The rise of the RWA track not only represents the maturity of blockchain technology and the expansion of application scenarios but also signifies that the global financial market is entering a new stage of decentralization and efficiency.

I. In-depth Analysis of the RWA Track: The Growth Engine of the 2025 Crypto Market

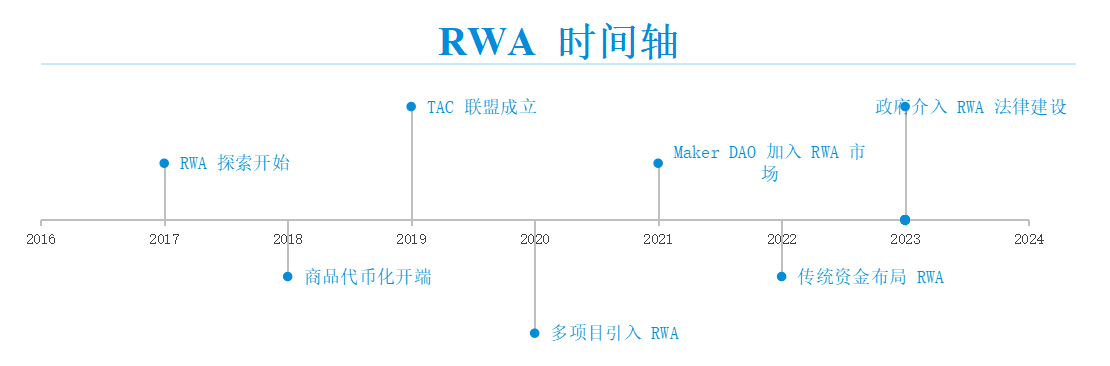

In recent years, decentralized finance (DeFi) has rapidly emerged, creating a financial ecosystem that operates without the traditional banking system. However, a core issue facing the DeFi space is that the entire market's operation still heavily relies on crypto assets (such as BTC, ETH, and stablecoins), lacking sufficient real-world assets (Real-World Assets, RWA) to support it, which limits the development of DeFi to the volatility of the crypto market itself. The emergence of the RWA track is breaking this limitation by combining real-world financial assets with blockchain technology, which not only enhances the stability of on-chain financial products but also brings significant liquidity increments to the entire market. This track is becoming a key bridge for institutional investors and mainstream financial institutions to enter the crypto industry, and it may even drive the entire blockchain industry into a new growth cycle.

The core concept of RWA is to digitize various assets in the traditional financial market (such as bonds, real estate, stocks, artworks, private equity, etc.) and convert them into tokenized assets that can be traded, collateralized, or lent on the blockchain. This process not only enhances asset liquidity but also reduces friction costs in traditional financial markets, such as long transaction clearing times, high intermediary costs, and limited liquidity. For example, in the bond market, traditional bond trading often involves multiple financial institutions and regulatory bodies, with cumbersome intermediaries leading to high transaction costs, while RWA tokenization can achieve real-time on-chain clearing, greatly improving transaction efficiency and reducing costs. Additionally, due to the transparency and traceability of blockchain, the management of RWA assets becomes more transparent, effectively reducing fraud and improper operations in the market.

As blockchain technology matures and market demand grows, the RWA track is attracting more and more institutional participation. For instance, one of the world's largest asset management companies, BlackRock, recently launched a blockchain-based tokenized fund called BUIDL, which primarily holds stable assets like U.S. Treasuries and offers more efficient trading methods through blockchain. Additionally, traditional financial giants like Franklin Templeton are actively trying to tokenize some of their fund products, allowing investors to participate in the market more conveniently. These cases indicate that the RWA track is no longer just a "crypto narrative" but is becoming a core trend in the digitalization of the global financial market.

From a technical perspective, the development of RWA relies on the support of several key infrastructures, including underlying blockchain networks, smart contracts, oracles, decentralized identity (DID), and compliance management. First, public chains, as carriers of RWA assets, determine the security and operability of the assets. Currently, Ethereum remains the preferred network for RWA tokenization, with many institutions deploying smart contracts on Ethereum to manage RWA assets, while Layer 2 solutions (such as Arbitrum and Optimism) are also becoming popular choices for RWA asset trading to reduce transaction costs and improve throughput. Additionally, public chains like Solana, Avalanche, and Polkadot are exploring application scenarios for RWA assets, striving to capture market share in this field.

