50% MainstreamBTC Mining Machines Approaching Mining Cost, ETF Average Holding Price of $97,000 After the US Election** Stuck? Fear Index Hits New Low Since June 2022!**

Macroeconomic Interpretation: As the price of Bitcoin continues to decline, hitting a low of $82,250, it faces the most severe survival test in three years—mass shutdowns of mining machines and continuous outflows of ETF funds create a double squeeze, while new policies on tariffs from Trump, SEC regulations, and North Korean hacker attacks are adding salt to the market's wounds. This sudden "stress test" is reshaping the underlying logic of the entire crypto ecosystem.

The roar of machines in the mining farms is becoming sparse, with over half of Bitcoin mining machines caught in the "electricity price squid game." Data shows that at an electricity price of $0.06 per kWh, 68 out of 135 mainstream mining machines have turned negative in daily earnings, with models like the Shennma M30S+ having electricity costs approaching 100%, meaning miners are essentially paying for electricity without any profit. Ironically, the electricity cost absorption rate of former king machines like the Antminer S19 has reached 100%, making it a "perfect loss machine." However, there is a glimmer of hope in the crisis; the new generation of water-cooled mining machines, the S21XP series, with a 35% electricity cost ratio and a shutdown price of $29,000, is becoming a lifeboat for miners, potentially accelerating the elimination of outdated mining machines in this arms race.

The "great escape" of funds from the ETF market is even more alarming. Coinank data shows that since the US election, the average holding price of spot Bitcoin ETFs has reached $97,000, resulting in current holders facing a paper loss of about $1.3 billion. On February 27, a single-day net outflow of $757 million set a new record, with BlackRock's IBIT suffering a loss of $420 million in one day, breaking historical records. This "stampede-style escape" resonates with the cryptocurrency fear index dropping to an extreme value of 10, bringing market sentiment back to the freezing point seen during the LUNA collapse in 2022. Interestingly, some altcoins are performing a "bloodsucking market" against the trend, with Bitcoin's market share plummeting from 61% to 59.5% in just two days.

Meanwhile, the largest holders of Bitcoin are buying the dip. According to on-chain data, wallets holding at least 0.1% of the circulating supply have increased their holdings by nearly 15,000 BTC when BTC fell below $90,000, with a total value of about $1.28 billion.

Signals of reconciliation from regulators are injecting some warmth into the market. The SEC has reached a litigation suspension agreement with Sun Yuchen and the Tron Foundation, a "halftime break" mode similar to previous cases involving Binance and Coinbase. Although the SEC still insists on its involvement in 600,000 wash trades and illegal fundraising, the softening of regulatory attitudes suggests that compliance channels are opening up. Interestingly, Sun Yuchen's newly appointed World Liberty Financial has close ties to former US President Trump, hinting that this litigation battle may conceal political undertones.

Geopolitical black swans are still hovering. The Trump administration has revived the 25% EU tariff plan, combined with weak new home sales data in the US, successfully orchestrating a rollercoaster in the US stock market. Tech stocks barely closed in the green, driven by Nvidia's better-than-expected earnings report, but the crypto market became an outlet for emotional release, with Bitcoin briefly spiking to $82,256. More dramatically, the FBI confirmed that North Korean hackers stole $1.5 billion in assets from Bybit, in a textbook-level on-chain money laundering operation involving the precise manipulation of thousands of addresses, akin to a real-life "Now You See Me." These geopolitical risks and security crises are testing the safe-haven attributes of crypto assets.

At this crossroads, the Bitcoin market is facing a revaluation of value. The migration of hash power triggered by the shutdown of mining machines may reshape the global mining landscape, with North American mining farms potentially becoming the biggest winners due to cheap electricity. The continuous outflow of ETF funds has exposed the vulnerability of institutional investors. When the market fear index hits rock bottom, historical experience tells us that this is often the darkness before dawn—after the "Black Thursday" in March 2020, Bitcoin achieved a 300% increase in six months. Now, as the yield curve of US Treasuries deepens its inversion (with the 2/10 year spread narrowing to 17.7 basis points), the unease in traditional financial markets may be brewing a new narrative for the crypto market.

