Original text: Stacy Muur, crypto researcher

Translation: Yuliya, PANews

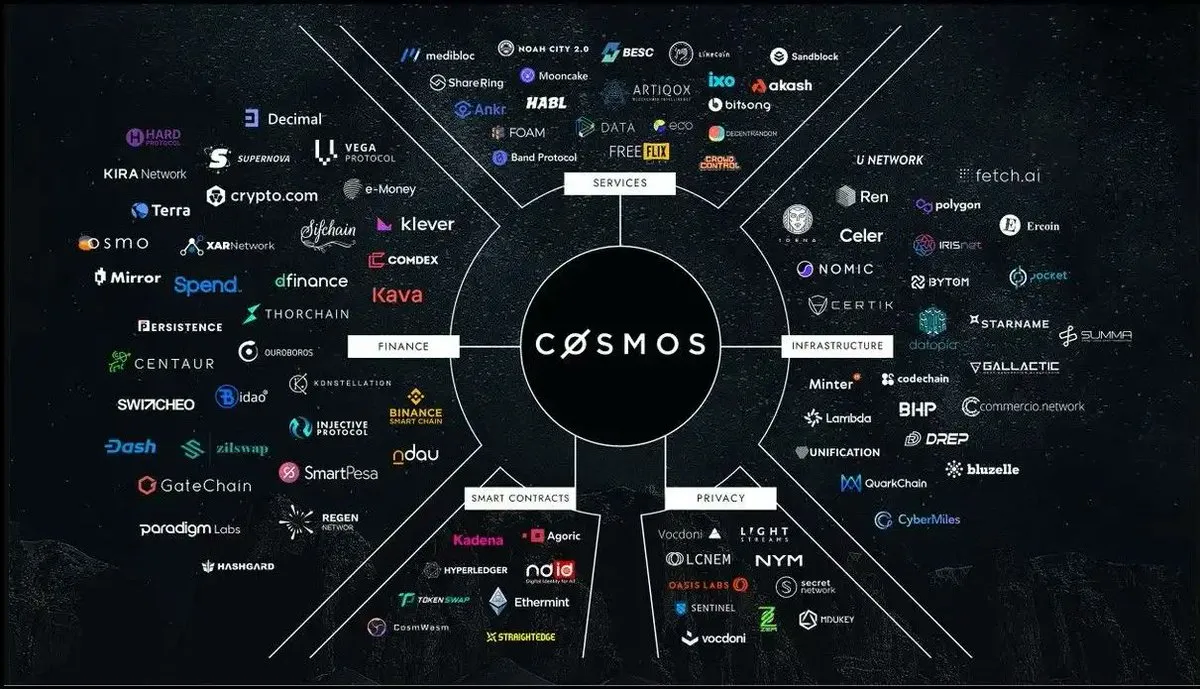

Appchain was originally designed to provide customized, scalable, and sovereign solutions, but unexpectedly formed isolated "walled gardens." Each chain operates independently, with liquidity dispersed across more than 100 chains, forcing users to frequently bridge assets across chains just to meet basic service needs.

A more serious issue is "bare chains." These chains lack the necessary infrastructure, such as oracles, cross-chain bridges, and indexers, resembling cities without public facilities—appealing on the surface but difficult to use in practice.

