non-accredited investors to participate in early financing.

Buidlpad: Balancing Openness and Compliance

Buidlpad was founded by former Binance executive Erick Zhang and officially launched in December 2024. Erick previously managed Binance Research and Launchpad, possessing deep knowledge of financing platform operations. Buidlpad emphasizes openness and compliance, requiring users to undergo KYC certification while accepting stablecoin payments, lowering the participation threshold. Its first project, Solayer (a re-staking protocol in the Solana ecosystem), ended its public sale on January 18, 2025, originally planning to raise $10.5 million but ultimately over-raised to $57.3 million, exceeding expectations by 545.24%. The public sale price of its token LAYER was $0.35, reaching a peak price of $1.20 after launch, yielding over 3 times the return.

The successful financing of Solayer demonstrates Buidlpad's appeal to the community, with its ecosystem establishing partnerships with major DeFi players like Binance and Bybit. Compared to Echo's elite route and Legion's reputation-oriented approach, Buidlpad resembles a traditional ICO platform aimed at the general public, more suitable for projects looking to quickly attract a wide user base. The platform ensures compliance and user-friendliness through KYC and stablecoin payments, although the KYC requirement may deter some decentralization advocates, its compliance has earned it a regulatory-friendly advantage.

Echo, Legion, and Buidlpad represent different paths in the IDO field: Echo focuses on elite trust, Legion innovates with a reputation mechanism, and Buidlpad pursues openness and compliance. For investors, choosing a reputable platform and conducting in-depth research on projects is crucial; for project parties, collaborating with these platforms requires balancing community interests and compliance requirements. Together, they are driving the decentralized wave of crypto financing, creating a win-win situation for both the community and project parties. In the future, as blockchain technology advances and community power grows, IDO is expected to play a more important role in the crypto ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。