Recently, the homework has been difficult to write, and the market sentiment is a complete mess. The two words that are causing confusion are tariffs; these two words have erased all the positive sentiment surrounding the elections in January and February. Today, even Federal Reserve official Jeff Schmid expressed that the optimism regarding inflation is not as good as it was at the beginning of the year. Although he believes that tariffs may have a short-term effect, he is not willing to take any risks. To put it bluntly, the Federal Reserve's attitude towards tariffs is negative.

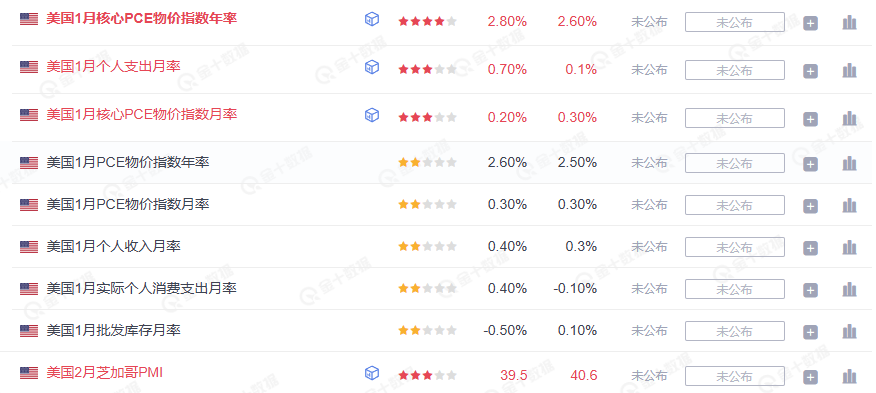

It is believed that tariffs will have a negative impact on inflation, and the direct consequence of this is that there is no rush to cut interest rates. After all, having the interest rate weapon in hand is more effective in deterring the market than using it. This also makes Friday's core PCE less significant because this part of the data does not include inflation data after the new tariffs. Of course, if it is lower, that is a good thing; if it is already high now, it will only be higher in the future.

Currently, there is no obvious risk-averse sentiment regarding Friday's core PCE. The main reason for the decline in U.S. stocks is that Trump reiterated the tariff policy against Mexico and Canada starting on March 4, rather than the April 2 date that many investors believed. As a result, both U.S. stocks and cryptocurrencies shifted from a slow rise to a direct decline.

Especially for U.S. stocks, the upward trend over the past two days was decent, and investors were barely lifting their spirits. However, tariffs are reminding investors every day that the upcoming period may not be easy. Currently, the market's forecast for core PCE is still good; last month's core PCE data was 2.8%, and the market expects this month's to be 2.6%. If it can indeed meet market expectations, it indicates that the data most closely watched by the Federal Reserve is showing a downward trend, which is originally a good thing.

Moreover, personal spending month-on-month is also declining, and personal income is decreasing. These three data points are not good, indicating a downward trend in the economy, which could lead the Federal Reserve to consider more interest rate cuts.

Additionally, the core PCE forecast data provided by the Cleveland Fed is 2.66%, which is similar to market expectations. As long as it is lower than the previous value, it is a good thing. If Friday's data can be within expectations, it will have a certain calming effect on market sentiment. However, tariffs are still very important, and there is also the dot plot in March, which will almost certainly affect investor sentiment in Q2.

Of course, if Friday's core PCE data is poor, the sentiment is likely to worsen.

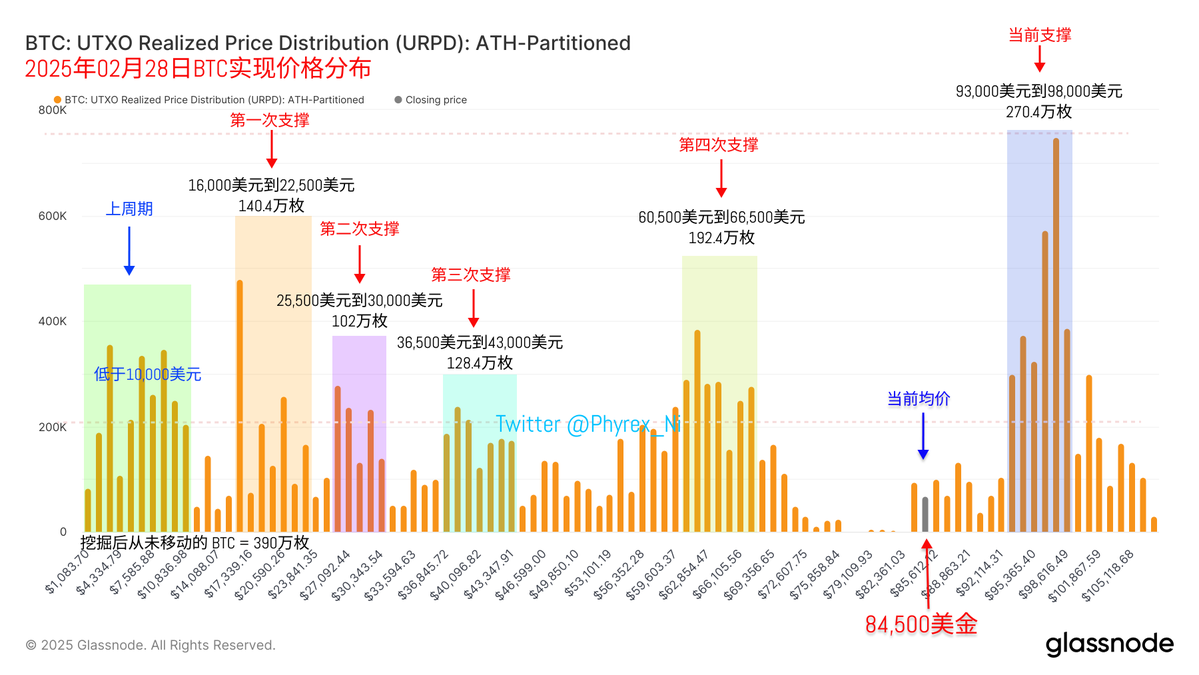

As I write this, #Bitcoin has already fallen below $84,000, and there is no new negative news. It may be that some investors are starting to hedge, and the sentiment is pushing investors to anticipate that a bear market has already begun. But what is the difference between a bear market and a bull market for everyone? One is afraid to buy the dip, and the other is willing to buy the dip. However, in reality, retail investors do not significantly affect the price of BTC.

The sentiment has been poor in the last 24 hours, leading to a decline in investor confidence, and the turnover rate continues to rise. Especially for investors in loss, the panic has not ended. Investors who bought the dip in the last two days are increasing their exit efforts even if they are at a loss, and earlier investors in loss are also showing signs of unstable confidence.

However, from the on-chain support data, the support between $93,000 and $98,000 is still quite stable. Although a large number of these investors are still exiting daily, at least for now, there are no signs of support being broken. Of course, new followers may not understand this, but those who have been watching from $60,000 should know what it represents.

On-chain support represents the sentiment of investors with concentrated chips. As long as this group of investors does not choose to exit at a level that would halve their investment to rebuild support, it means that the current support price is "attractive."

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。