Changing Staking Landscape

Since the launch of Lido and stETH in 2020, the staking market has undergone significant changes due to new users, emerging use cases, and evolving challenges. The demand for staking from institutions has been steadily increasing, accompanied by stricter regulatory and compliance considerations. While many institutions have already staked through Lido, others still face internal restrictions.

Ethereum and its vast protocol ecosystem have been working to address scalability and staking centralization issues, while advanced users seek more customized solutions in terms of reward structures.

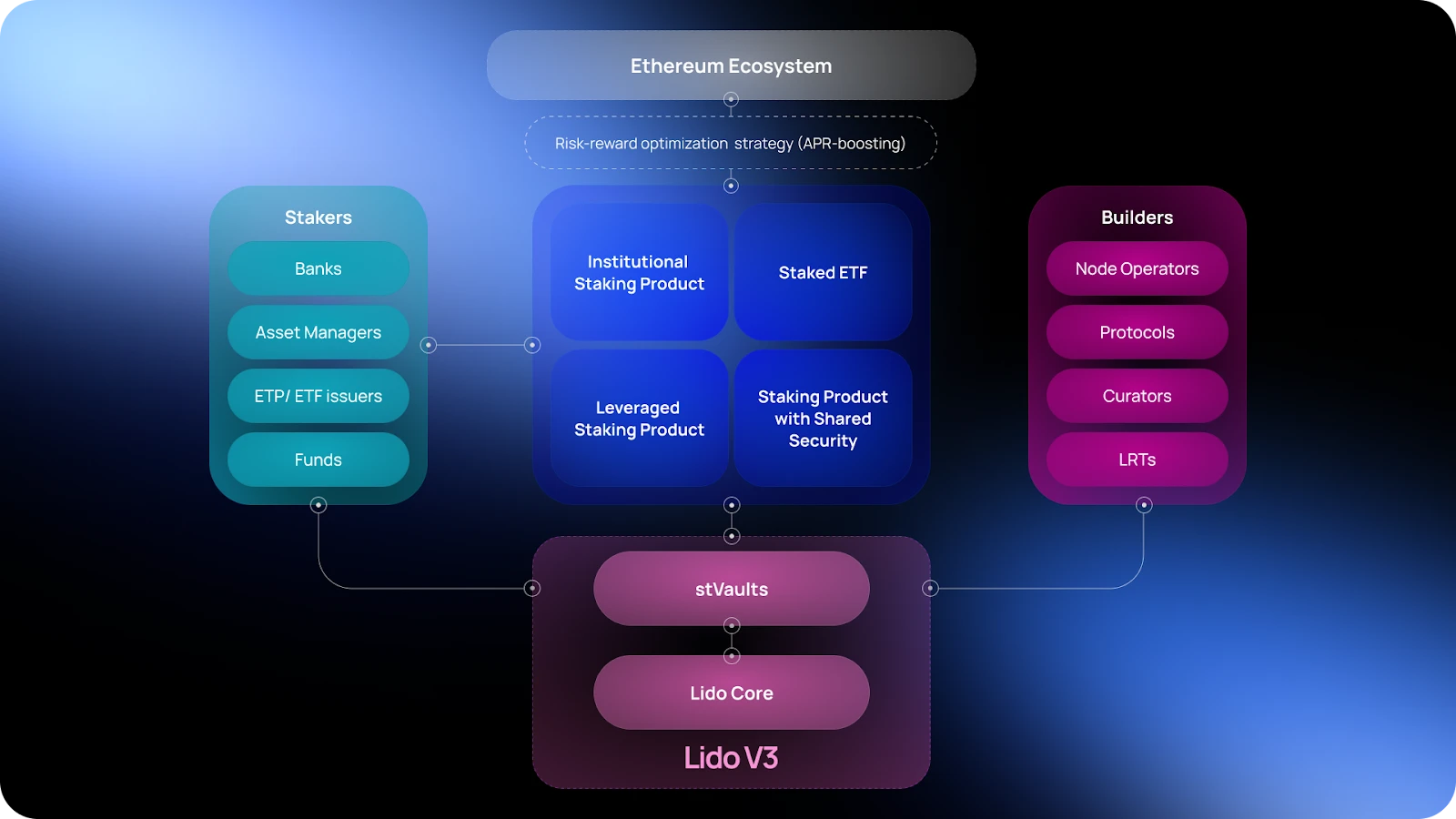

As a result, Lido V3 introduces a new staking solution, stVaults, unlocking tailored, customizable, and modular Ethereum staking solutions, leading the industry.