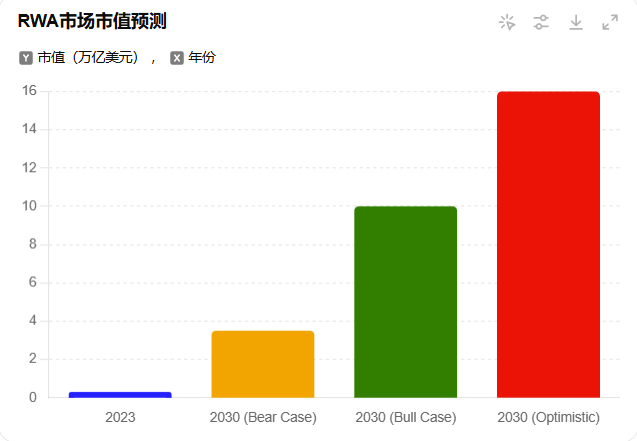

In terms of market size, the potential of the RWA track is enormous. According to research by the Boston Consulting Group (BCG), the market size of the RWA track is expected to reach $16 trillion by 2030, far exceeding the current total market capitalization of the entire crypto market. Currently, the global real estate market is valued at approximately $300 trillion, but most real estate investments require substantial capital and have low liquidity. If just 1% of these assets are tokenized, it could create a $3 trillion RWA market. Similarly, the global bond market exceeds $120 trillion; if 1% enters the blockchain, it would form a $1.2 trillion emerging market.

Institutional funds are rapidly flowing into the RWA track, indicating that this track is no longer a purely "crypto experiment" but is becoming an important component of the global financial system. This trend will continue and develop in 2025 as the Trump administration shows unprecedented support for the crypto industry. For investors, the RWA track not only provides a new market opportunity but may also become an important bridge for the integration of the crypto market and traditional financial markets. In the coming years, as more infrastructures are improved, regulatory frameworks are established, and mainstream financial institutions further position themselves, the RWA track is expected to become a new growth engine for the blockchain industry, even driving the digital transformation of the entire financial market.

Overall, the rise of the RWA track not only represents the maturity of blockchain technology and the expansion of application scenarios but also signifies that the global financial market is entering a new stage of decentralization and efficiency. For market participants, how to seize the opportunities of RWA asset tokenization and lay out infrastructures and key protocols will become a core proposition for the development of the crypto industry in the coming years.

II. Current Market Environment: Macroeconomic and Catalytic Factors for RWA Development

In the context of increasing global economic uncertainty, changes in liquidity cycles, and the booming digital asset market, the RWA (Real-World Assets) track is becoming one of the most important growth points in the crypto industry. With the adjustment of the Federal Reserve's monetary policy, the ongoing impact of inflation pressures, fluctuations in the debt market, and increased institutional participation in the crypto market, the development of RWA has ushered in unprecedented opportunities. At the same time, the shortcomings of the traditional financial system and the increasing maturity of DeFi (decentralized finance) are also accelerating the migration of real-world assets to the blockchain. This article will explore the catalytic factors for the development of the RWA track from five aspects: the global macroeconomic situation, liquidity environment, policy and regulatory trends, institutional entry, and the maturity of the DeFi ecosystem.

2.1 Global Macroeconomic Situation: Changes in Inflation, Interest Rates, and Market Risk Aversion

The global macroeconomic environment is one of the core variables affecting RWA development. In recent years, due to factors such as weak economic recovery after the COVID-19 pandemic, escalating geopolitical conflicts, supply chain issues, and adjustments in central bank policies, there is significant uncertainty in global economic growth. Among these, changes in inflation and interest rate policies directly affect liquidity and investors' asset allocation strategies, indirectly promoting the development of the RWA track.

