I'm sorry to make my friends feel this way. I have indeed been a bit lazy recently because the ETF data is fixed and written daily, so I've kept it up, just like homework, while I haven't been writing other data lately.

The main reason is that I feel we are currently in a policy-driven environment, and the data is just a compilation of past events, making it difficult to predict changes in policy. For example, it's impossible to anticipate how many times the Fed's dot plot will indicate in March, or to predict Trump's tariff policies, or when the strategic reserves will be approved, or if they will be approved at all.

On the other hand, this halving cycle is the first currency tightening cycle in Bitcoin's history, so previous data may not necessarily apply now. Therefore, I focus more on fundamental data, such as capital flow and the inventory of exchanges.

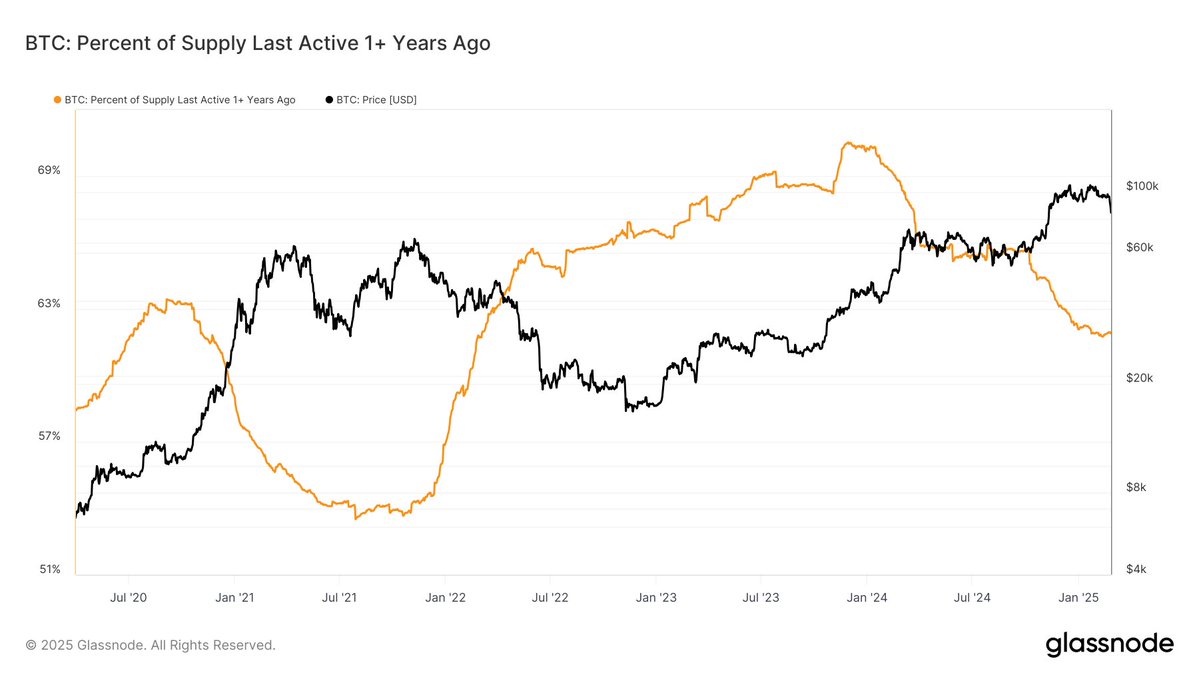

Of course, this is not an excuse for my laziness. If we look at the data from long-term holders, it may already be the end of the bull market. The distribution phase for long-term holders has already ended, although the possibility of continued distribution cannot be ruled out. If distribution continues, it must be accompanied by a price increase; if the price does not rise, the distribution by long-term holders will not persist.

So, based on the data, it seems like it should be time to exit. However, there is also a glimmer of opportunity in the policy aspect. Will you choose to believe the data and exit, or will you prepare to trust the policy and gamble once more?

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。