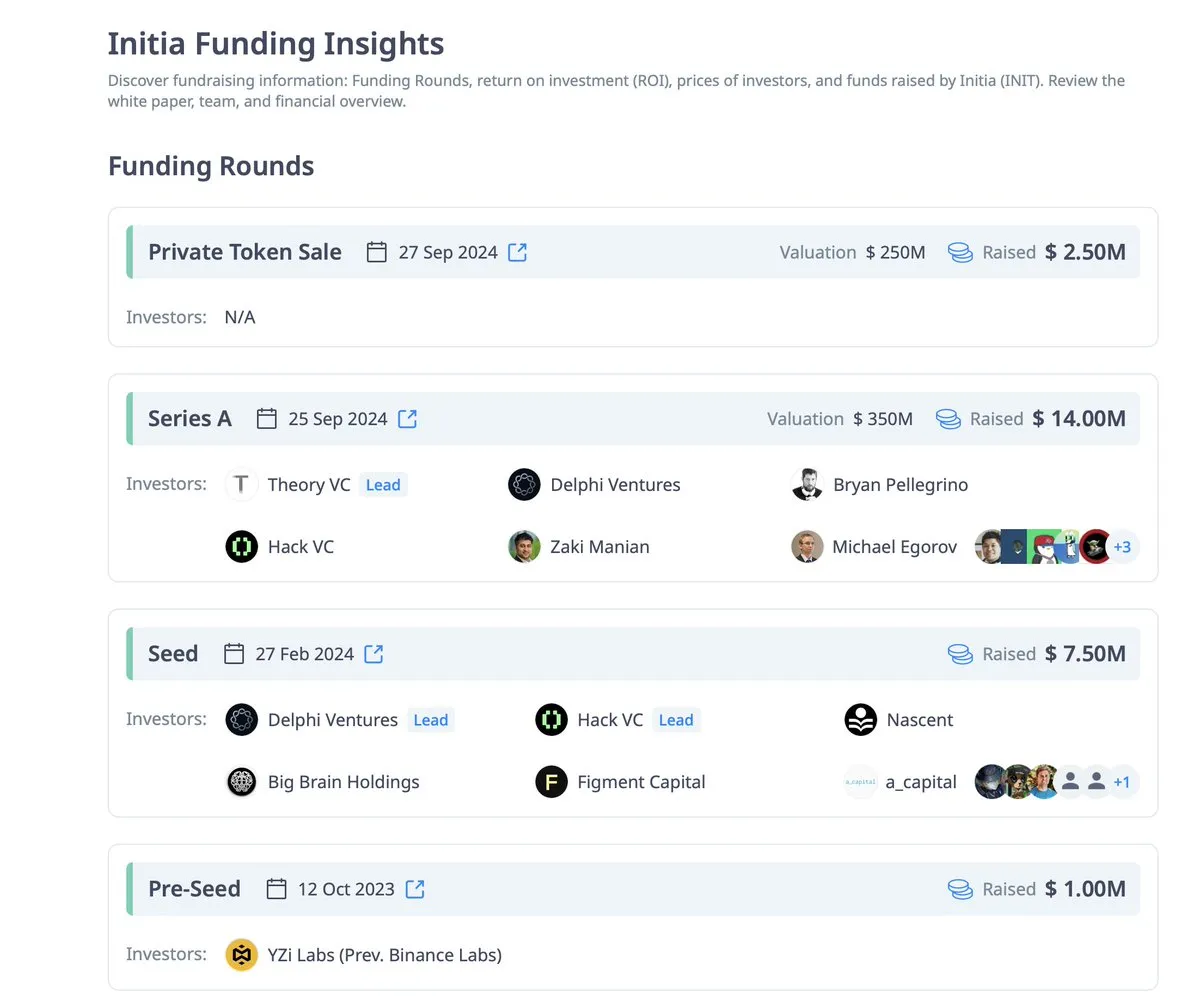

Meanwhile, user experience remains stagnant at 2017 levels: users need to manage more than five wallets, each chain has different gas tokens and UI designs, and the learning curve is steep with complex operations. Despite it being 2025, interoperability still resembles a disconnected network. Among the Web3 protocols set to emerge in 2025, Initia is undoubtedly a standout. So, what makes Initia so special that it continues to attract the attention of top researchers?

Historical Review: Cosmos and Ethereum

Cosmos proposed the concept of application chains, aiming to provide developers with sovereignty and specialization, but faced the following major issues in practice:

- Validator Launch Challenge: Launching a new application chain requires a strong validator network, which not only needs technical expertise but also substantial economic incentives, leading to severe token inflation issues.

- IBC Token Fragmentation: Moving assets across chains generates duplicate tokens (e.g., USDC on Chain A ≠ USDC on Chain B), resulting in inefficient liquidity.

- Liquidity Dispersion: Cosmos Hub failed to become a central router, instead giving rise to multiple competing hubs, each vying for liquidity, ultimately weakening the network effect.

The theory behind Cosmos's application chains is correct, but due to a lack of strong collaborative incentives, these chains ended up competing with each other rather than forming a cohesive ecosystem.