First, from the perspective of inflation, the Federal Reserve's aggressive interest rate hike policy over the past two years has had a profound impact on global markets. Since 2022, the Federal Reserve has raised interest rates multiple times to curb high inflation rates, leading to tightening global liquidity. In a high-interest-rate environment, investors' risk appetite decreases, traditional financial markets are impacted, and capital tends to flow into low-risk, high-yield asset classes. This has prompted investors to focus on assets such as government bonds, gold, and real estate, and the tokenization of these assets has become an important growth point for the RWA track. For example, the tokenization of U.S. Treasuries (such as the OUSG token provided by Ondo Finance) has become an important investment tool in the crypto market due to its high annual yield (over 5%), attracting significant DeFi capital inflow. Secondly, as the global debt crisis intensifies, the RWA track has become an important option for capital risk aversion. As of 2024, the total global debt has surpassed $300 trillion, with U.S. Treasuries exceeding $34 trillion and the fiscal deficit reaching a historic high. In this context, investors' confidence in traditional financial markets is shaken, prompting them to seek more transparent and efficient financial infrastructures, and the characteristics of trustlessness, borderlessness, and low cost provided by blockchain technology make the on-chainization of RWA assets the best solution. Additionally, in a high-inflation environment, the demand for gold and commodities has surged, and gold tokens (such as PAXG and XAUT) have also become popular assets in the crypto market. Overall, the increasing uncertainty in the global economy has heightened investors' demand for safe-haven assets, while innovations in the RWA track allow these assets to enter the crypto market more conveniently, driving explosive growth in this track.

2.2 Liquidity Environment: Federal Reserve Policy Shift and Changes in Market Risk Appetite

The rapid development of the RWA track is closely linked to changes in the global liquidity environment. From 2022 to 2023, the Federal Reserve implemented significant interest rate hikes, leading to severe tightening of global market liquidity. However, since 2024, as inflation pressures ease, the Federal Reserve has entered the tail end of interest rate hikes and may even begin a rate-cutting cycle, changing market liquidity expectations, which greatly boosts the RWA track.

First, the adjustment of the Federal Reserve's monetary policy has increased the demand for stable-yield assets in the market. The DeFi ecosystem experienced high volatility and risk during 2021-2022, but current investors prefer low-risk, predictable yield products, and the RWA track provides this solution. For example, bond tokenization and private market tokenization allow investors to enjoy a more stable and compliant yield model within the DeFi ecosystem, which is one of the important reasons for the RWA's explosion in 2024. Secondly, from the perspective of the crypto market, the approval of spot ETFs for BTC in 2024 has led to continuous inflow of institutional capital, expanding the entire crypto market's capital pool, and these funds, beyond BTC, also need to seek more stable investment targets. RWA assets, due to their deep ties to traditional financial markets, have become an important allocation direction for institutional funds. For instance, asset management giants like BlackRock and Fidelity have begun to focus on the RWA field and launched related investment products, which will further drive the growth of the RWA track. Additionally, as DeFi interest rates decline, the yield advantage of the RWA track becomes increasingly apparent. In 2021-2022, the yields in the DeFi ecosystem were generally above 10%, but in 2024, the yields of most DeFi protocols' stablecoins have dropped to between 2% and 4%, while the yield on U.S. Treasuries in the RWA track remains above 5%, making RWA assets a new pillar of DeFi yields, attracting significant capital inflow.

2.3 Policy and Regulatory Trends: The Compliance Process of the RWA Track

In the development history of the crypto industry, regulatory issues have always been a focal point of market attention, and the rise of the RWA track is due to its greater compliance compared to other DeFi tracks, meeting the needs of institutional investors. Regulatory agencies in various countries are gradually accepting the innovative model of asset tokenization and exploring how to support the development of the RWA ecosystem through legal frameworks.

First, the U.S. SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) have begun research in areas such as security tokenization and bond tokenization, allowing certain institutions to issue tokenized assets within a compliance framework. For example, Securitize has received SEC approval to issue blockchain-based security tokens, providing a good demonstration for the compliance of the RWA track. Additionally, regions such as Europe, Japan, and Singapore hold a relatively open attitude towards the RWA track. For instance, Switzerland's SIX Digital Exchange (SDX) and Germany's Boerse Stuttgart Digital Exchange (BSDEX) have supported tokenized stock trading, while the Singapore government is actively promoting the on-chain development of RWA assets. These favorable policies make institutional investors more willing to enter the RWA track, providing a solid foundation for its development.