This breakout battle in the winter is essentially an experimental collision between the crypto economy and the traditional financial system. As the alarms of mining machine shutdowns and the beeping of ETF redemptions resonate, Bitcoin is undergoing its most complex stress test since its inception. Perhaps, as revealed by the counter-trend rise of water-cooled mining machines—true technological innovation will never be buried by market fluctuations, and those investors who can traverse cycles will ultimately reap the spring buds when the ice and snow melt.

BTC* Data* Analysis:

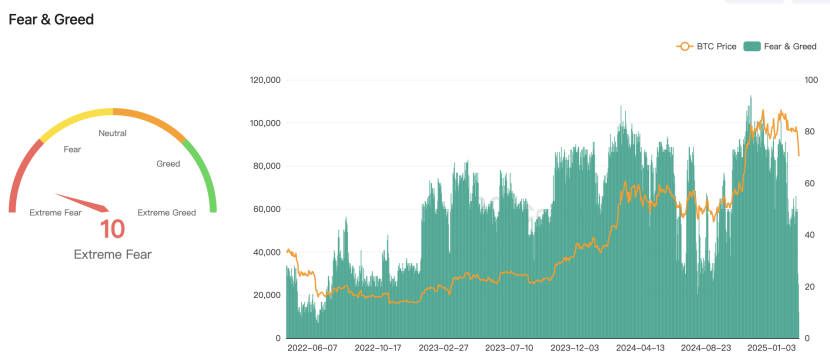

Today's cryptocurrency #Fear and Greed Index has dropped to 10 (down from 21 yesterday), with Coinank data showing it has reached the lowest level since June 2022, indicating "extreme fear" in market sentiment.

We believe that the sharp drop in the cryptocurrency #Fear and Greed Index to 10 (a new low since June 2022) reflects not only the severe contraction of short-term liquidity but also reveals deep-seated characteristics of the current market structure and cycle position from a composite perspective of market sentiment and funding behavior.

On the short-term trigger level, this index reaching historical extremes often corresponds to a clearing of leverage and a "long squeeze." Currently, the perpetual contract funding rates in the derivatives market are deeply negative (-0.2% to -0.5%), and the reserves of #BTC on exchanges have surged by 3.2%, indicating that panic selling has triggered large-scale deleveraging. It is noteworthy that this round of emotional freezing coincides with the dual pressures of accelerated Fed balance sheet reduction and escalating geopolitical conflicts, with the resonance effect with traditional risk assets exacerbating liquidity squeezes.

The mid-term structural contradictions are reflected in the behavioral differentiation of market participants: on-chain data shows that long-term holders (LTH) have increased their holdings by 1.8%, while short-term holders (STH) have a loss-selling ratio of 76%, indicating that the transfer of chips from "weak hands" to "strong hands" is accelerating. Although this process intensifies short-term volatility, it provides structural support for market bottoming.

In terms of historical cycle reference, after the index bottomed at 10 in June 2022, Bitcoin formed a long-term secondary bottom at $17,600 (with a minimum around $15,500 in November 2022), and then began a 600% upward cycle. The current market environment has key differences from that time—spot ETFs have brought in an average of $830 million in institutional funding daily, and the total market value of stablecoins has surpassed $161 billion (a 39% increase from 2022), significantly thickening the liquidity buffer.

Extreme fear often breeds reversal opportunities, but caution is needed regarding the differing paths of emotional recovery: if macro liquidity does not show a turning point (such as US Treasury yields remaining high), the market may enter a "low volatility bottoming" phase; conversely, if inflation data unexpectedly declines and triggers a correction in interest rate pricing, crypto assets may lead the way in a high-elasticity rebound. At this stage, investors need to pay more attention to signals of whale accumulation on-chain and the resonance timing of ETF fund flow reversals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。