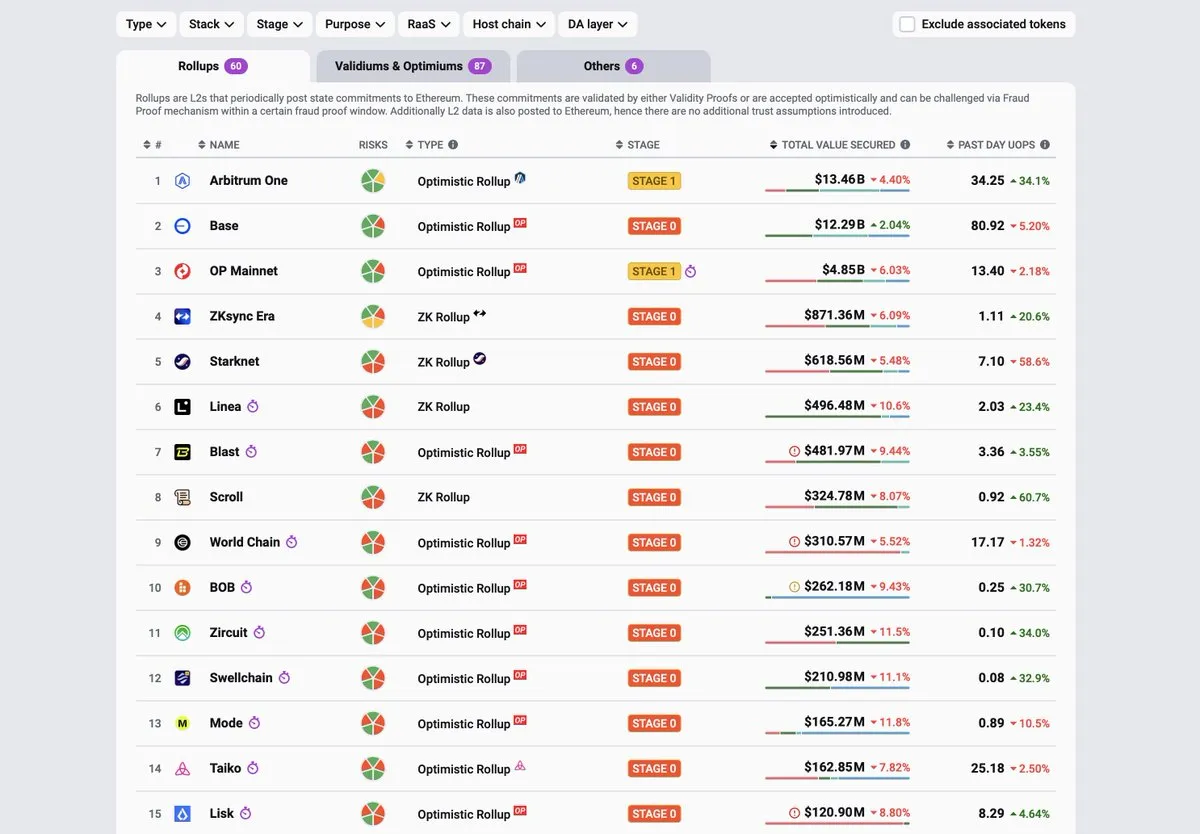

On the other hand, Ethereum's Rollup serves as an alternative to application chains, offering some advantages but also facing significant challenges in the following areas:

- Limited Cross-Rollup Interaction: Rollups typically operate independently, and asset transfers across Rollups rely on third-party bridges, further exacerbating liquidity fragmentation and inconsistencies in asset standards.

- Dependence on Third-Party Solutions: Key functionalities (such as bridging, oracles, and stablecoins) are not natively supported and require reliance on external providers.

The ecosystem urgently needs a solution:

- Unify different application chains to ensure they adhere to a common interoperable standard.

- Provide built-in infrastructure (bridging, oracles, liquidity) to avoid "reinventing the wheel" with each new chain.

- Adjust incentive mechanisms to ensure that launching new chains contributes to the overall strengthening of the network rather than competing with it.