2.4 Institutional Entry and the Maturity of the DeFi Ecosystem

In addition to macroeconomic factors and regulatory policies, the entry of institutions and the maturity of the DeFi ecosystem are also important driving forces for the growth of the RWA track. Traditional institutions are beginning to focus on the integration of DeFi and TradFi (traditional finance), with many leading asset management companies, banks, and hedge funds researching how to issue and trade RWA assets on the blockchain. Meanwhile, the DeFi ecosystem is gradually shifting from "high volatility, high risk" to "stable returns, compliant development," with the RWA track becoming a core beneficiary of this trend. An increasing number of DeFi protocols (such as MakerDAO, Aave, Maple Finance) are deeply integrating with RWA assets, making the growth of the RWA track more sustainable.

In summary, the explosion of the RWA track is not only driven by market demand but is also a product of the interplay between global macroeconomic conditions, regulatory policies, liquidity environments, and the evolution of the DeFi ecosystem. Driven by these catalytic factors, the RWA track is expected to become one of the most important engines for growth in the crypto market from 2024 to 2025.

III. Main Classifications and Core Project Analysis of the RWA Track

Against the backdrop of a maturing crypto market and accelerated institutional capital inflow, the rise of the RWA track has become a significant trend. The core goal of the RWA track is to issue, trade, and manage assets from traditional financial markets, such as bonds, real estate, commodities, and private equity, through blockchain tokenization, making them more liquid, accessible, and integrable with the DeFi ecosystem. This not only brings the convenience of decentralized finance to traditional assets but also provides a more stable source of income for the DeFi ecosystem. The application scenarios of the RWA track are rich, and different types of real-world assets exhibit various forms on-chain, typically categorized into the following major categories: bond RWA, commodity and bulk asset RWA, real estate RWA, equity and private market RWA, and infrastructure and supply chain RWA. In this section, we will explore the core logic of these categories in detail and analyze representative projects in the current market to gain a deeper understanding of the layout of the RWA track.

3.1 Bond RWA: On-Chainization of U.S. Treasuries, National Bonds, and Corporate Bonds

The bond market is one of the most important asset classes in the global financial market, especially U.S. Treasuries (UST), which are considered one of the safest assets globally and are widely used for hedging and reserve assets. As the DeFi ecosystem matures, more and more institutions are attempting to bring bond assets onto the blockchain to achieve transparency in returns, enhanced liquidity, and the possibility of global trading.

Currently, the global debt market has exceeded $300 trillion, with a significant proportion represented by U.S. Treasuries, while the total market capitalization of the crypto market is only $2-3 trillion. If RWA track's tokenized bond assets can be successfully integrated into the DeFi ecosystem, it will greatly change the market landscape. The liquidity of the traditional bond market is limited by factors such as trading hours, market access thresholds, and settlement cycles, while on-chain bonds can offer 24/7 trading, borderless access, and second-level settlement advantages, making them an important supplement to the DeFi ecosystem.

Representative Project Analysis: Currently, the main participants in the bond tokenization field within the RWA track include Ondo Finance, Maple Finance, and Backed Finance.

Ondo Finance: Currently one of the most active bond tokenization projects, focusing on U.S. Treasury tokenization, offering OUSG (Ondo Short-Term US Government Bond Fund), which allows DeFi users to earn returns similar to short-term U.S. Treasury ETFs on-chain, with an annual return rate exceeding 5%. Ondo's tokenized bonds are held by compliant institutions and meet U.S. securities law requirements, while also being freely tradable on-chain.

Maple Finance: Initially focused on the DeFi lending market, it later expanded into the RWA track, providing on-chain debt financing services. Maple allows institutional investors to issue bonds within the DeFi ecosystem, providing a stable source of income for the crypto market.

Backed Finance: Launched various bond ETF tokenization products, such as $bIB01 (corresponding to iShares Short-Term U.S. Treasury ETF), providing investors with on-chain versions of mainstream bond ETFs in traditional financial markets, lowering trading thresholds and increasing accessibility.

The rise of bond RWA track not only meets the needs of traditional institutions but also brings new sources of income to the DeFi ecosystem, further promoting the growth of RWA assets.

3.2 Commodity and Bulk Asset RWA: On-Chainization of Gold, Crude Oil, and Other Commodities

The commodity market is another important RWA track, especially gold, which has long served as a store of value and has become one of the first assets to achieve tokenization on the blockchain. The tokenization of commodities allows investors to trade more conveniently and directly integrate with the DeFi ecosystem, enhancing asset liquidity.

