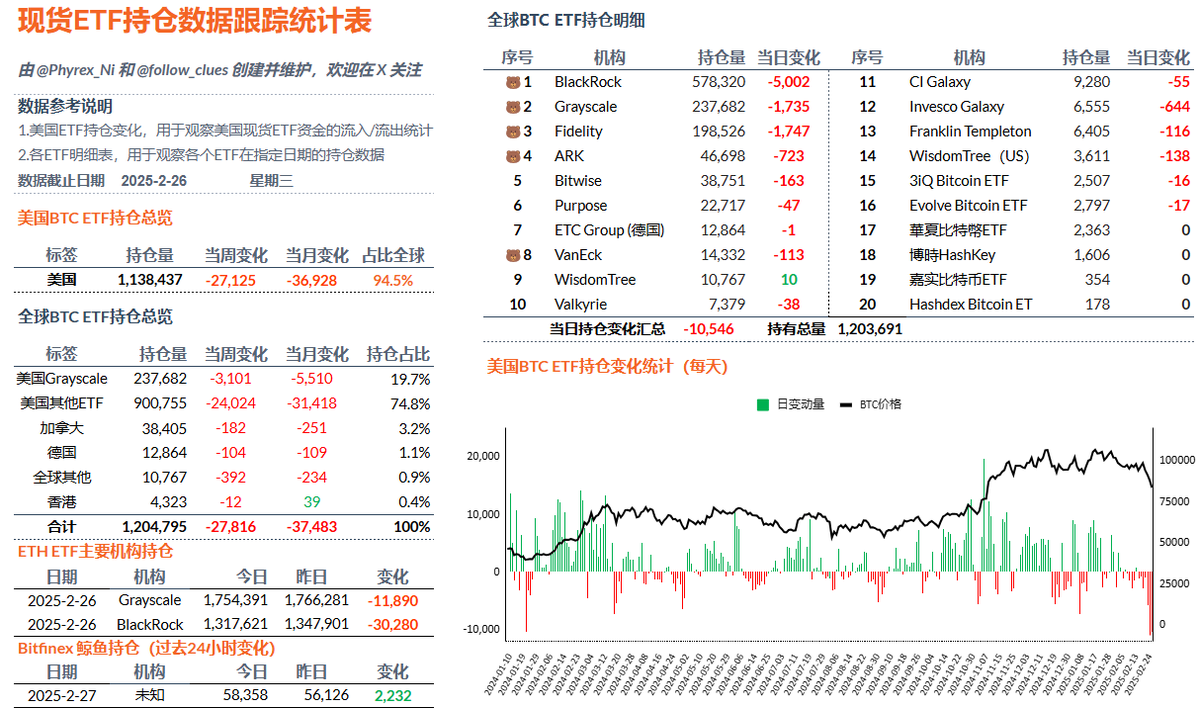

It is indeed a bit difficult. Tuesday saw the largest net outflow of Bitcoin spot ETFs in history. Although Wednesday showed some relief in terms of capital volume, the data from various official websites indicates that the difference from Tuesday is not significant, and it was still a day of substantial outflows.

In particular, investors from BlackRock saw a net outflow of over 5,000 #BTC on Wednesday, accounting for 0.86% of BlackRock's total holdings, marking the largest single-day reduction in BlackRock's history. Moreover, it wasn't just BlackRock; Fidelity, which had the largest reduction on Tuesday, also reduced its holdings by over 1,700 BTC yesterday.

The 12 U.S. spot ETF institutions collectively reduced their holdings by 10,281 BTC on Wednesday, which is about 1,000 fewer than Tuesday's historical high. Additionally, 11 institutions showed signs of reduction, indicating that the panic among ETF investors is gradually increasing.

The root cause is still Trump's tariff policy. Through this policy, investors are very concerned about the Federal Reserve's monetary policy, and worries about the U.S. entering an economic recession under high interest rates are also gradually rising.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。