The Emergence of Initia: Weaving an Interconnected Rollup Network

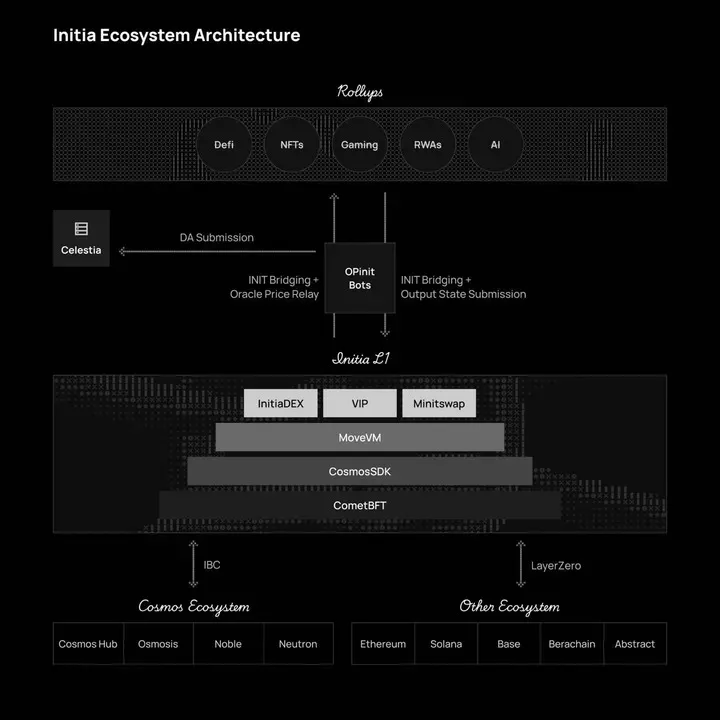

To address these issues, Initia combines the advantages of Cosmos and Ethereum Rollup architectures, providing a comprehensive framework that eliminates fragmentation while maintaining customization capabilities. Initia's full-stack solution includes:

- Layer 1 (L1) Coordination Layer: Handles security, governance, and liquidity coordination.

- Layer 2 (L2) Rollups (Minitias): Provides high-speed and scalable execution capabilities.

Developers can launch customized Rollups on Initia without worrying about liquidity fragmentation or interoperability barriers, making it the first truly unified application chain network that offers scalability and seamless cross-chain collaboration.

The Four Core Pillars of Initia

Initia addresses key issues in the current application chain space through the following four foundational pillars, potentially supporting the most powerful application chain theory to date:

1. User and Developer Experience-Centric

Problem: The existing Rollup ecosystem forces developers to build critical infrastructure from scratch. Teams using existing Rollup stacks or RaaS providers only gain basic tools and then must spend substantial costs integrating oracles, bridges, block explorers, wallets, and other essential components.

Initia's Solution: Initia reverses this model by prioritizing the establishment of a fully integrated ecosystem before the mainnet launch. Its toolkit includes:

- A complete toolkit, including Initia Scan (block explorer), Initia App (portfolio dashboard), .init usernames (similar to ENS but designed for Initia), and multi-ecosystem wallet support.

- Gas abstraction technology: Users can pay gas fees with any token through JIT, not just INIT.

- Native USDC integration: Achieved through Noble and Circles CCTP.

- Standardized cross-Rollup communication: Utilizing IBC and LayerZero protocols.

- Single-slot determinism: Achieving rapid confirmation between L1 and L2.

- Built-in liquidity: Enabled through Minitswap on L1.

This strategy allows developers to focus on application building without expending resources on infrastructure development.

2. Reliable Cross-Rollup Interoperability

Problem: Transferring assets between different chains is a nightmare for users. They either wait days to withdraw (e.g., over 7 days in optimistic Rollups) or rely on third-party bridges, which carry significant risks. Cosmos's multi-chain transfers also generate multiple versions of tokens, further fragmenting liquidity.

Initia's Solution: This issue is addressed by embedding liquidity at the foundational layer.

- One token, multiple chains: Initia L1 acts as a central hub, unifying all Rollup assets. For example, when transferring ETH from an EVM Rollup to a Cosmos chain, it automatically converts to the correct token standard (ERC-20 ↔ CW-20) without needing a third-party bridge.