Gold has long been a tool for hedging against inflation, and as global economic uncertainty increases, the demand for gold continues to rise. However, the traditional gold market has high trading costs and complex delivery processes, while tokenized gold assets (such as PAXG, XAUT) can provide seamless cross-border trading, smart contract management, and DeFi staking functions, making them an important asset class in the crypto market.

Representative Project Analysis:

PAXG (Paxos Gold): A gold token issued by Paxos, where each PAXG represents one ounce of physical gold stored in a London vault, redeemable for physical gold at any time. PAXG is currently the highest traded gold token on-chain and is widely used for DeFi staking and trading.

XAUT (Tether Gold): A gold token issued by Tether, also pegged to physical gold, allowing users to trade seamlessly worldwide and participate in the DeFi ecosystem.

Commodities DAO: Exploring the potential for more commodities (such as oil, copper, soybeans, etc.) to be brought on-chain, enabling the bulk commodity market to operate more transparently and efficiently.

The tokenization of gold and other bulk commodities is changing the trading methods in the commodity market, making it more open and bringing stronger anti-inflation asset classes to the crypto market.

3.3 Real Estate RWA: A Breakthrough for Asset Liquidity

The real estate market is one of the largest real estate markets globally; however, due to high transaction costs and low liquidity, the traditional real estate market struggles to integrate with the DeFi ecosystem. The tokenization of real estate within the RWA track allows global investors to participate in the real estate market through blockchain, breaking geographical and capital barriers.

Representative Project Analysis:

RealT: Tokenizes U.S. real estate assets, with each token representing partial ownership of the real estate asset, allowing investors to earn rental income by holding tokens.

LABS Group: Focuses on the Asian real estate tokenization market, allowing individual investors to participate in high-end real estate investments with very low thresholds.

The development of the real estate RWA track significantly enhances the liquidity of the real estate market while also providing new collateral assets for DeFi, promoting the growth of the entire ecosystem.

3.4 Private Equity and Fund RWA: Making VC Investments More Transparent

The traditional VC investment and private equity fund market has long faced issues of high barriers to entry and low transparency, while the tokenization within the RWA track makes these assets more liquid. For example, well-known asset management company Hamilton Lane issues tokenized funds through blockchain, allowing investors to participate in the private market with lower thresholds.

Additionally, compliant tokenization platforms like Securitize are helping more traditional institutions bring equity assets on-chain, enabling them to trade in secondary markets and enhancing liquidity.

IV. Challenges and Potential Breakthroughs in the RWA Track

In recent years, the RWA track has gradually attracted significant attention from the blockchain industry. RWA aims to digitize real-world assets such as real estate, bonds, stocks, and commodities and incorporate them into the blockchain ecosystem, allowing them to be traded, staked, and lent on decentralized finance (DeFi) platforms. This track has enormous potential but also faces numerous challenges; overcoming these challenges will be key to its sustainable development.

First, one of the most significant challenges is legal compliance. Traditional assets are often subject to the legal and regulatory frameworks of various countries, and bringing these assets into the blockchain environment after digitization may face scrutiny from regulatory agencies and adaptability issues with policies. Many countries' current financial regulatory policies do not explicitly define crypto assets and blockchain technology, especially regarding cross-border asset transfers, where legal uncertainties increase the risks for enterprises. For instance, how to legally transfer traditional assets like real estate or bonds onto the blockchain globally and ensure compliance across different jurisdictions requires deep involvement from legal experts and may necessitate revisions to the legal frameworks of relevant countries. Furthermore, the management and transfer of ownership of digital assets may also pose complex regulatory challenges, involving how to verify the actual existence of assets and the legitimacy of their owners.

Additionally, technical challenges cannot be overlooked. Although blockchain technology has clear advantages in data immutability and decentralization, effectively converting real-world assets into digital forms remains a complex issue. This involves not only how to tokenize physical assets (i.e., convert them into digital tokens) but also ensuring that these tokens accurately reflect the value and liquidity of the assets. Currently, the process of asset digitization often relies on traditional third-party intermediaries for assessment and endorsement, such as banks or legal institutions, which creates a conflict between the decentralized concept and traditional centralized institutions. Moreover, the issues of asset custody and management are also significant technical challenges. While blockchain can provide transparency and automation, ensuring the security and compliance of assets, especially in the absence of centralized intermediaries, is a problem that must be addressed. Smart contracts on the blockchain can greatly simplify the asset trading process, but if vulnerabilities or errors occur, it may lead to significant asset losses, making the security and auditing of smart contracts extremely important.

