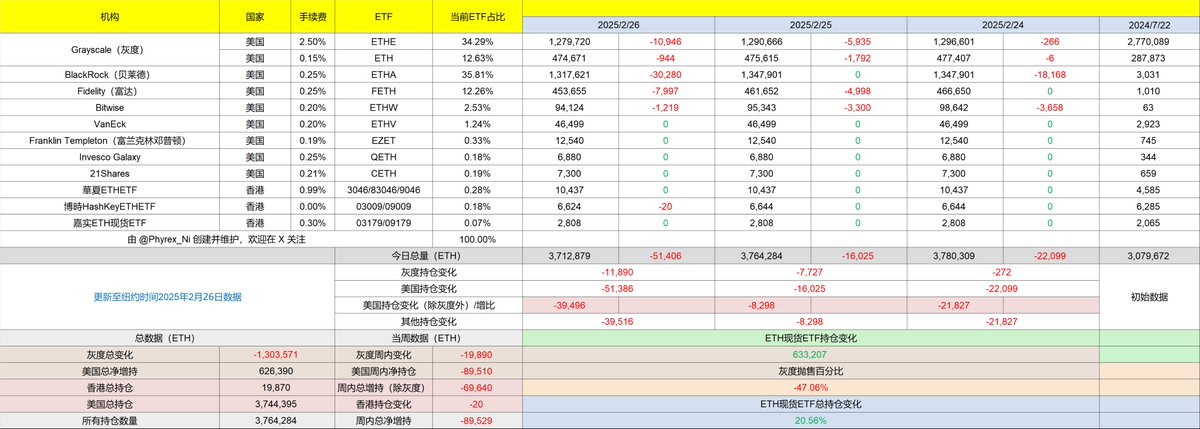

The data for the ETH spot ETF is also quite explosive today. Although it hasn't seen a historical maximum net outflow like BTC, the difference isn't very large, especially after BlackRock's investors heavily offloaded #BTC, there are also significant outflows observed in #ETH. This marks the highest single-day net outflow in the history of BlackRock's ETH spot ETF.

Over 30,000 ETH has flowed out, accounting for 2.25% of BlackRock's total holdings, which is nearly 0.9% higher than BTC. Indeed, investors' confidence in ETH is waning. While there was some patience before, considering the potential for a worse situation in the U.S. market, investors have started to choose to exit.

Even U.S. stock futures were on a slight upward trend before Trump announced the adjustment of tariff timing, but immediately turned to decline after the announcement. It seems some folks are starting to miss Biden. While it's hard for me to say this is Trump's fault, as president, he certainly has his own views, and sacrificing short-term gains in the risk market is normal.

However, this method of verbally crashing the market is indeed making it a bit uncomfortable. The last man to crash the market with words was Powell.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。