Lido V3: Ethereum Staking Infrastructure

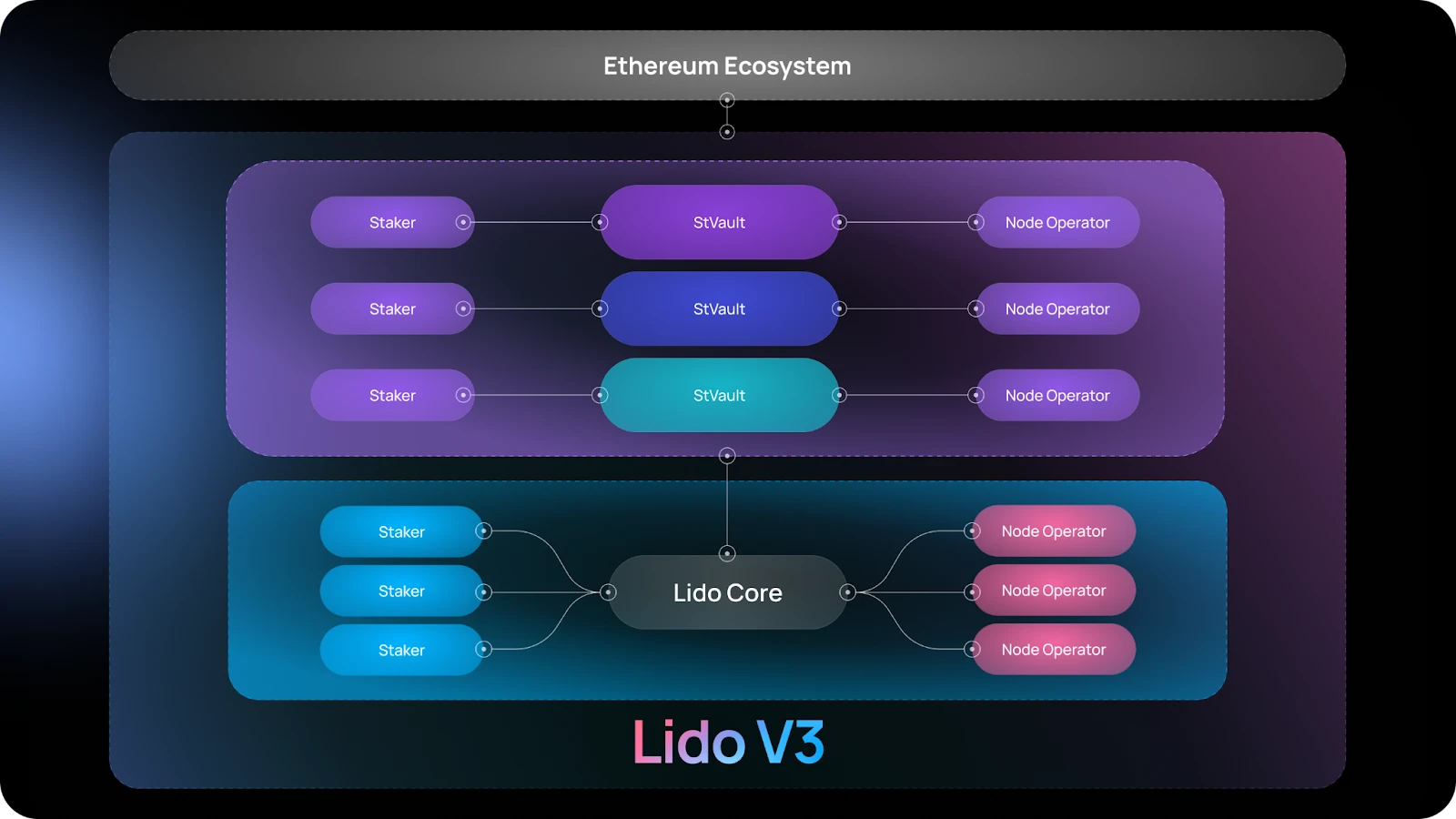

Lido V3 expands the capabilities of the Lido protocol (Lido Core) on Ethereum, which currently consists of a staking router and its modules, and introduces stVaults, aimed at providing customized solutions for various use cases.

stVaults support access to stETH liquidity in personalized settings, allowing users to configure validators, fee structures, risk-return profiles, and other parameters to meet the needs of various stakers.