- Instant withdrawals: The built-in AMM (MinitSwap) allows users to withdraw instantly from Rollups without waiting 7 days. Additionally, L2 tokens can be seamlessly exchanged for INIT on L1 through Peg Keepers, maintaining a 1:1 peg.

3. "Opinionated" Interconnected Stack

Problem: Existing Rollup frameworks force teams to make dozens of decisions regarding infrastructure: which data availability layer to choose, which bridging provider to use, how to handle interoperability, etc. These choices often lead to incompatible Rollup standards, poor user experiences, and wasted resources for development teams.

Initia's Solution: Initia standardizes core infrastructure through an "opinionated" stack while allowing customization in key areas:

- Fixed Components: Initia enforces high-quality defaults—native oracles (Connect), embedded AMM (InitiaDEX and Minitswap), unified bridging (IBC + LayerZero), using Celestia as the data availability layer, and CometBFT as the consensus mechanism, supporting 10k+ TPS and 500ms block times.

- Flexible Execution: Developers can choose EVM, MoveVM, or WasmVM as needed.

- Configurable Serialization: Default centralized but supports multiple sequencers through CometBFT.

- Advanced Features: Native integration with Skip protocol's POB (Protocol Owned Builders) and Protorev's non-toxic MEV extraction.

4. VIP (Vested Interest Program): Cross-Ecosystem Aligned Incentives

Problem: While Ethereum's application chains leverage Ethereum's security and brand influence, they do not contribute much to the ecosystem. In contrast, Cosmos's chains, while sovereign, compete with each other for liquidity and users, leading to fragmentation, with project teams focusing more on short-term token gains rather than long-term collaboration.

Initia's Solution:

1. VIP (Vested Interest Program): Rollups earn esINIT (locked tokens) rewards based on two metrics:

- Balance Pool: Measures the total value (TVL) of INIT tokens in its ecosystem.

- Weight Pool: Measures user participation through governance voting (e.g., users "quantitative vote" for their favorite Rollup).

Rollups cannot simply cash out rewards and leave. By tying rewards to long-term vesting, Initia ensures that projects have a financial incentive to remain within the ecosystem and drive overall network growth.

2. Cabal Governance: Rollups can "incentivize" INIT holders to vote for them through tokens, benefits, and other forms. The more votes a Rollup receives, the more esINIT rewards it earns from the VIP program. This mechanism creates a positive feedback loop: better applications → attract more users → users vote for them → rewards grow → applications improve further.

For example, suppose Uniswap needs to lobby Ethereum's ETH holders (not just UNI holders) to gain protocol rewards. This model forces Rollups to collaborate with the broader community rather than being confined to their small ecosystem.

In this way, Initia ensures that the reward mechanism for Rollups not only encourages their independent operation but also drives their contribution to the overall growth and liquidity of the network.

Looking Ahead

Initia plans to officially launch its mainnet in March 2025, followed by the deployment of the first interconnected Rollups. At the same time, the VIP program will further expand to incentivize ecosystem growth and achieve integration with more external chains through LayerZero and IBC.

Several applications are already prepared to launch within the Initia ecosystem, covering various fields from trading to NFTs, including:

- Blackwing: A leveraged trading platform with rapidly growing TVL;

- Milkyway: A liquidity staking and re-staking market;

- Civitia: A gamified social platform on-chain, focusing on land and yield;

- Echelon: A lending protocol with high TVL, aiming to support multi-VM environments;

- Intergaze of Stargaze: An NFT launch platform designed specifically for the Initia ecosystem.

The Initia ecosystem follows a strategic cycle that gradually addresses the key issues faced by application chains:

- Infrastructure → Applications: Through pre-built toolchains, developers receive complete development support from day one, eliminating infrastructure barriers.

- Applications → Users: By providing grants, co-marketing, and liquidity mining, projects can quickly attract users.

- Liquidity → Network Effects: The built-in AMM and VIP reward mechanism integrate the ecosystem's TVL, creating a self-reinforcing growth cycle—growth in one area further drives the prosperity of the entire network.

If Ethereum is the "world computer," then Initia is the "world conductor." It enables application chains to "perform" together in an interconnected network through a unified collaborative framework, achieving true ecological synergy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。