For innovators in the RWA track, effectively combining the advantages of blockchain with the needs of the real world is key. Especially regarding asset liquidity, the decentralized nature of blockchain can enhance asset liquidity, but real-world assets often face liquidity challenges. For instance, the trading cycle of high-value assets like real estate is relatively long, and the number of market participants is limited. How to leverage blockchain to break the liquidity bottleneck of traditional assets, allowing these assets to flow globally and become liquid assets on DeFi platforms, is one of the potential breakthroughs in the RWA track. By introducing asset tokenization, a real estate project or bonds can be divided into multiple smaller shares, thereby lowering the trading threshold, attracting more investors, and making the assets more liquid. Additionally, asset tokenization can improve market transparency, allowing investors to track asset movements through blockchain's public records, reducing the issue of information asymmetry in the market.

In addition to legal and technical challenges, market acceptance is also a significant barrier faced by the RWA track. Although blockchain has achieved remarkable success in the cryptocurrency and DeFi fields, for traditional investors, blockchain and digital assets remain relatively unfamiliar concepts. Especially for those accustomed to traditional financial systems and asset classes, digital assets may not immediately gain their trust. To break this barrier, the RWA track needs to establish closer collaborations with traditional financial institutions. A potential breakthrough lies in the fact that as more traditional financial institutions begin to accept blockchain technology and explore cooperation with crypto assets, the RWA track has the opportunity to gain support from these institutions' resources and credibility. For example, banks and asset management companies can help promote the market acceptance of RWA by endorsing digital assets or collaborating with blockchain platforms.

Moreover, potential breakthroughs in the RWA track also include multi-chain interoperability and liquidity innovation. Currently, many RWA projects rely on Ethereum or other mainstream public chains; however, interoperability between different public chains still presents significant challenges. If RWA can achieve multi-chain interoperability, cross-chain asset transfers will become smoother, and the flow of asset value will be greatly enhanced. To achieve this, cross-chain protocols and bridging technologies will become important breakthroughs in the RWA track. This will not only enhance asset liquidity but also expand the market share of RWA, attracting more investors and users.

V. Future Outlook and Investment Strategies for RWA

As blockchain technology continues to mature and develop, the RWA track is undergoing a subtle transformation. The integration of traditional assets with the crypto world will not only supplement digital assets but may also reshape the global financial system. The future of RWA will bring enormous market opportunities, but it also comes with complex challenges. To succeed in this field, investors need to have a deep understanding of industry development trends and design reasonable investment strategies.

The future outlook for RWA is full of potential, especially as the bridging role between blockchain technology and traditional financial systems becomes increasingly evident. As blockchain technology is gradually accepted by financial institutions, the tokenization of traditional assets will become more common. It is expected that in the coming years, asset tokenization will become mainstream, particularly in areas such as real estate, bonds, equity, and commodities. The openness of traditional financial markets to digital assets is increasing, and this trend will accelerate the growth of RWA. Banks, insurance companies, and asset management firms are exploring how to leverage blockchain technology to achieve automation and transparency in asset management while reducing operational costs and improving efficiency. Particularly in capital-intensive industries, the market potential of RWA will be more pronounced, as digitized assets can transcend geographical limitations, providing unprecedented investment opportunities for global investors.

The future outlook for RWA is closely related to the digitalization process of the entire financial system. As financial markets increasingly transition to digitalization and automation, RWA will gradually become an important component of the global capital market. With technological advancements and market maturation, there may be more opportunities for industry consolidation and mergers in the future RWA track, and some leading RWA platforms and projects may become "unicorns" in the blockchain industry. In this process, investors can not only gain direct asset returns but may also participate in the "dividends" of blockchain financial innovation. Therefore, investment opportunities in the RWA track will continue to grow, and investors need to keep abreast of market dynamics and flexibly adjust their investment strategies to achieve the maximum returns in this innovative market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。