Institution-Friendly: Institutional stakers can:

(1) Utilize stETH liquidity, and (2) Keep funds in non-custodial contracts to help ensure compliance with regulatory and risk management requirements;

Node Flexibility: Allows nodes to act as curators, customizing solutions for high TVL clients to achieve higher income and more TVL;

Yield Enhancement: Asset managers can quickly adapt to market dynamics, leveraging the universal collateral properties of stETH to devise innovative strategies, optimize capital efficiency, and integrate with emerging DeFi opportunities.

Ultimately, all parties should have long-term incentive mechanisms to establish predictable, future-oriented, and value-based reward sources within the Ethereum ecosystem.

Technical Foundation: stVaults

stVault is a key smart contract that enables non-custodial delegated liquid staking through a single node operator (or DVT NO cluster) and connects to Lido's infrastructure, allowing it to mint stETH on behalf of this vault.

The goals of stVaults are as follows:

(1) Allow users to customize the risk and yield configuration of liquid staking without affecting the stability and fungibility of existing stETH tokens.

(2) Enable mutual designation between institutional stakers and node operators.

(3) Better integrate stETH.

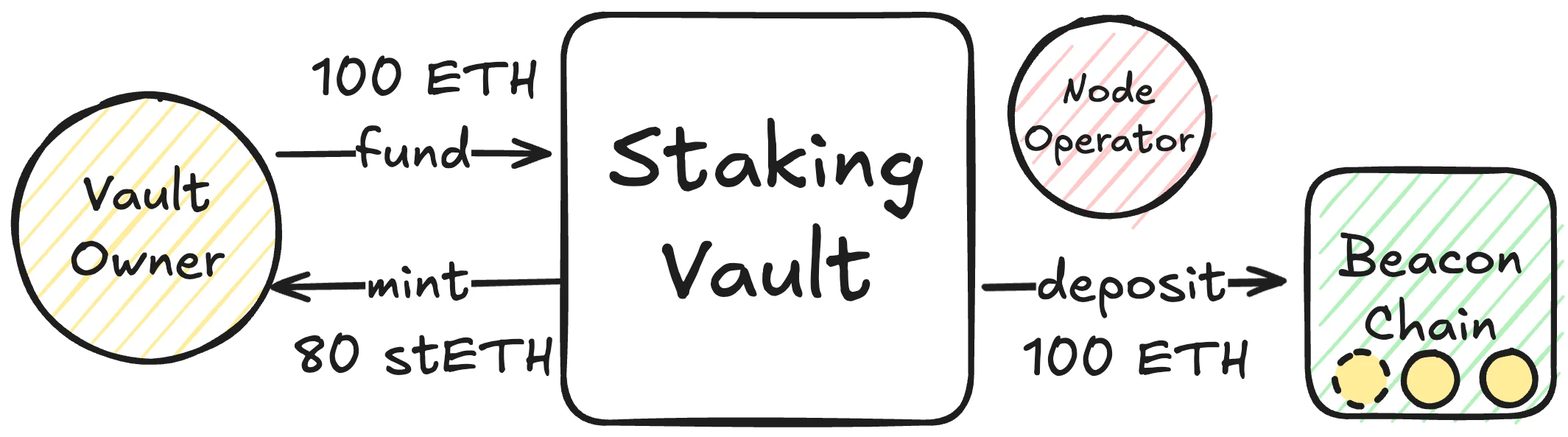

The following diagram illustrates how institutional stakers can complete staking in a non-custodial manner and receive a proportion of stETH:

When minting stETH, the corresponding amount will be locked to withdraw from the vault. The locked amount is specified in stETH shares, and the share balance increases daily as stETH re-bases. To unlock ETH withdrawals, the vault must burn the necessary amount of stETH.

To bear the risk of maintaining customized staking settings for stETH holders, the minting ratio of stETH differs from the 1:1 allowed by Lido Core, instead having some reserve margin (referred to as the reserve ratio or RR, e.g., 80% in the diagram), determined by risk parameters and limits.

This ensures that stETH minted through stVaults remains reasonably over-collateralized. Over-collateralization enhances its economic security by increasing stETH's resilience to potential slashing events and penalties. Additionally, it allows for dynamic adjustments to the reputation and collateral requirements of public node operators at the protocol level, ensuring network stability and supporting advanced integrations.

Overall, stVaults serve as a non-custodial staking platform that operates alongside the existing Lido Core protocol. Any user can securely stake ETH through their chosen node operator.

By connecting with Lido Core, stVaults can mint stETH supported by personalized validation settings, thus gaining high liquidity and integration offered by the market.

The main difference between using Lido stVault and Lido Core is that stVaults are independent smart contracts for each institution's self-use, while Lido Core's ETH custodial address acts as a public pool.

Customizable Vaults to Meet Various Needs

stVaults feature flexible configuration options, allowing different builders to customize staking settings, optimize rewards, and develop tailored product lines while benefiting from the security and liquidity of stETH.

Institutional Staking: Institutional staking requires higher flexibility and control. stVaults meet these needs by allowing institutional users to create dedicated stVaults that connect to specific node operators, configure integrations, and manage deposit and withdrawal access.

stVaults can support both custodial and non-custodial settings, meeting various operational requirements while providing access to stETH liquidity.

Leveraged Staking: For advanced stakers, stVaults provide tools to implement leveraged staking strategies, supporting both manual and automated smart contracts.

Potential methods include:

Primary Market: Directly acquiring ETH from the Lido Core protocol.

Secondary Market: Utilizing ETH provided by DeFi lending platforms.

Re-Staking Risk Control: stVaults introduce a selective join method for shared security, allowing participants to explore customized strategies and engage in re-staking without imposing socialized risks on the broader ecosystem.

Future-Oriented Infrastructure: stVaults serve as a modular foundation for builders and developers, supporting the creation of staking products and tools that adapt to the ecosystem. By leveraging the universal collateral properties of stETH, developers can seamlessly integrate with DeFi applications.

How Lido V3 Strengthens Ethereum's Decentralization?

Emerging Market of Open Coordination and Competition

As is well known, Ethereum relies on globally distributed nodes, and Lido V3 introduces stVaults to provide a modular, customizable staking framework that can make Ethereum more decentralized. Each stVault has independent operators, thus reducing the Matthew effect of ETH nodes.

Balancing Liquidity, Performance, and Security

stVaults have mechanisms to balance capital efficiency, validator performance, and staking concentration. ETH bonds mitigate slashing risks, while optional dynamic fees (based on the Lido Core protocol) are associated with a subset of validators within the staking router, helping to manage liquidity, assess performance, and support decentralization.

Voluntary Upgrades and Autonomy

stVault allows its stakers to choose whether to adopt and when to adopt Lido's upgrade features. Minting stETH means opting into the evolving governance process of the protocol, while returning stETH restores the vault to its native staking under the staker's upgrade dissent control. This seamless switch approach can maintain autonomy, reduce friction, and respect Ethereum's openness and decentralization.

Roadmap

Lido V3 is designed as a builder-centric product, enabling node operators, asset managers, LRT (Liquid Restaked Tokens), and other DeFi protocols to create optimal solutions for end users utilizing stETH liquidity. This strategy prioritizes effectively providing the necessary tools and building blocks while iterating with partners and the broader community.

The launch plan is divided into three phases:

Phase 1: Early adopters can use the existing tech stack to build re-staking vaults and initiate stVault's pre-deposit and early access programs. These initial vaults will transition to full stVault functionality after the mainnet launch.

Phase 2: The testing network for deploying stVaults will begin, allowing for rigorous testing and integration development with partners, preparing for mainnet readiness.

Phase 3: The mainnet launch of stVaults will enable key use cases, including customized institutional setups, leveraged staking, and shared security configurations.

Conclusion

Lido V3 introduces the modular innovation of stVaults, significantly increasing flexibility for institutional stakers by enabling customizable staking settings, allowing users to choose node operators and validation infrastructure. Stakers can meet their needs through tailored Ethereum staking strategies and optimize rewards based on priorities, fully leveraging the liquidity, security, and integration advantages of stETH.

With a more relaxed regulatory environment, institutional interest in Ethereum staking will further increase. Therefore, the Lido V3 upgrade specifically targets institutional stakers, node operators, and asset managers—institutional stakers can use stETH through fully customized settings that help meet internal compliance requirements while providing the operational control they need.

At the same time, node operators can design personalized staking products for large staking participants, offering features such as validator customization and enhanced reward mechanisms; asset managers can develop future-oriented structured products, utilizing stETH as the primary collateral in the Ethereum ecosystem.

Additionally, Lido V3 prioritizes Ethereum's decentralization, liquidity, and security. Its design encourages healthy competition among validators while reducing governance and slashing risks. By balancing performance, liquidity, and risk, Lido V3 provides a solution that serves both the Ethereum community and its long-term vision.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。